Market News

Trade Setup for Oct 30: NIFTY50 sustains bullish momentum, 24,500 crucial for further upmove

.png)

5 min read | Updated on October 30, 2024, 08:09 IST

SUMMARY

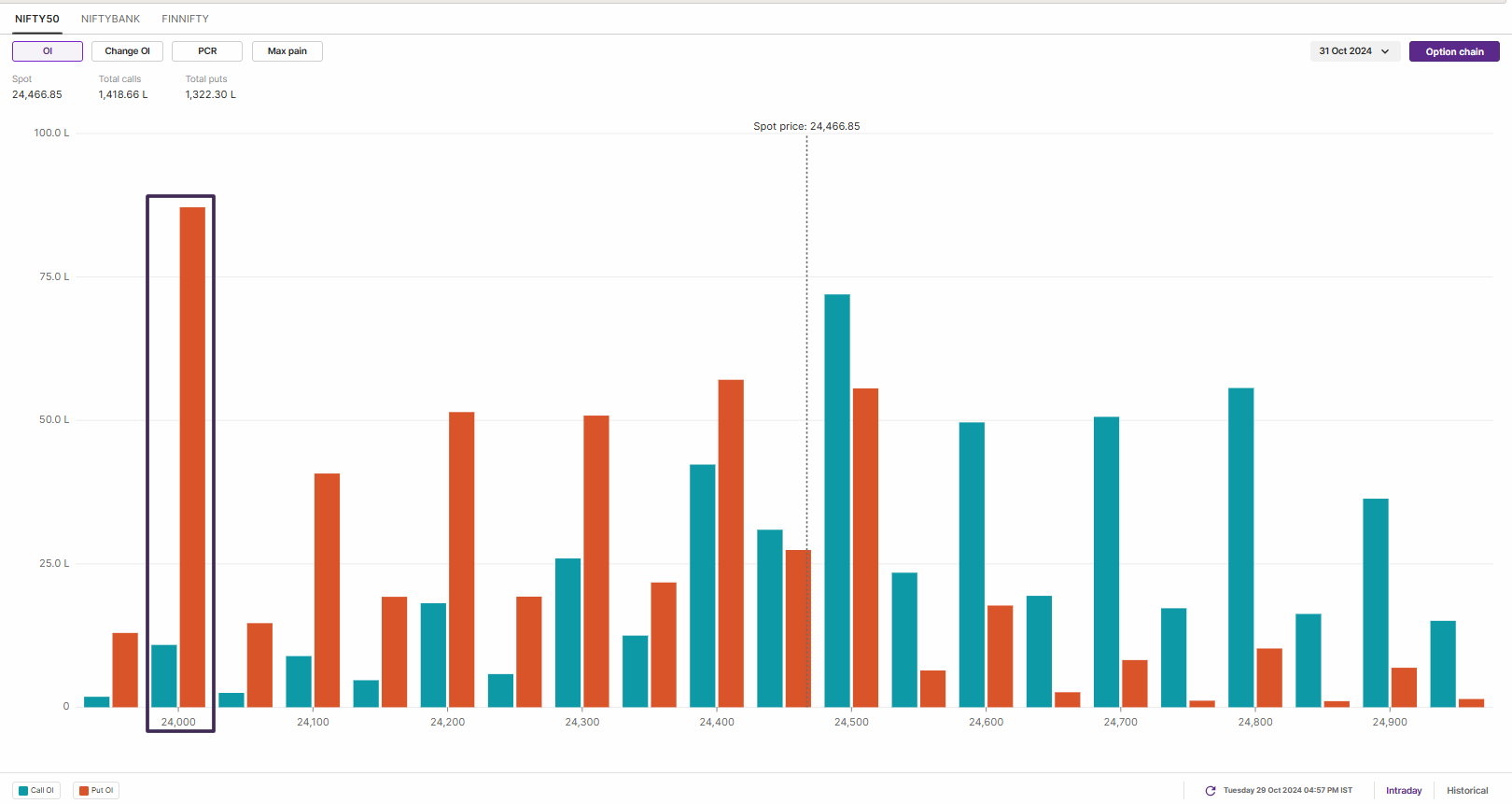

The NIFTY50 index witnessed significant put writing from 24,000 to 24,400 strikes, suggesting the entry of fresh buyers from lower levels. Traders should monitor the price action of the index around the 24,500 and 24,600 zones. A close above this zone will result in a rebound towards the 24,700 region.

