Market News

Trade setup for 25 June: Bullish piercing follow-through on NIFTY50 and BANK NIFTY?

.png)

4 min read | Updated on June 25, 2024, 07:55 IST

SUMMARY

Both the NIFTY50 and BANK NIFTY rallied sharply from the day's lows, forming a bullish piercing pattern. However, traders will be watching today's close for confirmation before taking action.

Both Foreign Institutional Investors and Domestic Institutional Investors were net sellers on June 24.

Asian markets update

The GIFT NIFTY (+0.1%) is trading marginally higher, indicating a flat to positive start for the Indian equities today. Meanwhile, other Asian indices are trading positively. Japan's Nikkei 225 is up 0.5% and Hong Kong's Hang Seng is up 0.9%.

U.S. market update

- Dow Jones: 39,411 (▲0.6%)

- S&P 500: 5,447 (▼0.3%)

- Nasdaq Composite: 17,496 (▼1.0%)

U.S. equities closed mixed for the second day in a row as technology stocks remained under pressure, while banks and energy saw buying interest. The entire semiconductor pack weighed on the broader indices, with heavyweight Nvidia down over 6%.

NIFTY50

- June Futures: 23,555 (▲0.2%)

- Open Interest: 4,59,149 (▼1.8%)

The NIFTY50 started Monday's session with a gap-down, but made a smart recovery of over 200 points from the day's low. On a closing basis, the index again defended the previous day's low and closed 0.1% higher.

On the daily chart, the index formed a bullish piercing pattern after opening lower, indicating support based buying at the lower levels. The bullish piercing is a two-candlestick pattern that forms after a downward movement.

In this pattern, the first candle is a red candle, followed by a green candlestick that opens below the previous day's low. The green candle then closes above the mid-point of the previous day's red candle, piercing it. However, traders wait for the next day's close to ensure that the bullish trend is sustained before taking action.

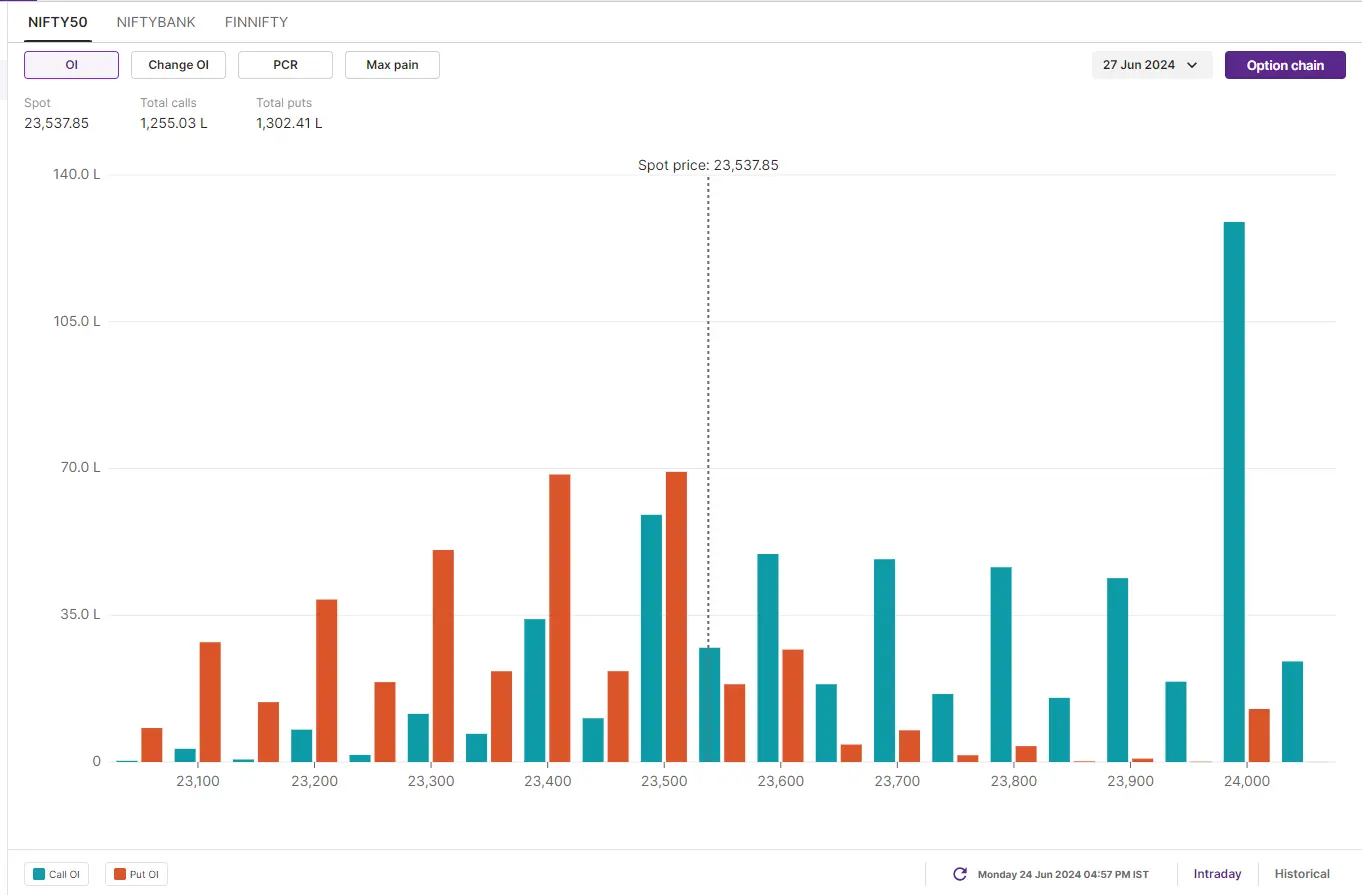

According to the open interest build-up for the 27 June expiry, the index continues to consolidate between the range of 23,400 and 23,700. Experts believe that a break of this range on a closing basis will provide traders with clearer directional clues. The highest open interest remains at the 24,000 call strike and the 23,000 put strike. In addition, there is significant open interest in both the call and put options at the 23,500 strike price, suggesting that further consolidation around this level is likely.

