Market News

Trade Setup for Dec 2: NIFTY50 forms inside candle on daily chart, 24,350 remains a resistance

.png)

4 min read | Updated on December 02, 2024, 07:17 IST

SUMMARY

As per options data, the NIFTY50 index may consolidate between the 24,600 and 23,800 range. However, it has immediate resistance around 24,350, its previous week’s high. Unless the index reclaims this level on a closing basis, the trend may remain sideways to negative.

Stock list

After a flat start, the SENSEX rebounded sharply, recovering most of its previous session’s losses and closing Friday’s session with a solid 1% gain.

Asian markets @ 7 am

GIFT NIFTY: 24,359 (-0.15%) Nikkei 225: 38,069 (-0.36%) Hang Seng: 19,442 (+0.10%)

U.S. market update

Dow Jones: 44,910 (▲0.4%) S&P 500: 6,032 (▲0.5%) Nasdaq Composite: 19,218 (▲0.8%)

U.S. indices ended the Friday’s session on a positive note with Dow Jones and S&P 500 closing at the record high at the end of the holiday-shortened trading session.

Looking ahead to next week, investors will be closely watching the November jobs report from the Bureau of Labour and Statistics. The jobs data is crucial ahead of the Federal Reserve's December 18th meeting, as market participants are looking for a rebound from October's dismal numbers, which were hit by hurricane and strikes. Meanwhile, as of Friday, markets are pricing in a 66% chance of a rate cut at the Fed's final meeting of the year.

NIFTY50

- December Futures: 24,155 (▲0.8%)

- Open interest: 4,54,670 (▼3.5%)

The NIFTY50 index started the December series on the positive note, ending the Friday’s session on a positive note. The index formed an inside candle on the daily chart after the formation of a strong bearish candle, sending mixed signals.

The technical structure of the index on the daily chart is pointing to a range-bound activity around the psychologically crucial 24,000 mark. However, after the formation of inside candle on Friday, traders can focus on the high and the low of bearish candle formed on the 28 November. A break above the high or low of the bearish candle on closing basis will provide further directional clues to traders.

