Market News

Trade Setup for Dec 19: Will NIFTY50 hold or surrender crucial support of 24,000 on expiry day?

.png)

4 min read | Updated on December 19, 2024, 07:20 IST

SUMMARY

The NIFTY50 index slipped below the previous week’s low on the intraday basis, extending the weakness and losing streak for the third day in a row. However, the index protected crucial support on closing basis but if surrenders this level on closing basis, it may extend the weakness up to 200 EMA.

The SENSEX extended its losing streak to a third consecutive session, slipping below the critical support level of the 50-day exponential moving average (EMA).

Asian markets @ 7 am

- GIFT NIFTY: 23,946 (-1.29%)

- Nikkei 225: 38,691 (-1%)

- Hang Seng: 19,610 (-1.28%)

U.S. market update

- Dow Jones: 42,326 (▼2.5%)

- S&P 500: 5,872 (▼2.9%)

- Nasdaq Composite: 19,392 (▼3.5%)

U.S. indices fell on Wednesday despite the Federal Reserve cutting interest rates by 25 basis points to 4.25%-4.5%. However, along with the policy announcement, the Fed released an updated economic forecast for 2025, known as the dot plot, which shows where interest rates are headed in the future.

Fed officials projected that interest rates would fall to 3.9% by 2025, higher than the Fed's previous projection of 3.5%. In September, the Fed projected four rate cuts in 2025. In addition, the market priced in four rate cuts in 2025 when the policy was introduced. However, the updated dot plot projections took a cautious approach. The Fed has moved in 25 basis point increments over the past year, suggesting that the central bank is signaling two rate cuts in 2025.

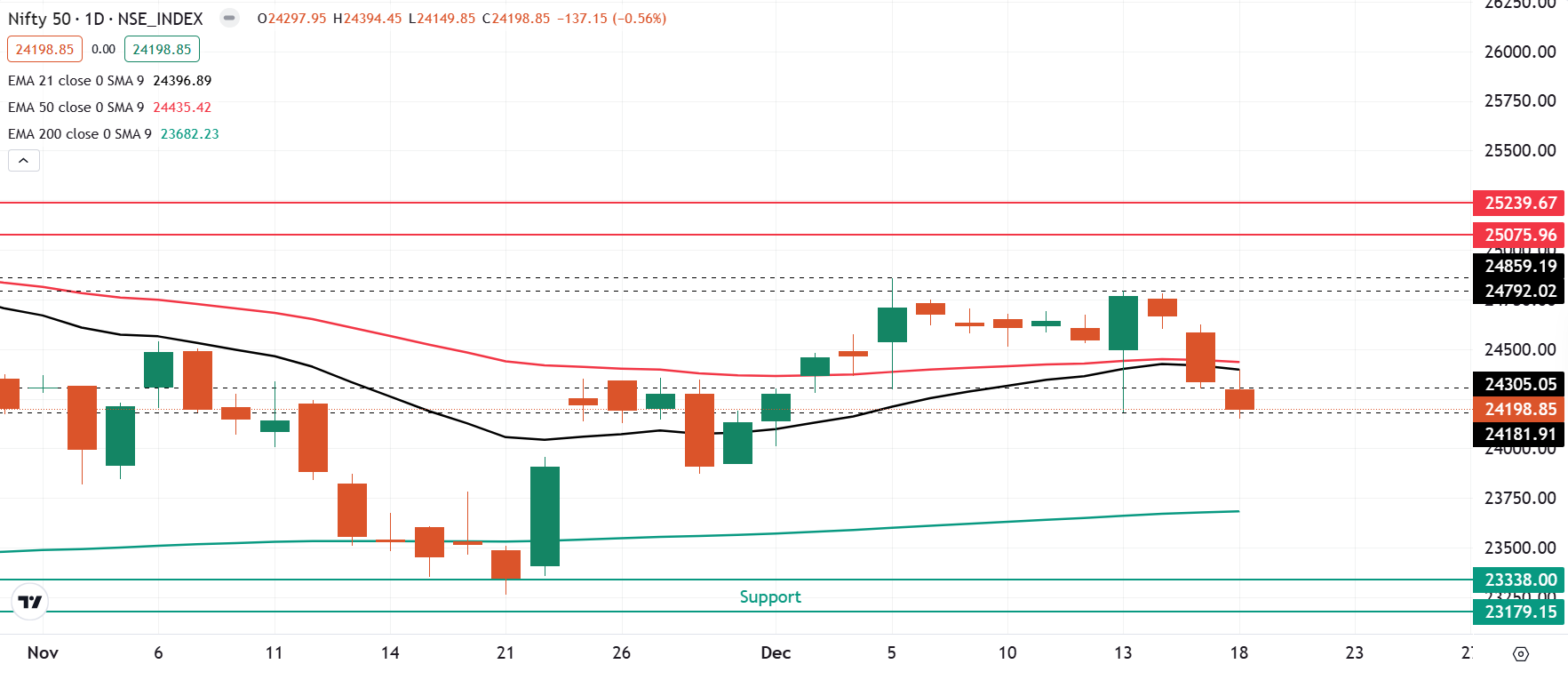

NIFTY50

- December Futures: 24,257 (▼0.6%)

- Open interest: 4,37,931 (▼1.0%)

The NIFTY50 continued its downward trend for the third straight session on December 18, testing last week's low as investors exercised caution ahead of the Federal Reserve's final meeting of the year.

