Market News

Trade setup for 20 June: NIFTY50 faces volatile expiry with bearish engulfing pattern

.png)

4 min read | Updated on June 20, 2024, 08:29 IST

SUMMARY

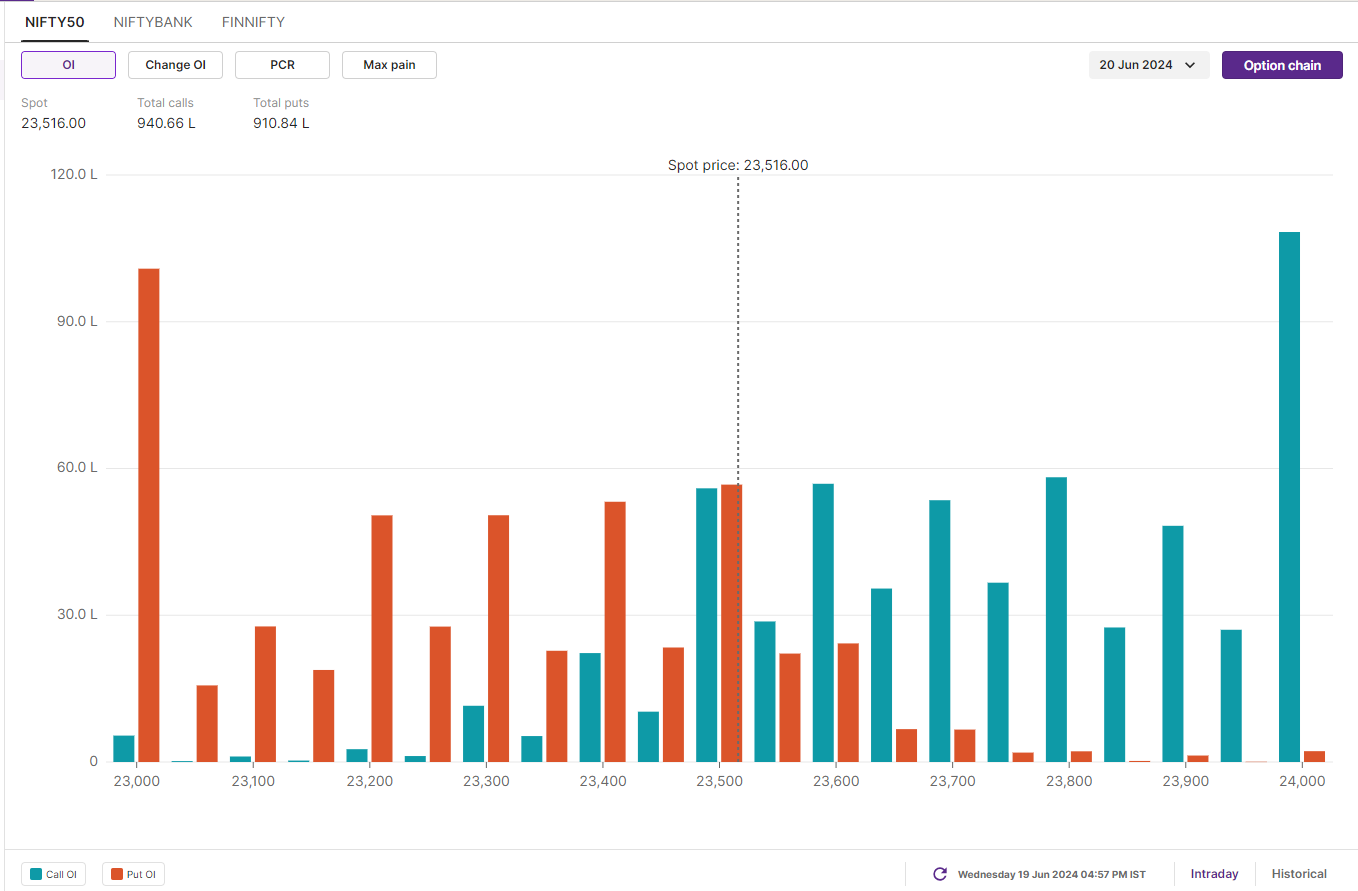

Based on options data, the NIFTY50 has a maximum call and put open interest at 23,500 strike. This indicates that market participants expect the NIFTY50 to trade between 23,300 and 23,800.

The GIFT NIFTY is trading flat, indicating a subdued start for Indian equities today.

Asian markets update 7 am

The GIFT NIFTY is trading flat, indicating a subdued start for Indian equities today. Meanwhile, other Asian markets are trading mixed. Japan's Nikkei 225 is down 0.7%, while Hong Kong's Hang Seng Index is up 0.3%.

U.S. market update

U.S. markets were closed on Wednesday in observance of Juneteenth.

NIFTY50

- June Futures: 23,503 (▼0.3%)

- Open Interest: 4,91,056 (▼0.2%)

The NIFTY50 index broke its five-day winning streak and closed Wednesday’s session below the previous session’s close. The index formed a negative candle on the daily chart, indicating profit-booking at higher levels after a positive start.

