Market News

Trade setup for June 17: Will NIFTY50 cross 25,000 on Tuesday? Here's all you need to know

.png)

3 min read | Updated on June 17, 2025, 07:47 IST

SUMMARY

Indian markets are expected to open in red on Tuesday, taking cues from the weak global market and escalated geopolitical risks. Traders' eye for the psychological resistance of 25,000 after a strong rally on Monday.

On the NIFTY50 index, 32 stocks advanced in the early session while 18 were trading in red. | Image: Shutterstock

GIFT NIFTY futures indicate a negative opening for Indian markets on Tuesday, owing to weak global cues. The geopolitical risks continue to rise from the Middle East as Trump ordered all its citizens to evacuate Tehran.

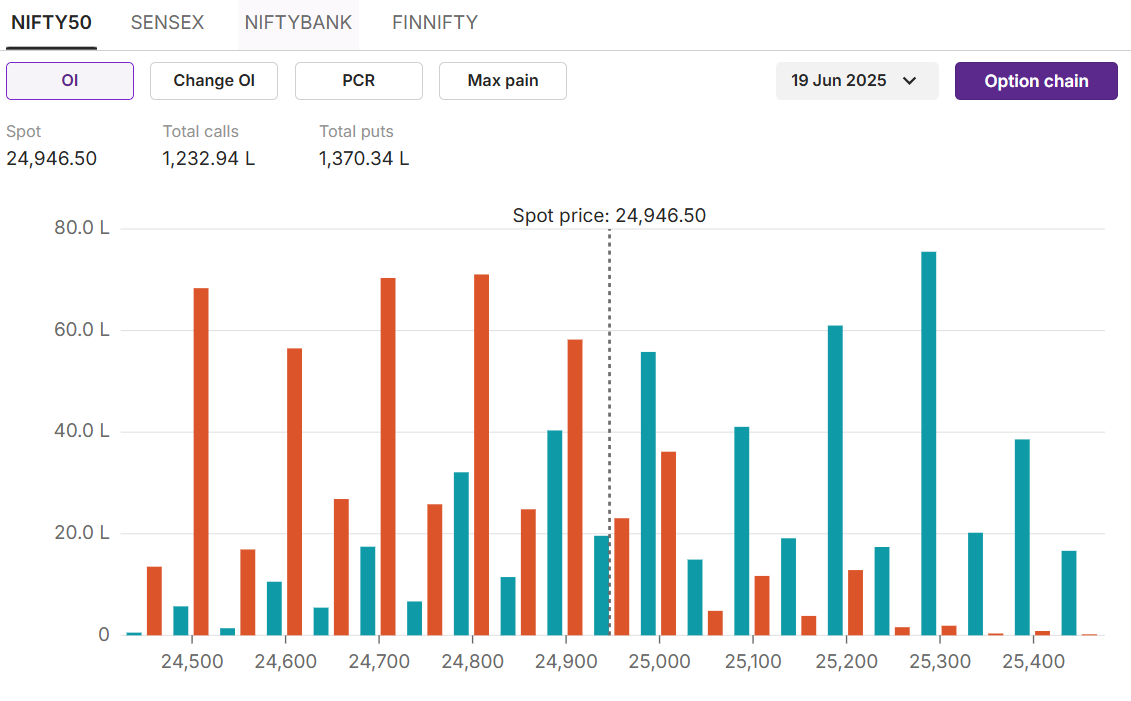

NIFTY50

Max call OI: 25,300

Max put OI: 24,800

(Ten strikes to ATM, 19th June expiry)

NIFTY50 bounced back from lower levels, closing 50 points away from the psychological resistance level of 25,000. Banking, IT, oil and gas stocks, including HDFC Bank, Infosys, ICICI Bank, Reliance, and others, led the nearly 250-point rally on Monday. Experts believe the volatility to continue due to mixed global cues and geopolitical factors.

On technical charts, the index made a bounce back above the 21 EMA levels by closing above it on Monday. The index failed to confirm a bearish reversal after closing near 24,700 levels. Experts believe the bullish rally in the index may continue only after a strong weekly closing above the 25,200 levels.

On the options data front, the 25,300 calls hold the highest open interest, indicating strong resistance at these levels for the 19th June expiry. On the downside, the 24.800 levels indicate strong support.

