Market News

Trade setup on May 13: Will NIFTY50 breakout above 25,000 on Tuesday? Here's all you need to know

.png)

4 min read | Updated on May 13, 2025, 09:08 IST

SUMMARY

After a strong session, NIFTY50 is expected to open on a negative note amid renewed tensions at the India-Pakistan border. The US markets closed with the best gains in over 3 years, and Asian markets traded mixed on Tuesday morning. Despite the positive sentiments, investors will remain cautious on the upcoming CPI release in the evening.

GIFT NIFTY indicates gap down opening for Indian markets on Tuesday.

Indian markets are expected to open in the red after posting their best gains in over four years on Monday. The GIFT NIFTY indicates a gap-down opening of 154 points after late-night drone attacks on the India-Pakistan border renewed the tensions.

Asian markets

Asian markets traded mixed on Tuesday morning after the US markets rallied on the US-China trade truce. The Japanese index rallied nearly 1%, while Hong Kong’s Hang Seng index traded red with over 1% losses.

US markets

The US markets rallied the most in three years on Monday as the US-China trade deal eased the tensions of an economy-induced recession. Experts believe it also reduced the probability of recession to some extent. The NASDAQ and S&P 500 rallied 4% and 3.5% respectively, while the Dow Jones surged 1,160 points on Monday. The US cut the tariffs to 30% and China to 10% for 90 days. Following the key development, tech stocks led the rally with stocks like Nvidia, Apple, Amazon, Tesla, Meta and Alphabet gaining more than 5%.

Despite the buoyed and optimistic sentiments, investors need to remain cautious on today’s CPI data release for the US. According to recent Federal Reserve minutes, the future rate cut trajectory is solely dependent on the data. The US futures traded steady holding on to yesterday’s gains.

NIFTY50

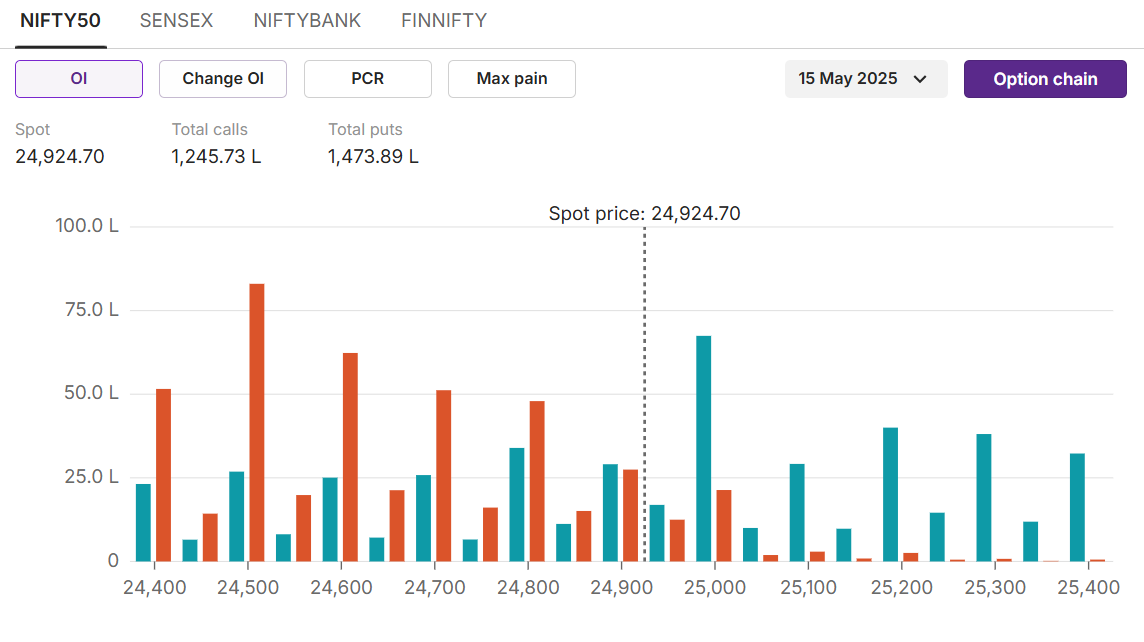

Max call OI:25,000

Max put OI:24,500

(Ten strikes to ATM, 15 May expiry)

NIFTY50 witnessed one of the best single-day gains in the last four years. Markets made a gap-up opening and extended their gains throughout the session, trading near the day’s high, as sentiments were optimistic after India and Pakistan announced reaching an understanding to stop all firings and military actions on land, air and sea. Sentimentally, NIFTY50 defended the 24,000 levels and closed above the previous swing high level of 24,800.

