Market News

Trade setup for Sept 29: Will NIFTY50 hold 24,500 support on Monday?

.png)

3 min read | Updated on September 29, 2025, 08:14 IST

SUMMARY

GIFT NIFTY futures indicate a positive start for the Indian markets on Monday with nearly 100 points gap up opening. The index continues to remain under pressure as indicated by the options data. The technical charts indicate 24,500 as crucial support for coming expiry.

GIFT NIFTY futures indicate a solid start for Indian markets on Monday. Image source: Shutterstock.

NIFTY50

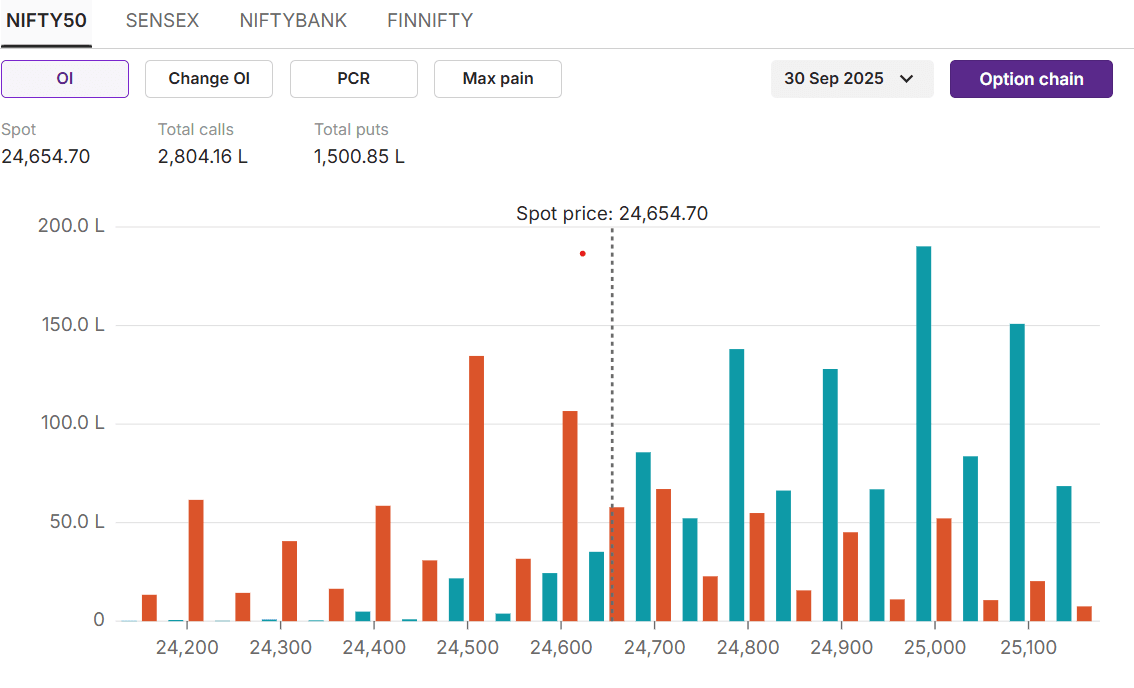

Max call OI:25,000

Max put OI:24,500

(Ten strikes to ATM, 30 Sep expiry)

The index continues to remain under pressure amid weak global cues, and markets reacted adversely to the new pharma tariffs announced by President Trump on Friday. Additionally, the latest round of negotiations with the Trump administration on the India-US trade deal yielded no significant results. Market participants are now focusing on the RBI policy outcome to be announced on Wednesday.

