Market News

Trade setup for 4 July: Banks drive NIFTY50 to record levels, volatility index eases 3%

.png)

5 min read | Updated on July 04, 2024, 07:58 IST

SUMMARY

For today’s expiry, the NIFTY50 index witnessed significant put writing at 24,200 strike, indicating support around this zone. As long as the index holds above this level, the trend may remain positive on the expiry day.

Dalal-Street-1200x900-PTI.webp

Indian equities are expected to start Thursday's session on a positive note, as indicated by the GIFT NIFTY, which is up 0.3%.Meanwhile, other Asian markets are also trading in the green. Japan's Nikkei 225 is up 0.3%, while Hong Kong's Hang Seng Index is up 0.4%.

U.S. market update

Dow Jones: 39,308 (▼0.0%) S&P 500: 5,537(▲0.5%) Nasdaq Composite: 18,188 (▲0.8%)

U.S. equities ended Wednesday's holiday-shortened session on a mixed note, with both the S&P 500 and Nasdaq hitting fresh record highs. The moves come ahead of the 4th of July holiday and the employment report, which will be released on Friday before markets reopen.

The payrolls data is expected to show that U.S. job growth is likely to have slowed in June, after a surge in the month of May. The report is expected to show that the US economy added around 2,00,000 jobs in June, less than the 2,72,000 jobs added in May.

NIFTY50

July Futures: 24,350 (▲0.6%) Open Interest: 5,79,214 (▼0.8%)

Following positive global cues, the NIFTY50 index started Wednesday's session on a positive note and closed at a record high. The strong opening gains of the index were on the back of strong momentum in HDFC Bank, which touched a record high. This comes on the back of expectations of passive fund inflows amid a likely increase in its weightage in the MSCI index.

On the daily chart, the NIFTY50 has formed a small red candle similar to a doji candlestick pattern. The formation of this pattern indicates a consolidation at higher levels with a positive bias, as the index has not yet given a reversal signal on the daily chart. From a positional point of view, the index has strong support between 23,600 and 23,700, while short-term resistance remains at 24,500.

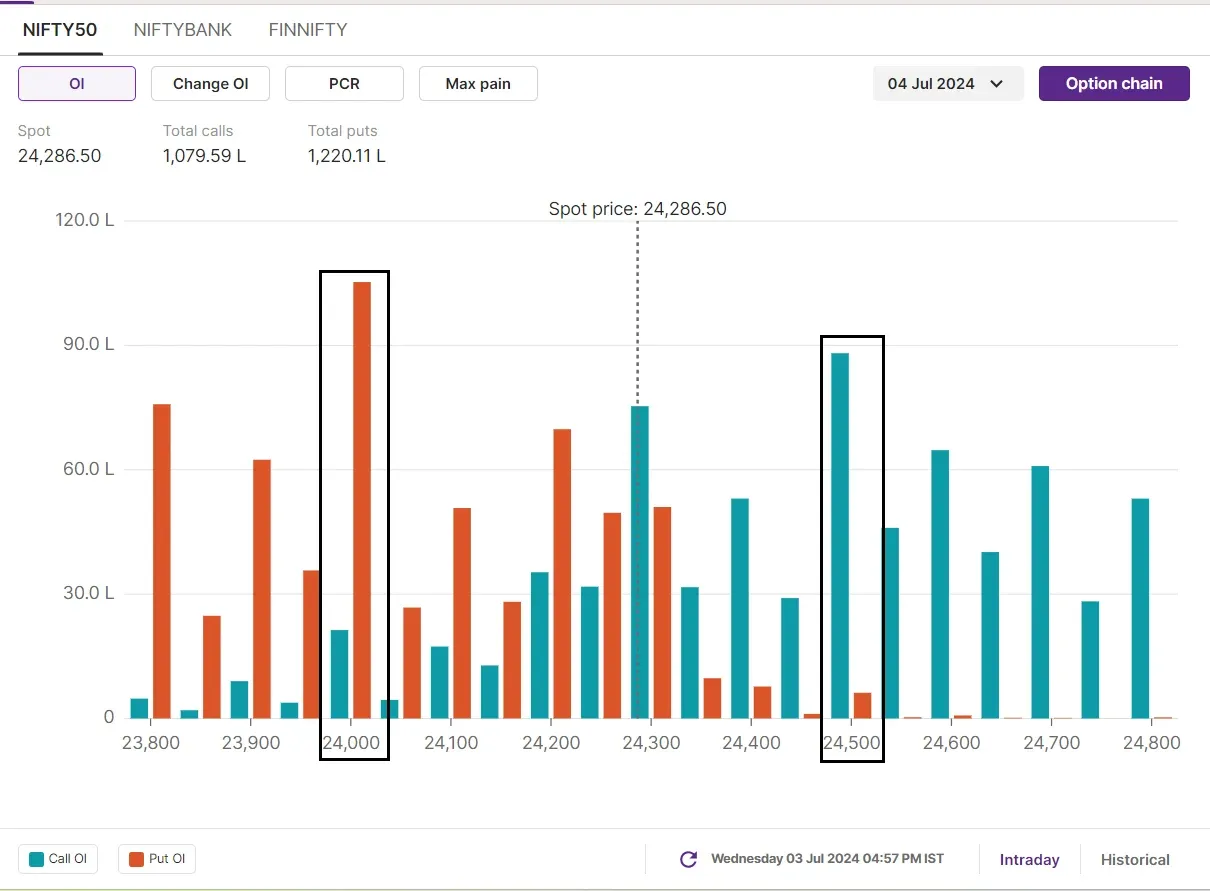

For today's weekly expiry, the NIFTY50 has immediate support at the 24,200 level on the 15-minute chart. As long as the index holds above this level, the trend may remain positive on the expiry day. On the other hand, if the index falls below 24,200, the next support will be around the 24,000 level.

