Market News

Trade Setup for June 10: NIFY50 hit new YTD peak, but sustainability remains in question!

.png)

4 min read | Updated on June 10, 2025, 07:59 IST

SUMMARY

The optimism of last week was taken forward in the NIFY50 at the start but could not sustain and witnessed slight intraday profit booking. Hence, a new high of 2025 at minimal gain has left investors wandering if its a brief pause or a sign of sellers taking control. Immediate resistance stands at 25,230 for further upside

NIFTY50 has broken out of its trendline level of 25,050 on closing basis. However, the breakout candle is in the form of a Doji which shows indecisiveness at the peak. Image: NSE

Asian markets @7:30 am

-

GIFT NIFTY: 25,245.50 (+0.25%)

-

Nikkei 225: 38,467.49 (+0.99%)

-

Hang Seng: 24,198.89 (+0.07%)

U.S. market update

-

Dow Jones: 42,761.76 (0.00%)

-

S&P 500: 6,005.88 (+0.09%)

-

Nasdaq Composite: 19,591.24 (+0.31%)

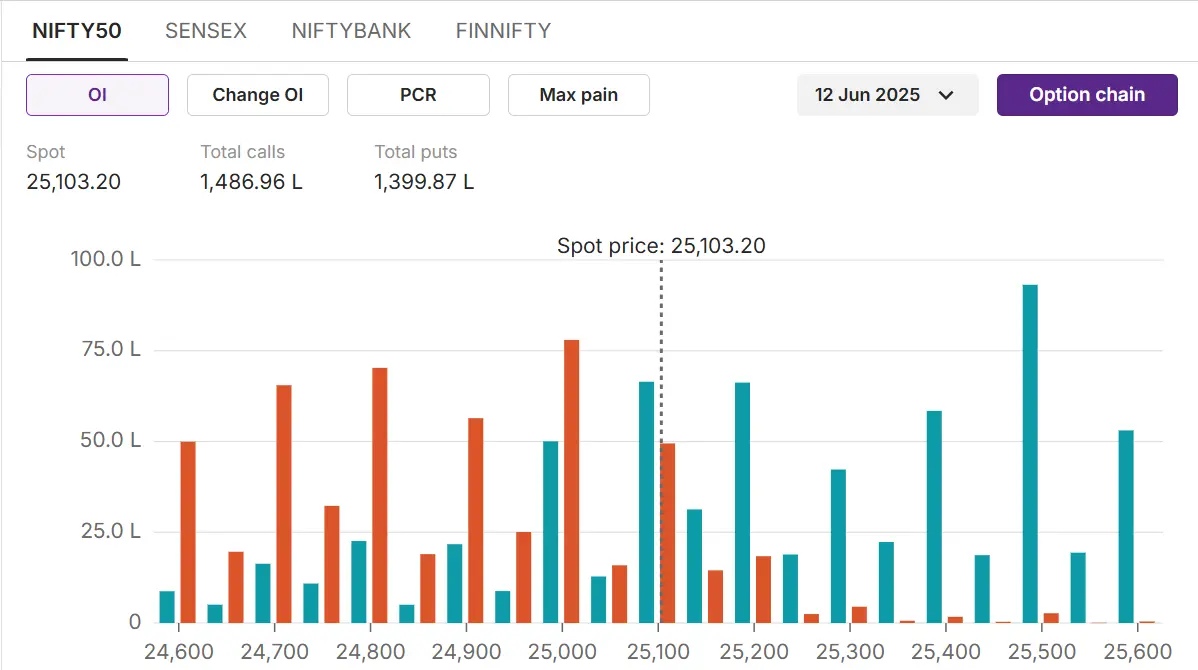

NIFTY50:

-

Max call OI: 25,500

-

Max put OI: 25,000

-

(Ten strikes to ATM, 12th June expiry)

A strong closing, led by RBI policy decisions at the end of last week, prompted the benchmark index NIFTY50 to open with a gap up on Monday, June 9. Moreover, favourable US employment data and improving trade negotiations between India and US contributed to the sentiments. However, after a positive opening NIFTY50 slightly shed early gains in the first hour, followed by sluggish movement throughout the day. Yet, NIFTY50 noted its fourth consecutive upbeat, gaining 0.4% from the previous close.

