Market News

Week Ahead: Banks hold momentum; Nvidia’s big earnings and FII flows key to market direction

.png)

5 min read | Updated on November 16, 2025, 12:29 IST

SUMMARY

This week will be driven by strong momentum in banking stocks, with markets closely tracking Nvidia’s earnings for global cues. FII cash and derivatives flows will remain key in determining whether the current uptrend can sustain or cool off.

The NIFTY50 closed above 25,900, marking a weekly increase of around 0.7%. | Image: Shutterstock

Week ahead: Indian markets opened the November 9 week with increased volatility, but ultimately rallied, bouncing back strongly in the final session to reverse initial losses. Domestic sentiment was boosted by election results from Bihar, where the NDA crossed the 200 mark, outweighing mixed corporate earnings and weak global cues.

The NIFTY50 closed above 25,900, marking a weekly increase of around 0.7%, while the SENSEX finished at around 84,100, up by almost 0.8%. Unlike in previous weeks, large-cap indices outperformed their mid- and small-cap counterparts. The Mid-cap 150 index ended the week at 22,331, up 1.3%, while the Small-cap 250 index ended the week flat at 17,081.

Sector-wise, except for Real-Estate (-0.5%) all the major sectoral indices ended the week in green. Defence (+4.4%), IT (+3.7%) and Pharma (+2.9%) led the way and outperformed the benchmark indices.

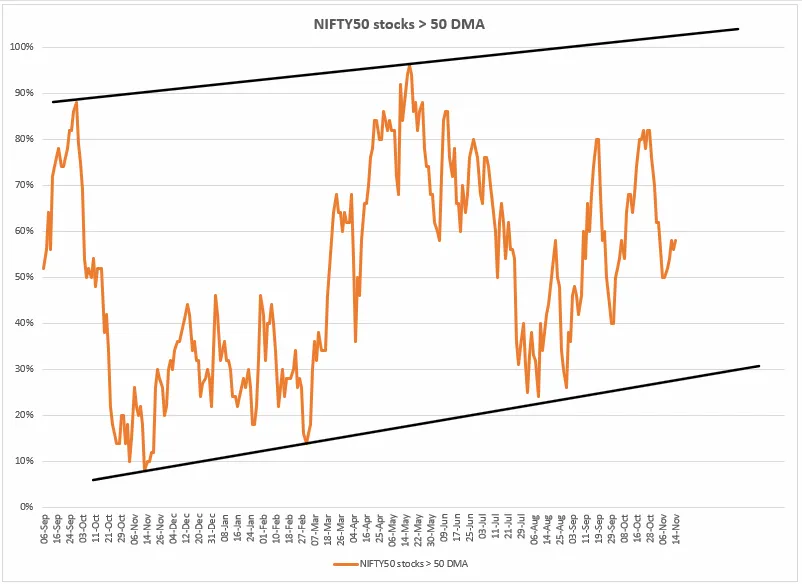

Index breadth

Last week, the percentage of NIFTY50 stocks trading above their 50-day moving average improved to around 55–60%. This shows a slight strengthening in market breadth, following a rebound from the lower rising trendline. Although this keeps the indicator in a neutral mid-range zone, it suggests that buyers have entered the market at a key structural support level. The broader trend remains positive, but meaningful confirmation of a bullish expansion will only come if the breadth reading pushes towards the 70%+ zone. Conversely, a slip back below 50% would suggest renewed weakness.

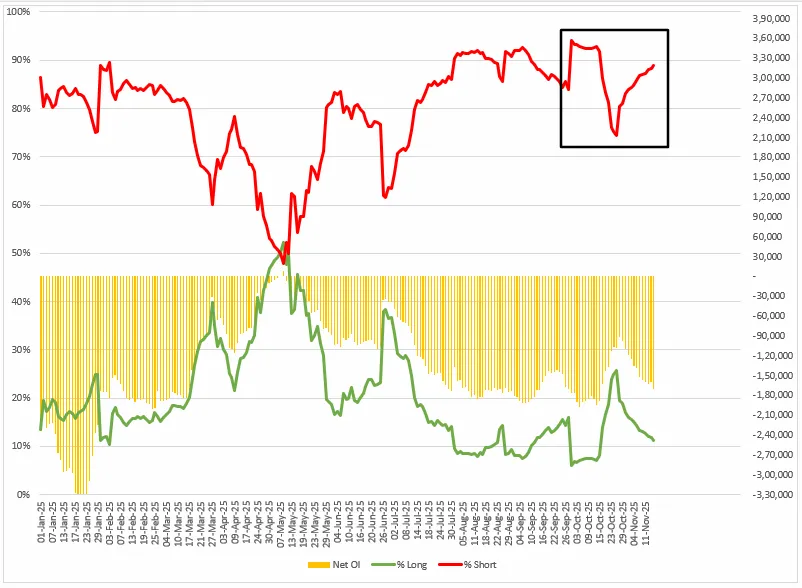

FIIs positioning in the index

Data on foreign investor futures last week shows a fresh build-up of short positions, with the net short percentage (red line) increasing to 89%, even though the index is continuing to recover. Conversely, the percentage of long positions (green line) has fallen further, suggesting that foreign institutional investors (FIIs) are reducing their long positions while simultaneously increasing their short positions. Meanwhile, overall futures open interest (orange bars) remains negative.

