Market News

Trade Setup for Dec 13: SENSEX consolidation continues around 81,500, forms fourth inside candle on daily chart

.png)

4 min read | Updated on December 13, 2024, 07:23 IST

SUMMARY

The SENSEX continued its consolidation for the fourth consecutive session, forming another inside candle on the daily chart. Since the sharp rally on December 5, the index has been largely range-bound, oscillating within the previous week's high and low. A decisive breakout above or below this range could offer clear directional cues.

Stock list

The NIFTY50 index traded in a range for the fifth consecutive day and consolidated around the 24,600 mark.

Asian markets @ 7 am

- GIFT NIFTY: 24,540.50 (-0.38%)

- Nikkei 225: 39,421.67 (-1.07%)

- Hang Seng: 20,238.21 (-0.78%)

U.S. market update

- Dow Jones: 43,914 (▼0.5%)

- S&P 500: 6,051 (▼0.5%)

- Nasdaq Composite: 19,902 (▼0.6%)

U.S. indices ended Thursday's session in the red after a hotter-than-expected wholesale inflation report dented investor sentiment seen in tech stocks earlier in the week. The Producer Price Index, which tracks wholesale prices, rose 0.4% month-on-month, beating Street expectations for a 0.2% increase.

NIFTY50

- December Futures: 24,648 (▼0.3%)

- Open interest: 4,44,625 (▼0.2%)

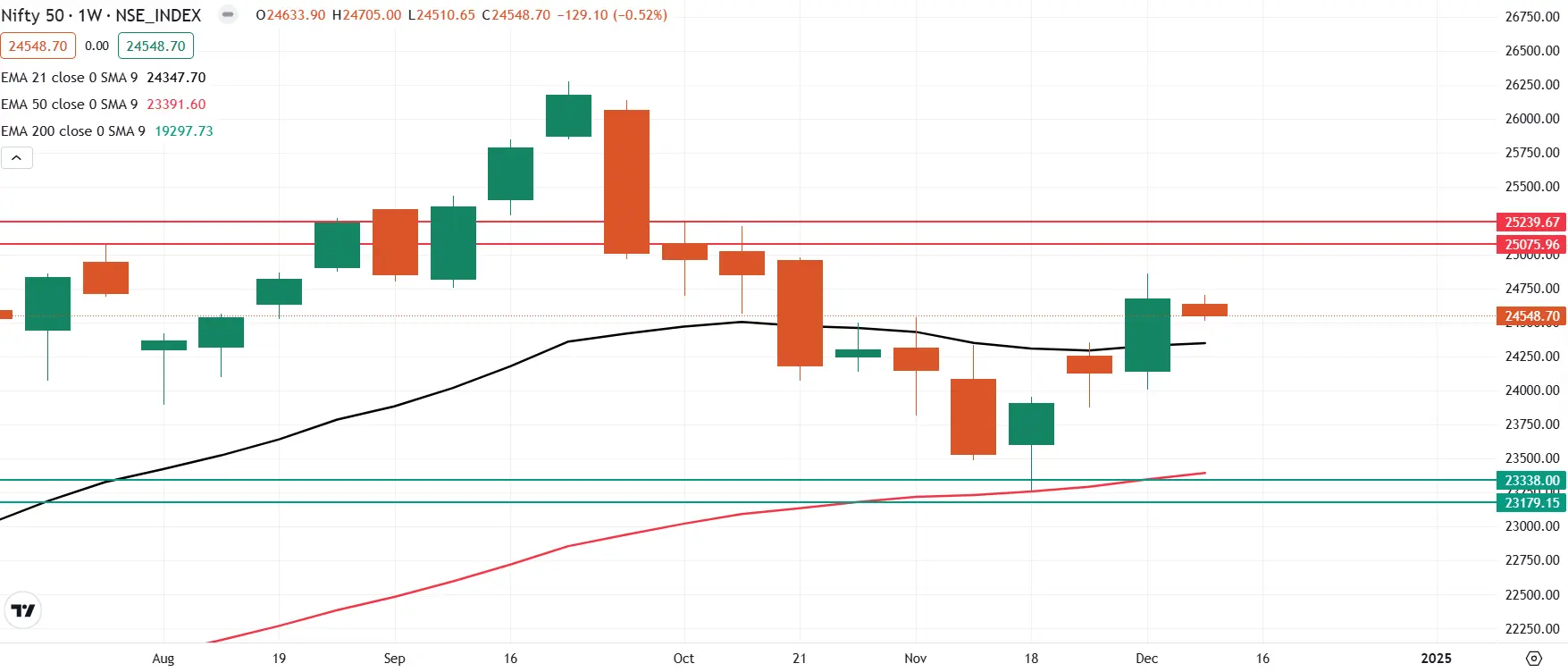

The NIFTY50 index traded in a range for the fifth consecutive day and consolidated around the 24,600 mark. For the past few sessions, the index has been trading within the 24,500 and 24,700 zone and a break of this range may provide short-term directional clues.

As per the weekly chart, the index is hinting at the formation of the potential inside candle, signalling consolidation at the higher levels after previous week’s sharp up move. Traders planning for directional clues can monitor the high and the low of previous week’s candle. A break above the high or low on daily closing basis will provide further clues.

