Market News

Trade setup for 30 April: BANK NIFTY hits fresh all-time high, eyes 50,000-mark

.png)

4 min read | Updated on April 30, 2024, 08:23 IST

SUMMARY

BANK NIFTY formed a bullish Marubozu candle on the daily chart and closed at the record high level. For today's expiry, BANK NIFTY has immediate support in the range of 48,500 to 48,600. In addition, the immediate all-time high range of 48,900 to 49,000 could be retested and act as further support for the index.

The BANK NIFTY index registered its highest ever closed on Monday and zoomed past 49,000 mark to make fresh all time high

Asian markets update 7 am

Indian equities are set to open slightly higher, with the GIFTY NIFTY up 0.1%. Other Asian markets are also showing positive trends. Japan's Nikkei 225 is up 1.4% and Hong Kong's Hang Seng is up 0.2%.

U.S. market update

U.S. indices closed higher on Monday, kicking off an important week on a positive note. Key events this week include the Federal Reserve meeting, the release of April jobs data and earnings reports from Amazon and Apple.

The S&P500 and the Nasdaq Composite jumped 0.3% and closed the day at 5,116 and 15,983 respectively. The Dow Jones Industrial Average also gained 0.3% and ended at 38,386.

NIFTY50

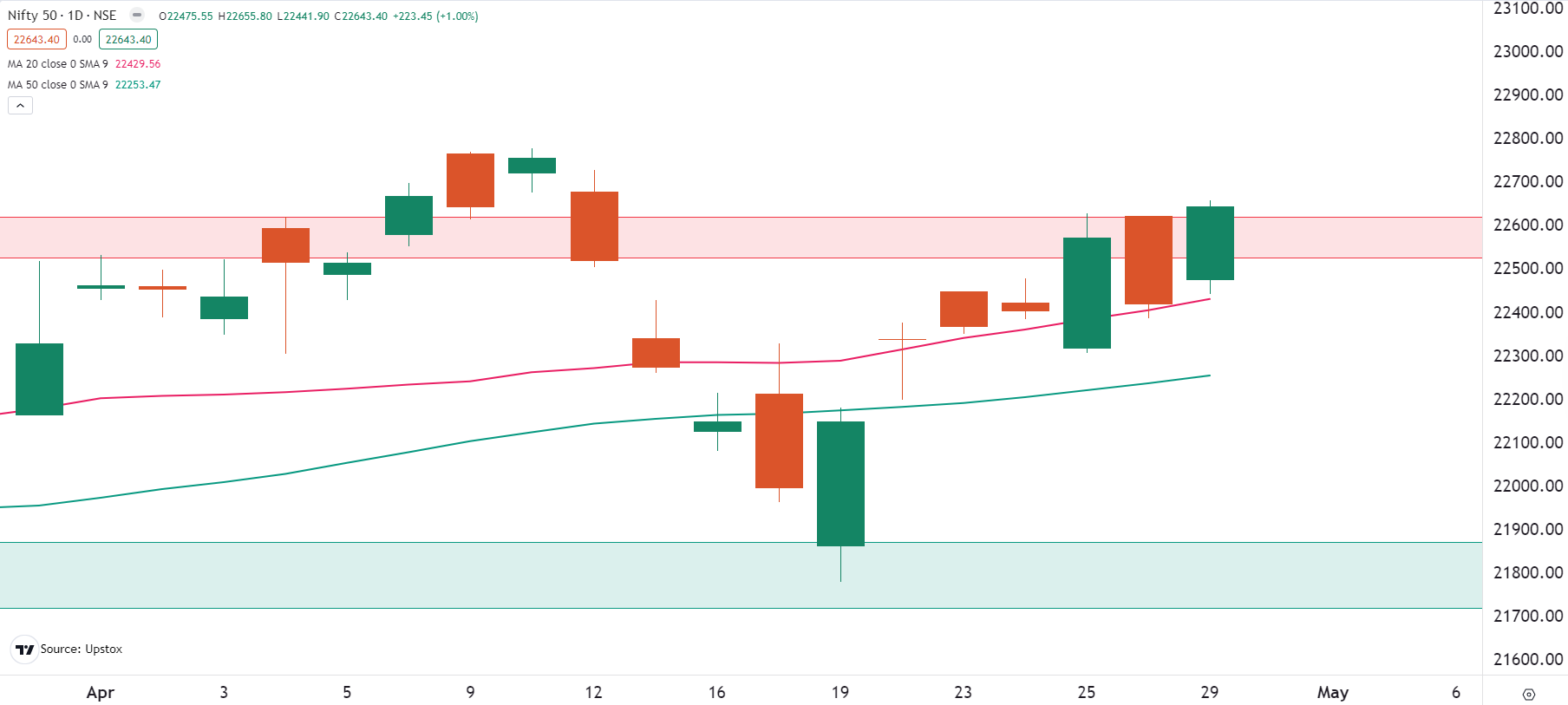

After starting the Monday’s session on positive note, the NIFTY50 index sustained its gains and gradually moved higher, recapturing the crucial 22,500 mark on the closing basis. The strong gains in banking stocks lifted the momentum and the NIFTY50 advanced 1% to 22,633.

