Market News

Trade setup for Feb 20: NIFTY50 defends 22,700 for fifth session, extends consolidation

.png)

4 min read | Updated on February 20, 2025, 08:47 IST

SUMMARY

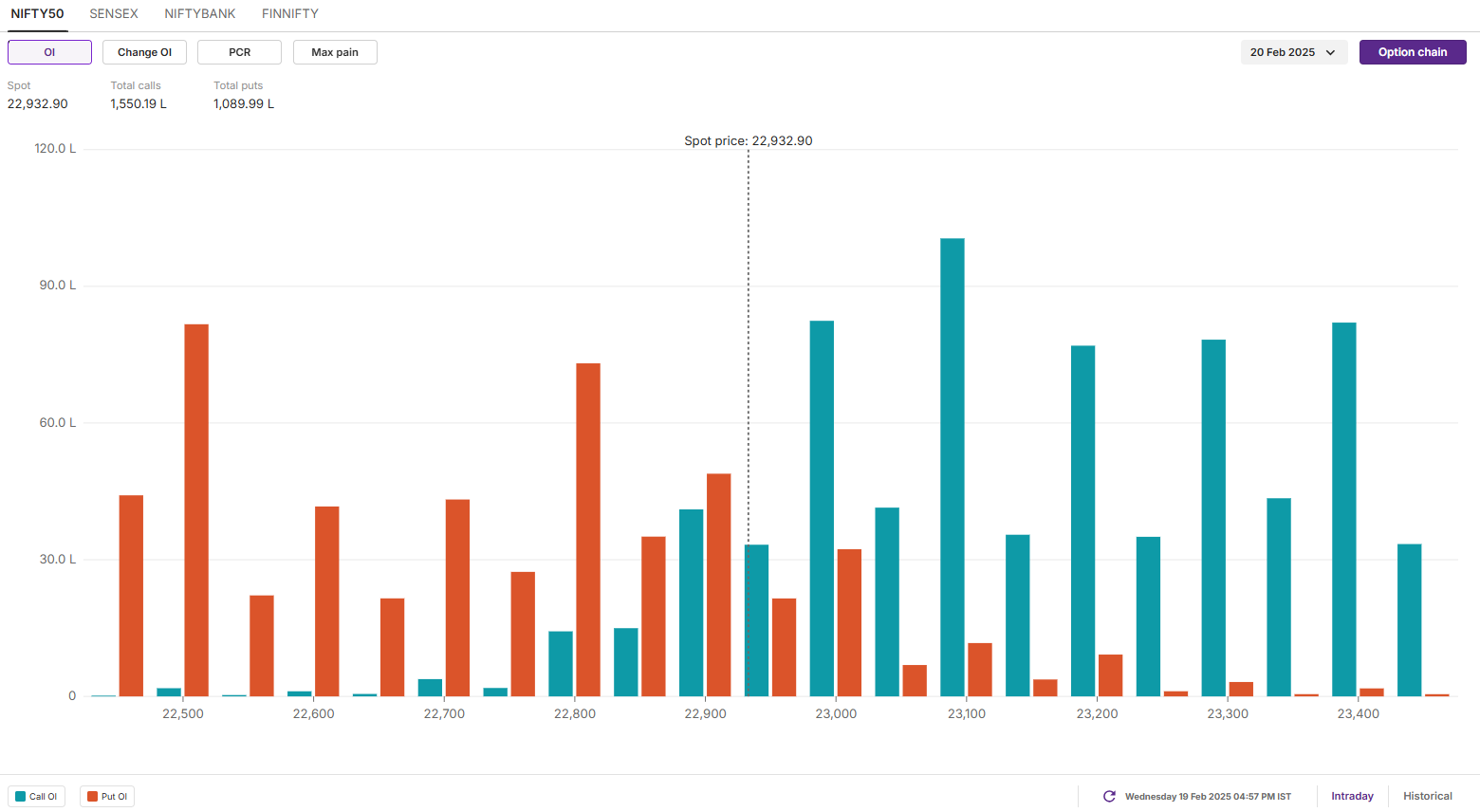

The NIFTY50 remained range-bound between 22,700 and 23,300 for the fourth consecutive session, closing flat on February 19th. Options data for today's expiry show significant call buildup at 23,100, indicating resistance, while put positions at 22,800 and 22,500 suggest support.

Indian markets expected to open lower on weak global cues. image source: Shutterstock.

Asian markets @ 7:00 am

GIFT NIFTY: 22,896 (▼0.27%)

Nikkei 225: 38,698 (▼1.24%)

Hang Seng: 22,615 (▼1.44%)

U.S. market update

Dow Jones: 44,627 (▲0.1%)

S&P 500: 6,144 (▲0.2%)

Nasdaq Composite: 20,056 (▲0.0%)

U.S. indices closed higher on Wednesday, with the S&P 500 hitting a fresh record high. Investors assessed the impact of a newly announced 25% tariff on automobile, chip, and pharmaceutical imports while also parsing the Federal Reserve minutes for policy cues. The minutes revealed that central bank officials favored keeping rates at restrictive levels amid concerns over persistent inflation.

NIFTY50

February Futures: 22,964 (▼0.1%) Open interest: 2,22,131 (▼0.7%)

After a negative start, the NIFTY50 recouped all of its opening losses in the first half of the session and surpassed the previous session's high and the 23,000 level in the course of the day. However, the index failed to sustain the gains at higher levels amid heavy selling pressure in the index's heavyweight technology stocks. It closed flat for the second consecutive day, signaling consolidation for the index around the 23,000 level.

The open interest data for today's expiry showed a significant call option build-up at the 23,100 strike, suggesting resistance for the index around this area. On the other hand, put bases were observed at the 22,700 and 22,500 strikes, suggesting support for the index around these levels.

SENSEX:

Max call OI: 76,000 Max put OI: 76,000 (20 Strikes from ATM, Expiry: 25 Feb)

The SENSEX also attempted to reclaim the psychological level of 76,000 during intraday but failed to sustain the crucial level on the closing basis. Amid sharp volatility during the session, the index failed to sustain its first session gains and ended the session on a flat note for the second consecutive day.

As highlighted on the chart below, the index took support in the zone of 75,200 and 75,600 zone for the fifth time in last six trading sessions. If the index ends below this zone on closing basis, it may further extend weakness. Meanwhile, the resistance for the index remains around the 77,000 zone, coinciding with its 21-day exponential moving average.

FII-DII activity

Stock scanner

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story