Market News

Trade setup for April 16: Will NIFTY50 cross 200 EMA on Wednesday? Here's all you need to know

.png)

4 min read | Updated on April 16, 2025, 07:54 IST

SUMMARY

After a sharp recovery from the lower levels, NIFTY50 and SENSEX face resistance at 200 EMA levels on the daily charts. The overall trade setup remains bullish, with strong buying strength visible at lower levels. The global market cues remain mixed for Wednesday as US markets closed in the red and Asian markets traded in the red on Wednesday morning.

GIFT NIFTY indicates negative opening for Indian markets on Wednesday morning. Image source: Shutterstock.

Asian markets at 7:00 am

Nikkei: 34,111 (-0.47%)

Hang Seng: 21,148 (-1.4%)

GIFT NIFTY: 23,277 (-0.5%)

US markets

Dow Jones: 40,368 (-0.38%)

NASDAQ: 16,823 (-0.05%)

S&P500: 5,393 (-0.17%)

The US markets closed in the red after the situation between the US and China remained stretched on the trade front. The Dow Jones and S&P500 slipped up to 0.2%, and NASDAQ closed almost flat-to-negative. The Trump administration guided for potential pharma and semiconductor tariffs exports to the US, which unnerved investor confidence. Furthermore, in post-market hours, Nvidia said it could cost $5.5 billion in earnings due to the ban on H20 chip exports to China. Following the announcement, the Nvidia shares slipped 6.6% in after-hours trading on Tuesday.

Gold prices continue to hit new record highs as the flight of capital to precious metals and treasuries continues due to uncertainty over global growth. On the other hand, China reported a strong GDP growth of 5.4% in Q1 of 2025, exceeding the estimates of 5.1%.

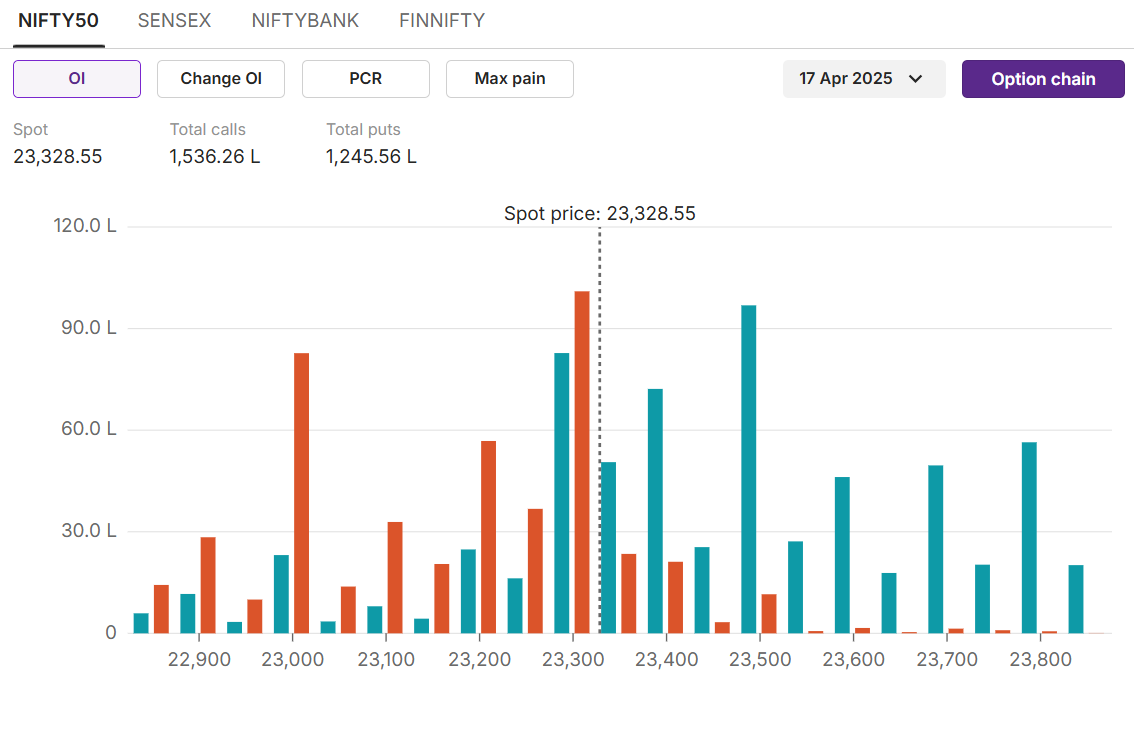

NIFTY50 Max call OI:23,500 Max put OI:23,300 ( Ten strikes to the ATM, 17 April expiry)

On the options front, the 23,500 strike holds the highest open interest on the call side, indicating a strong resistance at these levels. On the flipside, 23,300 put strike holds the highest open interest on the downside, indicating limited downside for the NIFTY50 for current expiry.

