Market News

Trade setup for May 20: Will NIFTY50 bounce back above 25,000 mark? Here's all you need to know

.png)

3 min read | Updated on May 20, 2025, 07:56 IST

SUMMARY

NIFTY50 closed below 25,000 on Monday amid weak global cues. The benchmark index continued to consolidate with a positive bias. The GIFT NIFTY indicates a positive start for Tuesday morning with positive global cues.

GIFT NIFTY indicates positive opening for Indian markets on Tuesday. Image source: Shutterstock.

GIFT NIFTY indicates a gap up opening for Indian markets on Tuesday amid positive global cues. Investors shrugged off the worries of US debt downgradation. The US markets closed in green and Asian markets traded with strong gains on Tuesday morning.

Asian markets

Asian markets traded with strong gains across the board on Tuesday morning, taking cues from overnight gains in the US markets and a strong liquidity boost from China. The Chinese central bank reduced the interest rates for the first time since October 2024. Following the positive developments, the Japanese Nikkei, Hong Kong’s Hang Seng and Chinese indices trade in green on Tuesday morning.

US markets

The US benchmark indices shrugged off worries of a government debt ratings downgrade and closed in green across the board on Monday. The Dow Jones closed in green with 0.3% gains followed by NASDAQ and S&P500, which closed marginally higher.

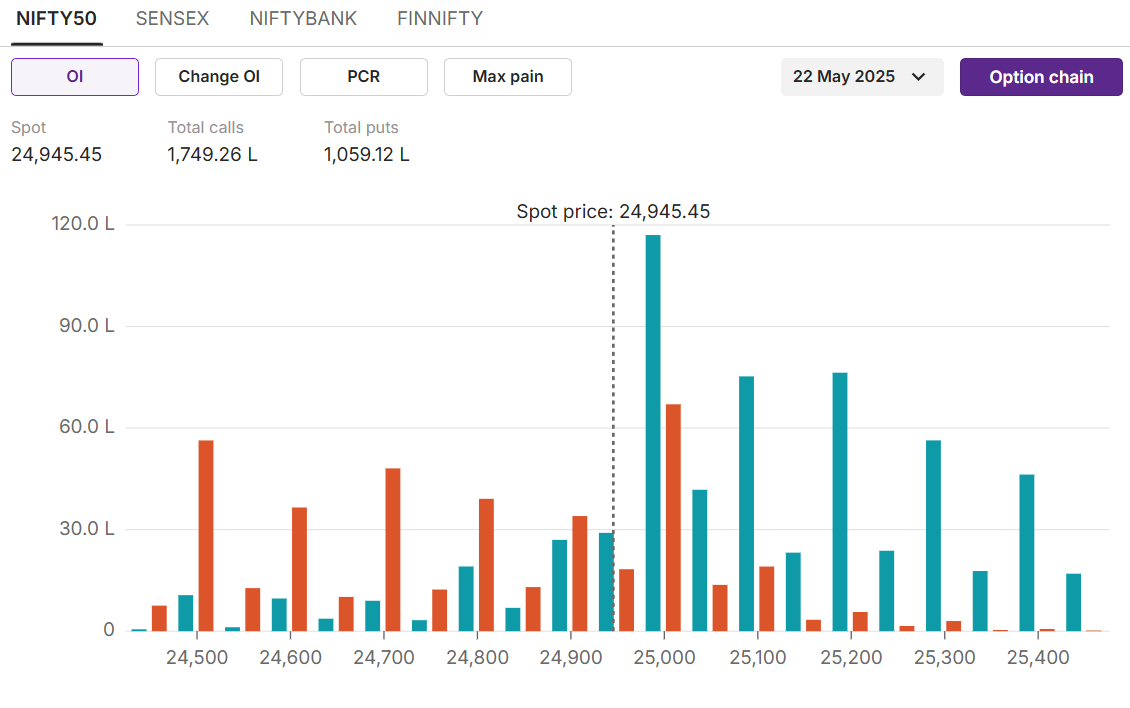

NIFTY50

Max call OI:25,000

Max put OI:25,000

(Ten strikes to ATM, 22nd April expiry)

NIFTY50 posted a lacklustre performance on Monday amid negative global cues. Moody's downgrading of the US credit rating soured investor sentiments across the board. Experts believe the index could consolidate further, with a positive bias toward touching the previous record high levels.

