Market News

Week ahead: GST tax reform, FOMC minutes, Jackson Hole speech and FII flows to shape market sentiment

.png)

5 min read | Updated on August 17, 2025, 13:45 IST

SUMMARY

In the coming week, markets will react to the Trump–Putin talks, which signalled progress on the Ukrainian conflict and reduced geopolitical concerns. Meanwhile, back home, Prime Minister Modi’s proposed Goods and Services Tax (GST) reforms are viewed positively, with lower rates expected to boost consumption and investor confidence.

NIFTY50 is expected to open on a positive note amid strong internal and external cues.

Indian markets experienced a reversal last week, with benchmark indices finally ending their six-week losing streak, the longest since 2020. Although volatility persisted throughout the week, improving inflation figures, support from Domestic Institutional investors and appreciation of Rupee provided much needed breather. However, sentiment remained cautious amid ongoing outflows of Foreign investors.

Against this backdrop, the NIFTY index rebounded by 1.1% to close at 24,631, while the SENSEX advanced by 0.9% to reach 80,597. Both indices recovered from recent lows, though remained below the previous week’s high. Meanwhile, the broader market also ended its losing streak, with the NIFTY Midcap 150 rising nearly 1% and the Smallcap 250 closing 0.6% higher.

Sector-wise, except for Consumer Durables(-0.5%) and FMCG(-0.4%), all the major indices ended the week in the green. Pharma (+3.5%), Automobiles (+2.7%) and PSU Banks (+2.0%) stood out, driven by renewed investor interest in defensive stocks and strong earnings in the automobile sector and among public sector lenders.

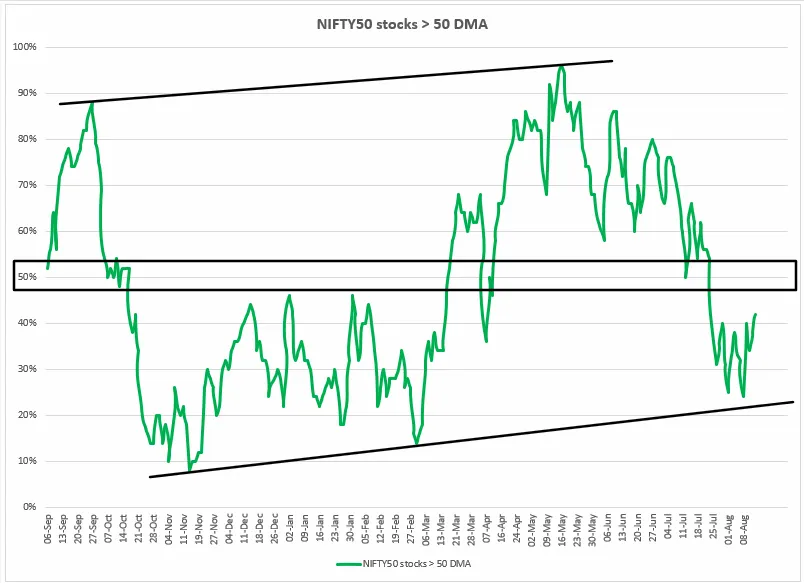

Index breadth

The breadth of the NIFTY50 index remains weak as over 50% of its stocks are still trading below their respective 50-day moving average (DMA). This is a key technical threshold that is often used to gauge the strength of the short-term trend.

After peaking above 90% in early June, the percentage of NIFTY50 stocks above their 50-DMA declined sharply, falling below 50% and struggling to recover. The chart illustrates how this 50% threshold has served as a pivotal zone. When the breadth is above this level, momentum tends to build; when below, the trend weakens.

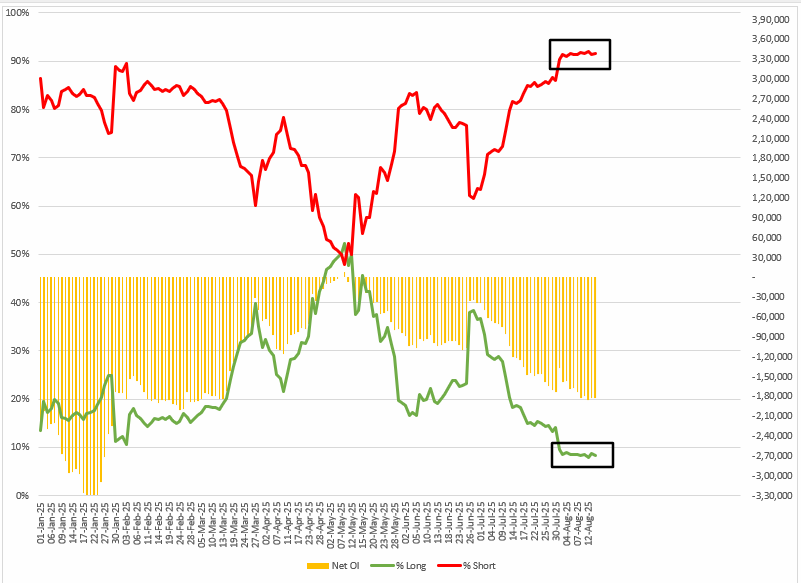

FIIs positioning in the index

Foreign Institutional Investors (FIIs) continue to double down on their bearish bets in index futures, with the long-to-short ratio stuck at an skew of 8:92. The net short positions remain elevated, with no meaningful unwinding visible so far. Additionally, the net open interest remains around -1.8 lac contracts, making it the most aggressive bearish positioning of 2025.