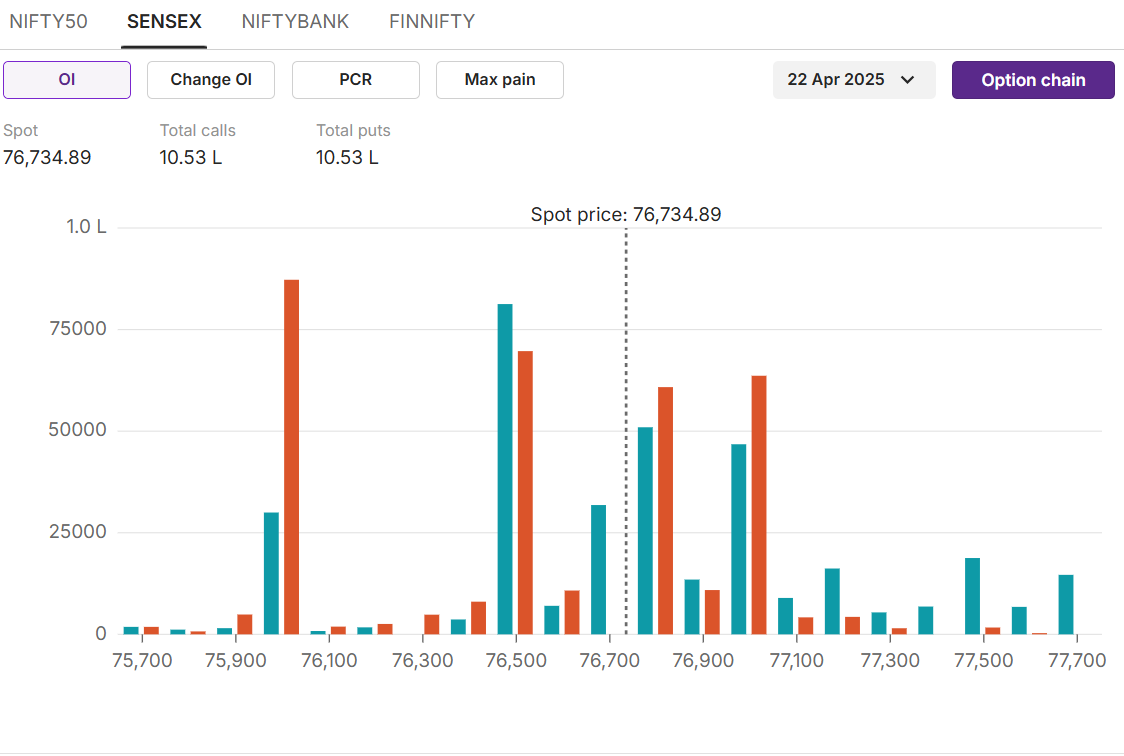

On the options front, the 23,500 strike holds the highest open interest on the call side, indicating a strong resistance at these levels. On the flipside, 23,300 put strike holds the highest open interest on the downside, indicating limited downside for the NIFTY50 for current expiry.SENSEX Max call OI:76,500 Max put OI:76,000 (Ten strikes to ATM, 22 April Expiry)

On technical charts, SENSEX too faced resistance at 200 EMA levels after crossing 20 EMA and 50 EMA on Tuesday. The index formed a bullish hammer pattern, which indicates a strong bullish momentum in the markets. Similar to NIFTY50, a closing above 200 EMA could change the sentiments to bullish from slightly bearish.

On technical charts, SENSEX too faced resistance at 200 EMA levels after crossing 20 EMA and 50 EMA on Tuesday. The index formed a bullish hammer pattern, which indicates a strong bullish momentum in the markets. Similar to NIFTY50, a closing above 200 EMA could change the sentiments to bullish from slightly bearish.

On the options front, the initial buildup for the 22 April expiry does not show any clear trend and support & resistance levels at the index. The highest open interest on the call side stands at 76,500 and on the put side at 76,000.

On the options front, the initial buildup for the 22 April expiry does not show any clear trend and support & resistance levels at the index. The highest open interest on the call side stands at 76,500 and on the put side at 76,000.Stock scanner

Long build-up: Shriram Finance, Adani Ports

Short build-up:

Top traded futures contracts: HDFC Bank, ICICI Bank, Infosys, Bharti Airtel

Top traded options contracts: SBIN 780 CE, HDFC Bank 1880 CE

Under F&O ban: Birlasoft, Hindustan Copper, Mannapuram, National Aluminium

Out of F&O ban: Nil

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story