Market News

Week ahead: F&O monthly expiry, Trump’s tariffs, GDP data, and Q4 results among key market triggers to watch

.png)

6 min read | Updated on May 25, 2025, 12:32 IST

SUMMARY

Market trends next week will be driven by Q4 results, GDP estimates for the first quarter, Trump's tariffs on the European Union and Nvidia earnings. Meanwhile, the technical structure of the NIFTY50 index remains rangebound, with immediate resistance around 25,200 and support at around 24,350.

Stock list

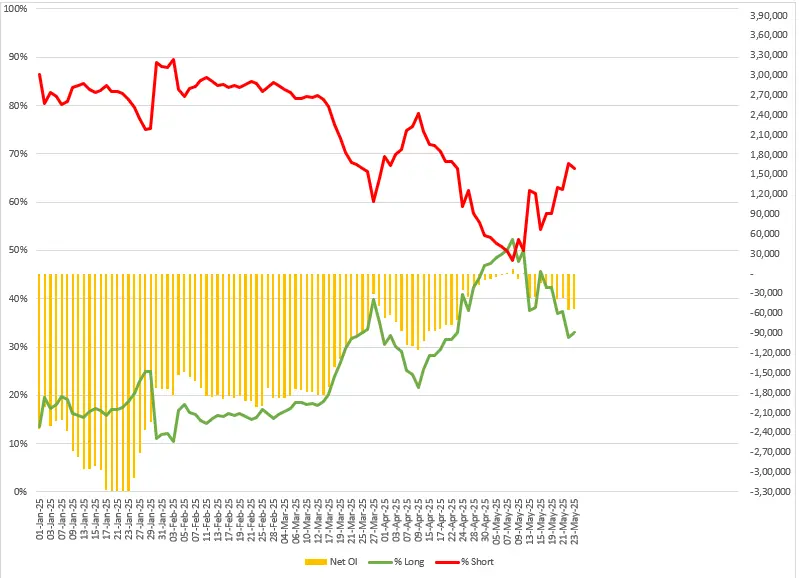

Foreign Institutional Investors (FIIs) maintained a mixed approach to index derivatives, shifting their long-to-short ratio to 33:67.

Indian markets saw increased volatility last week, ending slightly lower amid global bond market turmoil and foreign fund outflows. Meanwhile, the latest announcement of tariffs by U.S. intensified trade tensions, causing sharp swings in the NIFTY50 index. Despite the volatility, the headline index closed with a modest decline of 0.6%.

The broader markets closed with mixed results, with the NIFTY Midcap 100 index declining by 0.6% and the Smallcap 100 index rising by 0.4%. However, both indices formed indecision candles on the weekly chart.

In terms of sectors, the breadth remained neutral, with Real-Estate (+2.6%) and PSU banks (+1.1%) advancing the most among the major indices. Consumer Durables (-2.1%) and Automobiles (-1.8%) were the top losers.

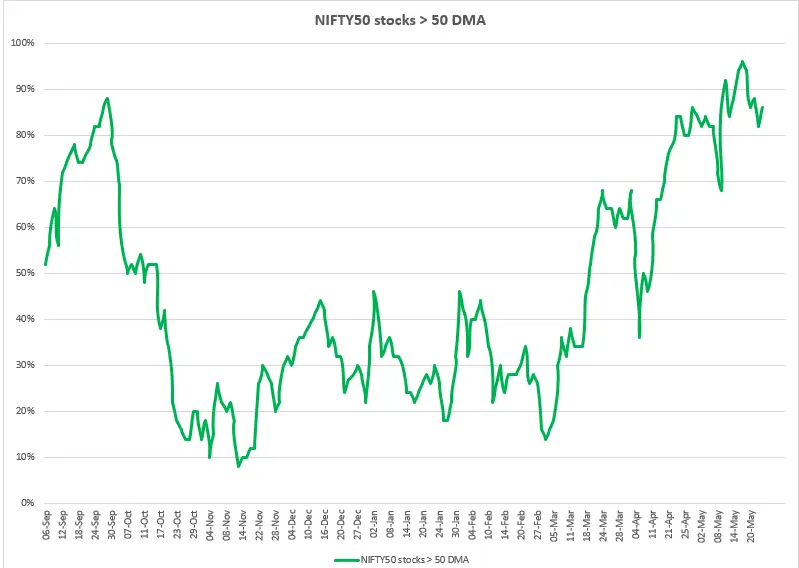

Index breadth

Last week, the breadth of the NIFTY50 index cooled off, with 96% of its constituents trading above the 50-day moving average (DMA). In last week's blog, we informed our readers that such elevated readings often lead to profit-taking and consolidation from higher levels. As a result, the index consolidated higher, maintaining positive breadth. Throughout the week, over 87% of its constituent traded above 50 DMA, indicating consolidation at higher levels.