As highlighted in last week's blog, historically these zones are marked as reversal points. But, as long as FIIs sustain their bearish bets, the trend may remain sideways to bearish. The reversal from this zone will require a sharp unwinding of short contracts.

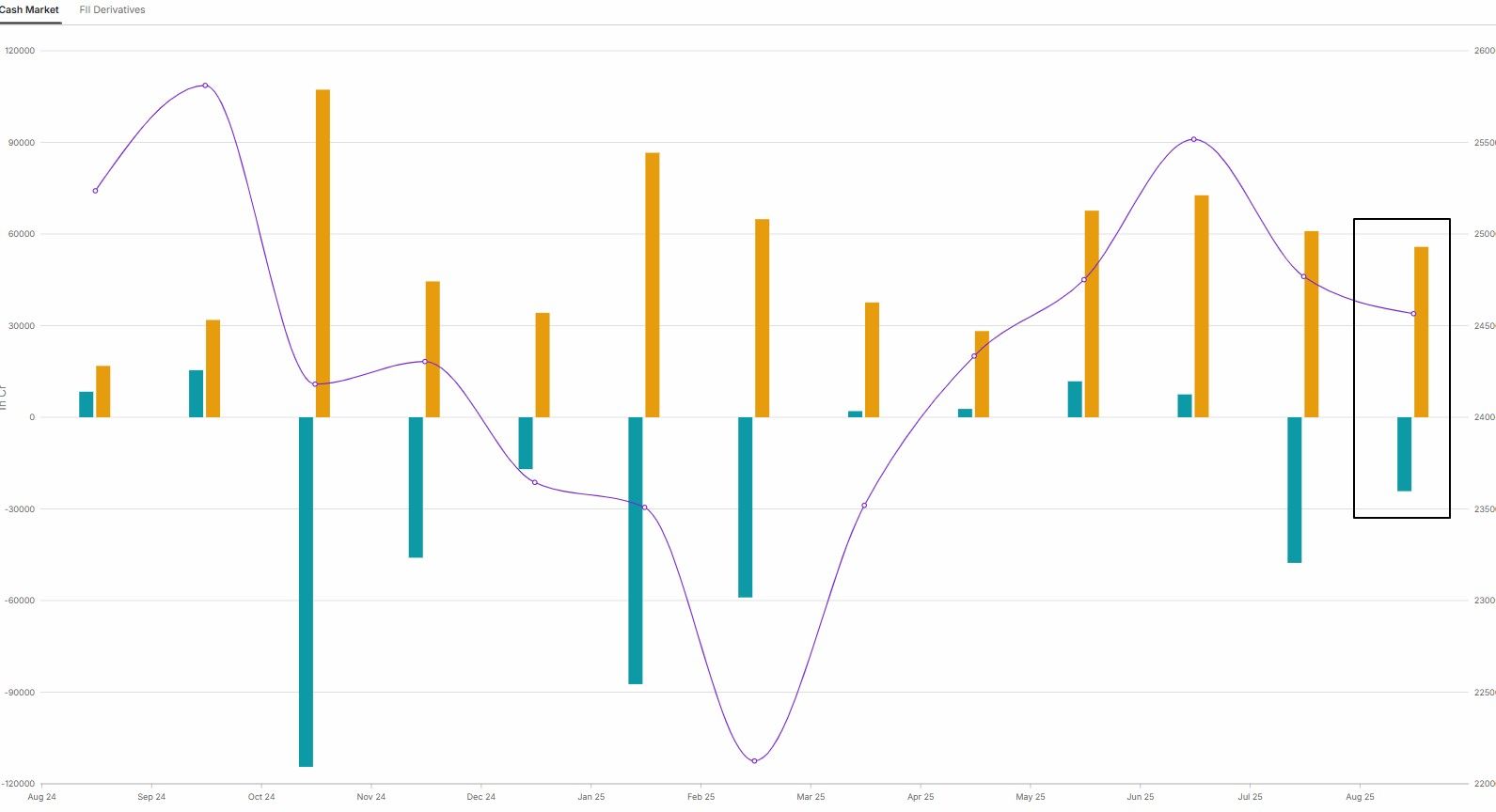

In the cash market, the FIIs have maintained an aggressive selling stance in the cash market, offloading shares worth a staggering ₹24,000 crore so far in August. In contrast, the Domestic Investors supported the markets and have bought shares worth ₹55,700 crore this month.

NIFTY50 index

Following six consecutive weeks of decline, the NIFTY50 index rebounded above the 24,600 mark. Price action largely remained within the 24,800–24,300 range, indicating that the short-term technical structure remains in a consolidation phase. As index oscillates within this range, traders should stay nimble. A decisive close above or below this range will provide further directional clues.

📌Spotlight: PSU banks staged a strong recovery this week, leading the broader market rally and outperforming their private sector peers. This was attributed to the sector's robust Q1 earnings, improved asset quality and continued margin expansion. Against this backdrop, the NIFTY PSU Bank Index jumped by almost 2%, with Indian Bank (+3.2%), State Bank of India (+2.7%), and Central Bank of India (+2.2%) among the standout performers.

Following the summit between the U.S. President Donald Trump and Russian President Vladimir Putin in Alaska, oil prices showed a muted reaction. Trump emphasised that the goal was to achieve a full peace deal for Ukraine rather than just a ceasefire. Importantly, Trump said he would hold off on imposing tariffs on countries like China and India for purchasing Russian oil, which positively affects the continued flow of Russian oil to global markets.

About The Author

Next Story