Market News

Trade setup for April 11: Will NIFTY50 defend 22,300 on Friday. Here’s all you need to know

.png)

4 min read | Updated on April 11, 2025, 08:22 IST

SUMMARY

Traders are expected to witness a highly volatile day on Friday as choppy global market movements remain key triggers for the market. The NIFTY50 and SENSEX may form a bullish piercing candlestick pattern on weekly charts if they manage to close above the previous week’s swing low.

Indian markets are set to open mixed amid high volatile session on Wednesday and Thursday in global markets. Image source: Shutterstock.

Asian markets at 7: 00 am

NIkkei : 33,124 (-4.3%)

Hang Sensg : 20,547 (-0.6%

US markets

Dow Jones: 39,593 (-2.5%)

S&P500: 5,268 (-3.5%)

Nasdaq: 16,287 (-4.3%)

The US markets witnessed another rollercoaster ride on Wednesday and Thursday after Trump announced a 90-day pause in tariff imposition. However, the trade war intensified between the US and China as Trump increased the total tariffs on China to 145%. The US markets saw one of the best days on Wednesday in over a decade as Dow Jones and NASDAQ jumped more than 8%.

However, the rally fizzled out on Thursday after the Trump administration announced renewed tariffs to 145%. Despite relaxation to a major chunk of other nations, the intensified trade war between the world’s top two economies sent jitters to investors across the globe, leading to a major slump on Thursday and Friday morning.

Amid anxiety over increased recession fears, gold price touched the roof of $3,213 per ounce. Similarly, gold prices gave up gains and fell more than 5% on Thursday.

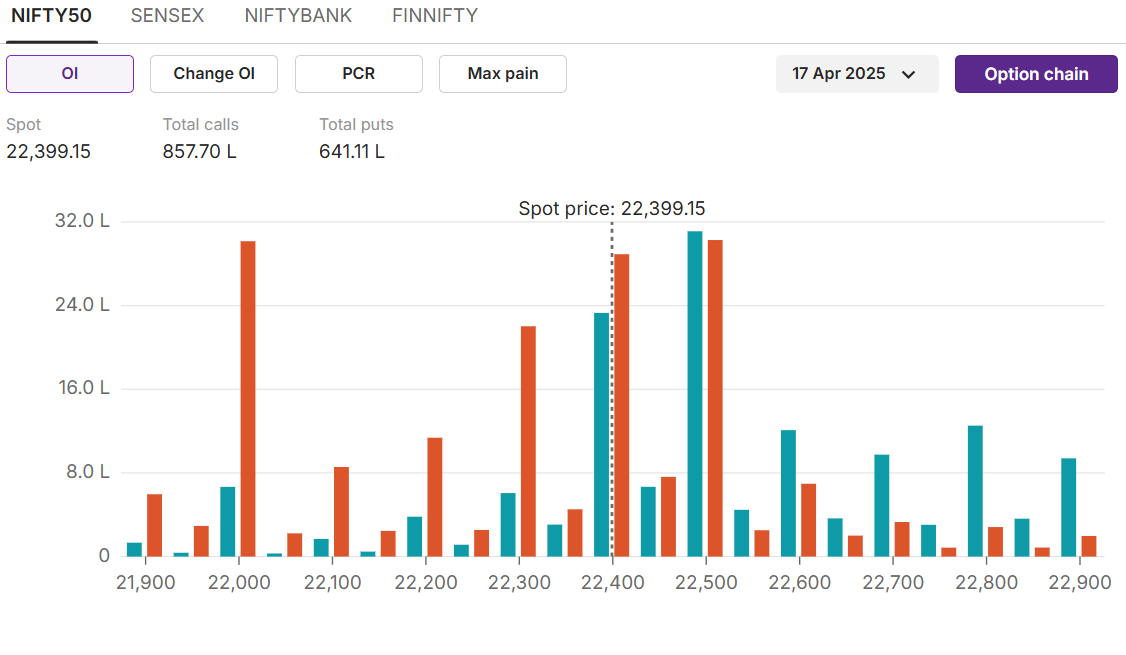

NIFTY50

Max call OI: 22,500

Max put OI: 22,000 (Ten strikes to ATM, 17 April expiry)

NIFTY retreated on Wednesday after a big gap-up on Tuesday as trade war concerns elevated with the US and China tariff war reaching its peak. However, after the sharp rally in US markets on Wednesday and Thursday, the NIFTY50 is expected to see a sharp gap-up opening. NIFTY50 is expected to fill the gap created on Monday’s gap-down opening, taking cues from the positive global markets

On the options front, the initial buildup for the 17 April expiry shows 22,500 as resistance, with the highest open interest on the call side and the flipside 22,000 as the support with the highest open interest on the put side.