NIFTY50 witnessed open and high as the same on June 09 and thereby witnessed slight selling pressure on intraday terms. However, after breaching 25,000 mark, NIFTY50 has surged up to 25,100 but has closed within the mentioned resistance zone of 25,080-25,120. NIFTY50 has broken out of its trendline level of 25,050 on closing basis. However, the breakout candle is in the form of a Doji which shows indecisiveness at the peak.

Going forward, once 25,120 is breached, chart shows that 25,230 would act as immediate resistance followed by the all time high level. On the downside, if the gap is filled at 25,030, 24,900 would act as the immediate support.

On the options data front, the 25,500 calls hold the highest open interest for the 12th June expiry, indicating a strong resistance at these levels. On the downside, the index holds the highest open interest at 25,000 puts, indicating strong support at these levels.

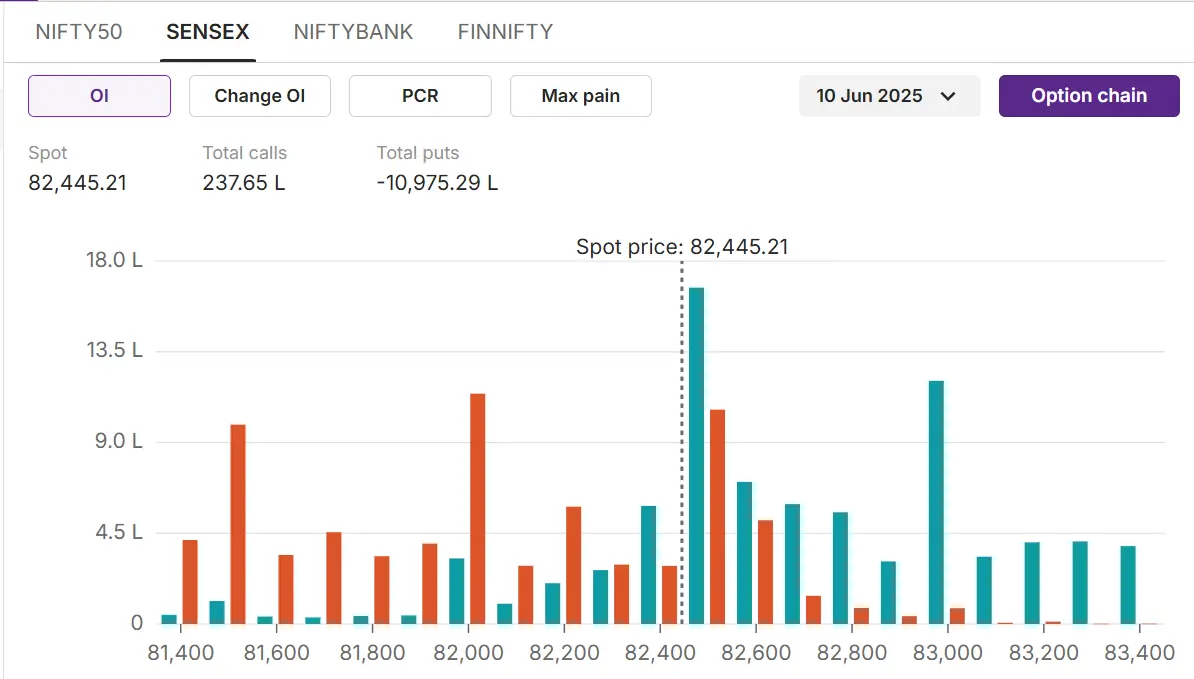

SENSEX

-

Max call OI: 82,500

-

Max put OI: 82,000

-

(Ten strikes to ATM, 10th June expiry)

SENSEX too opened with a gap-up but witnessed a slight reversal on intraday basis. SENSEX could near the 2025 high but could not breach and closed with marginal gains of 0.3% from the previous close.

SENSEX is seen struggling at its multi-month resistance line which has a breakout above 82,500-82,700. Once the said zone is taken out on closing basis, SENSEX would give an Inverse Head & Shoulders pattern breakout which has a potential upside rally. On the downside, after filling a gap at 82,300, the support zone is slightly upgraded to 81,900 and 81,400.

On the options data front, the index continued to face heavy resistance at the 82,500 levels due to the highest open interest on the call side. On the downside, the 82,000 puts hold the highest open interest, indicating strong support for the current weekly expiry.

Stock scanner

-

Long buildup: JIOFIN, KOTAKBANK, BAJFINANCE, TRENT, AXISBANK

-

Top traded futures contracts: BAJFINANCE FUT

-

Top traded options contracts: SBIN 850CE

About The Author

Next Story