Market News

Trade Setup for Sept 19: NIFTY50 sustains bullish momentum, US Fed cuts rates by a half point

.png)

4 min read | Updated on September 19, 2024, 07:36 IST

SUMMARY

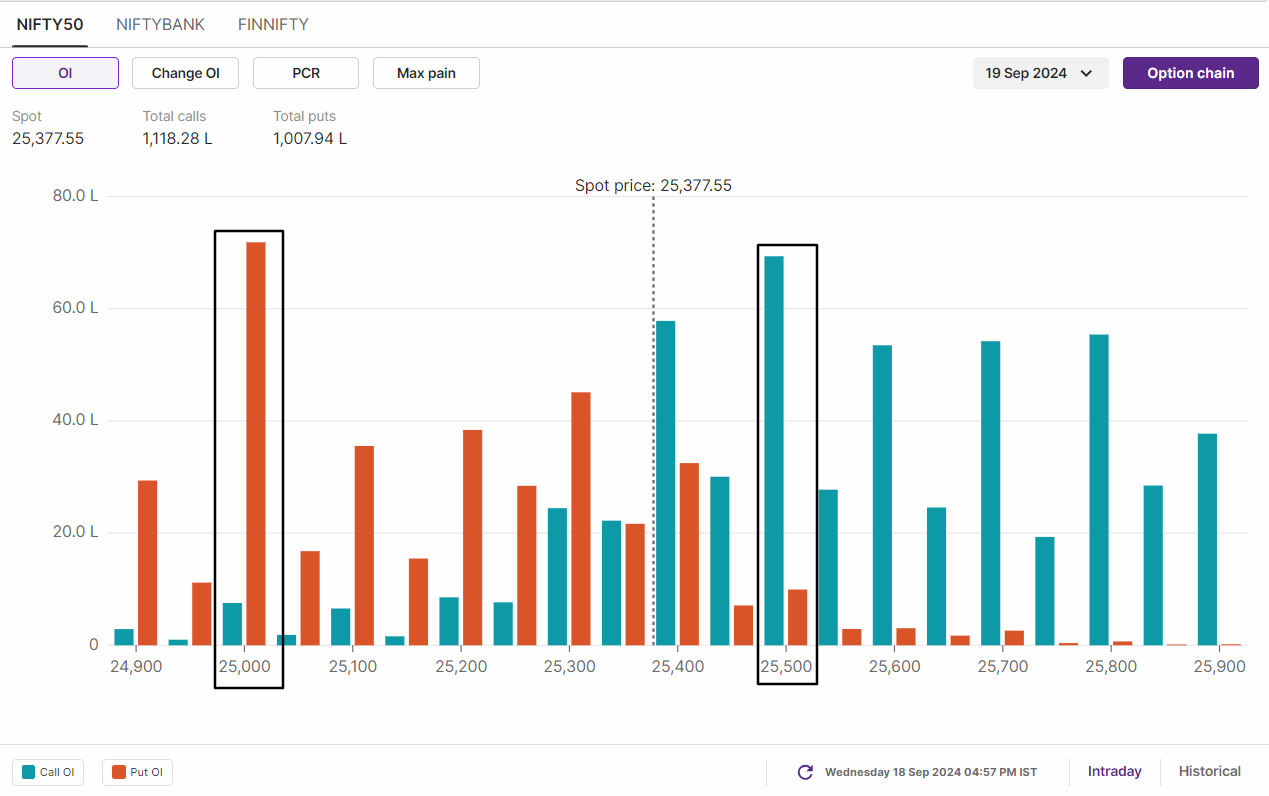

As per options data for today’s expiry, the NIFTY50 has immediate support around the 25,000 zone, while the hurdle remains at 25,500. A break of this zone on an intraday or closing basis will provide traders with further clues.

Stock list

The Bank Nifty is currently showing strong support around the 51,750 level, which is the breakout zone from September 12.

Asian markets update at 7 am

The GIFTY NIFTY is trading flat, hinting at a subdued start for the Indian equities today. Meanwhile, the other Asian markets are trading mixed. Japan’s Nikkei 225 is up 2.2%, while Hong Kong’s Hang Seng index slipped 0.2%.

U.S. market update

- Dow Jones: 41,503 (▼0.2%)

- S&P 500: 5,618 (▼0.2%)

- Nasdaq Composite: 17,573 (▼0.3%)

U.S. indices ended Wednesday's volatile session in the red after the Federal Reserve cut interest rates by 0.5%. In its first rate cut since 2020, the central bank has now shifted the federal funds rate between 4.75% and 5%.

Moreover, in its latest projections, the Fed expects two more rate cuts of up to 0.5% in 2024, which means that the Fed expects rates to be in the range of 4.25% to 4.4%. The easing is significantly less than the June 2024 projections, which saw rates in the range of 5.0% to 5.25%.

NIFTY50

- September Futures: 25,369 (▼0.3%)

- Open Interest: 5,29,6009 (▼3.4%)

The NIFTY50 index ended Wednesday's volatile session in the red and formed third consecutive doji candlestick pattern on the daily chart. With the sharp uptick in the volatility, the index expanded its trading range and formed an indecision candle.

On the technical front, the index has formed third consecutive doji candle, hinting at indecision. As you can see on the chart below, the index has immediate support between 25,100 to 25,150 zone, while the resistance remains around 25,500 levels. The positional traders should closely monitor the closing price on the daily chart. A close below or above these zones will provide clear directional clues.

Meanwhile, the options data for today’s expiry saw significant call build-up at 25,500 strike, hinting at immediate hurdle for the index around these levels. Conversely, the put base remained established at 25,000 strike, indicate support around this strike.

BANK NIFTY

- September Futures: 52,757 (▲0.8%)

- Open Interest: 1,28,175 (▼4.9%)

The BANK NIFTY index extended the winning streak for the fifth consecutive day and inched closer to it all-time high. The index formed a bullish Marubozu candle on the daily chart, pointing at continuation of the bullish momentum.

A bullish Marubozu is a candlestick pattern with a long green body and no lower wick, indicating strong buying pressure throughout the session. It suggests the continuation of an upward trend, as the open equals the low.

The index is currently showing strong support around the 51,750 level, which is the breakout zone from 12 September. On the upside, resistance lies between the 53,200 to 53,300 range, its previous all-time high. If the index manages to sustain and close above the 53,000 level on smaller time frames, it may attempt to retest this all-time high resistance zone.

FII-DII activity

Stock scanner

Under F&O ban: Aarti Industries,Balrampur Chini Mills, Biocon, Birlasoft, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, LIC Housing Finance, Oracle Financial Services Software, Punjab National Bank and RBL Bank

Added under F&O ban: Oracle Financial Services Software

Out of F&O ban: Bandhan Bank and Hindustan Copper

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story