BANK NIFTY

- June Futures: 51,703 (▲0.0%)

- Open Interest: 1,44,381 (▲6.1%)

After a gap-down start, the BANK NIFTY quickly recovered over 500 points from the day's low to close Monday's session flat with a positive bias. The index also formed a bullish piercing pattern on the daily chart, highlighting the presence of buyers around key support zones.

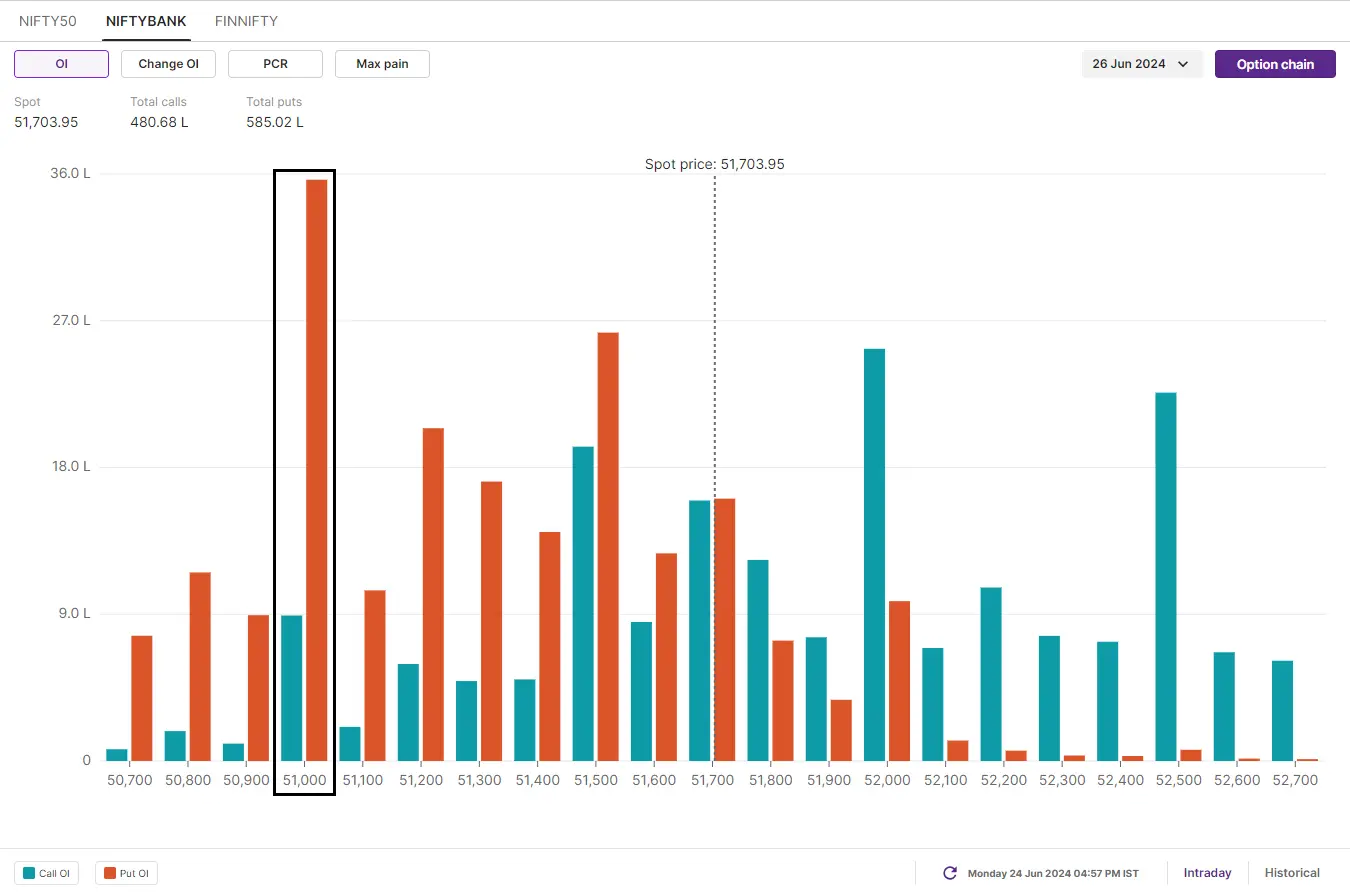

In yesterday's blog, we pointed out to our readers that after a strong weekly close, the banking index had immediate support around the 51,000 level. Today, the index tested this support and staged a sharp V-shaped recovery, led by gains in the index's heavyweight private banks. On the other hand, immediate resistance for the index is around the 52,000 level.

Open interest structure for the June 26 expiry shows the highest call accumulation at 53,000 and put accumulation at the 51,000 strike. In yesterday's session, the index witnessed significant put writing from 51,500 to 51,000, indicating the strength of the current trend.

FII-DII activity

Stock scanner

Long build-up: Astral, Jubilant FoodWorks, Cummins India, AU Small Finance Bank and Indian Hotels

Short build-up: Container Corporation of India, Steel Authority of India, IndusInd Bank and NMDC

Under F&O ban: Balrampur Chini Mills, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers, Granules India, Indus Towers, Piramal Enterprises, Punjab National Bank and Steel Authority of India

Out of F&O ban: Hindustan Aeronautics and Hindustan Copper

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story