Market News

Trade Setup for Oct 24: NIFTY50 struggles to gain momentum, eyes support near 24,000

.png)

4 min read | Updated on October 24, 2024, 07:25 IST

SUMMARY

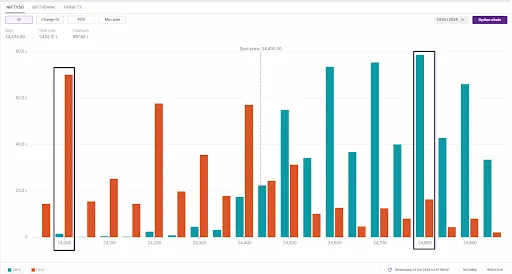

As per the options data, the NIFTY50 index saw significant call open interest build-up between 24,600 and 24,800 zones. These levels may act as immediate resistance for today’s expiry. On the flip side, the put base was seen at 24,000 and 24,300 strikes, suggesting support for the index around these levels.

The NIFTY50 closed in the red for the third consecutive day, failing to breach the 24,500 level on a closing basis.

Asian markets update

The GIFT NIFTY is up 0.12%, pointing to a positive start for the NIFTY50 today. Meanwhile, major Asian indices are trading on a mixed note. Japan's Nikkei 225 gained 0.44%, while Hong Kong's Hang Seng Index is down 1.25%.

U.S. market update

- Dow Jones: 42,514 (▼0.9%)

- S&P 500: 5,797 (▼0.9%)

- Nasdaq Composite: 18,276 (▼1.6%)

U.S. indices ended Wednesday’s session in the red after mixed earnings reports dragged all three indices lower, along with a sharp rise in the 10-year Treasury yield. Boeing reported a $6.2 billion dollars quarterly loss, the highest since the pandemic. On the other hand, Coca-Cola posted soft sales and coffee maker Starbucks suspended guidance for the next fiscal year.

NIFTY50

- October Futures: 24,482 (▼0.2%)

- Open Interest: 5,15,967 (▼1.7%)

The NIFTY50 closed in the red for the third consecutive day, failing to breach the 24,500 level on a closing basis. The index was unable to sustain the rally seen in the first half of the session and came under selling pressure from higher levels.

The broader trend of the index remains weak with immediate resistance around the 25,200 zone. The index is currently trading below all three major moving averages such as 20, 50 and 100. Conversely, immediate support for the index is seen around the 24,000 zone. If the index slips below this zone, the weakness could extend to the 23,800 region. On the other hand, a close above 24,600 could lead to a short-term rebound.

On the 15-minute timeframe, traders can monitor the low of the 23rd October. If the index breaches this level with a strong candle, it could slide to the important support level of 24,000. On the other hand, resistance remains at 24,700 and 24,800.

The open interest data for today’s expiry saw significant call open interest between 24,800 and 24,600 strikes, indicating resistance for the index around these levels. Conversely, the put base was seen between 24,000 and 24,400 levels, pointing at support for the index around these strikes.

BANK NIFTY

- October Futures: 51,352 (▼0.1%)

- Open Interest: 1,61,704 (▼6.5%)

After the initial volatility, the BANK NIFTY consolidated in a range and ended the day flat, above the psychologically important 51,000 level. The index protected the key support level on a closing basis, but closed near the day's low, indicating weakness.

As shown in the chart below, the index is at a critical point. A break below the immediate support at 51,000 could lead to a test of the 50,000 level. Conversely, if the index holds above the 51,500 level on the 15-minute timeframe, it could trigger a short-covering rally that could take the index to the 52,000 level and beyond.

FII-DII activity

Stock scanner

Under F&O ban: Aarti Industries, Bandhan Bank, Birla Soft, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), IEX, Indiamart Intermesh, Manappuram Finance, NMDC, Piramal Enterprises and RBL Bank

Out of F&O ban: Chambal Fertilisers, L&T Finance and Punjab National Bank

Added under F&O ban: NMDC

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story