Market News

Trade setup for May 7: Will NIFTY50 defend 24,000 as charts show reversal? Here's all you need to know

.png)

3 min read | Updated on May 07, 2025, 08:05 IST

SUMMARY

GIFT NIFTY indicates a gap-down opening for Indian markets amid border tensions between India and Pakistan. The charts indicate a reversal of the current bullish trade setup as NIFTY50 formed a bearish engulfing pattern on the daily charts.

NIFTY50 and SENSEX indicate bearish outlook for current weekly expiry. Image source: Shutterstock.

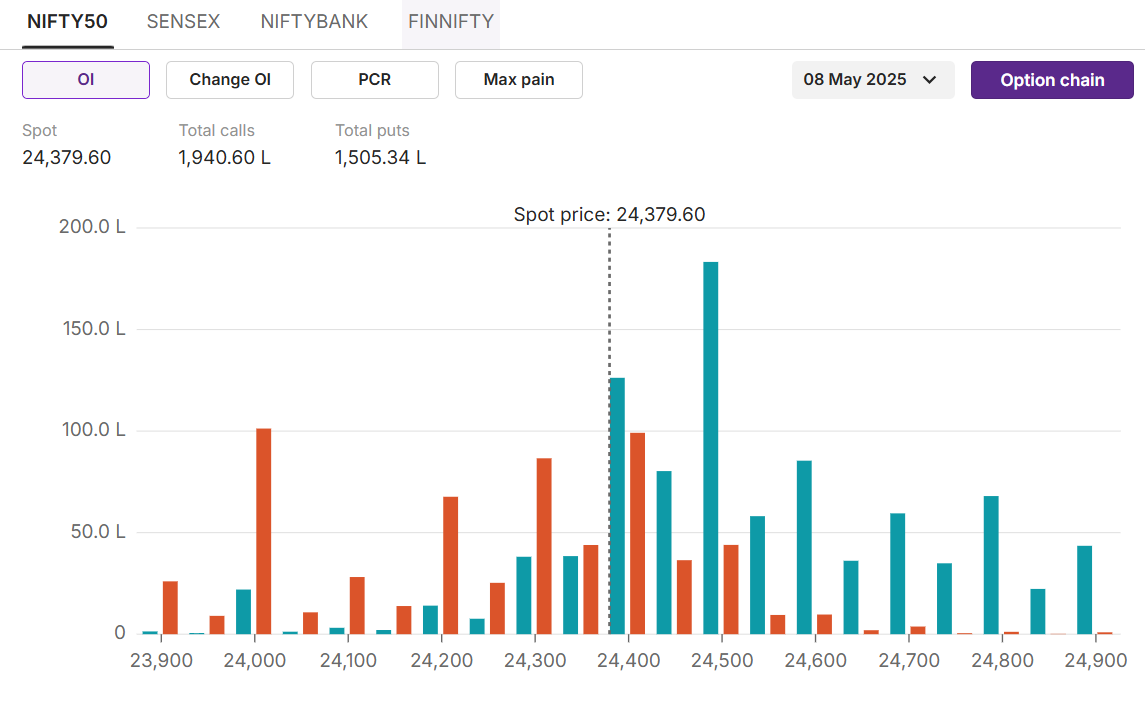

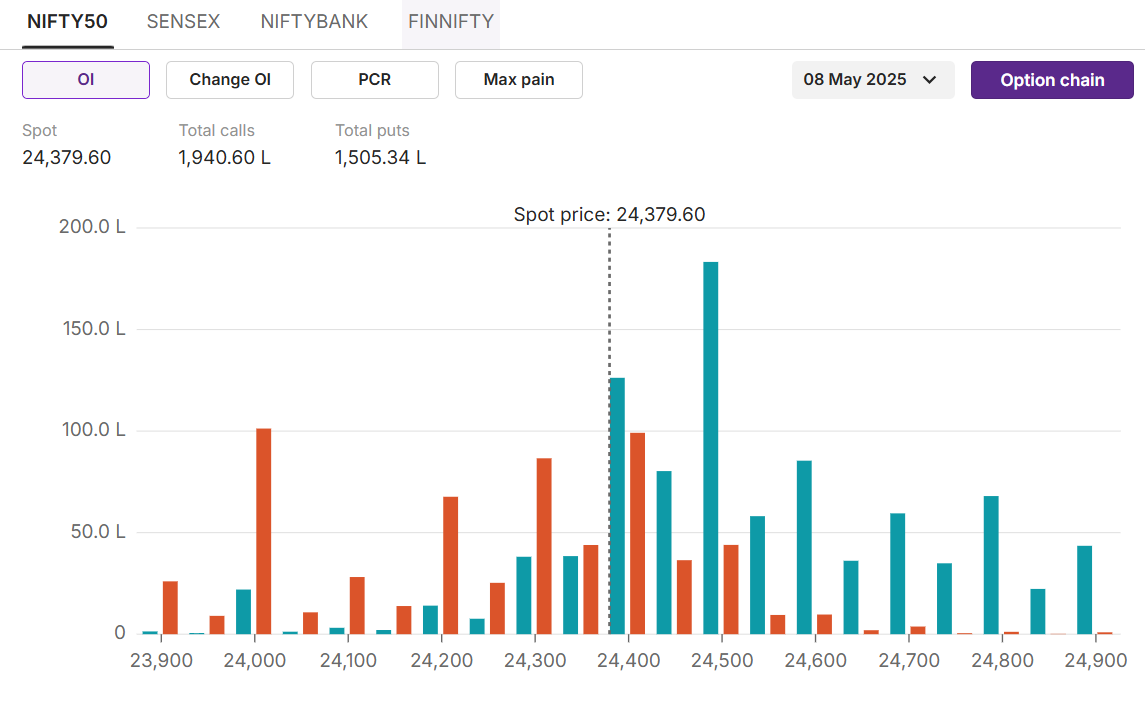

NIFTY50

Max call OI: 24,500 Max put OI:24,000

NIFTY50 continued to defend the resistance level of 24,500 for the third consecutive session on Tuesday. The index opened lower and intensified the losses towards the closing session. However, the benchmark index showed resilience as compared to the broader indices which fell more than 2%.

On technical charts, the NIFTY50 has formed a bearish engulfing pattern, indicating a reversal to the current rally and a change of stance to slightly bearish from bullish.

On technical charts, the NIFTY50 has formed a bearish engulfing pattern, indicating a reversal to the current rally and a change of stance to slightly bearish from bullish.

On technical charts, the NIFTY50 has formed a bearish engulfing pattern, indicating a reversal to the current rally and a change of stance to slightly bearish from bullish.

On technical charts, the NIFTY50 has formed a bearish engulfing pattern, indicating a reversal to the current rally and a change of stance to slightly bearish from bullish.Open FREE Demat Account within minutes!

Join nowOn the options front, the 24,500 calls witnessed strong open interest additions and continue to hold the highest open interest for the weekly expiry. On the flipside, 24,000 puts hold the highest open interest, indicating strong support on the downside at these levels.

