Market News

Trade Setup for August 27: Will BANK NIFTY reclaim the 50 DMA ahead of the monthly expiry?

.png)

5 min read | Updated on August 27, 2024, 09:18 IST

SUMMARY

The BANK NIFTY is currently at a critical juncture after breaking out of its twelve-day-long consolidation. The index failed to provide follow-through momentum on Monday despite closing above the previous week's high. Traders should keep a close eye on the index's 50 and 20 DMAs. A break above or below these levels will provide directional clues.

Stock list

Currently, the NIFTY50 has not formed a reversal signal on the daily chart and has protected the previous day's low on a closing basis.

Asian markets update at 7 am

GIFT NIFTY is down 0.2%, suggesting a subdued start for the NIFTY50 today. In broader Asian markets, the sentiment is also negative. Japan’s Nikkei 225 is down 0.3%, while Hong Kong’s Hang Seng index has declined by 0.5%.

U.S. market update

- Dow Jones: 41,240 (▲0.1%)

- S&P 500: 5,616 (▼0.3%)

- Nasdaq Composite: 17,725 (▼0.8%)

The Dow Jones Industrial Average closed at a record high level on Monday, while the S&P 500 and Nasdaq ended the day in red. This comes after investors weighed the imminent arrival of interest rate cuts, leading to decline in technology stocks.

The energy sector was the best performing sector amid a rebound in crude oil prices amid heightened tensions in the middle east. With the market now pricing in a September rate cut, attention is turning to Nvidia's earnings on Wednesday. If the chipmaker's results meet expectations, the positive trend is likely to continue. However, if the results fall short of expectations, the recent rally could see some weakness.

NIFTY50

- August Futures: 25,043 (▲0.1%)

- Open Interest: 3,89,968 (▼10.7%)

After a gap-up start, the NIFTY50 extended its gains and continued its winning streak for the eighth consecutive day. The index filled the second bearish gap formed on 2 August and regained the 25,000 level on a closing basis.

As you can see on the chart below, the index has captured the 24,850 and 24,950 area on a closing basis and this area will now act as immediate support for the index. However, as the index approaches its previous all-time high (25,078), traders should also be wary of taking profits.

Currently, the NIFTY50 has not formed a reversal signal on the daily chart and has protected the previous day's low on a closing basis. The broader trend of the index remains positive until it breaks the 20-day moving average on a closing basis. Moreover, the index can extend its momentum to 25,300 level if it reclaims 25,100 level on closing basis.

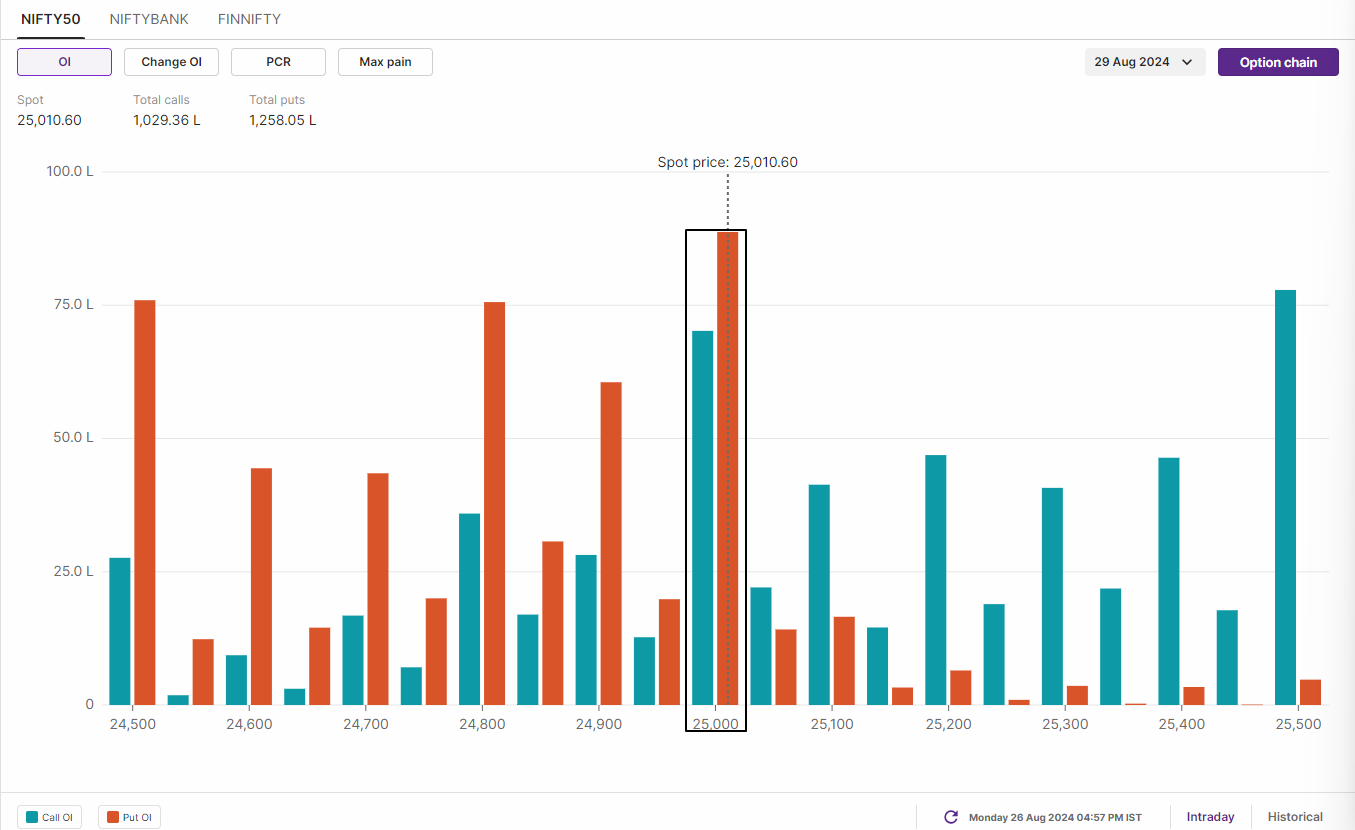

The open interest build-up for the 29 August expiry saw significant put writing at 25,000 and 24,800 strikes, indicating support for the index around these levels. However, index still has significant call base at 25,000 strike and maximum open interest at 25,500 strike, suggesting resistance for the index around these zones.