On the options front, the initial buildup for the 17 April expiry shows 22,500 as resistance, with the highest open interest on the call side and the flipside 22,000 as the support with the highest open interest on the put side.

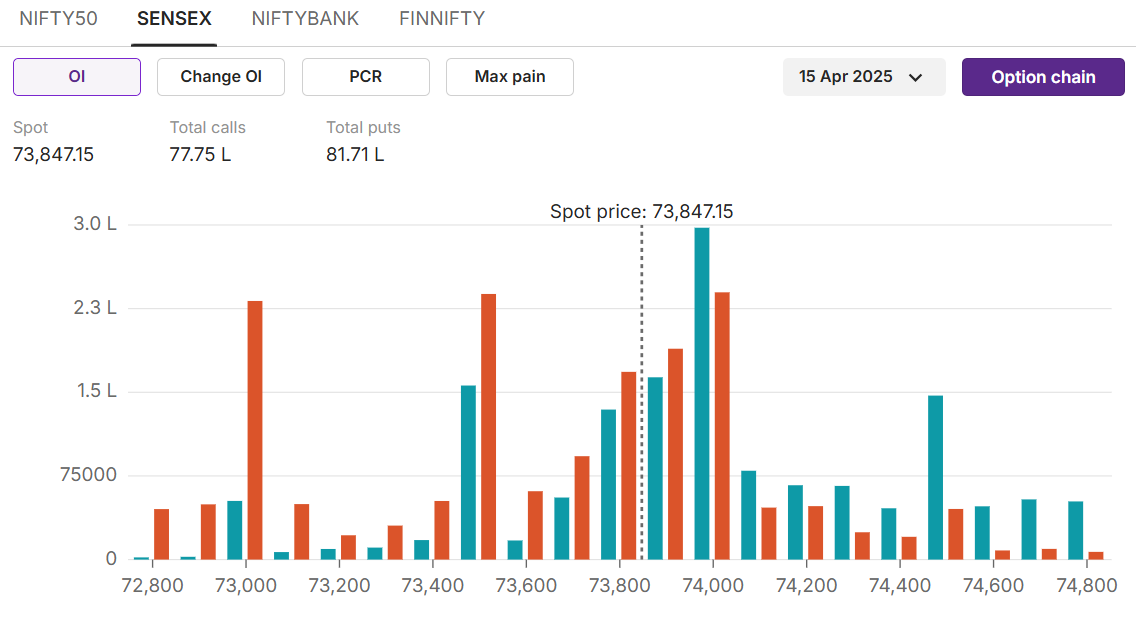

SENSEX

Max call OI:74,000

Max put OI: 73,000

(Ten strikes to ATM, 15 April expiry) SENSEX 379 points lower amid continued selling pressure from IT, Pharma and Realty sector stocks as tariff war pressures intensified selling in IT and Pharma stocks. The realty stocks witnessed selling pressure despite strong tailwinds led by RBI policy rate cuts. However, the index defended the swing low levels of 72,740 for three consecutive days, indicating strength in the markets. The Friday’s gap-up opening is expected to boost much-needed animal spirits amongst investors in Indian markets.

On a daily chart basis, the index is expected to take resistance at the 20 SMA level of 75,670 after a big gap-up opening on Monday. Experts believe closing above 20 SMA levels on a daily chart basis could give a boost for the next leg of rally in the Indian markets.

On a daily chart basis, the index is expected to take resistance at the 20 SMA level of 75,670 after a big gap-up opening on Monday. Experts believe closing above 20 SMA levels on a daily chart basis could give a boost for the next leg of rally in the Indian markets.

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story