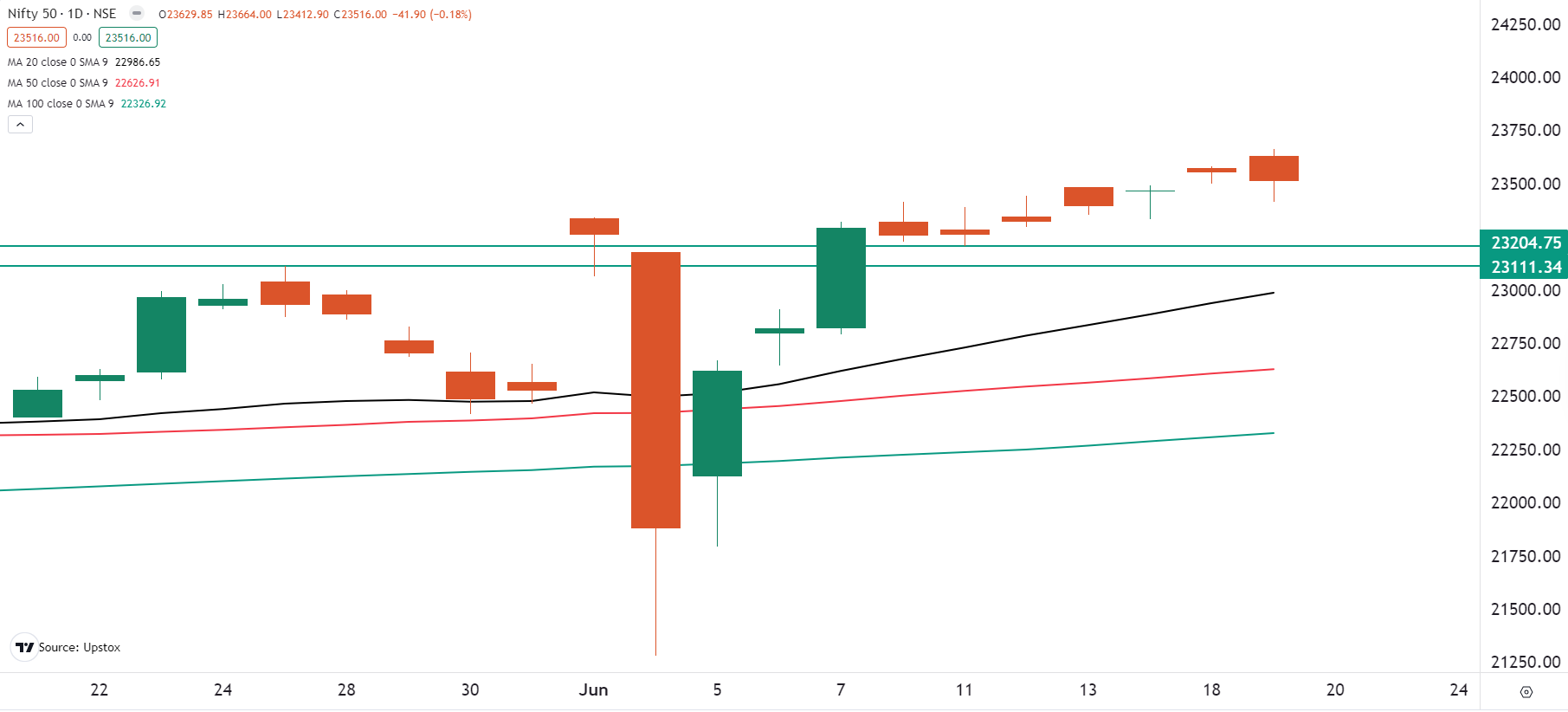

A bearish engulfing pattern has formed on the daily chart. This pattern is considered to be a bearish reversal pattern that forms after an uptrend. The pattern is confirmed when the next candle closes below the reversal pattern.

For today’s expiry, we have marked critical levels for our readers on a 15-minute time frame. As seen on the chart below, if the index slips below 23,400, we may see some weakness extending towards the 23,200 zone. It is important to note that the broader trend of the index on the daily chart remains positive as the index is trading above its crucial 20-day and 50-day moving averages (DMA). Positionally, minor weakness will only emerge if the index closes below its 20-DMA.

The open interest build-up for today's expiry has significant call and put additions at the 23,500 strike. This suggests range-bound activity between 23,300 and 23,700. However, traders should keep a close eye on the key levels mentioned above. A break of these levels on an intraday basis will provide directional clues.

BANK NIFTY

- June Futures: 51,353 (▲2.0%)

- Open Interest: 1,60,399 (▼2.1%)

The BANK NIFTY index zoomed past its previous all-time high and closed at the record high levels, led by strong gains in the the index heavyweight HDFC, ICICI and Axis Bank.

In yesterday’s trade setup blog, we highlighted two key levels on the 15-minute timeframe for our readers to watch for directional clues. The first level was 50,550 on the higher side, and the second was 50,250 on the lower side. On June 19, the index opened above the 50,550 mark and subsequently experienced a strong upward move.

On the daily chart, the index has formed a bullish candle with an upper shadow. As you can see on the chart below, the index now has immediate support between the 51,000 and 51,100 levels. On the other hand, the immediate hurdle would be at the 52,000 level, which came within striking distance yesterday. The index could see further bullishness if it reaches this level on a closing basis.

The initial open interest (OI) for the June monthly expiry of BANK NIFTY has significant OI at the 51,000 put strike, indicating support around this level. On the contrary, the maximum call OI is placed at 52,000 strike.

FII-DII activity

Stock scanner

Long build-up: Chambal Fertilisers, HDFC Bank, ICICI Bank, Coromandel International and Deepak Nitrite

Short build-up: Hindustan Aeronautics, Voltas, Titan, Container Corporation of India and Bharat Electronics

Under F&O ban: Balrampur Chini Mills, Chambal Fertilisers, Hindustan Aeronautics, Hindustan Copper, India Cements, Indus Towers, Piramal Enterprises, Steel Authority of India

Out of F&O ban: Gujarat Narmada Vly Fertilizers and Sun Tv

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story