Market News

Week ahead: Fed policy, inflation data, a weak rupee and IT sector moves to guide market sentiment

.png)

5 min read | Updated on December 07, 2025, 12:43 IST

SUMMARY

In the week ahead, the market’s tone will be shaped by the U.S. Federal Reserve’s policy outcome and India’s inflation data. At the same time, ongoing rupee weakness may influence foreign flows and add another layer to sentiment. Taken together, these cues will guide NIFTY’s short-term direction.

NIFTY50 witnessed intense selling pressure at record high levels last week. Image sourece: Shutterstock.

Indian markets hit fresh record highs this week, albeit with noticeable intraday volatility as investors balanced optimism around RBI’s repo rate cut and currency weakness. The benchmark indices sustained the momentum, even as broader market participation remained mixed. Both the NIFTY50 and SENSEX ended the week flat at 26,186 and 85,712 respectively.

In contrast to the gains seen in the benchmark index, pressure was evident in the Mid and Small-cap universe. The Midcap 150 index slipped 0.8%, while the Smallcap 250 index dropped 1.4% for the week. On the macro front, currency weakness stayed in focus as the rupee slipped to a record low against the U.S. dollar. Despite this, equity sentiment held firm, suggesting that the market is currently treating rupee depreciation as manageable in the context of stable domestic growth and steady institutional flows.

Sectorally, IT gained about 3.4% this week, with currency weakness supporting export-focused tech stocks. Automobiles rose 0.5%, while Metals added 0.4%. Sectorally, Consumer Durables fell 3.1%, Defence declined 2.6%, and Energy dropped 1.6%, as these sectors faced profit-booking pressure.

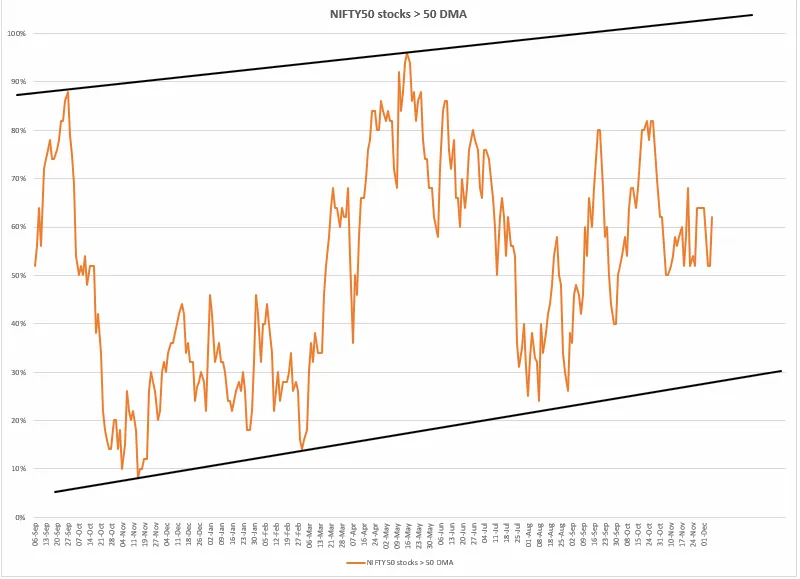

Index breadth

This week, the breadth of the index remained stable, with around 55 to 65 per cent of NIFTY50 stocks trading above their 50-day moving average. This kept the index within a supportive zone, though it failed to demonstrate the kind of momentum that would drive sustained upside. Buyers are showing up, yet breadth continues to stall well below its upper trend line, which signals that participation is good but not strong enough to push the market into a higher-momentum phase.

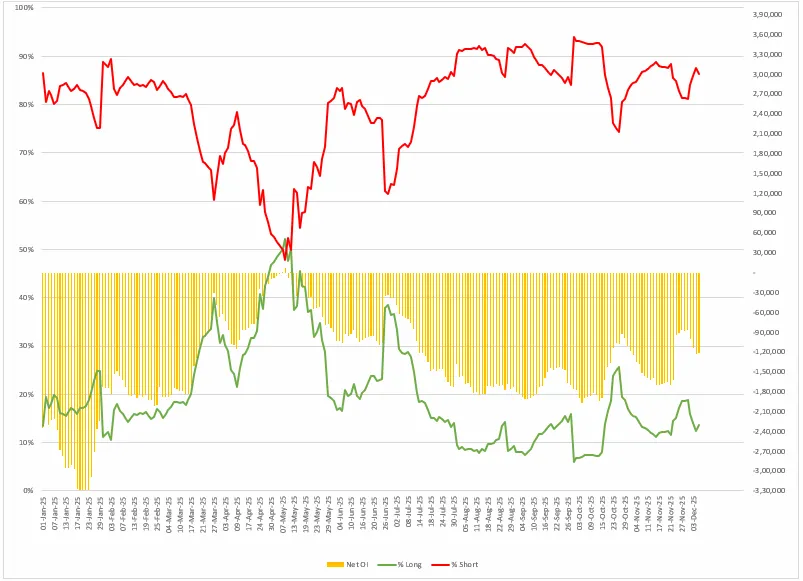

FIIs positioning equity and derivatives

This week, Foreign Institutional Investors (FIIs) further increased their short positions, with the long-to-short ratio moving from 19:81 to around 14:86. The steady rise in shorts and reduction in longs shows their broader positioning still remains bearish. Additionally, the net open interest remains lower than past peaks, which means FIIs are active but not building large positions. Overall, the data shows a clear pickup in short positioning through the week.

