Market News

Trade setup for April 15: NIFTY50 faces resistance at 20 EMA, what lies ahead? here's all you need to know

.png)

4 min read | Updated on April 15, 2025, 07:29 IST

SUMMARY

Indian markets are set for a positive start on Tuesday morning as global markets remain upbeat on tariff exemptions. On technical charts, NIFTY50 faces resistance of 20 EMA and closing above those levels could give bullish momentum to the markets. The GIFT NIFTY indicates a 340-point gap up opening on Tuesday morning after a holiday on Monday.

NIFTY50 and SENSEX faced resistance at 20 EMA levels on Friday. Image source: Shutterstock.

Asian markets at 7:00 am

Nikkei: 34,333 (+1.03%)

Hang Seng: 21,248 (+0.02%)

US markets

Dow Jones: 40,524 (+0.78%)

S&P 500: 5,405 (+0.79%)

NASDAQ: 16,831 (+0.64%)

US markets remained upbeat on Monday after the Trump administration announced the exemption of smartphones, semiconductors, and certain electronic items from the reciprocal tariff list. The Dow Jones and S&P 500 jumped nearly 0.8%, and the NASDAQ jumped 0.64%.

In addition, the sentiment remained positive as President Trump is also planning to consider pausing tariffs on vehicles and related auto components to give carmakers time to adjust supply chains and set up manufacturing plants in the US.

NIFTY50

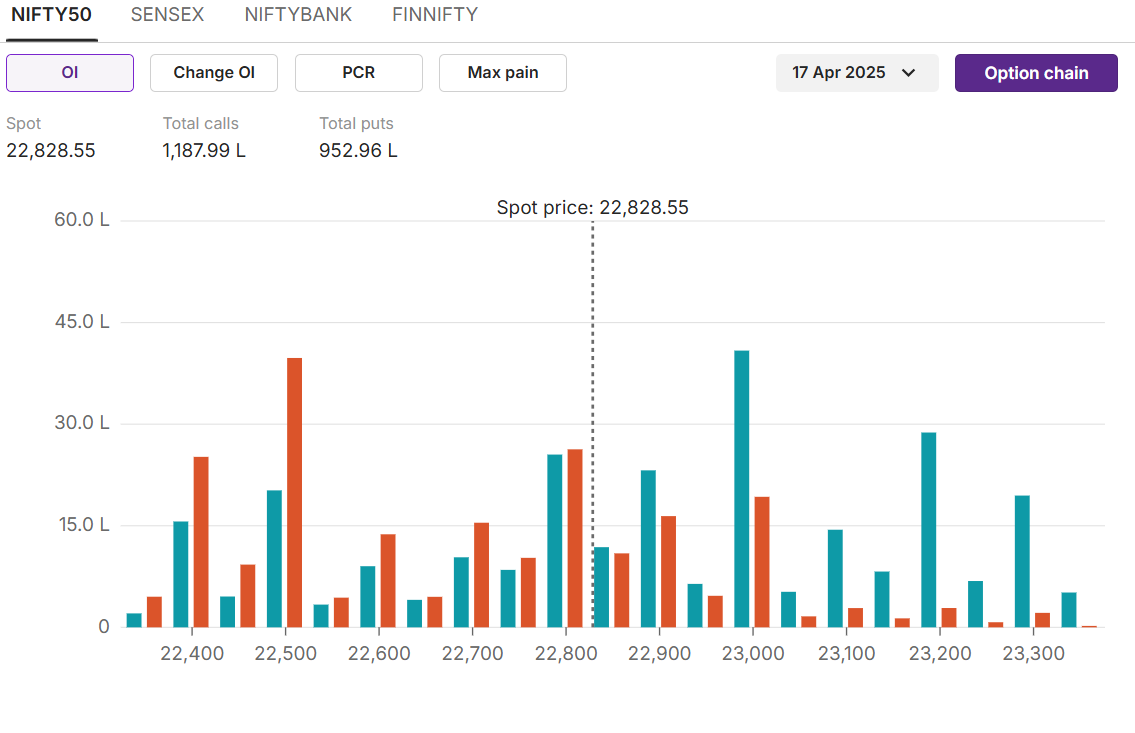

Max call OI: 23,000 Max put OI: 22,500 ( Ten strikes to ATM, 17 April expiry) NIFTY50 closed with a week on a flat-to-negative note after opening more than 5% lower on Monday. The sharp recovery from lower levels underscores the strength in the index amid global volatility and pessimism around tariffs. The 21,743 may now act as a crucial and near-term support for the index as it opened and made low on similar on last Monday.