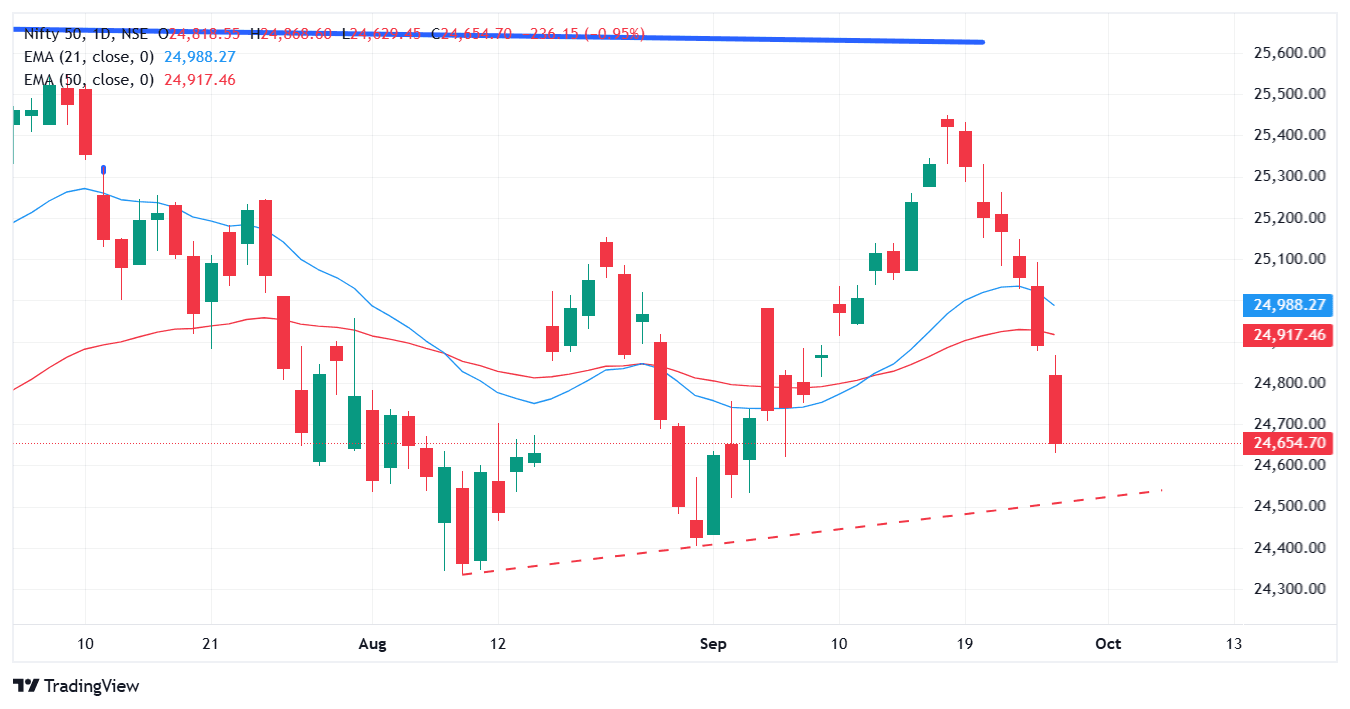

On the technical front, the index has broken the short-term and medium-term support levels of 21 EMA and 50 EMA. The index now eyes the support of the swing low support trend line at 24,500. Experts believe, for the index to march ahead, it should close above 25,000 on a monthly basis.

On the options data front, the 25,000 calls hold the highest open interest, indicating a strong resistance on the upside. Similarly, the 24,500 puts hold the highest open interest, indicating a crucial support for tomorrow’s monthly expiry.

NIFTY50 Max call OI:25,000

Max put OI:25,000

(Ten strikes to the ATM, 30 Sep expiry)

The NIFTY50 index closed in the red for the fifth consecutive session after the index continued to face heavy selling pressure. The index is expected to remain under pressure on Friday due to weak global cues, as President Trump announced 100% tariffs on the Pharmaceutical exports to the US.

On the technical charts, the index broke the crucial support level of 25,000, indicating weakness in the sentiment. According to the experts, the swing low trendline remains the next best support for the index at 24,500.

Nifty50_2025-09-26_07-13-19.png On the options data front, the 25,000 calls and puts for the 30th September expiry hold the highest open interest, indicating indecisiveness by the options traders on the direction of the NIFTY50.

Stock Scanner

Long buildup: - L&T, ITC

Short buildup: - M&M, Eternal, Sun Pharma

Top traded futures contracts: HDFC Bank, ICICI Bank

Top traded options contracts: TCS 2900 PE, Reliance 1380 CE

F&O securities under ban: RBL Bank,

F&O securities out of the ban:Sammancap

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities or strategies for trading. The securities quoted are exemplary and are not recommended. The stock names mentioned in this article are purely for showing how to do analysis.

About The Author

Next Story