Market News

Trade setup for April 7: NIFTY50 breaks 23,000 support, what next? Here’s all you need to know

.png)

5 min read | Updated on April 07, 2025, 07:22 IST

SUMMARY

The US markets witnessed one of the worst two-day falls since March 2020 after China retaliated with 34% tariffs on the US. The GIFT NIFTY trades 800 points lower on Monday morning, indicating a big gap down at opening. Technical charts indicate 22,500 as crucial support for NIFTY50.

GIFT Nifty futures indicate a negative start for Indian markets on Monday| Image source: Shutterstock.

Asian markets at 7:00 am

GIFT NIFTY: 22,132 (-3.62%)

NIkkei: 31,730 (-6%)

Kospi: 2,355 (-4%)

Hang Seng: 20,487 (-10.2%)

US Markets

Dow Jones: 38,314 (-5.5%)

NASDAQ: 15,587 (-5.8%)

S&P500: 5,074 (-5.9%)

The US markets witnessed one of the worst sell-offs since March 2020, as global economy got sucked into trade war. President Trump announced a barrage of reciprocal tariffs on almost the entire World barring a few like Canada, Mexico and Russia. Tariffs led to a massive correction in all assets, from equities to commodities. The US equities fell more than 5% across the board, gold prices retreated from record highs, and Crude oil prices fell more than 12% in two trading sessions. The US treasury yields fell below 4% for the first time since 2021. The industrial metals like Copper, Silver, Platinum and Aluminum fell more than 5%.

The sharp plunge in all assets points towards an impending recession in the US economy and its spillover effects on the world. The majority of the nations followed restraint in response to the tariffs, except China, which responded with equal 34% tariffs on US imports, taking the trade war to a larger scale, impact of which on the global economy is still unknown.

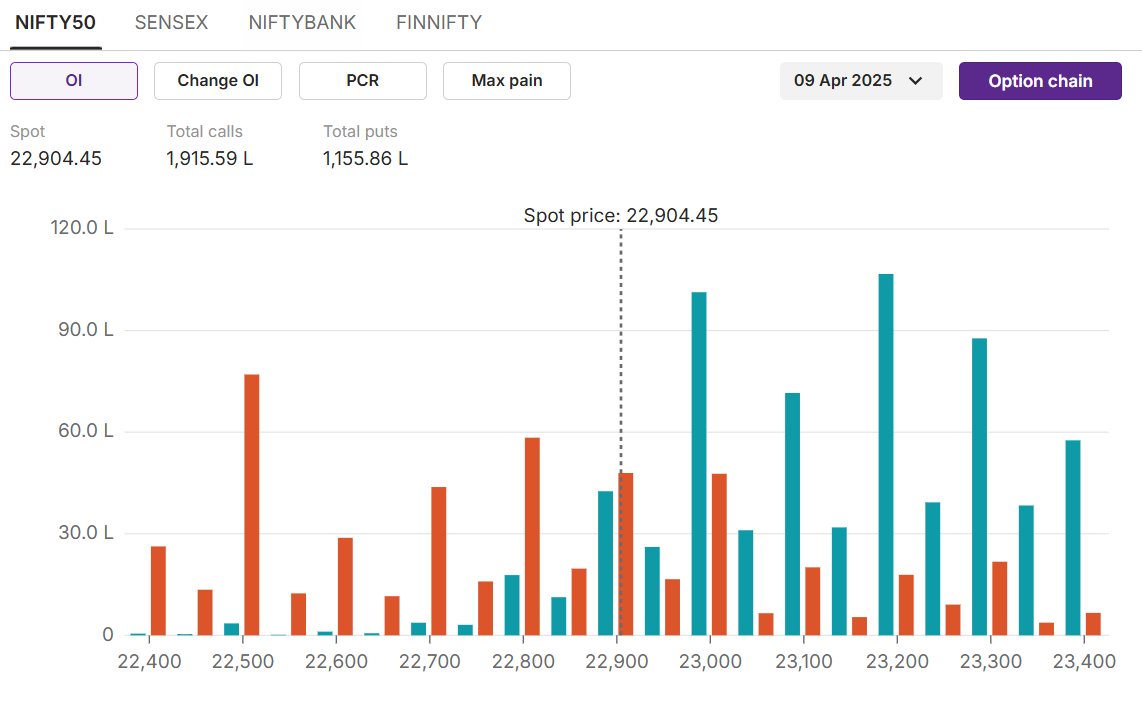

NIFTY50

Max call OI: 23,200

Max put OI: 22,500

( Ten strikes to ATM, 09 April expiry)

NIFTY50 fell 2.6% for the week in which Trump announced 26% tariffs on Indian goods. The markets showed resilience on the first day of tariff announcements. However, as the Trump administration also announced their plans of imposing tariffs on the Pharma sector, which forms a major chunk of India’s trade with the US, the index fell more than 1.15%.