On the technical front, the index formed a bullish piercing pattern, again showing strength in the index at lower levels. On daily charts, the index faced resistance at the 20 EMA level of 22,919 on Friday.NIFTY50 has retraced 50% of the current correction from 23,800, and experts believe the relief rally could continue to a 61% of Fibonacci retracement levels, which is 23,077.

On the technical front, the index formed a bullish piercing pattern, again showing strength in the index at lower levels. On daily charts, the index faced resistance at the 20 EMA level of 22,919 on Friday.NIFTY50 has retraced 50% of the current correction from 23,800, and experts believe the relief rally could continue to a 61% of Fibonacci retracement levels, which is 23,077.Open interest buildup

On the options front, the open interest data suggests 23,000 as the resistance level with the highest open interest on the call side. On the downside, 22,500 may act as a support level with the highest open interest on the put side.

On the options front, the open interest data suggests 23,000 as the resistance level with the highest open interest on the call side. On the downside, 22,500 may act as a support level with the highest open interest on the put side.SENSEX

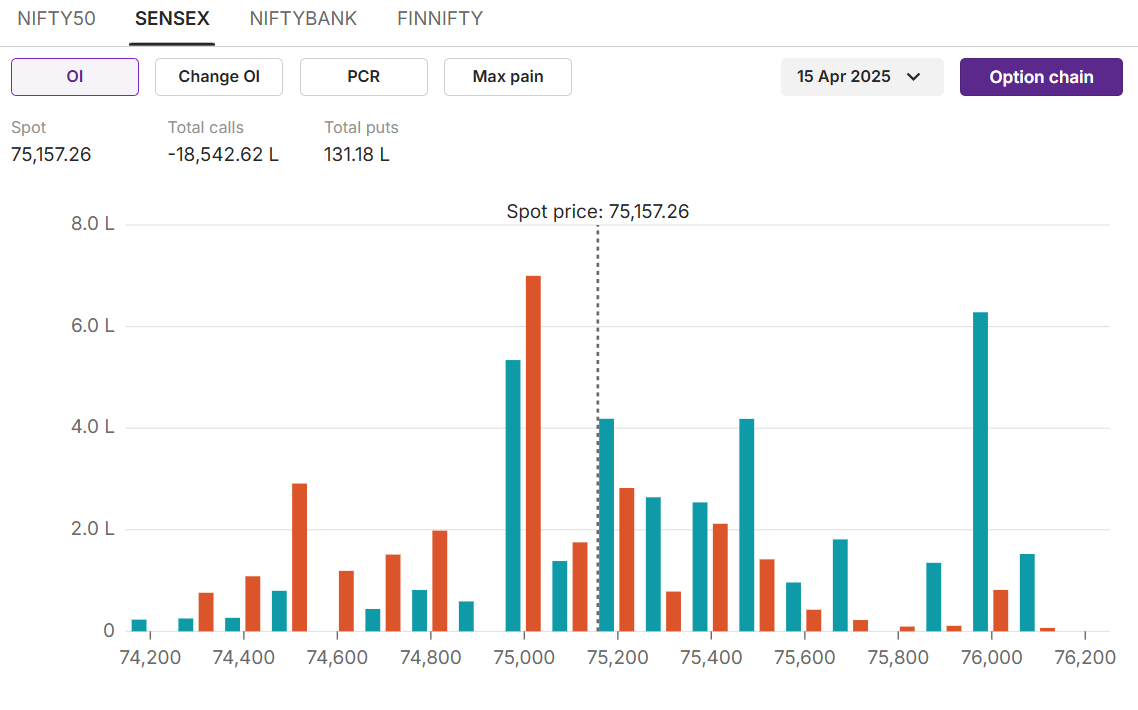

Max call OI: 76,000 Max put OI: 75,000 ( Ten strikes to ATM, 15 April Expiry)

