Market News

Trade setup for Sept 18: BANK NIFTY sustains rally, will it hold 52,000 on expiry?

.png)

5 min read | Updated on September 18, 2024, 09:39 IST

SUMMARY

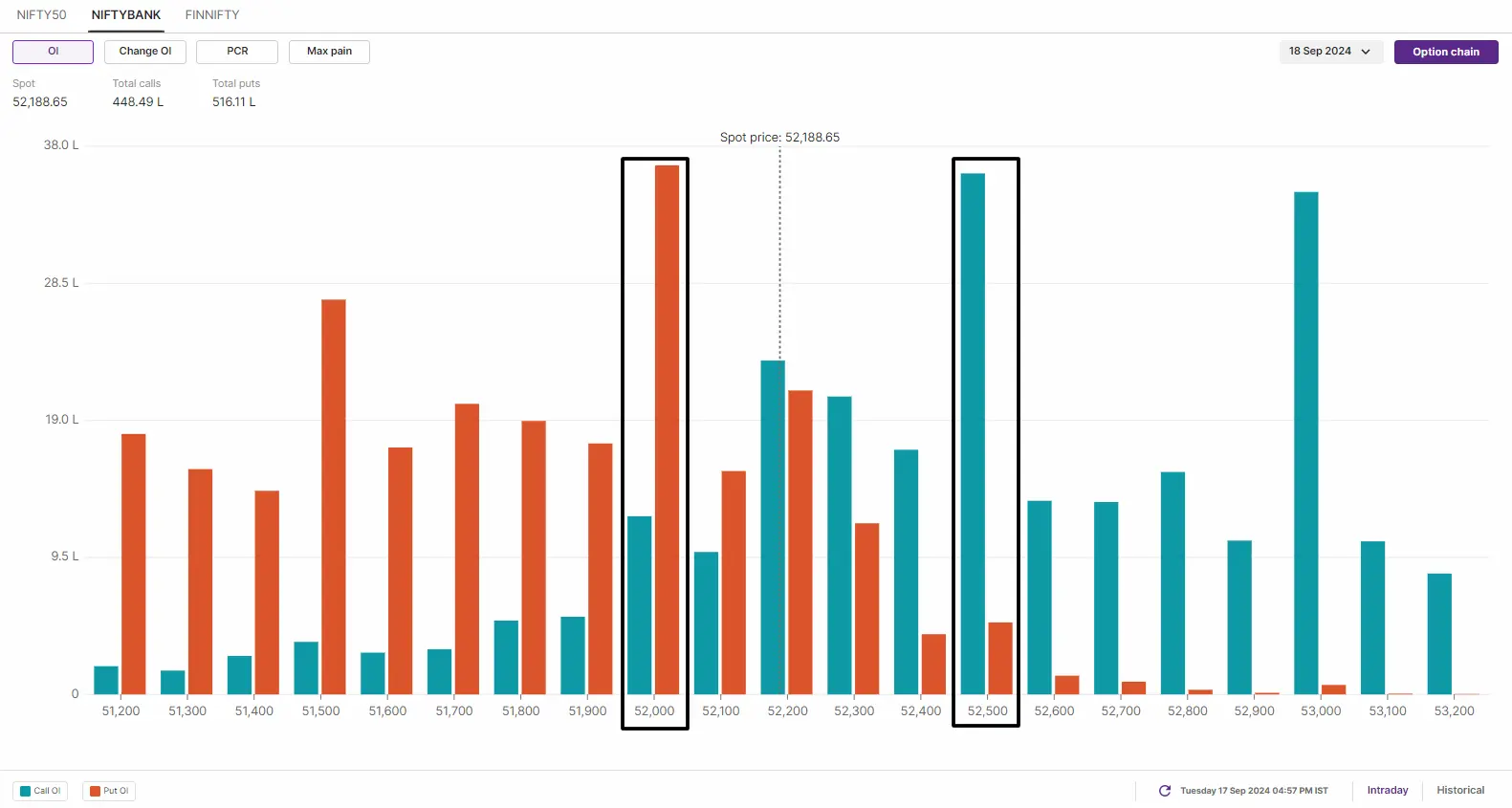

According to the options data, the significant build-up in call and put open interest occurred at the 52,200 strike. This suggests that traders are expecting the BANK NIFTY to expire between the 52,000 and 52,500 levels, around the 52,200 strike.

Stock list

NIFTY50 index formed a second consecutive doji on the daily chart, hinting at a pause and consolidation near all-time high

Asian markets update at 7 am

The GIFT NIFTY is flat, indicating a subdued start for the NIFTY50 today. Meanwhile, other Asian indices are trading in the green. Japan's Nikkei 225 is up 0.8%, while the markets in Hong Kong and South Korea are closed for the day.

US market update

- Dow Jones:41,606 (▼0.0%)

- S&P 500: 5,634 (▲0.0%)

- Nasdaq Composite: 17,628 (▲0.2%)

US indices ended Wednesday's volatile session flat, ahead of the Federal Reserve's expected interest rate cut to be announced later today. As of Tuesday, the Fed Funds Futures reflect a 65% probability of a 0.50% rate cut, up from 62% a day earlier. The odds of a 0.25% cut stand at 35%.

The two-day meeting of the US Federal Reserve, which started on Tuesday, is expected to deliver the first interest rate cut since early 2020. However, with uncertainty surrounding the size of the cut, market participants are keeping a close eye on how the first rate cut will be perceived by the market.

NIFTY50

- September Futures: 25,449 (▲0.0%)

- Open Interest: 5,48,417 (▼1.9%)

The NIFTY50 index sustained its upward momentum for the fourth day in a row and traded in a narrow range of 89 points. The index formed a second consecutive doji on the daily chart, hinting at a pause and consolidation near all-time high.