The majority of the losses were led by IT stocks, which collectively fell more than 9% for the week at index level. Followed by the Metals and Oil and Gas sector, which fell more than 5%. IT stocks became the first casualty of tariff announcements as they are expected to push the US economy into recession.

On the options front, the 23,200 levels may act as a resistance, with the highest open interest on the call side for the 9 April expiry. The 23,000-strike calls witnessed massive open interest addition on Friday, indicating a strong short-term resistance for the index. On the downside, 22,500 holds the highest open interest on the put side, indicating strong support for the index.

On the options front, the 23,200 levels may act as a resistance, with the highest open interest on the call side for the 9 April expiry. The 23,000-strike calls witnessed massive open interest addition on Friday, indicating a strong short-term resistance for the index. On the downside, 22,500 holds the highest open interest on the put side, indicating strong support for the index.

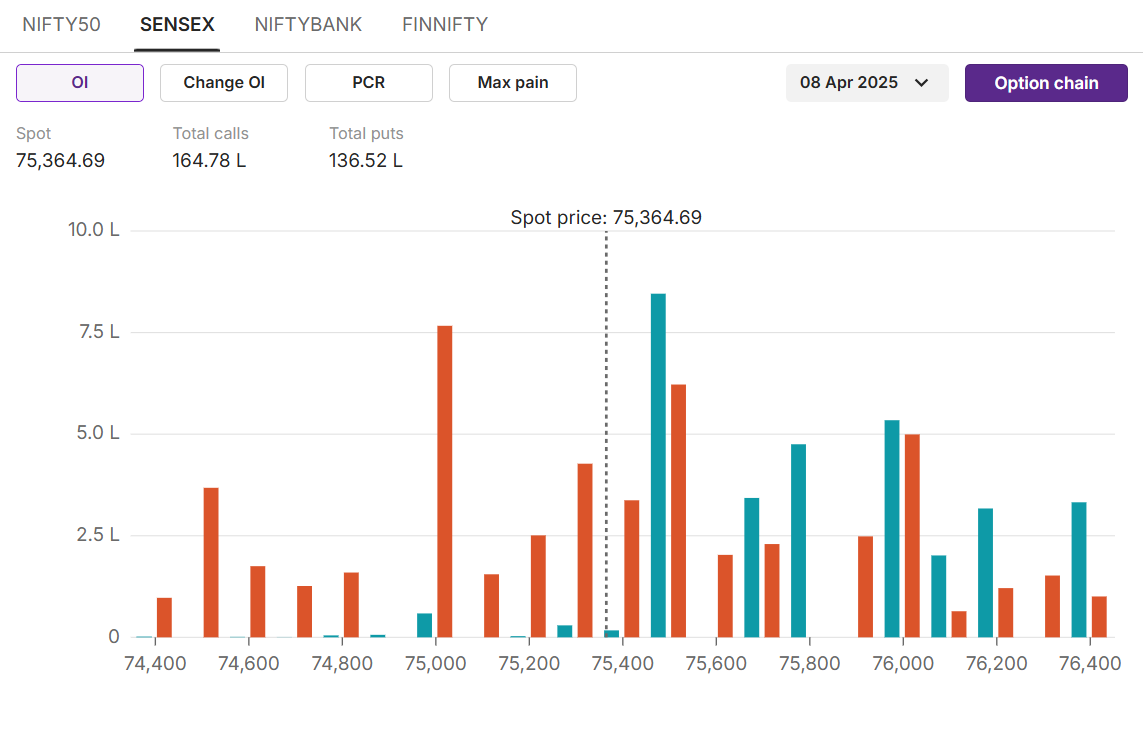

SENSEX

Max call OI: 75,500

Max put OI: 75,000 (Ten strikes to ATM, 08 April expiry) The 30-share SENSEX tumbled 2.6% for the week and 1.5% on Friday in the aftermath of US reciprocal tariffs. The index closed below the recent swing low levels of 76,000, indicating a shift in momentum from bullish to bearish. The tariff-led correction in the markets is expected to continue further as nations retaliate with tariffs on US imports. Consequently, SENSEX too is expected to witness high volatility.

Stock scanner

Stock scannerIn Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

About The Author

Next Story