The index managed to hold above the December 5 low of 24,180 on a closing basis, consolidating within this range throughout the session. In the coming sessions, traders should keep an eye on the 24,550 and 24,000 levels. A rebound from the 24,000 support zone could lead to a retest of the 24,500 resistance zone. However, a decisive close below the 24,000 support may indicate further downside potential.

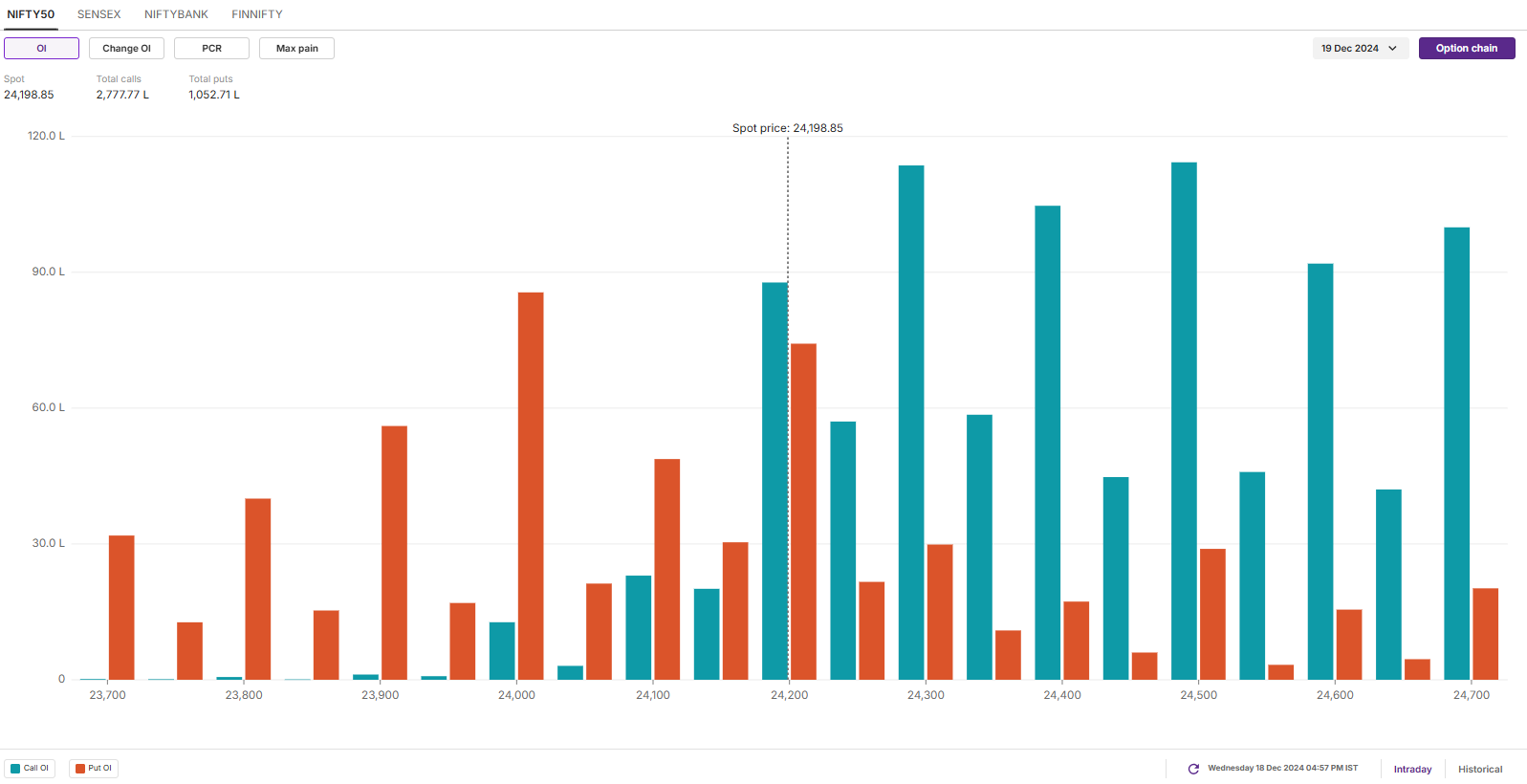

The open interest data for today's expiry saw significant call bases at 24,300 and 24,500 strikes, indicating that the index may face resistance around these zones. On the flip side, the put base was seen at 24,000 strike, suggesting immediate support for the index around this zone.