As shown in the chart below, the index is consolidating near its previous all-time high resistance from the 12th September. In addition, the formation of a second doji candle on the 16th - a neutral pattern within the range of the previous day's candle - creating an inside candle pattern.

In the upcoming sessions, the immediate support for the index lies in the 25,100 to 25,000 zone. As long as the index holds this zone on a closing basis, the bullish trend may continue. Positional traders should closely monitor the high and low of the inside candle. A close above this range would signal a continuation of the bullish momentum, while a close below may indicate potential weakness.

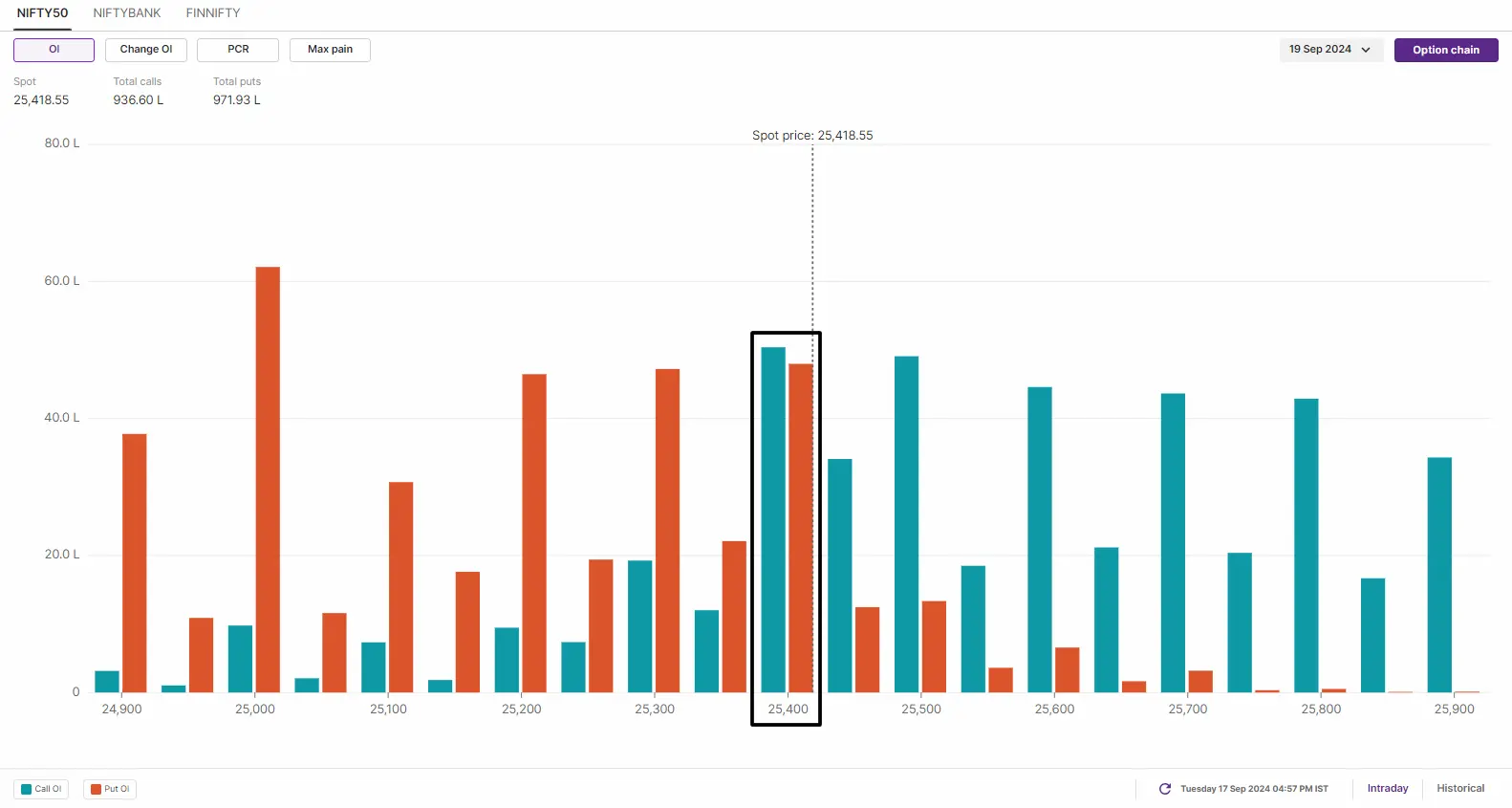

The open interest data for the 19 September expiry saw significant call and put build-up at 25,400 strike, indicating the traders are expecting range-bound movement around this strike. However, it is important to note that the NIFTY50 will react to the outcome of the U.S. Fed’s interest rate decision on expiry day. Traders should closely monitor the change in open interest at the close and plan strategies accordingly.

BANK NIFTY

- September Futures: 52,295 (▲0.0%)

- Open Interest: 1,34,885 (▼3.6%)

The BANK NIFTY extended its winning streak for the fourth consecutive day, ending the day flat. The index also formed a doji candlestick pattern on the daily chart, indicating a pause near the key resistance level of 52,300.

The technical structure of the BANK NIFTY remains positive on both the daily and 15 minute charts. As you can see on the 15 minute chart below, the index has immediate support around the 52,000 level, while it faced resistance around the 52,300 zone and failed to capture it on a closing basis.

For today's expiry, traders can monitor this zone for range-bound strategies. However, if the index breaches this zone with a strong intraday candle, it may provide directional clues.

Meanwhile, the open interest for today’s expiry has highest call base at 52,500 strike and put base at 51,000 strike. This indicates traders are anticipating expiry within this range. Additionally, significant call and put options build-up was seen at 52,200 strike.

FII-DII activity

Stock scanner

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

About The Author

Next Story