Market News

Trade setup for 17 May: NIFTY50 rejecting bearish engulfing on weekly chart?

.png)

4 min read | Updated on May 17, 2024, 08:57 IST

SUMMARY

Both the weekly candles on the NIFTY50 and BANK NIFTY suggest a possible reversal of last week's bearish engulfing pattern. However, it's important to watch today's price action for confirmation before making any trading decisions.

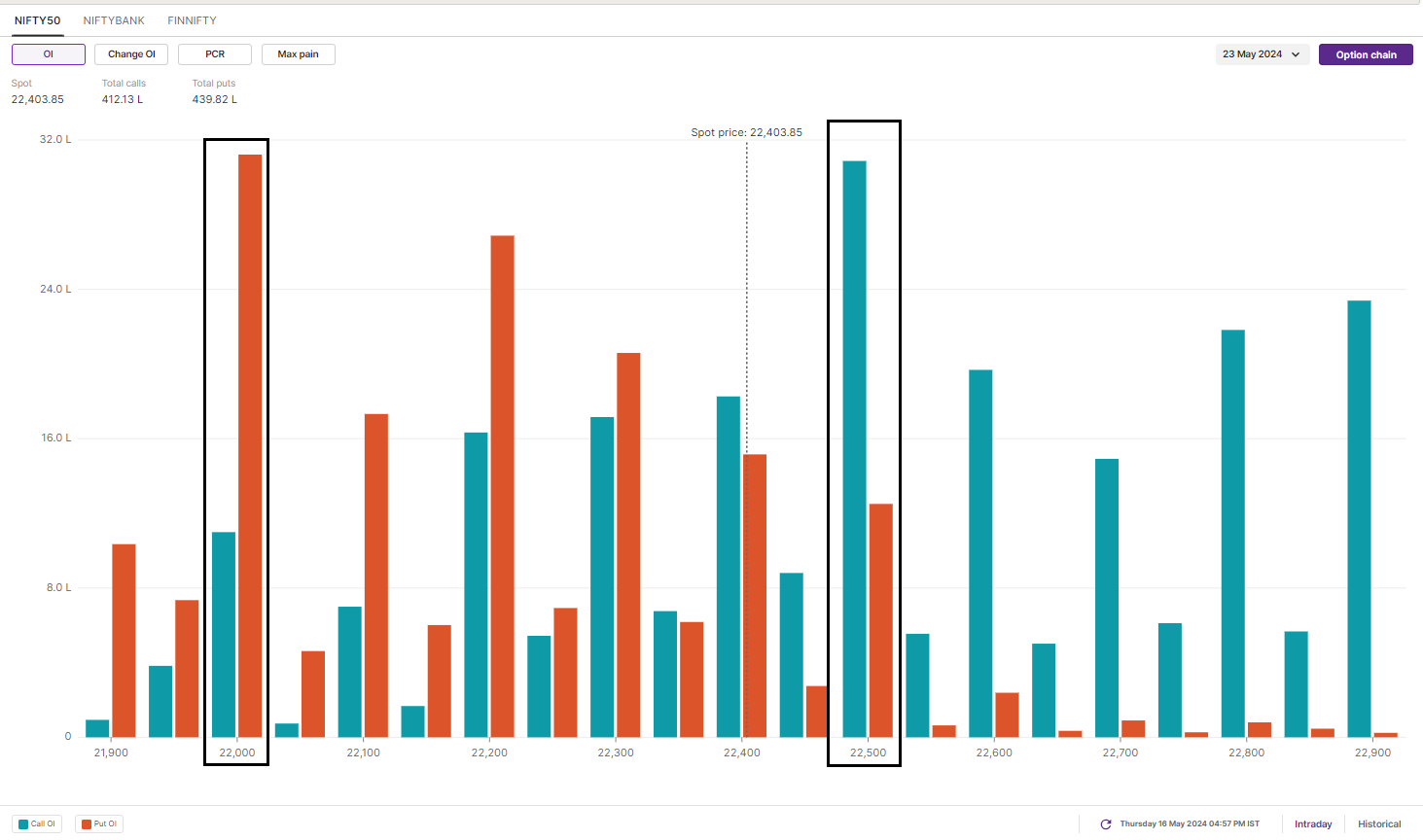

Early options data for the 23 May expiry shows significant call open interest at the 22,500 strike and put OI at the 22,000 strike.

Asian markets update 7 am

The GIFT NIFTY is trading flat, indicating a muted start for the Indian equities today. Meanwhile, Asian markets are trading in the mixed. Japan’s Nikkei 225 is down 0.5%, while Hong Kong’s Hang Seng index was up 0.9%

U.S. market update

U.S. markets hit record highs but failed to hold on to the gains at the close. Indices pared early gains after three Federal Reserve officials warned of higher interest rates for longer in separate speeches. The Dow Jones after briefly touching the 40,000 mark slipped 0.1% to close at 39,869, while the S&P 500 slipped 0.2% to 5,297. The Nasdaq Composite fell 0.2% to 16,698.