The open interest build-up for today’s expiry has a maximum put base at 24,000 strike followed by 24,200. These levels will act as support for the index. On the other hand, the call base was seen at 24,500 and 24,300 strikes, these levels will act as immediate resistance for the index.

BANK NIFTY

July Futures: 53,091 (▲1.3%) Open Interest: 1,85,510(▲13.7%)

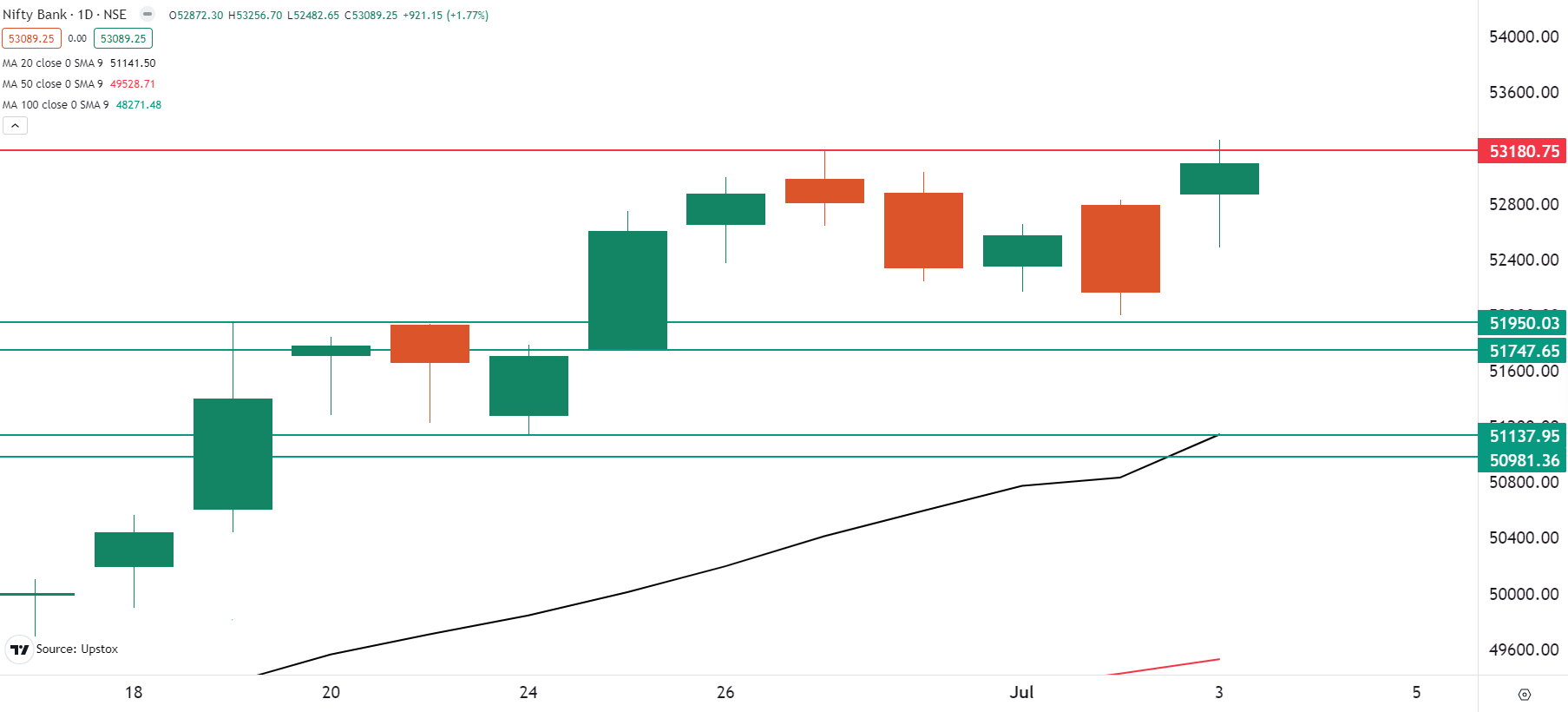

The BANK NIFTY started the session with a gap-up opening of over 600 points and hit a new all-time high on the weekly options expiry. With the exception of AU Small Finance Bank, all the eleven stocks in the banking pack participated in the rally with Bandhan Bank and Federal Bank being the biggest gainers.