On the options data front, the 25,300 calls hold the highest open interest, indicating strong resistance at these levels for the 19th June expiry. On the downside, the 24.800 levels indicate strong support.

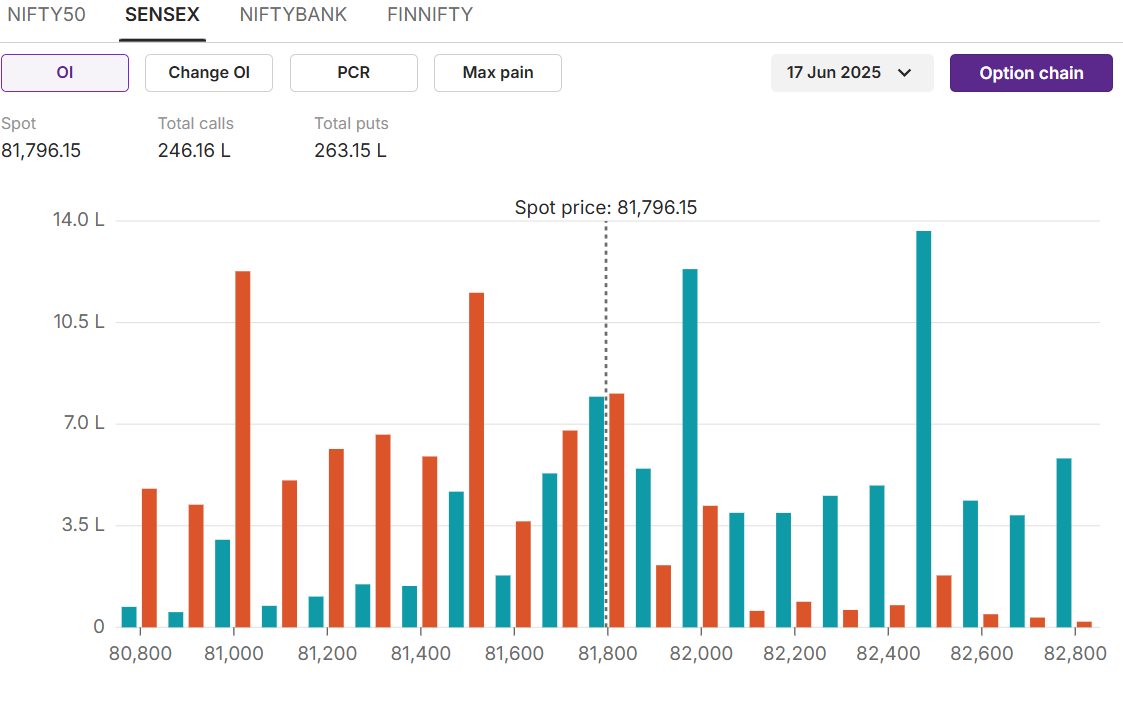

SENSEX

Max call OI:82,500

Max put OI:81,000

(Ten strikes to the ATM, 17th June expiry)

SENSEX closed 677 points higher on Monday, led by strong buying in banking, IT stocks. The index continues to consolidate in the broad range of 80,700 to 82,500 levels. Experts believe the index to close below 82,000 levels on Tuesday amid strong selling pressure at higher levels.

On the options front, 82,500 calls hold the highest open interest for today’s expiry, indicating strong resistance at these levels. Similarly, on the downside, 81,000 puts hold the highest open interest, indicating strong support for today’s expiry.

On the options front, 82,500 calls hold the highest open interest for today’s expiry, indicating strong resistance at these levels. Similarly, on the downside, 81,000 puts hold the highest open interest, indicating strong support for today’s expiry.

Stock scanner

Long buildup: BEL, Tech Mahindra, SBI Life,

Short buildup: Tata Motors

Top traded futures contracts: Tata Motors, ICICI Bank, BEL

Top traded options contracts: SBI 820 CE, TCS 3,600 CE

F&O securities under ban: ABFRL, BSOFT, CDSL, CHAMBLFERT, HUDCO, IREDA, MANAPPURAM, RBLBANK , TITAGARH

F&O securities out of ban: IEX

About The Author

Next Story