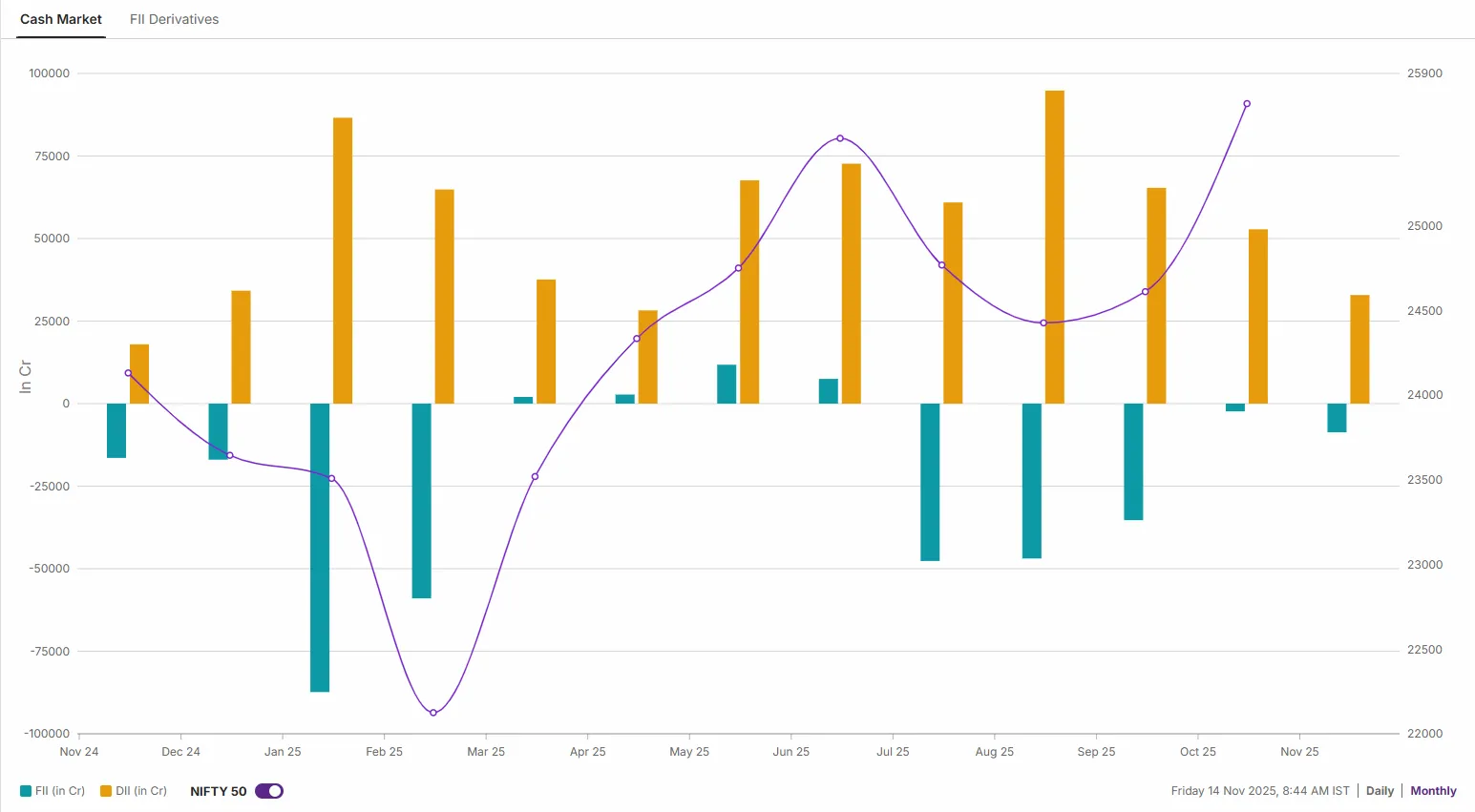

In the cash market, FIIs have remained net sellers so far in November, offloading equities worth ₹13,652 crore and reinforcing the broader trend of sustained foreign outflows. By contrast, domestic institutional investors (DIIs) have once again provided strong support, recording net purchases of ₹41,352 crore this month.

NIFTY50 index

In the past five sessions, the NIFTY50 index has largely consolidated within a narrow range after reclaiming the 25,700–25,900 zone. The index has consistently found support near its 21-day and 50-day exponential moving averages (EMAs), reflecting resilience from these short-term moving averages. In the upcoming sessions, the immediate resistance zone remains at 26,250, which coincides with the previous all-time high. A decisive close above this zone could pave the way for a fresh rally, whereas a break below 25,700 could lead to renewed selling pressure.

About The Author

Next Story