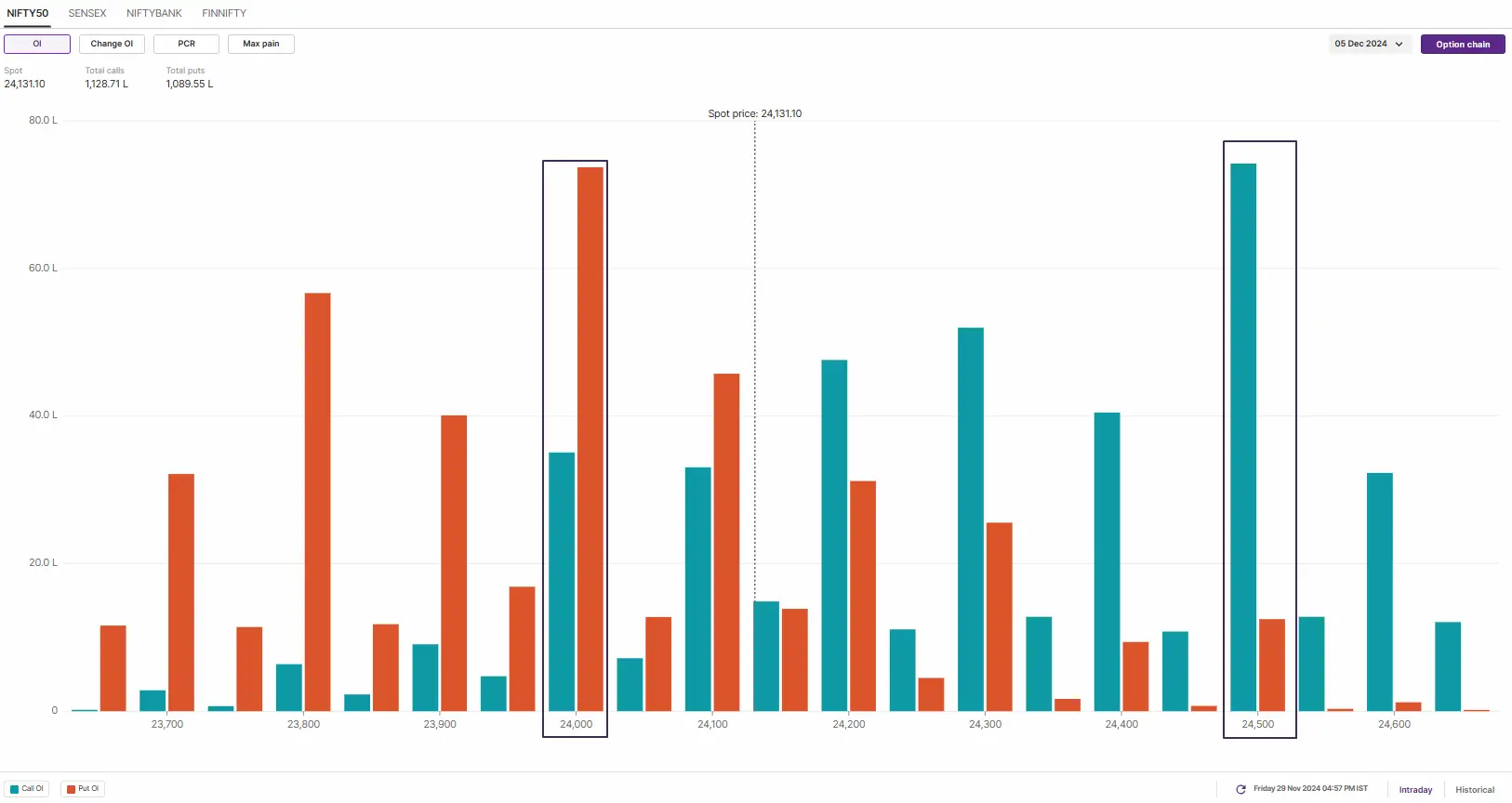

The open interest data for the 5 December expiry has highest call base at 24,500 and put base was placed at 24,000 strikes. This indicates that the market participants are expecting a range-bound between these levels. However, if the index breaks these level, traders can plan and execute directional strategies accordingly.

SENSEX

- Max call OI: 83,000

- Max put OI: 77,000

After a flat start, the SENSEX rebounded sharply, recovering most of its previous session’s losses and closing Friday’s session with a solid 1% gain. The index formed a bullish harami candlestick pattern, akin to an inside candle on the daily chart, signaling support-based buying at lower levels. This pattern suggests a potential reversal in sentiment, highlighting renewed buying interest and strength at critical support zones.

A bullish harami is a two-candlestick pattern which consists of a large bearish candle followed by a smaller bullish candle. The body of the smaller candle is entirely within the range of the previous candle, indicating diminishing selling pressure and potential buying momentum. However, the pattern gets confirmed if the close of the subsequent candle is higher than the smaller bullish candle.

Meanwhile, the immediate support for the index is currently around the 78,200 zone, while the resistance is visible around 80,500. Unless the index breaks this range on closing basis, the trend may remiain range-bound.