On the options front, gap-up opening and strong resilience throughout the day led traders to unwind the calls of 24,500, which previously held the highest open interest. After Monday’s strong rally, the 25,000 levels now hold the highest open interest on the call side, acting as crucial resistance for the 15th May expiry. On the downside, 24,500 puts witnessed strong open interest addition, indicating support for the weekly expiry.

On the options front, gap-up opening and strong resilience throughout the day led traders to unwind the calls of 24,500, which previously held the highest open interest. After Monday’s strong rally, the 25,000 levels now hold the highest open interest on the call side, acting as crucial resistance for the 15th May expiry. On the downside, 24,500 puts witnessed strong open interest addition, indicating support for the weekly expiry.

SENSEX

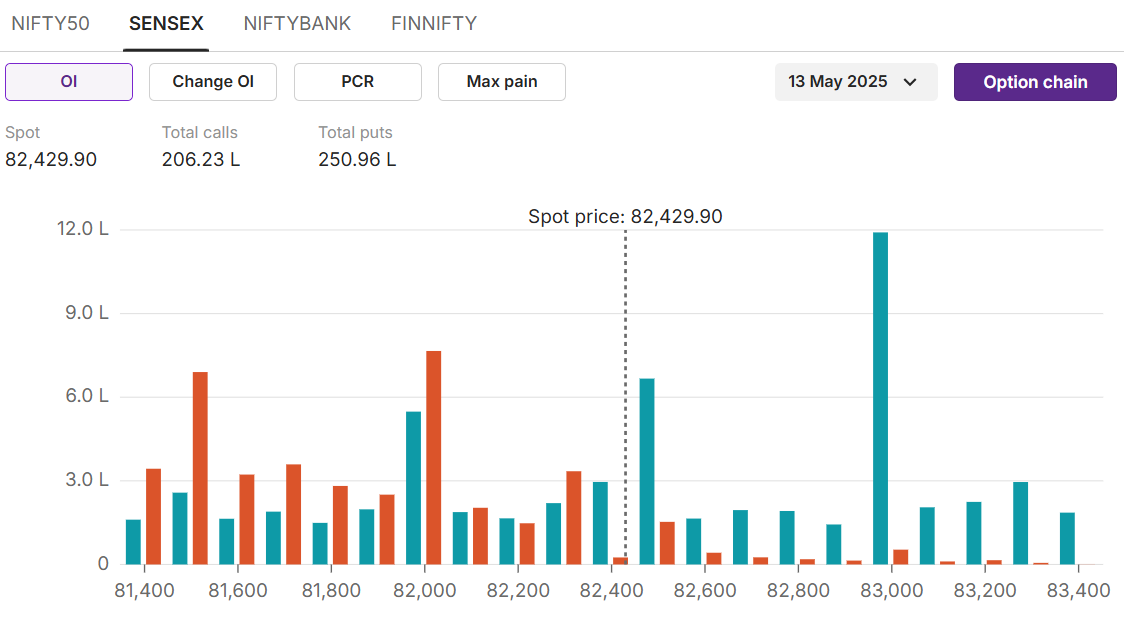

Max call OI: 83,000

Max put OI: 82,000

( Ten strikes to ATM, 13 May expiry)

Similar to NIFTY50, SENSEX also closed 3.7% higher on Monday, amid a broad-based rally led by positive global and domestic factors. SENSEX closed above the previous swing high levels of 82,000. Experts believe a closing above 82,429 could lead the index to rally towards the record high of 85,900-plus levels.

Stock scanner

Long buildup: Adani Enterprises, Infosys, Trent, Shriram Finance

Short buildup: IndusInd Bank, Sun Pharmaceuticals

Top traded futures contracts: HDFC Bank, ICICI Bank, SBI

Top traded options contracts: SBIN 820 CE, Reliance 1500 CE, Infosys 1700 CE

Under F&O ban:CDSL,Manappuram, RBL Bank

About The Author

Next Story