Market News

Trade setup for 23 May: NIFTY50 eyes all-time high, can it break through?

.png)

4 min read | Updated on May 23, 2024, 08:17 IST

SUMMARY

Based on options data, traders are expecting the NIFTY50 to trade between 22,400 and 22,800. However, with the volatility index hovering near 21, traders should remain wary of sharp intraday swings.

After a positive start, the NIFTY50 consolidated its gains amid volatility and came within striking distance of 22,600.

Asian markets update 7 am

The GIFT NIFTY is trading lower (-0.1%) than yesterday’s close, suggesting a flat to negative start for the Indian equities today. Meanwhile, the Asian markets are trading mixed. Japan’s Nikkei 225 is up 0.5%, while Hong Kong’s Hang Seng index is down 1.5%.

U.S. market update

U.S. stocks retreated from record highs on Wednesday. Investors awaited results from AI bellwether Nvidia and digested hawkish Fed minutes that hinted at further rate hikes if inflation risks rise.

The Dow Jones Industrial Average slipped 0.5% to 39,671, while the S&P 500 fell 0.2% to 5,307.The tech-heavy Nasdaq Composite was down 0.1% at 16,801. The U.S. market is set to react to Nvidia's earnings today, which beat Street estimates and sent the stock soaring in the post-hours session.

NIFTY50

May Futures: 22,657 (▲0.2%)

Open Interest: 3,89,529 (▼1.2%)

After a positive start, the NIFTY50 consolidated its gains amid volatility and came within striking distance of 22,600. Extending its winning streak to four consecutive days, the index breached 22,600 on an intraday basis but failed to close above it.

As highlighted in yesterday's blog, the index formed a bullish engulfing pattern on the 21st, indicating strength and support based buying. On the 22nd, the index confirmed the bullish pattern and closed above the previous day's high.

For today's expiry, let's take a closer look at the key levels on the hourly chart. With the exception of a flat close on the 15th, the NIFTY50 has closed in positive territory for eight consecutive days. As you can see in the chart below, the index is now approaching the all-time high and the resistance zone of 22,650 and 22,750. Experts believe that the index may encounter resistance at these levels and see some profit taking. On the other hand, the index's immediate support lies between 22,300 and 22,400.