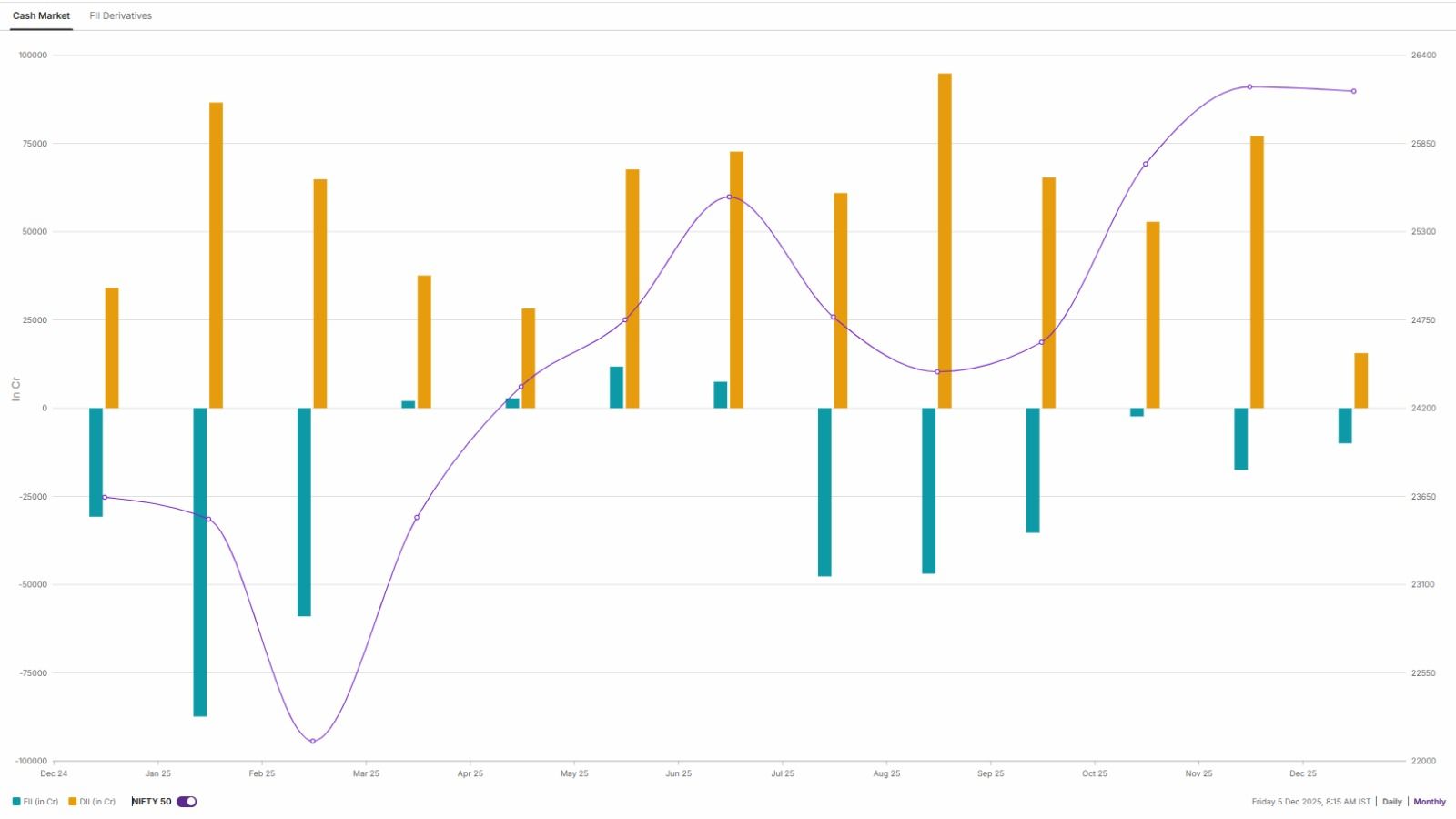

Meanwhile, in the cash market, FIIs have sold shares worth about ₹9,999 crore so far in December, extending the selling trend they carried through last month. Conversely, the Domestic Institutional Investors (DIIs) continue to support the markets and bought shares worth ₹15,596 crore last week.

NIFTY 50 index

The NIFTY50 is sending out mixed signals. The weekly candle has formed a bearish reversal pattern, which typically indicates exhaustion following a period of strong performance. However, Friday's sharp rebound added just enough strength to keep bullish sentiment. Currently, at this stage, the index is at a crossroads. If buyers follow through next week, this pullback could turn into early accumulation. However, if the rebound fades and supply increases again, the price would confirm distribution along with the confirmation of bearish reversal pattern.

Meanwhile, retail inflation in India, as measured by the CPI, fell to a record low of 0.25% year-on-year (YoY) in October 2025, down from 1.44% in September. This marks the ninth consecutive month that inflation has been below the Reserve Bank of India's (RBI) target of 4%. In response, the Reserve Bank cut its FY26 inflation projection to 2.0% from 2.6%. The November CPI data, due on 12 December, will reveal whether this downward trajectory continues, with forecasts suggesting a slight rebound to around 0.6% as base effects fade.

About The Author

Next Story