Market News

Trade Setup for Sept 16: NIFTY50 forms bullish engulfing on weekly chart ahead of the U.S. Fed meet

.png)

4 min read | Updated on September 16, 2024, 07:35 IST

SUMMARY

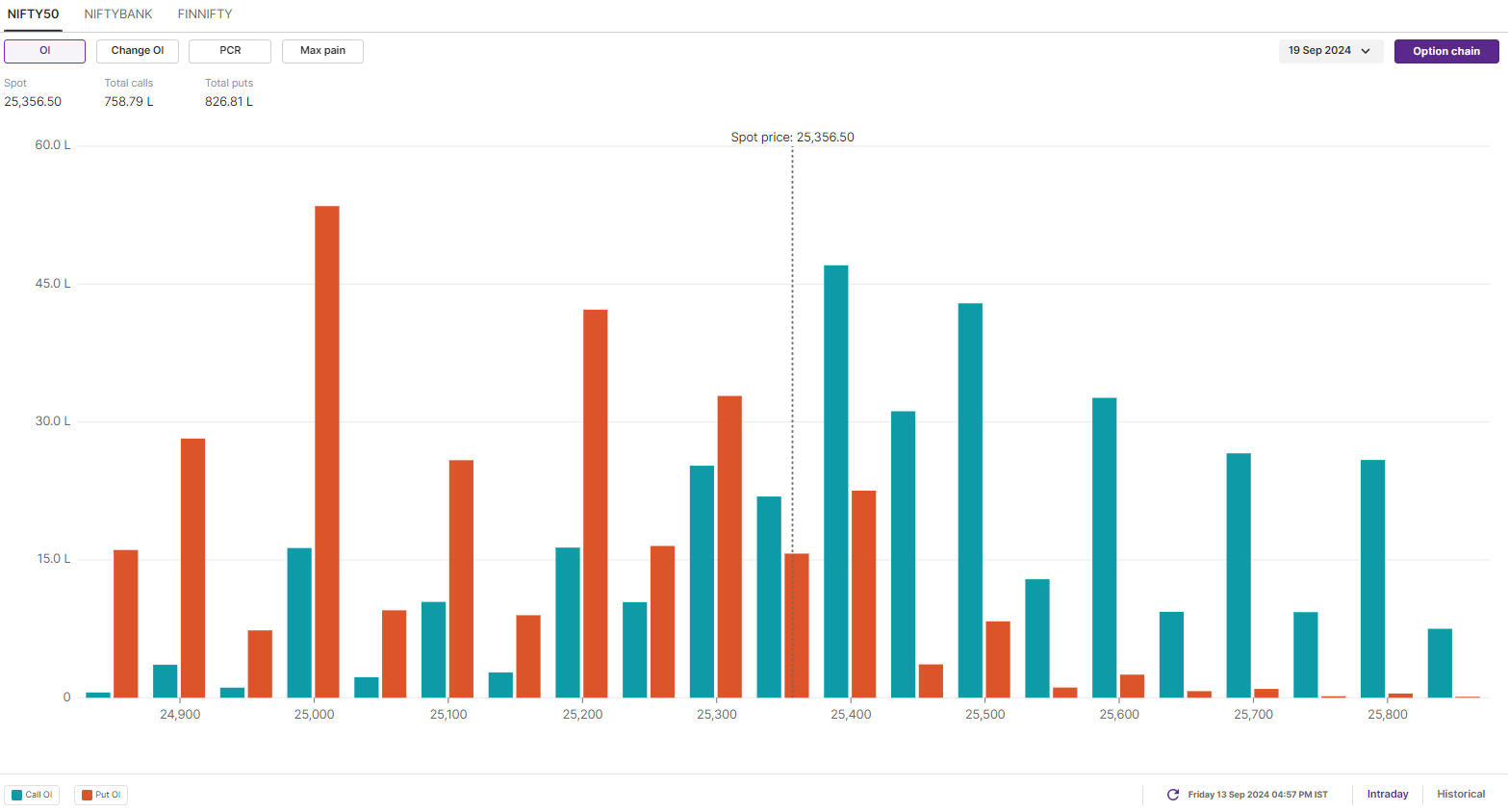

As per the options data of the September 19 expiry, the NIFTY50 index shows significant put build-up at the 25,000 strike, making it a crucial support zone. However, it is crucial to consider that the impact of the U.S. Fed’s interest rate decision on 18th September will likely influence the NIFTY50 weekly expiry on 19th September.

Stock list

The open interest positioning on the NIFTY50 for the September 19th expiry has its highest put base at the 25,000 strike, indicating support for the index around this level.

Asian markets update at 7 am

The GIFT NIFTYY is up 0.2%, signaling a positive start for the indian indices today. Meanwhile, markets in Japan and China are closed for a holiday. However, Hong Kong’s Hang Seng index is down 1%, reflecting the reaction to China’s slower-than-expected retail sales and industrial production data.

U.S. market update

- Dow Jones: 41,393 (▲0.7%)

- S&P 500: 5,626 (▲0.5%)

- Nasdaq Composite: 17,683 (▲0.6%)

U.S. market continued its winning streak, with the S&P 500 and Nasdaq 100 closing in the green for the fifth day in a row. Wall Street is now looking ahead to the Federal Reserve's policy meeting on 17-18 September, where the central bank is expected to cut interest rates. As on Friday, traders are pricing in a 50% chance of a 50 basis point cut, up from 15% last week.

NIFTY50

- September Futures: 25,372 (▲0.0%)

- Open Interest: 5,76,044 (▼1.5%)

The NIFTY50 started Friday's session on a positive note, consolidating gains at higher levels. The index formed a small red candlestick on the daily chart, indicating range-bound activity around current levels.

