Market News

Week ahead: AI Summit, FOMC minutes, IT rout, rising VIX among key market triggers to watch

.png)

4 min read | Updated on February 15, 2026, 13:10 IST

SUMMARY

Indian markets ended the week lower as a sharp 8% slide in IT stocks and weak US cues dragged benchmark indices lower. For the coming week, market sentiment will be influenced by U.S. FOMC minutes and Q4 GDP data. Domestically, the focus will also shift to the high-profile AI summit featuring global tech leaders and heads of state.

In the cash market, the Foreign Institutional Investors (FIIs) turned net sellers for the week and sold shares worth ₹4,019 crore. | Image: Shutterstock

Indian markets failed to build on the momentum of the previous week and ended on a negative note. The sharp fall in the IT sector alongside weak global cues from the U.S. led benchmark indices surrendering nearly 1%. The NIFTY50 index ended the week at 25,471, while SENSEX closed at 82,626.

The spike in India VIX, the volatility index to 13.29 (+11%), prompting investors to book profit at higher levels. However, the broader markets fared better than its benchmark peers. The NIFTY Midcap 150 index closed at 21,884, down 0.1% for the week, while the Smallcap 250 index ended the week marginally in green at 15,988, up 0.7%.

Sectorally, the performance was mixed this week with Consumer Durables (+3.2%), PSU Banks (+3.2%) and Automobiles (+2.6%) ending the week in the green. IT (-8.2%), Oil and Gas (-1.9%) and Energy (-2.0%) declined the most.

Meanwhile, in India the upcoming AI summit will draw some of biggest names in artificial intelligence. Among the prominent industry leaders expected to attend is Sam Altman, Sundar Pichai at the summit. The event will also see participation from Dario Amodei of Anthropic, reflecting strong engagement from leading generative AI firms.

Along with CEOs at least 20 heads of state and government, including leaders from France, Brazil, Spain, Sri Lanka, Finland, Greece, Switzerland and others, are confirmed to attend at the summit.

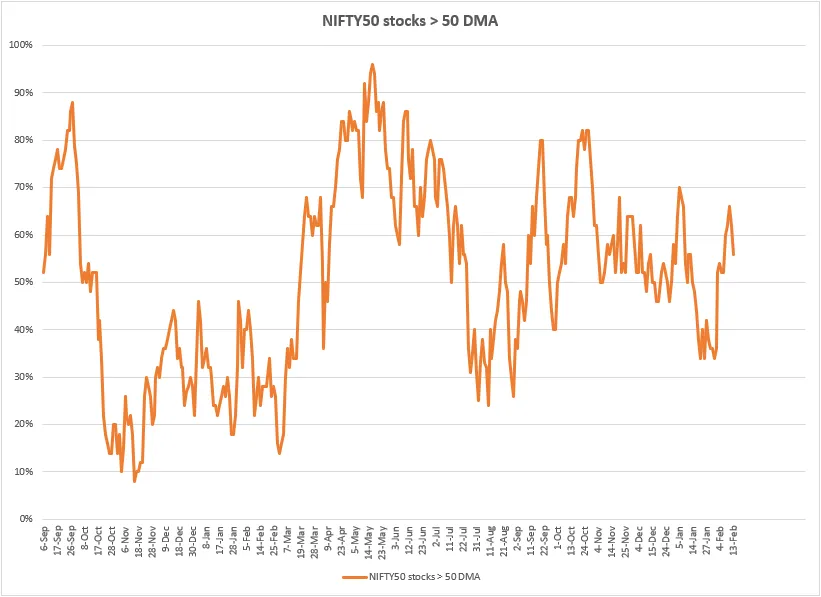

Market breadth

The NIFTY50 breadth indicator, representing percentage of stocks trading above their 50-day moving average (DMA), rebounded above 50%, indicating gradual recovery. However, it is important to note that the breadth remains far from overbought zone of 75–80%. A break below the 50% threshold will signal weakness in the momentum.

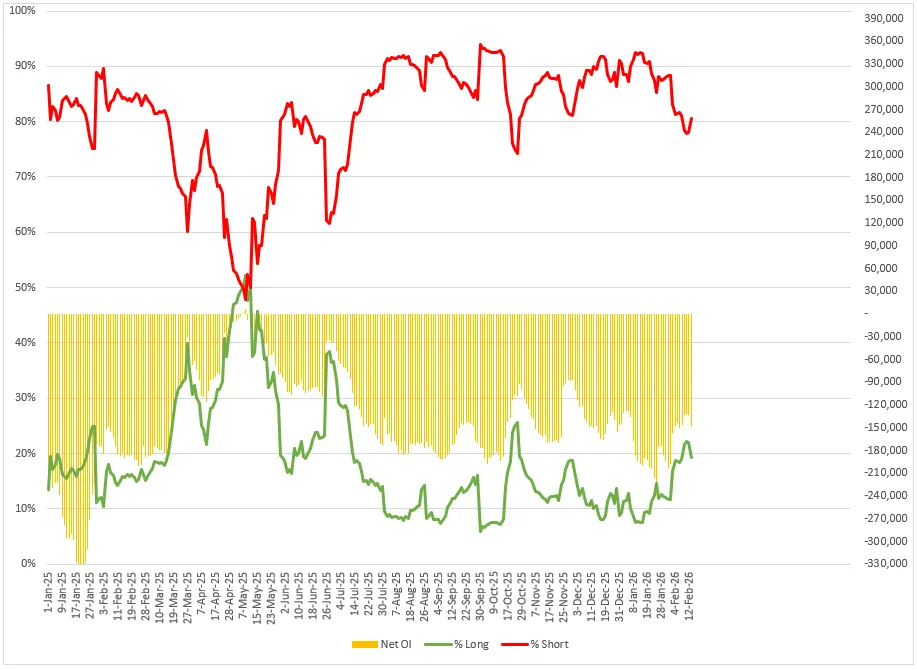

FIIs cash market and derivatives

In the cash market, the Foreign Institutional Investors (FIIs) turned net sellers for the week and sold shares worth ₹4,019 crore. However, the Domestic Institutional Investors continued to support the markets as they bought shares worth ₹6,883 crore.

In the derivatives market as well, the FIIs sustained and increased the bearish bets in index futures towards the fag-end of the week. Throughout the week they sustained the long-to-short ratio around 22:78 and increased the ratio to 19:81, signaling increase in bearish bets.

NIFTY 50 outlook

The NIFTY50 index faced significant selling pressure on Friday, 13 February and slipped below its 21-day and 50-day exponential moving averages (EMAs). This indicates that the short-term momentum of the index has weakened. It is now approaching the crucial support zone of 200-day EMA around 25,200. A decisive break below this zone will signal further weakness, with next support around 24,571 (budget day low). Meanwhile, 25,700 zone will now act as immediate resistance. Unless index reclaims this zone on a closing basis, the trend may remain bearish.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story