As highlighted in yesterday's blog, the index protected the 52,000 level and experienced short covering as it opened above the immediate resistance of 52,400. However, it broke through the 53,000 level, but encountered strong resistance around this area.

For the coming sessions, we believe that the BANK NIFTY will only show weakness if it closes below the 52,000 level on the daily chart. On the other hand, the index has been consolidating around the immediate hurdle of 53,000 throughout the day and any breach of this resistance will result in further short-covering rally. Until the index breaches both levels on a closing basis, it may consolidate within this range.

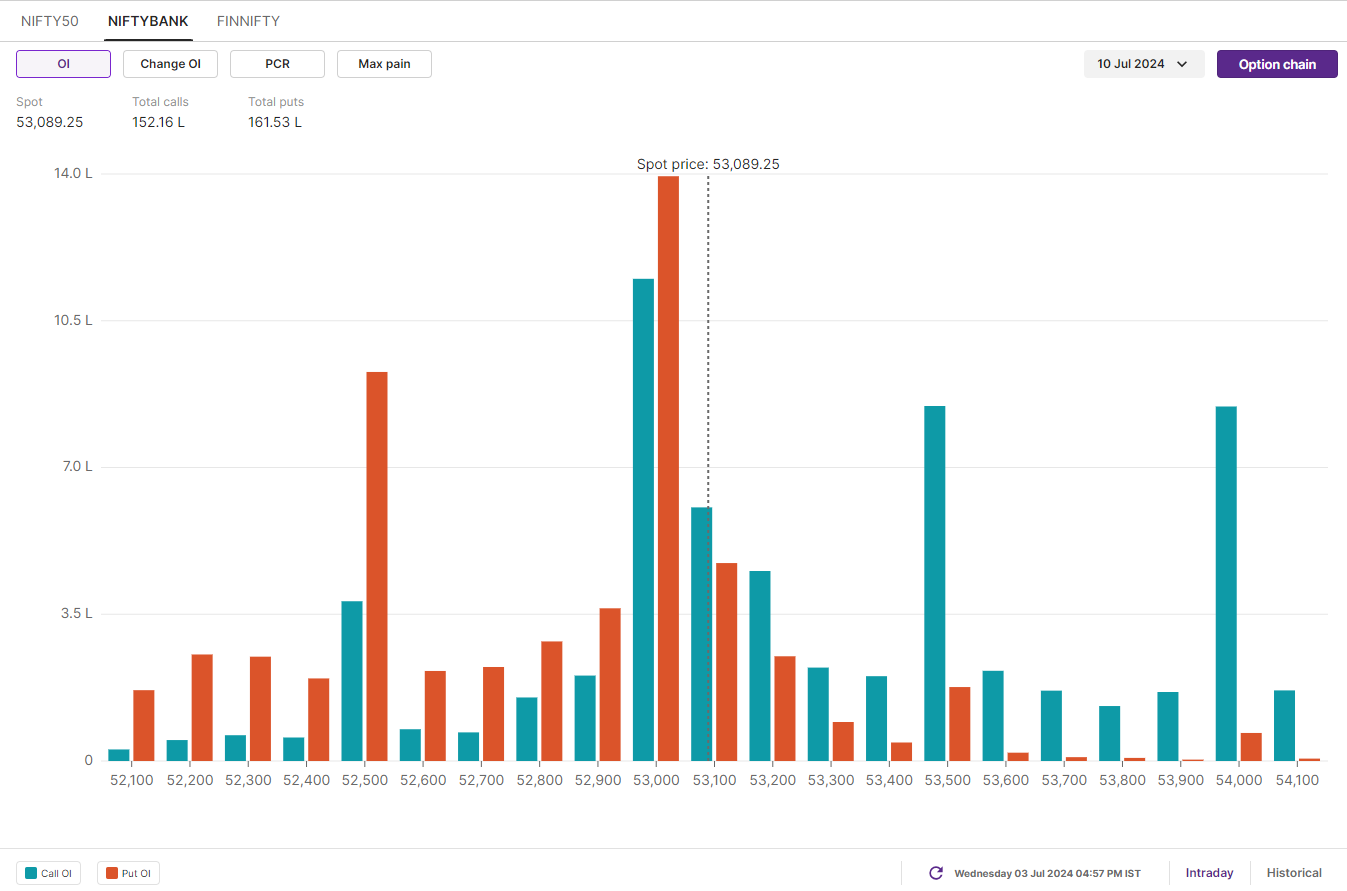

Meanwhile, the initial open interest for the 10 July expiry shows significant call and put open interest (OI) placed at 53,000 strike. This indicates potential range-bound activity for the index. Additionally, the notable call and put open interest was also seen at 53,500 and 52,500 strikes. As the weekly closing approaches, traders should closely monitor the build-up and changes in open interest for further insights.

FII-DII activity

Stock scanner

Long build-up: Federal Bank, Bandhan Bank, Steel Authority of India, Bharat Heavy Electricals and IDFC First Bank

Short build-up: Ashok Leyland and Gujarat Gas

Under F&O Ban: Hindustan Copper and India Cements

Out of F&O Ban: Indus Towers

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story