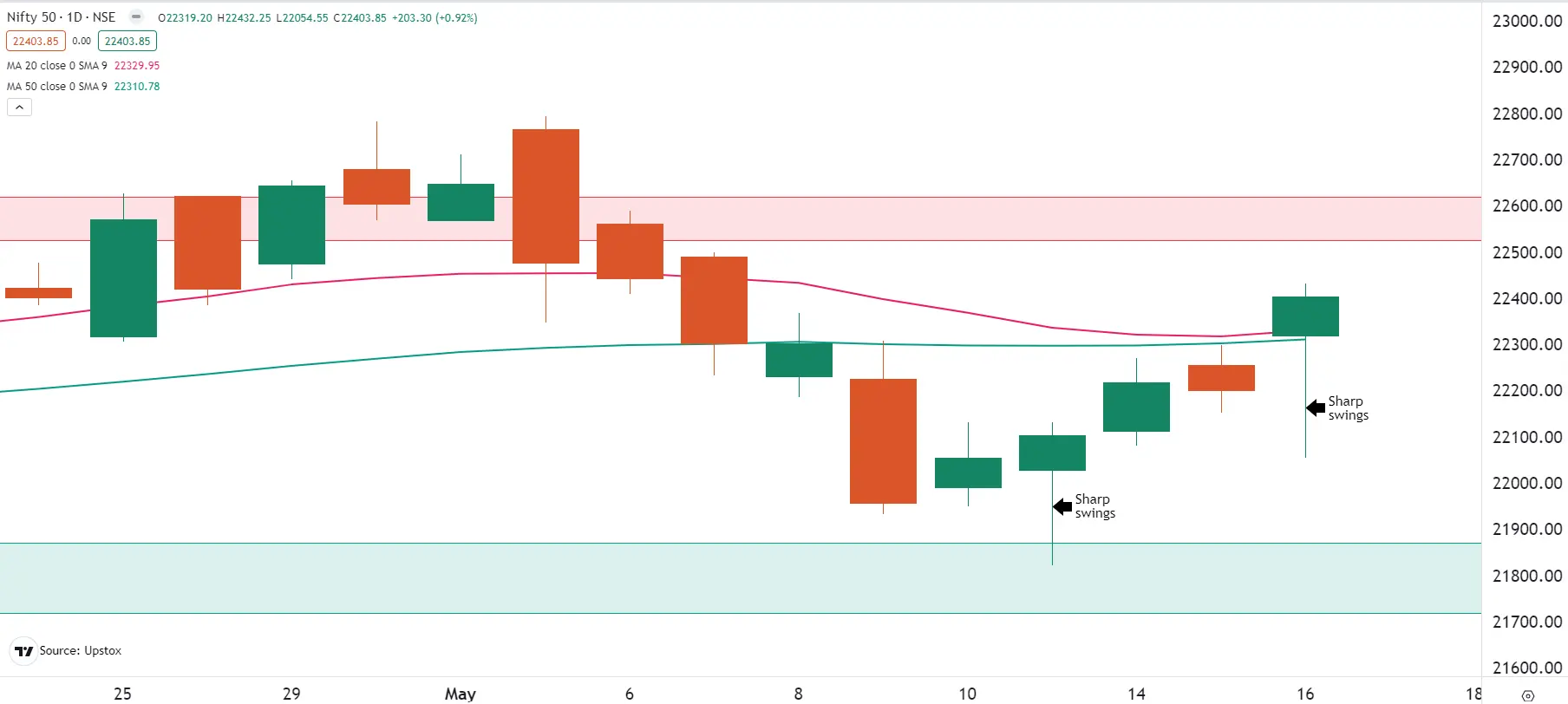

NIFTY50

May Futures: 22,452 (▲0.8%)

Open Interest: 4,04,766 (▼2.6%)

After a positive start, the NIFTY50 failed to hold on to its opening gains and slipped close to the 22,000 level. However, in the last hour of the session, the index bounced back from the day's low, gaining almost 1.7% from the day's low to close above the 22,400 level.

On the weekly options expiry, the NIFTY50 breached resistance at 22,300 and 22,350, which also coincided with its 20 and 50 day moving averages (DMAs). The index also formed a bullish hammer on the daily chart, indicating strength. Traders may want to keep an eye on today's close for further gains. A close above or below the hammer will provide traders with further directional clues.

Early options data for the 23 May expiry shows significant call open interest (OI) at the 22,500 strike and put OI at the 22,000 strike. Traders may want to keep a close eye on the 22,500 call strike for any unwinding or addition of OI at the strike.