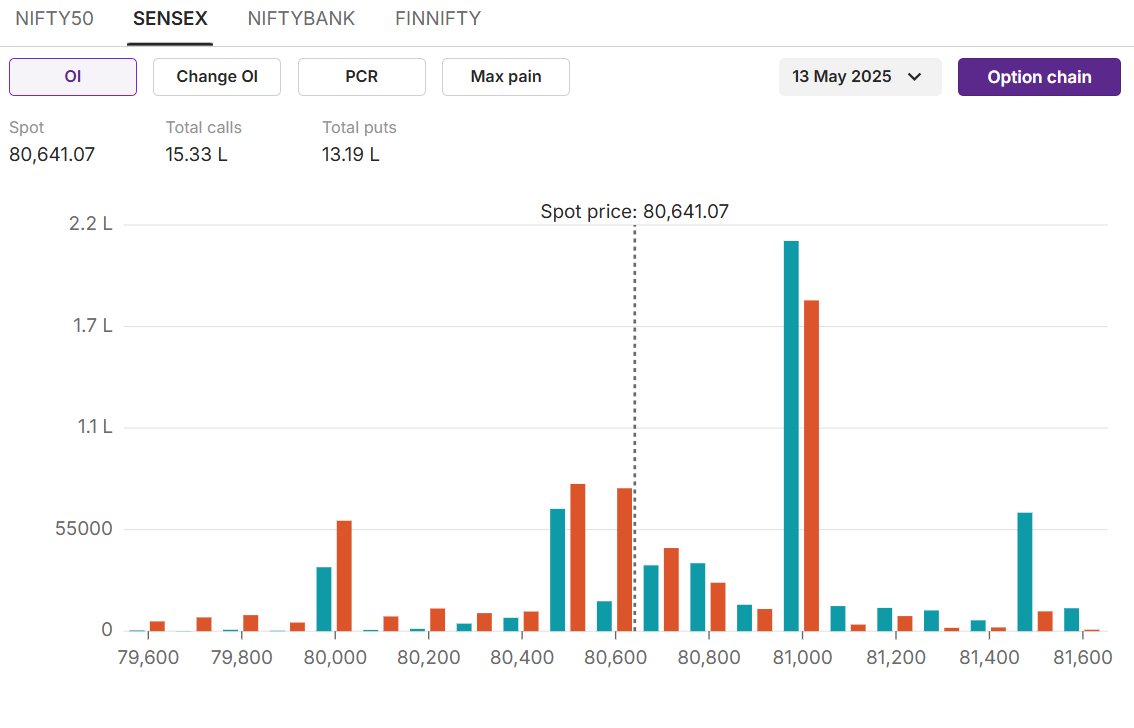

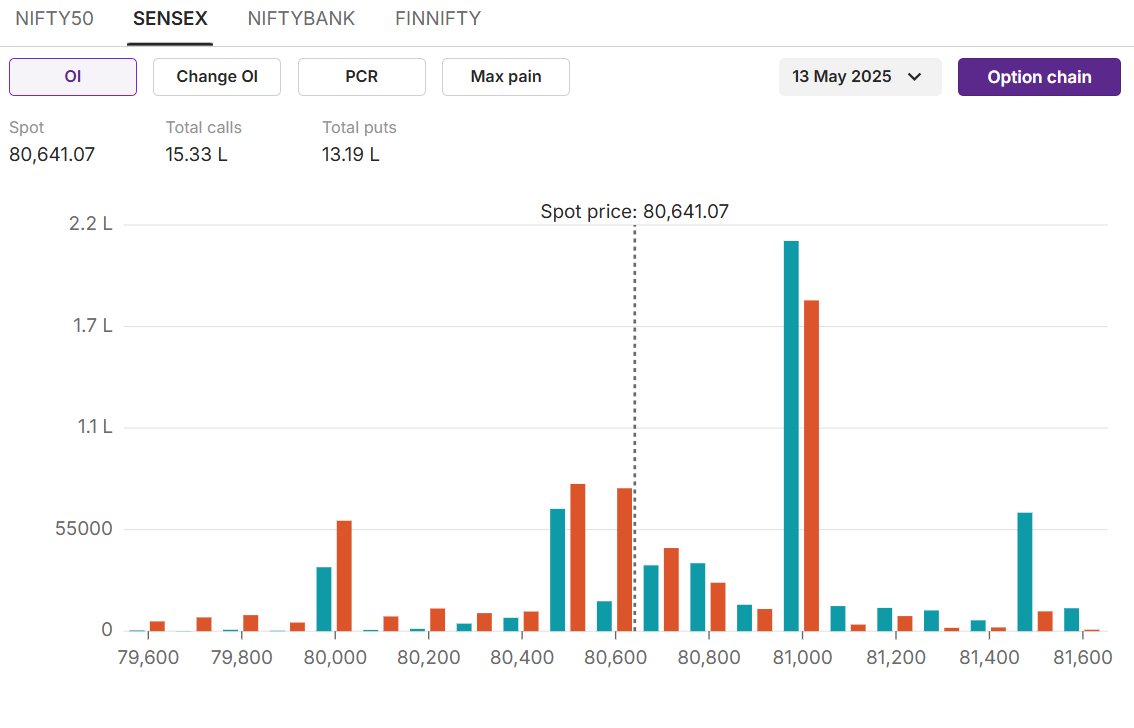

SENSEX

Max call OI: 81,000 Max put OI:81,000 (Ten strikes to ATM, 13 May expiry)

SENSEX closed 0.2% lower on Tuesday’s weekly expiry. The benchmark index failed to give a breakout above the 81,000 levels on the expiry, indicating a reversal for the current rally.

On the technical front, the charts show a reversal for the index in the near term as it failed to breakout above the 81,000 levels. Experts believe the index could find support at the 21 EMA levels of 78,700 in the retracement correction to the current rally.

On the technical front, the charts show a reversal for the index in the near term as it failed to breakout above the 81,000 levels. Experts believe the index could find support at the 21 EMA levels of 78,700 in the retracement correction to the current rally.

On the technical front, the charts show a reversal for the index in the near term as it failed to breakout above the 81,000 levels. Experts believe the index could find support at the 21 EMA levels of 78,700 in the retracement correction to the current rally.

On the technical front, the charts show a reversal for the index in the near term as it failed to breakout above the 81,000 levels. Experts believe the index could find support at the 21 EMA levels of 78,700 in the retracement correction to the current rally.On the options front, the initial buildup for the 13 May expiry indicates 81,000, a crucial level for the index. The 81,000 calls and puts hold the highest open interest for the coming weekly expiry.

Stock scanner

Top traded futures contracts: Bank of Baroda, Polycab, SBIN

Top traded options contracts: SBIN 820 CE, Reliance 1,480 CE

Under F&O ban:CDSL,Manappuram, RBL Bank

Out of F&O ban:

To access a specially curated smartlist of the most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with a price increase, and short build-up means an increase in Open Interest(OI) along with a price decrease. Source: Upstox and NSE. Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story