FIIs positioning in the index

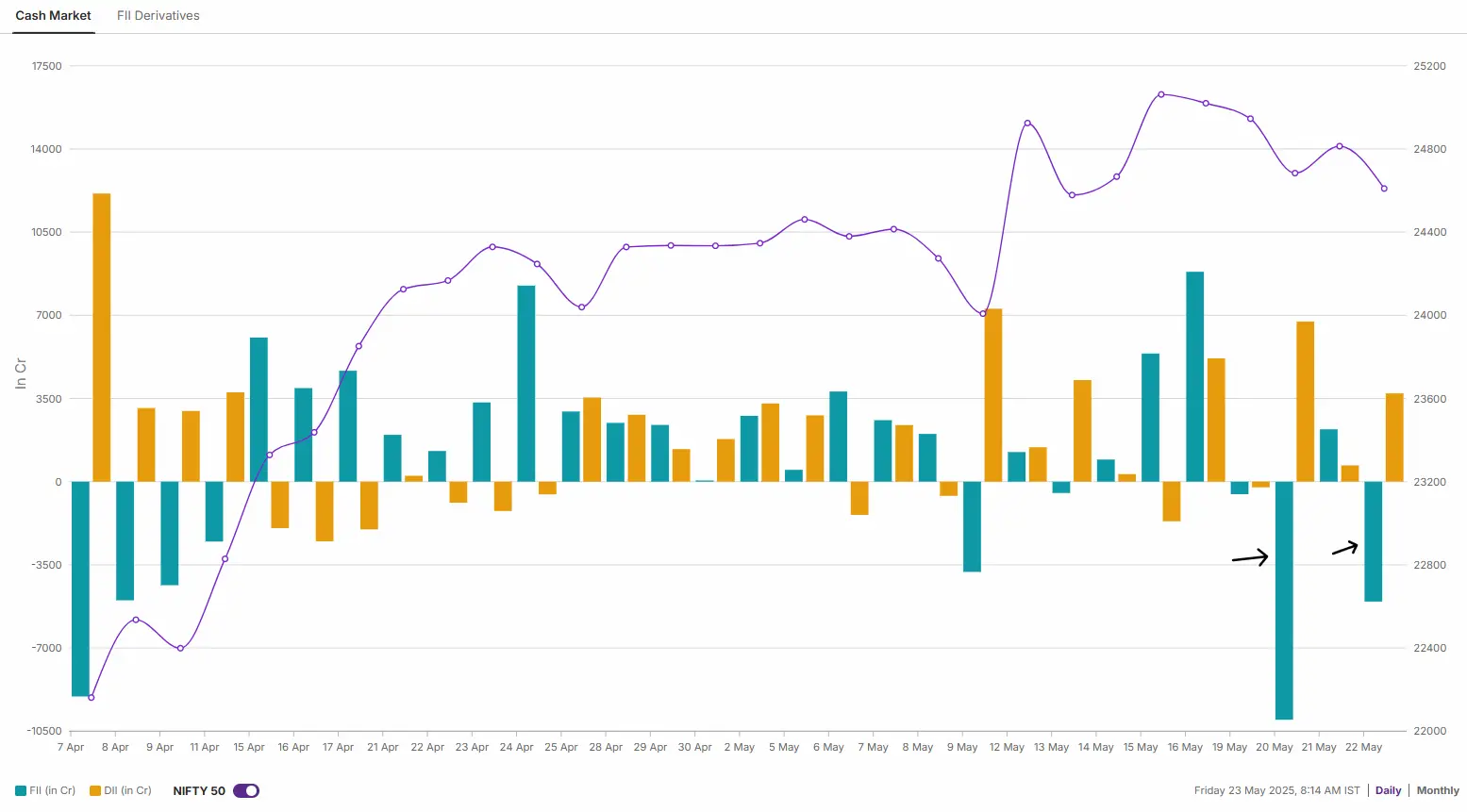

In the cash market, FIIs turned net sellers last week, offloading shares worth ₹11,591 crore. Their buying momentum remained weak, while selling activity increased, reflecting stronger selling pressure and subdued buying. Meanwhile, the Domestic Institutional Investors (DIIs) remained net buyers and purchased shares worth ₹11,197 crore.

NIFTY 50 index

After a sharp momentum, the NIFTY50 index entered a consolidation zone at higher levels and formed an inside candle on the weekly chart. The index broadly consolidated within the 24,350–25,200 range and failed to close above either level.

The formation of an inside candle with a large lower wick indicates that the bulls are still in control at higher levels. Additionally, the index is currently trading above all its key daily exponential moving averages (EMAs), such as the 21, 50 and 200-day EMAs. Provided it does not slip below the immediate support zone of 24,350 and 24,500, along with the 21 EMA, the breadth and trend may remain bullish. A close below this zone would be the first sign of weakness.

BANK NIFTY

After hitting a fresh all-time high in April, the BANK NIFTY index is consolidating at higher levels for the past nineteen trading sessions. The index is witnessing support based buying from the crucial zone of 54,100, while facing the resistance at 55,900 zone. For the short-term clues, traders can closely monitor the range as the break above or below these levels on a closing basis will provide further directional clues.

For the coming week, immediate support for the index is between 24,350 and 24,500 zone. Conversely, the immediate resistance is around 25,200 level. Within this range, the index may remain range-bound and a break of this range on a closing basis will provide further directional clues.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story