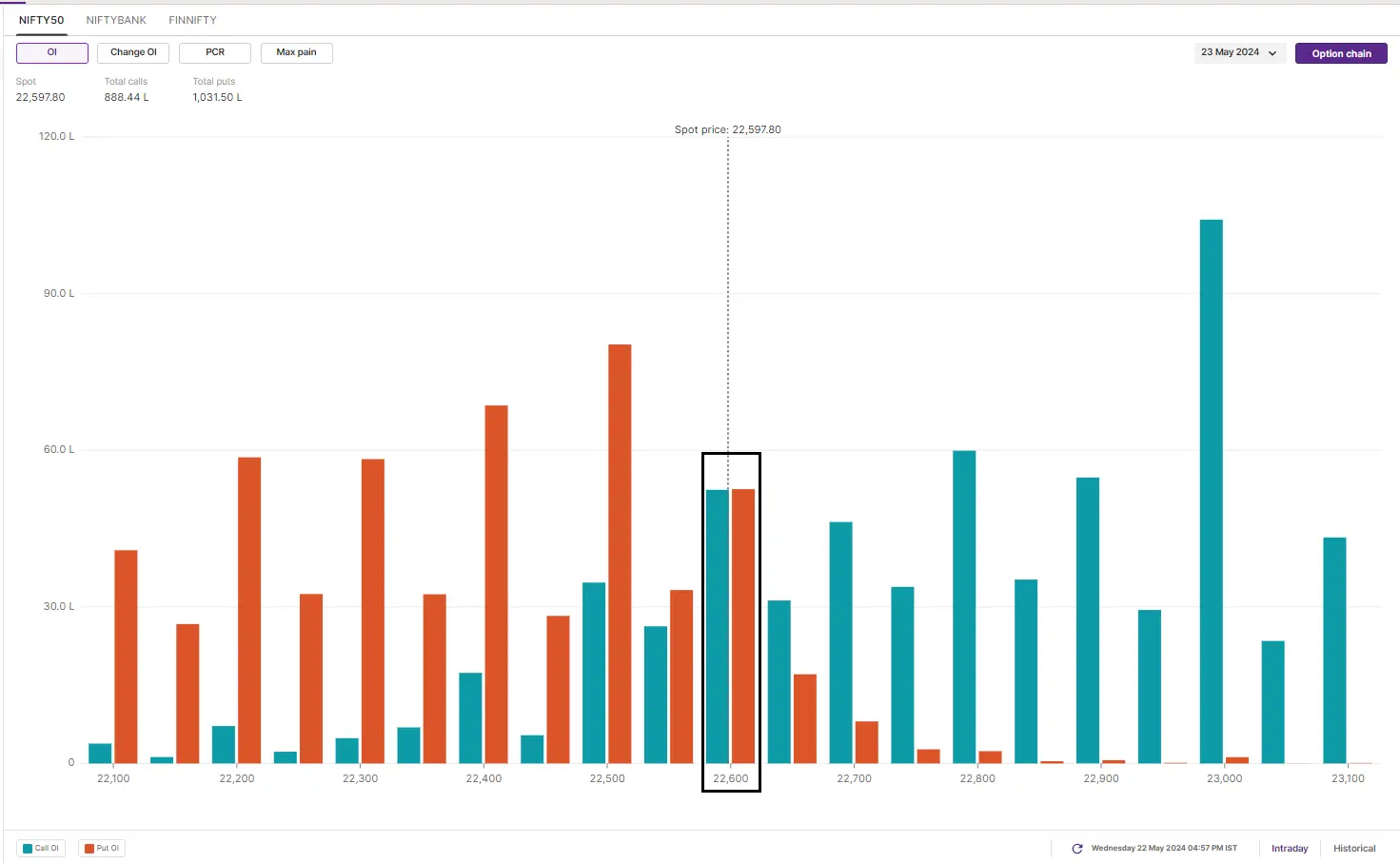

For today’s expiry, maximum call options open interest was seen on 23,000 strike, while the put base was accumulated on 22,500 strike. Moreover, significant call and put OI was also added on 22,600 strike, indicating that traders are expecting NIFTY50 to trade between 22,400 and 22,800.

BANK NIFTY

May Futures: 47,974 (▼0.1%)

Open Interest: 1,50,130 (▼6.0%)

The BANK NIFTY index swung wildly on expiry day, ending slightly below its key 50-day moving average (DMA). The index dipped below this level during the day, but a late rally recouped most of the losses. This seesaw session left the BANK NIFTY hovering near its 50 DMA at the close.

As discussed in our yesterday’s blog, the index is still broadly hovering between its 20 and 50 DMAs and witnessing sharp swings on intraday basis. Traders can track the range of both these key moving averages as the break above or below on closing basis will provide further directional clues.

