Market News

Trade Setup for Nov 27: NIFTY50 consolidates around 24,300, ends below the doji candle

.png)

4 min read | Updated on November 27, 2024, 07:22 IST

SUMMARY

According to the options data for NIFTY50’s monthly expiry, the index is currently consolidating between a smaller range of 24,350 and 23,950. A break above or below this range may provide directional clues to traders.

After a positive start, the NIFTY50 index failed to sustain its opening gains and consolidated around 24,300.

Asian markets @ 7 am

- GIFT NIFTY: 24,260 (+0.17%)

- Nikkei 225: 38,149.67 (-0.77%)

- Hang Seng: 19,187 (+0.15%)

U.S. market update

- Dow Jones: 44,860 (▲0.2%)

- S&P 500: 6,021 (▲0.5%)

- Nasdaq Composite: 19,174 (▲0.6%)

U.S. indices ended Tuesday's session on a positive note, with the Dow Jones and S&P 500 closing at fresh record highs. Markets shrugged off President-elect Donald Trump's threat of new tariffs on China, Mexico and Canada. As a result, the shares of carmakers Ford, General Motors and Nissan fell between 2% and 8%.

Investors also digested the minutes of the U.S. Federal Reserve's November meeting. The central bank said that if inflation moves towards the 2% range on a sustained basis, it will gradually begin to lower interest rates.

NIFTY50

- November Futures: 24,273 (▼0.2%)

- Open Interest: 3,19,871 (▼14.2%)

After a positive start, the NIFTY50 index failed to sustain its opening gains and consolidated around 24,300. The index formed a negative candle on the daily chart, ending below the previous day’s doji candlestick pattern. This indicates that the index is facing selling pressure from higher levels.

On the daily chart, the index has immediate resistance around 50 day exponential moving average (EMA) and 24,600, the immediate swing high. Meanwhile, the immediate support for the index is around 21 EMA, around 24,000 zone. Unless the index breaks this range, the trend may remain sideways.

The open interest data for the 28 November expiry has significant call bases at 24,500 and 24,300, suggesting that index may face resistance around these levels. On the other hand, the put base was observed at 24,000, indicating support for the index around this zone. As per the open interest, unless the index breaks 23,900 and 24,400 range, the trend may remain range-bound.

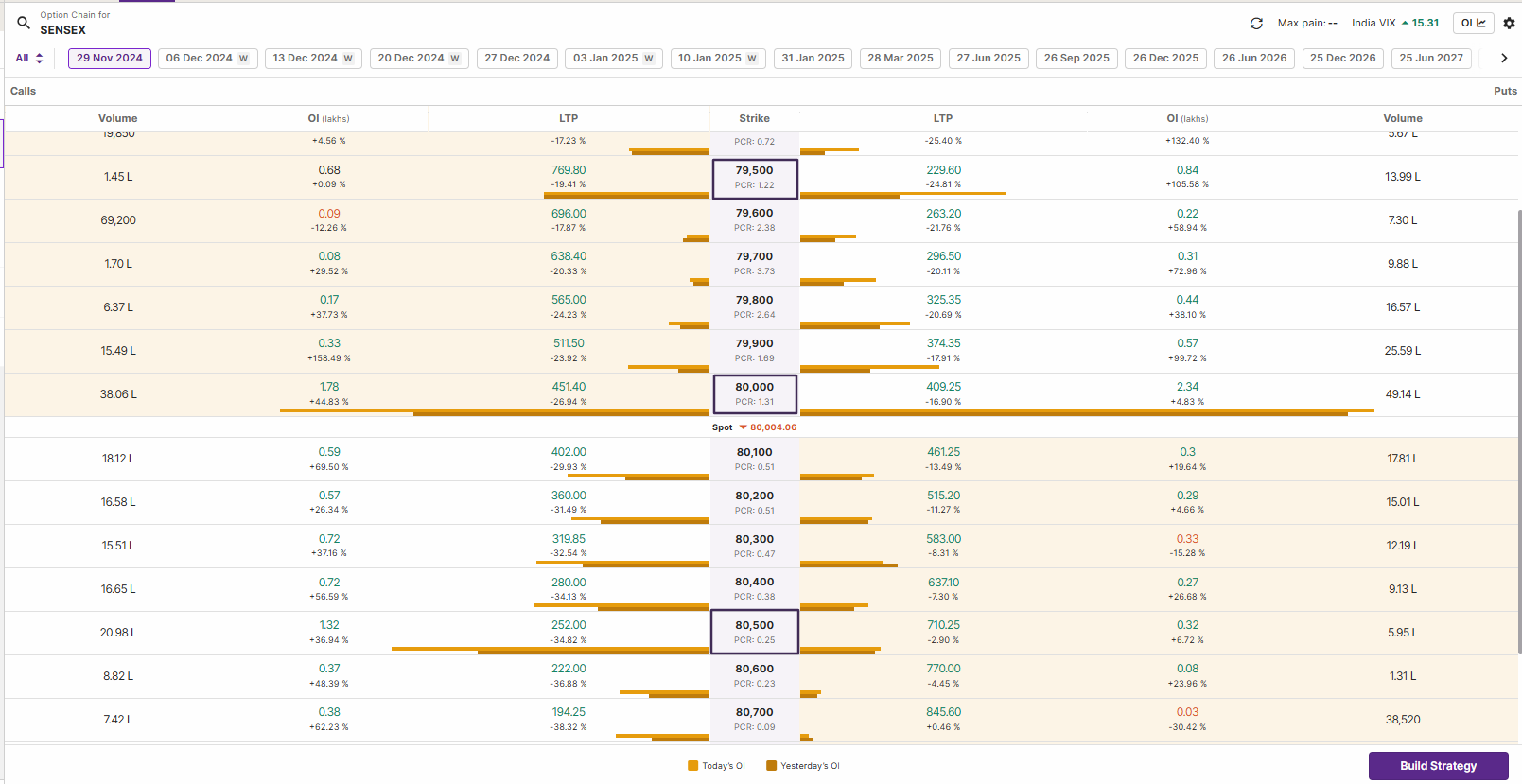

SENSEX:

- Max call OI: 80,000

- Max put OI: 74,000

The SENSEX also started the Tuesday’s session on a positive note but witnessed selling pressure from the immediate resistance zone of 50 EMA. The index also formed a small bearish candle on the daily chart and consolidated around 80,000 mark.

The technical structure of the SENSEX looks range-bound as the index is currently placed between 21 and 50 day EMA on the daily chart. After a sharp upmove on 22 November, the index is currently consolidating its gains but facing selling pressure from higher levels. Unless the index captures 50 EMA and the immediate swing high of 7 November, the trend may remiain sideways. On the flip side, the immediate support for the index is around 78,600.

The open interest data for the 29th November expiry shows the highest call and put base concentrated at the 80,000 strike, signaling potential range-bound activity around this level. Additionally, substantial open interest is observed at the 80,500 and 79,500 strikes, identifying these levels as key resistance and support zones for the index.

FII-DII activity

Stock scanner

- Long build-up: Biocon, City Union Bank and Marico

- Short build-up: Lupin, GAIL and Can Fin Homes

- Under F&O ban: NIL

- Out of F&O ban: Aarti Industries, Gujarat Narmada Valley Fertilisers & Chemicals (GNFC) and Granules

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story