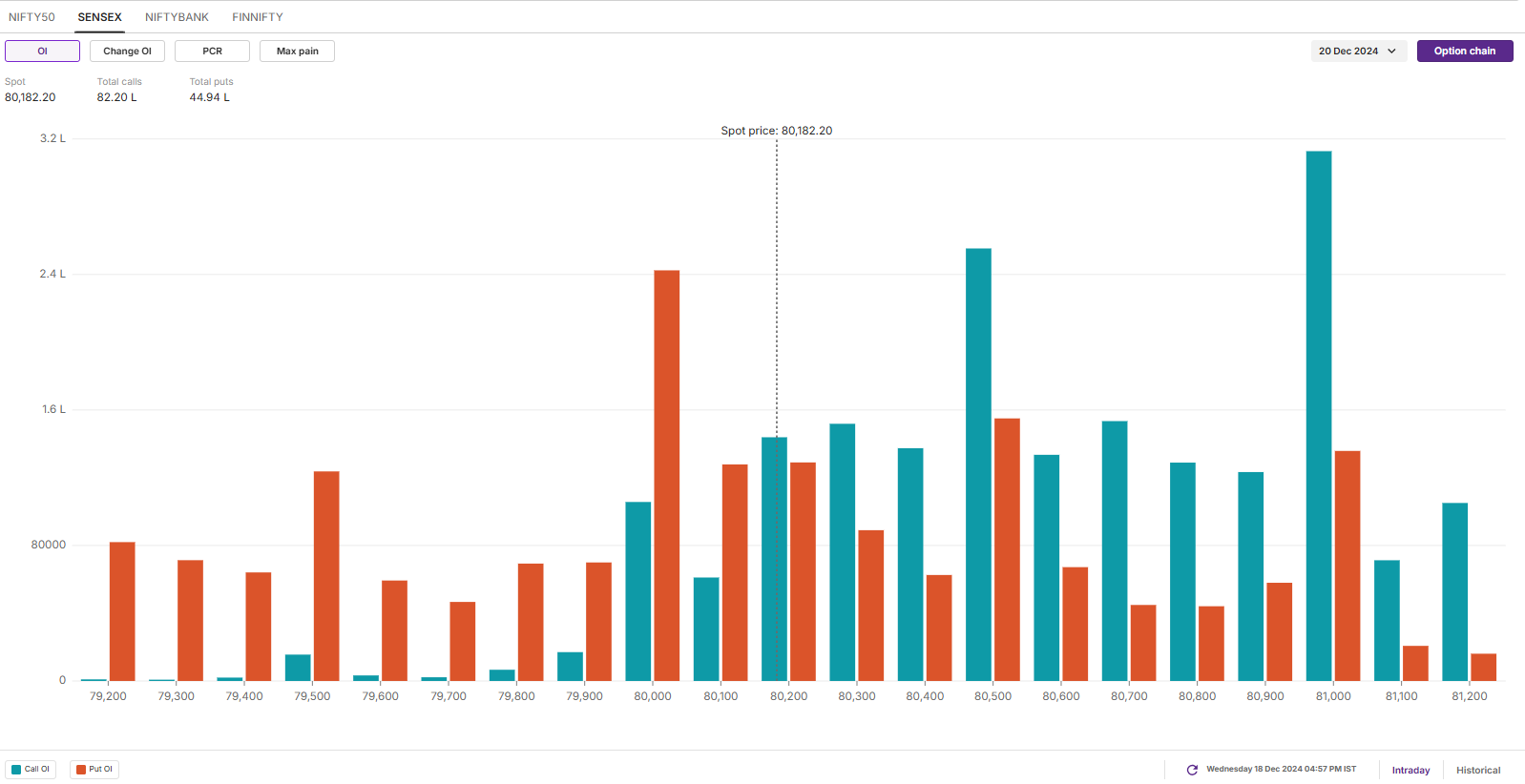

SENSEX

- Max call OI: 86,000

- Max put OI: 78,000

- (Expiry: 20 Dec)

The SENSEX extended its losing streak to a third consecutive session, slipping below the critical support level of the 50-day exponential moving average (EMA). Despite this, the index found support at last week’s low, positioning itself at a crucial juncture.

As highlighted in the chart below, a failure to hold the 80,000 support zone (previous week’s low) could lead to further downside, potentially testing the 200-day EMA. On the other hand, if the index stages a sharp rebound and reclaims the 81,000 level, it could pave the way for a retest of the key resistance zone at 82,300.

The open interest data for the 20 December saw significant call placement at 81,000 strike, suggesting resistance for the index around this zone. On the other hand, the put base was seen at 80,000 with the relatively lower volume.

FII-DII activity

Stock scanner

- Long build-up: Dr Reddy’s Laboratories

- Short build-up: NMDC, Ipca Laboratories, Federal Bank, Delhivery, Jio Financials and Ashok Leyland

- Under F&O ban: Bandhan Bank, Chambal Fertilisers, Granules India, Hindustan Copper, Manappuram Finance, National Aluminium, NMDC, PVR Inox, RBL Bank and Steel Authority of India

- Added under F&O ban: NMDC

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story