BANK NIFTY

- August Futures: 51,219 (▲0.4%)

- Open Interest: 1,47,687 (▼8.7%)

The BANK NIFTY faced selling pressure again from its 50-day moving average zone, unable to sustain the momentum despite breaking out of its twelve-day long consolidation and closing above previous week’s high.

As shown in the chart below, BANK NIFTY has immediate support at the 20-day moving average and faces resistance at the 50-day moving average. A decisive move above or below these levels, both intraday and on a closing basis, is likely to trigger a directional shift. With the monthly expiry approaching, traders using range-bound strategies should be cautious of potential sharp movements in the index.

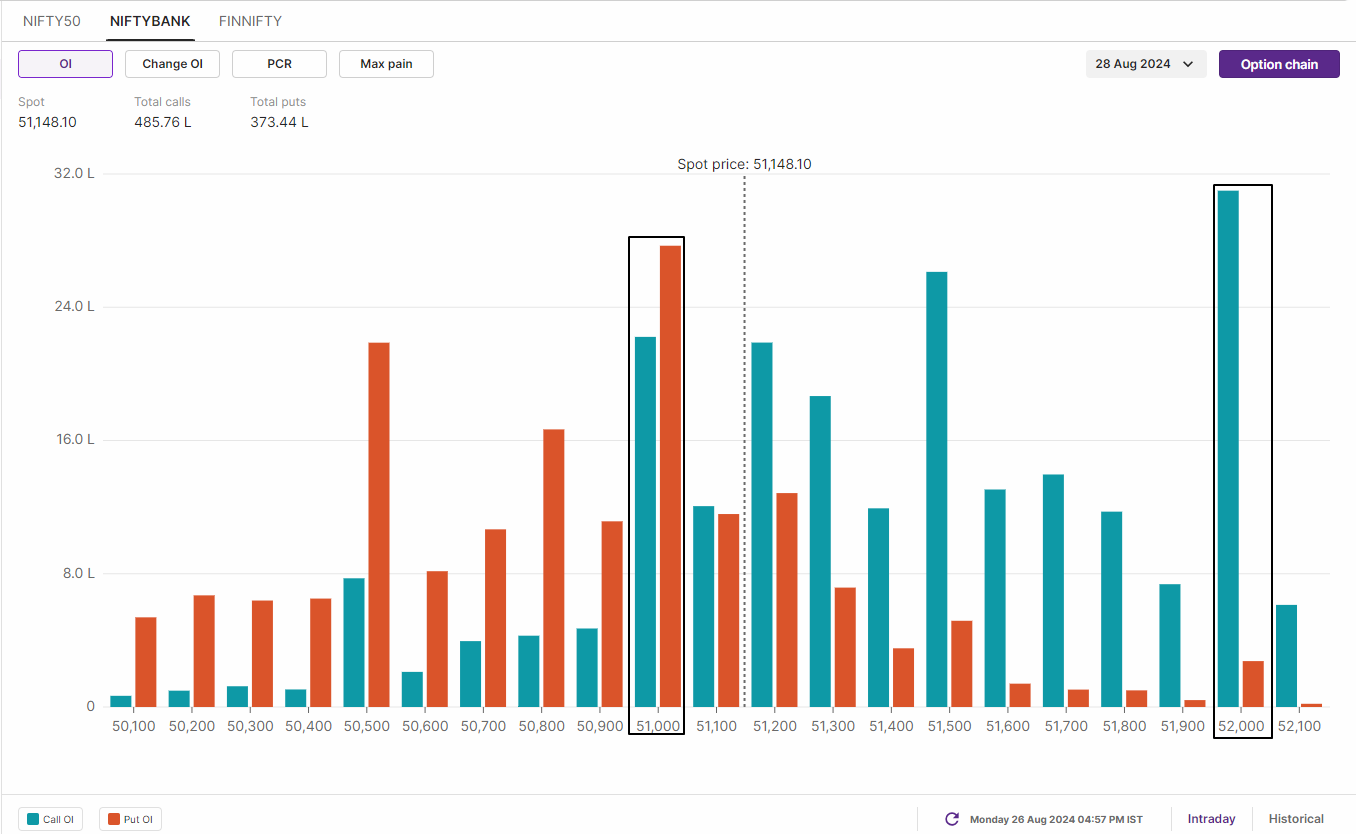

The open interest build-up of BANK NIFTY’s 28 August expiry is sending mixed signals. The index saw maximum call and put build-up at 51,200 strike along with 51,000 strike, indicating range-bound activity for the index. Additionally, the index also has highest call base at 51,500 and 52,000 strikes, suggesting resistance for the index around these levels.

FII-DII activity

Stock scanner

Short build-up: Zydus Lifesciences

Out of F&O ban: Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Hindustan Copper, National Aluminium, RBL Bank and Sun TV

Added under F&O ban: N/A

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Balrampur Chini, Birlasoft, Chambal Fertilisers, IEX, India Cements and RBL Bank

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story