Market News

Trade setup for April 2: 200 EMA support broken, all eyes on tariffs; here’s all you need to know

.png)

4 min read | Updated on April 02, 2025, 07:48 IST

SUMMARY

NIFTY50 and SENSEX closed more than 1% lower on Tuesday amid uncertainty over impending tariff announcements. On technical charts, both the benchmark indices broke the support level of 200 EMA on daily charts. The FIIs sold more than ₹5,000 crore.

At 7:29 AM, the GIFT NIFTY futures were trading at 23,323, up 15 points, or 0.07%. | Image: Unsplash

Asian markets at 7 am

Nikkei: 35,610 (-0.1%)

Hang Seng : 23,010 (-0.77%)

Kospi : 2,512 (-0.37%

US markets

Dow Jones: 41,989 (-0.03%)

S&P 500: 5,633(+0.38%)

Nasdaq Composite: 17,449 (+0.87%)

US markets

The US markets closed mixed on Tuesday, with Dow Jones in the red and NASDAQ and S&P500 in the green, ahead of major tariff announcements on Wednesday. The gains were led by consumer discretionary, technology and communication services stocks. Newsmax, a newly listed stock, skyrocketed 2000% in two days after listing at $10 per stock.

On the economic front, the US factory data signalled weakness in the manufacturing sector, which contracted in March. In addition, the new job openings fell to 7.57 million, missing expectations.

Treasury Secretary Scott Besant assured lawmakers that tariffs would act as a cap, allowing trading partners to reduce them.

NIFTY50

Max call OI:23,500

Max put OI:23,000 (Ten strikes to ATM, 3rd April Expiry)

NIFTY50 opened the new financial year negatively by falling 1.5% on Tuesday. Worries and uncertainty drove the sharp correction during the mid-market hours amid impending reciprocal tariff announcements on Wednesday. Apart from that, the 25% auto tariffs will come into effect on April 2 as well. The 350 points fall in the NIFTY50 was led by banking and IT names like HDFC Bank, Infosys, HCL Technologies, and ICICI Bank.

On the options front, the 23,500 now became the immediate resistance level with the highest open interest (OI) with 93 lakh contracts added on Tuesday itself. On the flip side, the 23,000 may act as resistance, with the highest open interest on the put side.

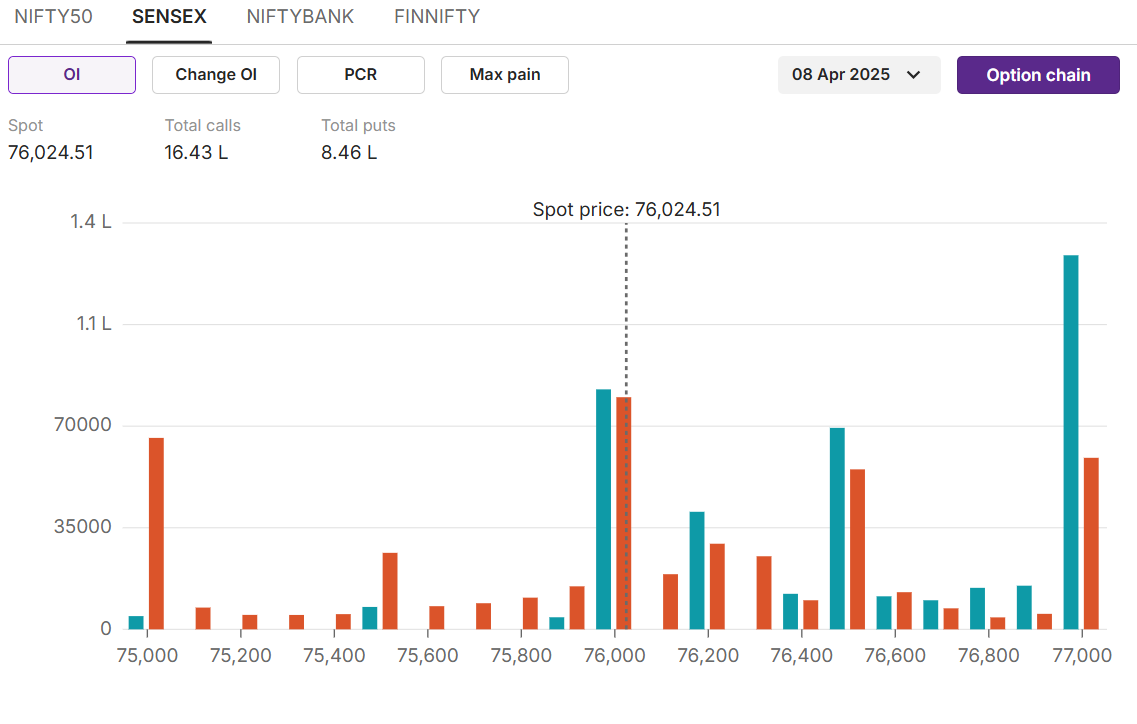

SENSEX

Max call OI:77,000

Max put OI:75,000 (Ten strikes to ATM, 8 April expiry)

The index witnessed high volatility on the weekly expiry day and closed 1,391 points down at 76,024 levels. Similar to the NIFTY50, the index saw selling pressure in banking and IT stocks and an overall bearish environment about tariff announcements. The FIIs have resumed their selling again after adding for six consecutive days in the last week of March. Experts believe the recent swing high will remain as a crucial resistance for the markets in the short-to-medium term

The initial build-up in the open interest (OI) for the 8 April Expiry indicates 77,000 as the resistance level with the highest OI. Similarly, the initial build-up on 75,000 levels indicates near-term support for the coming weekly expiry.

Foreign Institutional Investors (FIIs) snapped their buying streak on the sevent day as they sold Indian equities worth ₹5,901 crore. On the flip side, Domestic Institutional Investors (DIIs) bought equities worth ₹4,322 crore on Tuesday.

Stock scanner

Long build-up:

Short build-up: BEL, HCL Technologies, HDFC Bank

Top traded futures contracts: HDFC Bank, ICICI Bank, HAL, Infosys, Reliance

Top traded options contracts: SBIN 750 PE, Reliance 1200 PE, Infosys 1400 PE

Under F&O ban:

Out of F&O ban:

About The Author

Next Story