Market News

Trade Setup for Sept 30: NIFTY50 consolidates around 26,000, sustains bullish momentum

.png)

5 min read | Updated on September 30, 2024, 07:38 IST

SUMMARY

According to open interest data, the NIFTY50 has a substantial put base at the 26,000 level for the October 3 expiry, signalling strong support around this area. The index is likely to continue its bullish trend unless it closes below this key level.

GIFT NIFTY indicates a flat-to-negative opening on Monday, 30 Sept, 2024

Asian markets update

The GIFT NIFTY is down 0.1%, pointing at a flat-to-negative start for the NIFTY50 today. Meanwhile, the sentiment across Asian markets remains mixed. Japan's Nikkei 225 is down over 4%, while Hong Kong's Hang Seng Index has erased all of its opening gains and is now up 1%.

The sharp fall in the Nikkei 225 comes after the country's ruling party chose former defence minister Shigeru Ishiba as the next prime minister. The new party leader is in favour of raising interest rates to control inflation, strengthening the Yen and has expressed support for raising taxes on financial income.

U.S. market update

Dow Jones: 42,313 (▲0.3%) S&P 500: 5,738 (▼0.1%) Nasdaq Composite: 18,119 (▼0.3%)

U.S. indices ended the Friday’s session on a mixed note as the investors digested the latest reading of the August’s Personal Consumption Expenditures (PCE) Index, the Fed’s favoured inflation metric. The inflation reading slipped to 2.2% from a year earlier, below the expectation of 2.3%.

However, the experts believe more than the inflation the labour market data between October and Federal Reserve’s Novemeber meeting will be a key metric to track. The incoming labour data will provide greater confidence to the Fed regarding soft landing of the U.S. economy.

NIFTY50

October Futures: 26,345 (▲0.1%) Open Interest: 6,51,375 (▲1.4%)

The NIFTY50 index snapped its six-day winning streak and ended the Friday’s session in the red. The index formed a small red candle on the daily chart and ended the day broadly flat.

The open interest data of NIFTY50’s for the 3 October expiry has significant put base at 26,000 strike, suggesting that index has strong support in this area. Conversely, the call base was seen at 26,500 strike, indicating that the index may face resistance around this zone.

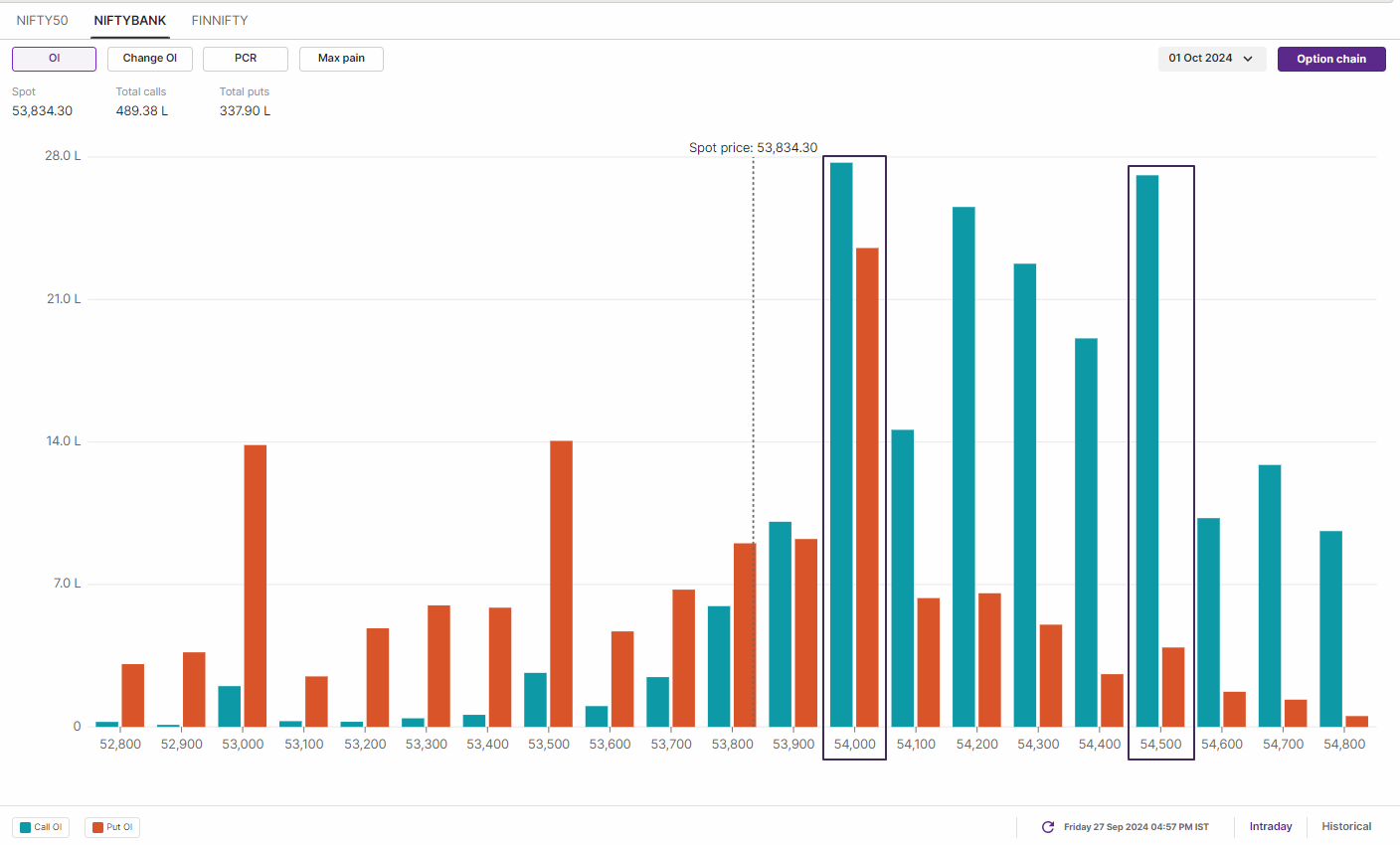

BANK NIFTY

October Futures: 54,220 (▼0.6%) Open Interest: 1,21,999 (▼3.0%)

The BANK NIFTY ended the Friday’s session in the red and formed a bearish engulfing candle on the daily chart. The index surrendered the crucial 54,000 mark on closing basis amid profit booking in the index heavyweight private banks.

As seen on the chart below, the index has formed a bearish engulfing candle on the daily chart, which is a bearish reversal signal. This is a two-candle formation where a smaller bullish candle is followed by a larger bearish candle, completely erasing the previous day's gains, indicating weakness. However, the pattern is confirmed if the close of the following candle is lower than the reversal pattern.

The broader trend of the index remains bullish following its breakout above the previous all-time high of 53,350 on September 20 . After the sharp rally over the past two weeks, the index may consolidate around this level in the near-term. However, if it falls below this key support zone, the trend could show signs of weakness.

FII-DII activity

Stock scanner

Long build-up: Bharat Petroleum, Polycab, Colgate Palmolive, Aditya Birla Fashion and Retail and NTPC

Short build-up: Godrej Consumer Products, Indian Energy Exchange and HDFC AMC

Under F&O ban: NIL

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story