After an initial dip, the NIFTY50 resumed its uptrend and formed a bullish candle on the daily chart. As noted in our 29 April’s morning trade setup blog, the index has immediate support at 22,300. As long as this level holds on closing basis, we may witness support based buying during retracements.

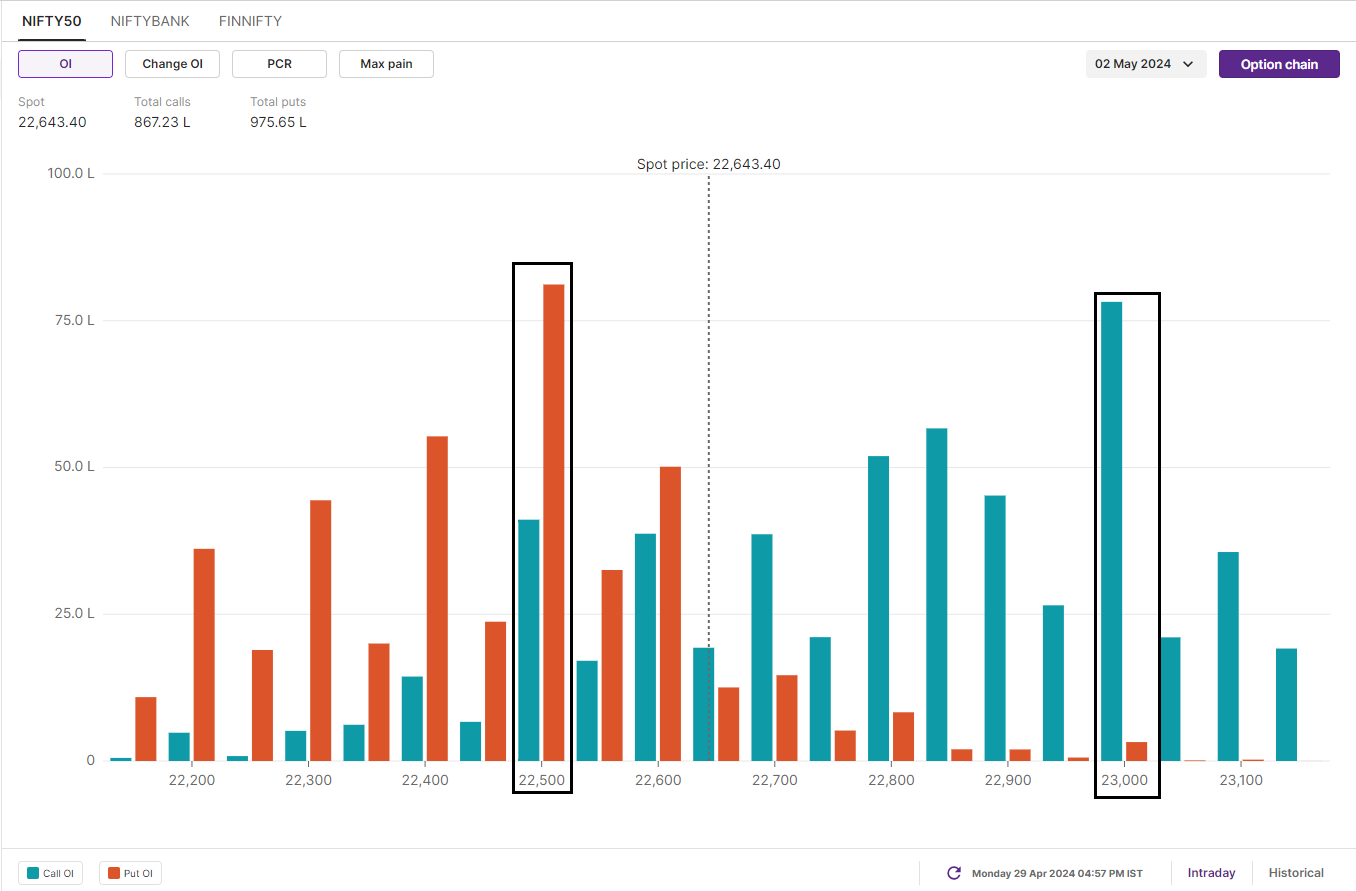

The open interest (OI) data for the 2 May expiry has a maximum call base at the 23,000 and 23,850 strikes. On the other hand, put OI has shifted there base to 22,500 and 22,400 strikes. Based on the options data, traders expect NIFTY50 to tarde between 22,250 and 23,000.

BANK NIFTY

The BANK NIFTY index registered its highest ever closed on Monday and zoomed past 49,000 mark to make fresh all-time high. Led by gains in banking heavyweights SBI, ICICI Bank and Axis Bank— the banking index jumped 2.5% and formed a bullish Marubozu candle on the daily chart.