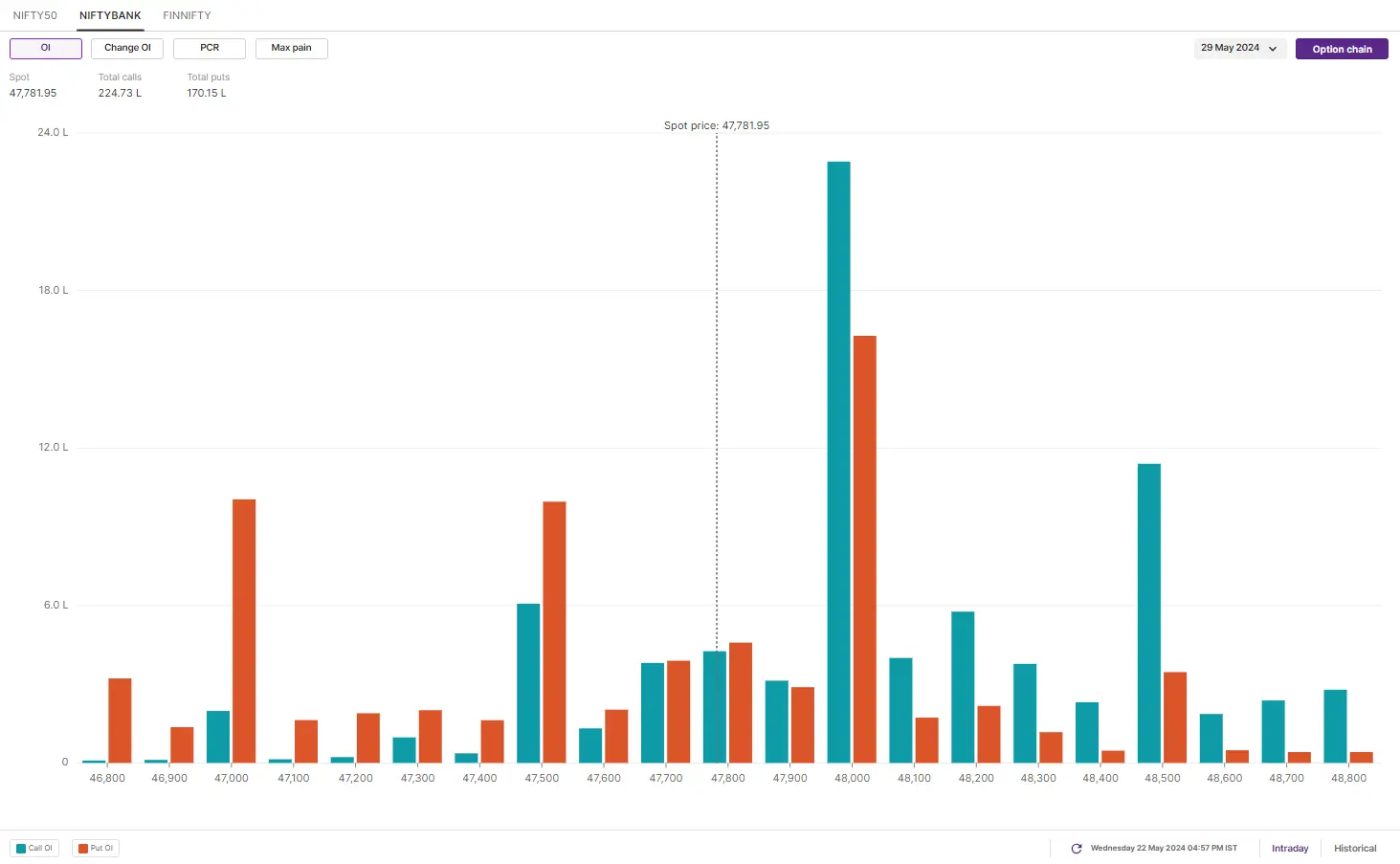

The initial open interest (OI) for the BANK NIFTY monthly expiry (29 May) of both call and put options is set at the 48,000 strike. Before initiating any strategies, traders may want to keep a close eye on the fresh OI positioning and monitor tomorrow's weekly close for further clues.

FII-DII activity

Stock scanner

Long build-up: Lupin, Metropolis and Page Industries

Short build-up: Hindustan Copper, Steel Authority of India and NMDC

Under F&O ban: AB Capital, Balrampur Chini, Bandhan Bank, Biocon, Hindustan Copper, Idea, IEX, India Cements, Metropolis, National Aluminium, Piramal Enterprises, Punjab National Bank and Zee Entertainment

Out of F&O ban: GMR Infra and Granules India

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story