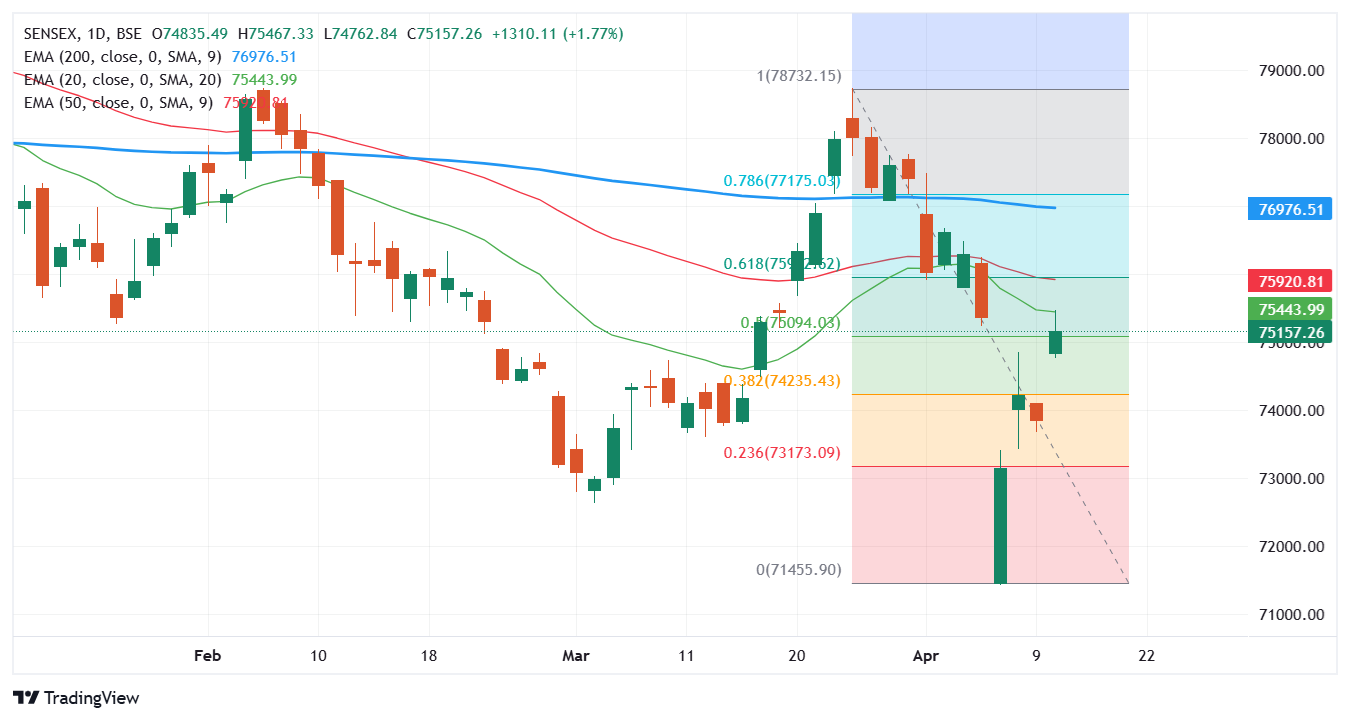

SENSEX closed the previous week with 0.3% losses by recovering more than 5% from the lows. The benchmark index made the new swing a low level of 71,425 on Monday. Similar to the NIFTY50, the SENSEX has recouped 50% of the correction from the recent swing high levels of 78,741. According to the Fibbonaci retractement, experts believe the index could recoup the 61% of the losses at 75,968.

On technical charts, the index faced resistance at 20 EMA levels on Friday. Experts believe the bullishness to continue only after closing above 20 EMA levels on daily charts.

On technical charts, the index faced resistance at 20 EMA levels on Friday. Experts believe the bullishness to continue only after closing above 20 EMA levels on daily charts.Open interest buildup

On the options front, the 76,000 level may act as a resistance level with the highest open interest on the call side. On the downside, the 75,000 level acts as a crucial support level with the highest open interest on the put side.

Stock scanner

Long build-up: Hindalco, JSW Steel

Short build-up:

Top traded futures contracts: HDFC Bank, TCS, Reliance

Top traded options contracts: SBIN 780 CE, HDFC Bank 1880 CE

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story