A bullish Marubozu candle underlines strong buying momentum and has no wicks, indicating that the price closed near the day’s high.

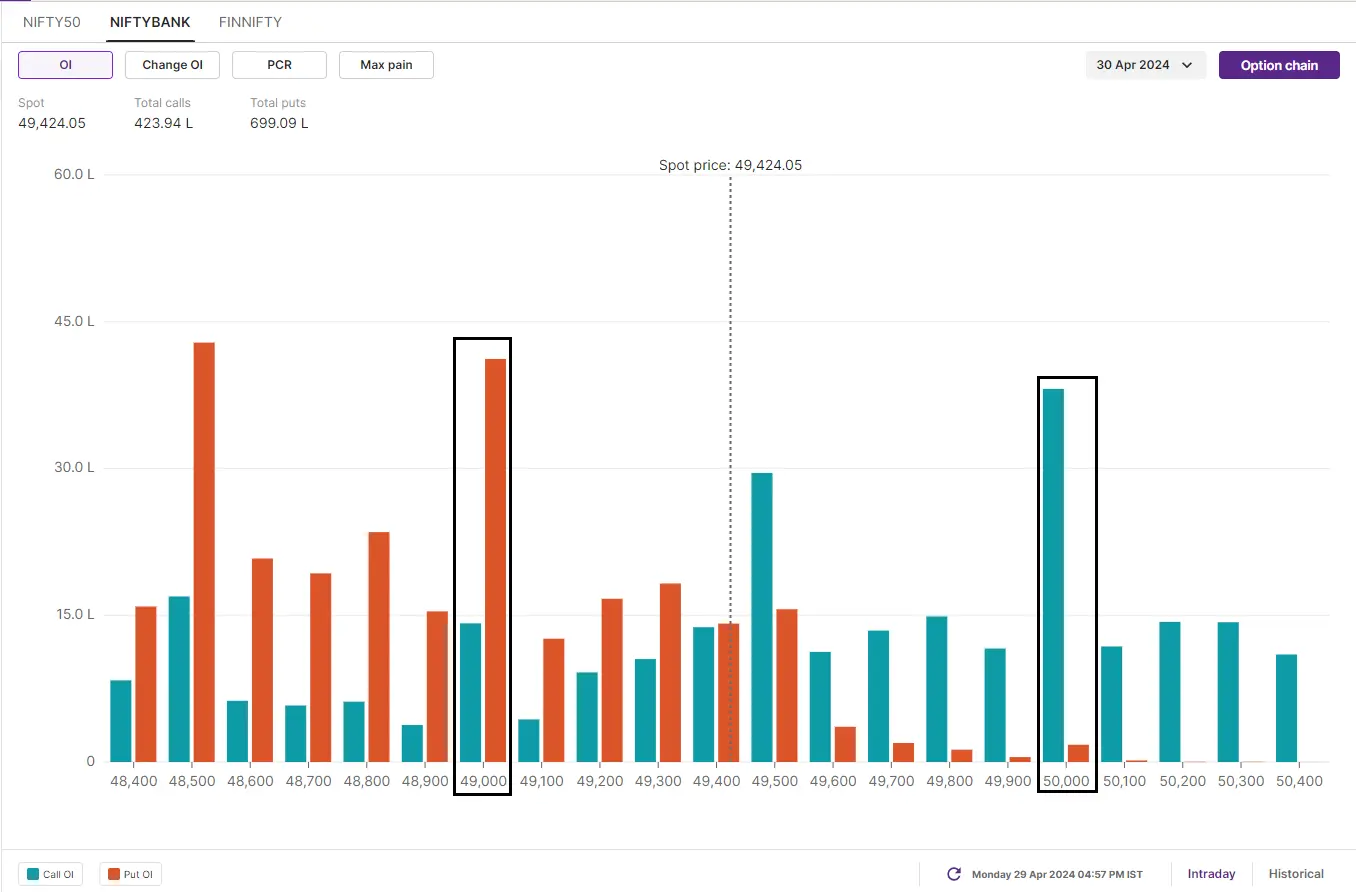

For today's expiry on 30 April, we have identified key support zones for the BANK NIFTY index, as shown in the chart below. The index finds immediate support in the range of 48,500 to 48,600. In addition, the immediate all-time high range of 48,900 to 49,000 could be retested and act as further support for the index.

Options data for the 30 April expiry shows significant call open interest at 50,000 and maximum put open interest at the 49,000 strike. Based on the open interest, traders expect the BANK NIFTY to trade between 49,000 and 50,000.

FII-DII activity

Stock scanner

Long build-up: AB Capital, Ultratech Cement, ICICI Bank and Navin Fluorine

Short build-up: HCL Tech, Apollo Hospitals, SBI Cards, GMR Infra and Tata Chemicals

Under F&O ban: Biocon and Idea

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story