Stock list

After an initial dip, the NIFTY50 Index bounced off the day's low and gained over 1%, led by strong gains in the banking sector and reduced selling by foreign investors.

Asian markets update

The GIFT NIFTY is trading flat, pointing to a subdued start for the NIFTY50 today. Other Asian indices are trading mixed. Japan's Nikkei 225 is up 1%, while Hong Kong's Hang Seng Index is down 0.5%.

U.S. market update

- Dow Jones: 42,233 (▼0.3%)

- S&P 500: 5,832 (▲0.1%)

- Nasdaq Composite: 18,712 (▲0.1%)

U.S. indices ended the Tuesday’s volatile session on a mixed note. The tech stocks were in focus as the Nasdaq Composite hit a fresh record high. The Google parent Alphabet started the earnings season for the tech giants after the market hours. The company’s third quarter earnings beat analysts’ estimates on both top and bottom lines, driven by strong growth in its cloud business.

NIFTY50

- October Futures: 24,477 (▲0.4%)

- Open Interest: 3,34,090 (▼17.6%)

After an initial dip, the NIFTY50 Index bounced off the day's low and gained over 1%, led by strong gains in the banking sector and reduced selling by foreign investors. The index found support near the previous day's low and saw buying interest from lower levels.

On the daily chart, the index formed a bullish candlestick and closed above the previous two sessions. The index also formed a long shadow on the daily chart, suggesting the arrival of fresh buyers from the lower levels. The immediate resistance lies between the 24,500 and 25,600 zones, and a close above the latter will open the door to the 24,700 zone. On the flipside, support for the index is around the 24,000 area, which coincides with last week's low.

The open interest positioning for tomorrow's expiry saw significant unwinding of call options between the 24,400 and 24,500 strikes, resulting in a short-covering rally. As a result, the call base shifted towards the 24,700 strike, making it as an immediate resistance level. On the other hand, the put base was visible from 24,000 to 24,400, establishing 24,000 as a key support level for the index.

BANK NIFTY

- October Futures: 52,294 (▲1.9%)

- Open Interest: 91,671 (▼8.0%)

The BANK NIFTY index opened Tuesday's session flat but quickly crossed the 52,000-mark on broad-based gains across banking stocks. Key players from both the private and public sectors including State Bank of India (+5.1%), HDFC Bank (+1.0%) and ICICI Bank (+3.0%) led the rally, resulting in a robust 2% gain for the BANK NIFTY.

The daily chart shows that the index regained its major moving averages (20, 50 and 100) and closed above the key resistance zone of 51,500-51,700. A strong bullish candle indicates a robust rebound. Positional traders should keep an eye on the swing high near 52,500, where resistance is located; a close above this level could trigger a strong rally, possibly leading to a new all-time high.

For today's expiry, traders can monitor the below highlighted range on the 15-minute chart. A close above or below this area with a strong candle could provide directional clues. On the other hand, if the index fails to break through these levels, it may remain sideways. Additionally, in a gap-up situation, traders should wait for initial profit-taking and monitor the price action around the 52,500 area.