SENSEX

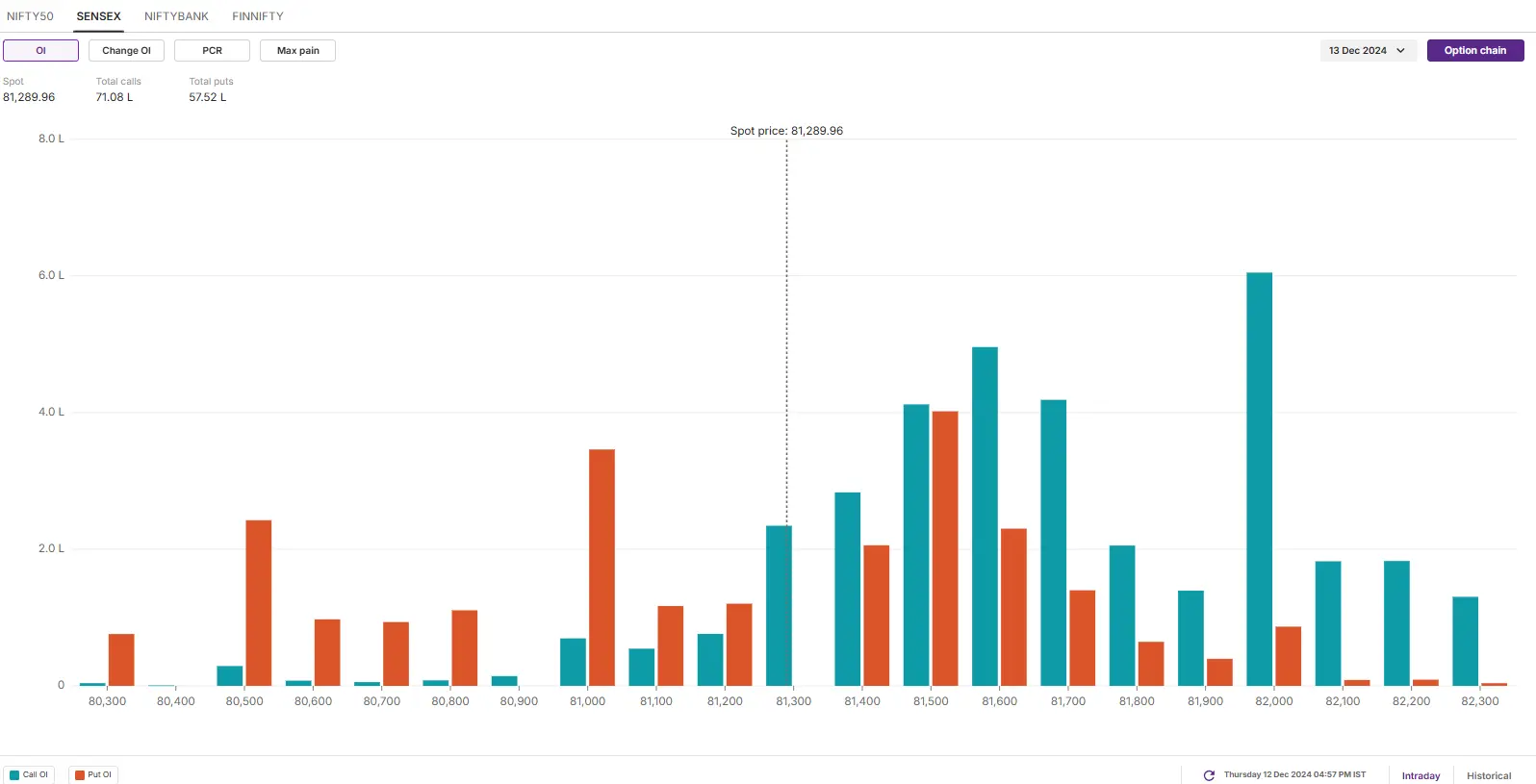

- Max call OI: 84,000

- Max put OI: 81,500

- (Expiry: 13 Dec)

The SENSEX also consolidated in a narrow range around the crucial 81,500 mark for the fifth day in a row and ended the Thurday’s session in the red. The index is currently trading above the crucial support of 21 and 50 exponential moving averages (EMAs), indicating that the broader structure of the index remains sideways to bullish. However, a close below the 80,300 zone may invite fresh selling pressure.

The 15 minute chart shows that the index is currently consolidating in a tight range between 81,100 and 81,800. Traders may monitor this range during intraday. If the index breaks out of this four-session consolidation range with a strong candle, it could provide directional clues.

The open interest data for today’s expiry saw significant call base at 82,000 strike, suggesting resistance for the index around this level. On the other hand, the put base was seen at 81,000 strike, indicating support for the index around this zone. Meanwhile, over the previous three sessions the index saw 81,500 as the base strike for both the call and put options, pointing at the rang-bound activity around this level.

FII-DII activity

Stock scanner

- Long build-up: Max Healthcare, Muthoot Finance and Coforge

- Short build-up: National Aluminium, Sun Tv, Jubilant FoodWorks, Indus Towers and BHEL

- Under F&O ban: Granules India, Hindustan Copper, PVR Inox, Metropolis, RBL Bank and National Aluminium

- Added under F&O ban: National Aluminium

- Out of F&O ban: Manappuram Finance

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story