The technical structure of the index looks bullish on the daily chart, with immediate support between the 25,150 and 25,200 levels. In addition, the index closed above the previous week's high, forming a bullish engulfing on the weekly chart. A bullish engulfing is a reversal pattern that is followed by a bearish candlestick, indicating the emergence of buyers.

The open interest positioning on the NIFTY50 for the September 19th expiry has its highest put base at the 25,000 strike, indicating support for the index around this level. Conversely, call bases are established at 25,400 and 25,500 strikes, suggesting resistance for the index around these levels.

BANK NIFTY

- September Futures: 51,929 (▲0.3%)

- Open Interest: 1,46,295 (▲0.4%)

The BANK NIFTY outperformed its benchmark indices on Friday and formed a bullish engulfing candle on the weekly chart, gaining almost 3%.

On the daily chart, the index is currently trading above its 20- and 50-day moving averages. It also closed above its recent swing high (51,750) from the 3rd of September, indicating bullish momentum. However, if the index falls below the 50,500 and 50,300 zone, it could become range-bound.

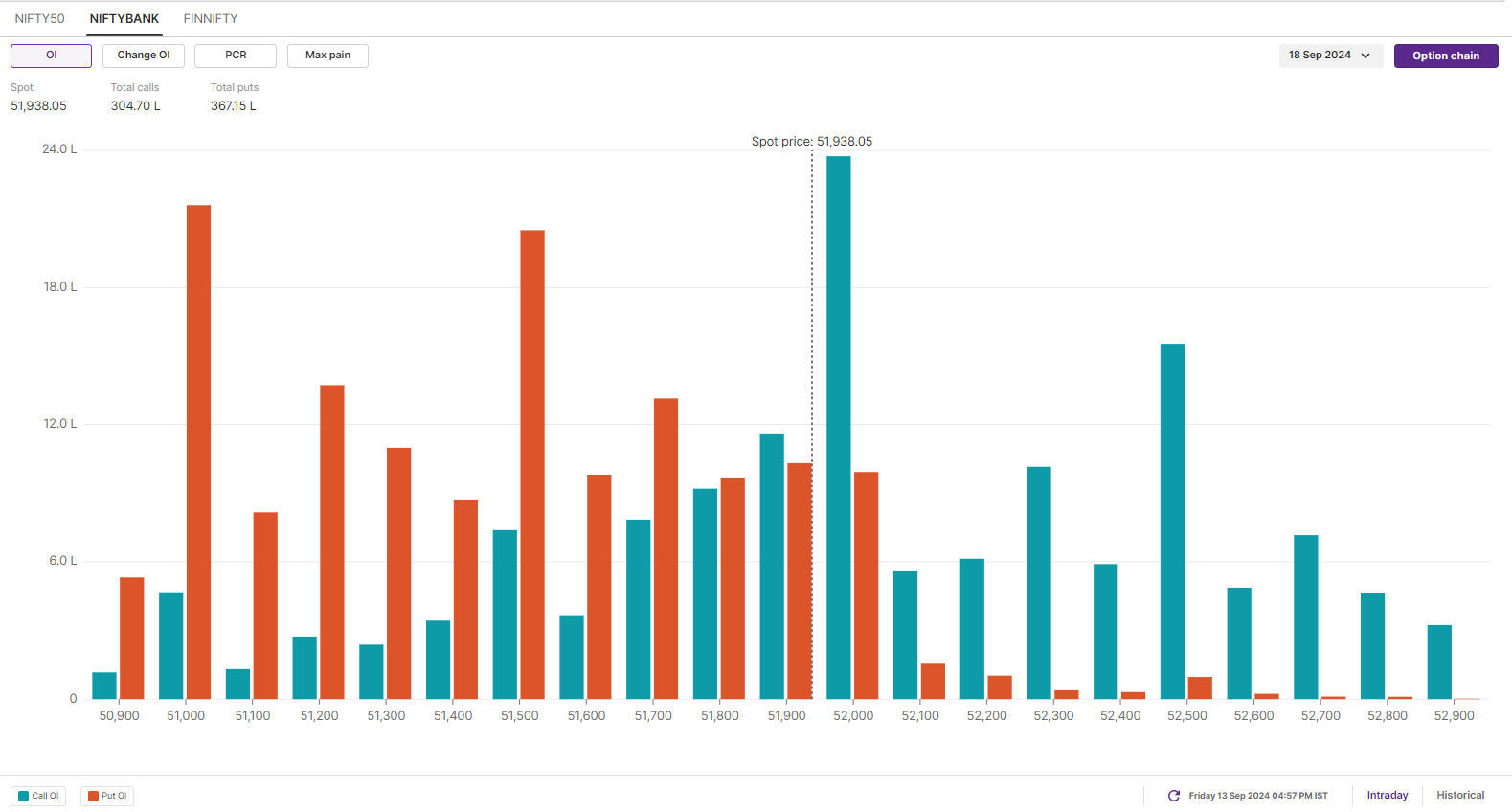

Open interest build-up for BANK NIFTY’s 18 September expiry has significant call placement ar 52,000 strike. This suggests that index may face resistance in this zone. On the other hand, the put base was established at 51,500 and 51,000 strikes, suggesting support for the index around these strikes.

FII-DII activity

Stock scanner

Short build-up: Godrej Consumer Products and Power Finance Corporation

Under F&O ban: Aarti Industries,Balrampur Chini Mills, Bandhan Bank, Chambal Fertilisers, Granules India, Hindustan Copper and RBL Bank

Out of F&O ban: Aditya Birla Fashion and Retail

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story