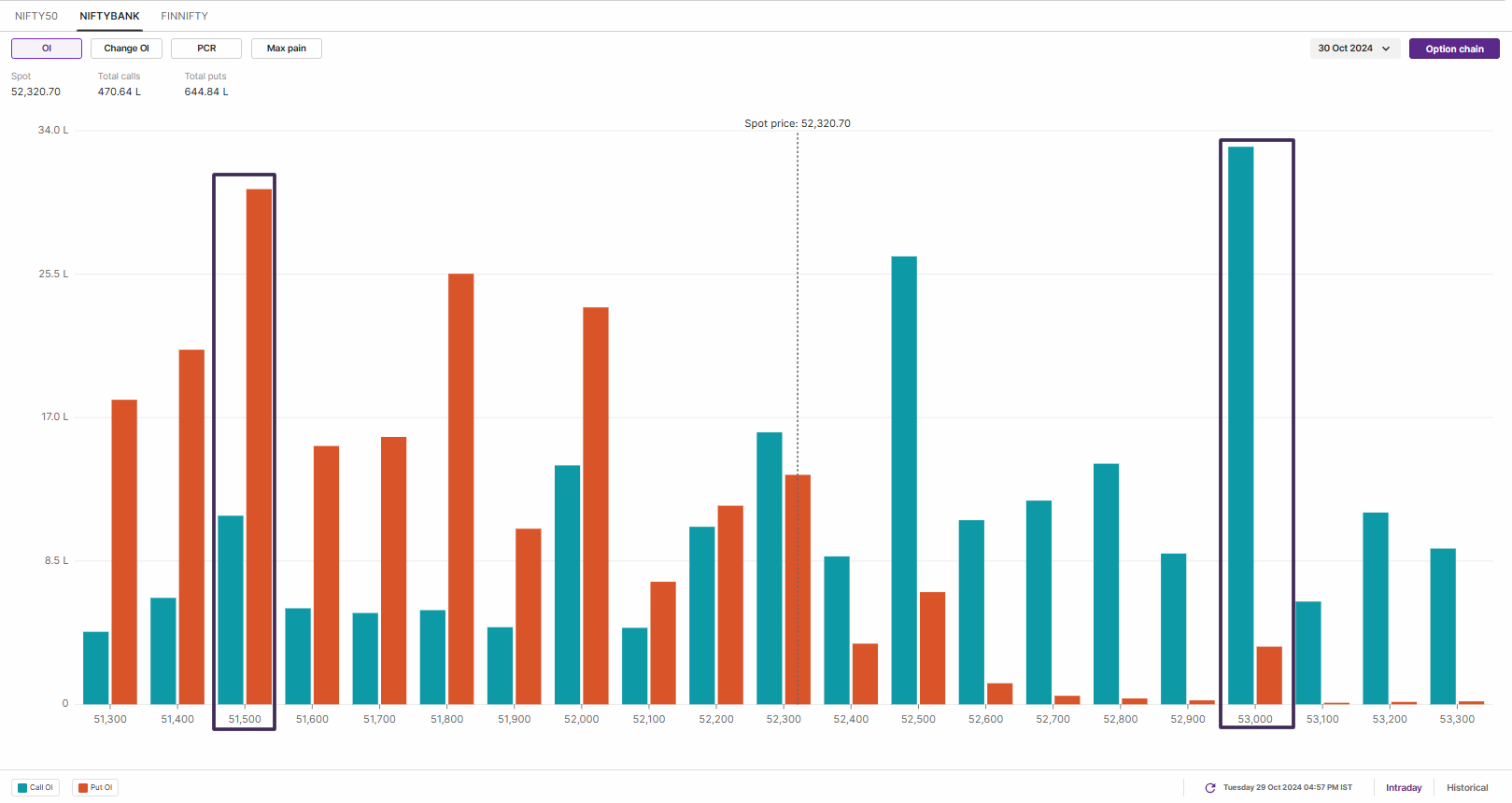

The open interest data for today’s expiry witnessed significant put writing from 51,500 to 52,000 strikes, suggesting support for the index around these levels. Conversely, the index saw significant unwinding of call options from 51,500 to 52,000 strikes, resulting in a short-covering rally.

FII-DII activity

Stock scanner

Short build-up: Maruti Suzuki, Bajaj-Auto, Bandhan Bank, Torrent Pharma and Dabur

Under F&O ban: IDFC First Bank, Indiamart Intermesh, L&T Finance, Manappuram Finance, Punjab National Bank and RBL Bank

Out of F&O ban: Dixon Technologies and Escorts Kubota

Added under F&O ban: NIL

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story