The 25,000 calls and puts hold the highest open interest for the 22nd May expiry, indicating support and resistance at these levels.

The 25,000 calls and puts hold the highest open interest for the 22nd May expiry, indicating support and resistance at these levels.

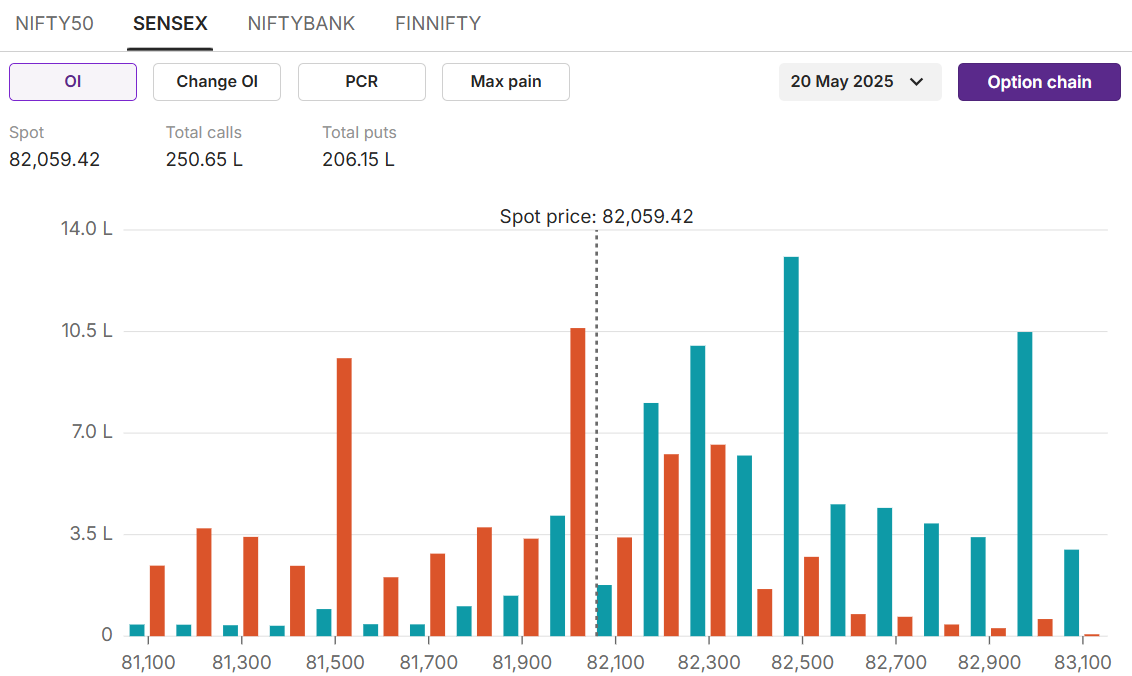

SENSEX

Max call OI: 82,500

Max put OI: 82,000

(Ten strikes to ATM, 20th May expiry)

SENSEX closed 271 points down on Monday owing to negative global cues and profit booking in IT stocks. The index continues to trade with a positive bias around the swing high resistance level os 82,200.

The 20th expiry data indicates 82,500 calls hold the highest open interest, and 82,000 puts hold the highest open interest, indicating the support and resistance range for today’s expiry.

The 20th expiry data indicates 82,500 calls hold the highest open interest, and 82,000 puts hold the highest open interest, indicating the support and resistance range for today’s expiry.

Stock scanner

Long buildup: Bajaj Auto

Short buildup: Eternal

Top traded futures contracts: Bharti Airtel, HAL, BEL

Top traded options contracts: HAL, BEL, DIVIS LAB

Under F&O ban:Hind Copper, Manappuram, Titagarh

Out of F&O ban:

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story