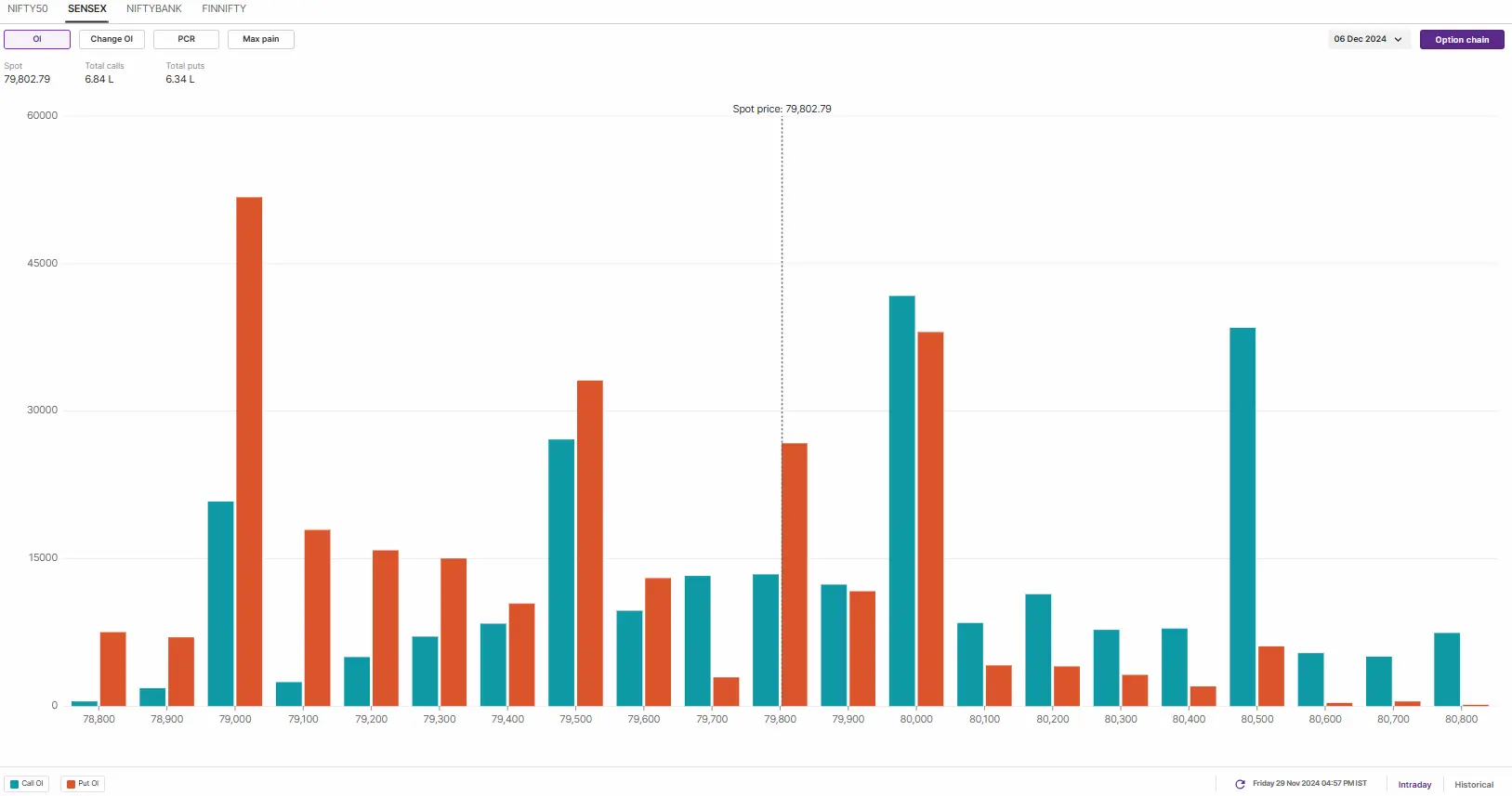

The open interest data for the 6 December expiry has highest call base at the 80,000 and 80,500 strikes, indicating that the SENSEX may face selling pressure around these levels. Conversely, the highest put base was seen at 79,000 strike, suggesting support for the index around this level.

FII-DII activity

Stock scanner

- Long build-up: Life Insurance Corporation of India (LIC) and Computer Age Management Services (CAMS)

- Short build-up: Poonawalla Fincorp, Colgate-Palmolive, IRFC, SJVN and CG Power

- Under F&O ban: NIL

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story