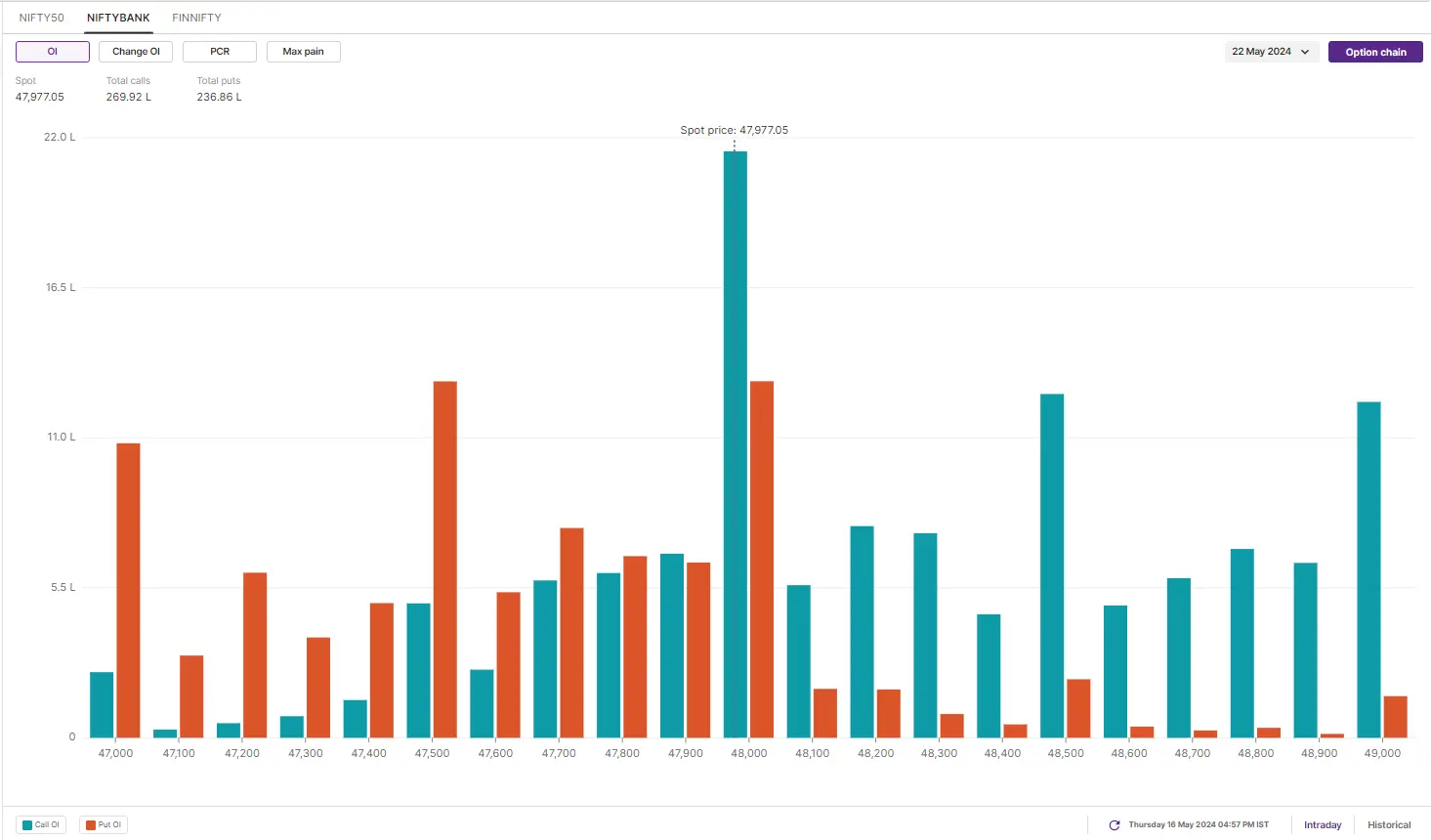

BANK NIFTY

May Futures: 48,092 (▲0.4%)

Open Interest: 1,59,974 (▼2.0%)

The BANK NIFTY also started the day on a positive note but was unable to hold on to its gains. In a volatile session, the index traded below the 47,500 level for most of the session, maintaining its weakness. However, similar to the NIFTY50, the BANK NIFTY experienced strong buying momentum in the last hour of the session and closed just shy of the 48,000 level.

On the daily chart, the index regained its 50-day moving average (DMA), but closed below the immediate resistance zone of 48,000 and 48,200, which coincides with the 20 DMA. Going forward, a close above this zone will indicate further strength. Meanwhile, support lies between the 47,300 and 47,500 zone.

The open interest data for the 22 May expiry shows significant call OI at the 48,000 strike, while the put base is spread between the 48,000 and 47,500 strikes.Before initiating any strategies, traders can monitor the fresh OI build-up in line with the index's weekly close.

FII-DII activity

Stock scanner

Long build-up: Hindustan Aeronautics, Mahindra and Mahindra, Oberoi Realty, Balkrishna Industries and Exide Industries

Short build-up: Bandhan Bank and Canara Bank

Under F&O ban: Balrampur Chini, Bandhan Bank, Biocon, Birlasoft, GMR Infra, Granules India, Hindustan Copper, Idea, India Cements, Piramal Enterprises, Steel Authority of India (SAIL) and Zee Entertainment

Out of F&O ban: LIC Housing Finance

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story