Market News

Trade setup for 12 June: BANK NIFTY expiry, key levels to plan your trade

.png)

4 min read | Updated on June 12, 2024, 07:56 IST

SUMMARY

The BANK NIFTY has been range-bound since Monday. The index has immediate support at 49,000 and resistance at 50,200. Traders can watch for a break of these levels for directional clues.

Foreign Institutional Investors snapped their two-day buying spree and turned net sellers on Tuesday.

Asian markets update 7 am

The GIFT NIFTY is trading lower, signalling a subdued start for Indian equities today. Markets in Asia are also trading in the red. Japan's Nikkei 225 is down 0.8%, while Hong Kong's Hang Seng Index is down 1%.

U.S. market update

- Dow Jones: 38,747 (▼0.3%)

- S&P 500: 5,375 (▲0.2%)

- Nasdaq Composite: 17,343(▲0.8%)

U.S. stocks ended Tuesday's session on a mixed note, with the S&P500 hitting a fresh all-time high. Gains were led by index heavyweight Apple as the iPhone maker soared over 7%. Meanwhile, the U.S. Federal Reserve began its monetary policy meeting. The meeting will conclude today and will be followed by a press conference by Chairman Jerome Powell.

NIFTY50

- June Futures: 23,309 (▲0.2%)

- Open Interest: 4,90,965 (▲0.1%)

The NIFTY50 extended its range-bound trading for the second consecutive day, consolidating gains around the 23,200 level. The index traded in a tight range ahead of the Federal Reserve meeting and U.S. inflation data due later in the evening.

On the daily chart, the index has formed a doji candle, highlighting investors' indecision. However, it is important to note that the index is trading above all of its major daily moving averages (20 and 50). Since Monday, the index has made two attempts to break above the previous week's high and faced rejection. Traders may want to keep an eye on these levels for further clues in the coming sessions.

In addition, the 15-minute chart shows the index range-trading within a nearly 200-point band. A break above or below this area on a closing basis will give traders further clues.

Traders' open interest (OI) positioning for the 13 June expiry highlights range-bound activity. The index has significant call OI at 23,500 and put OI at 23,000. A break of these levels will provide further clues for the coming sessions.

BANK NIFTY

- June Futures: 49,768 (▲0.0%)

- Open Interest: 1,66,083 (▲0.7%)

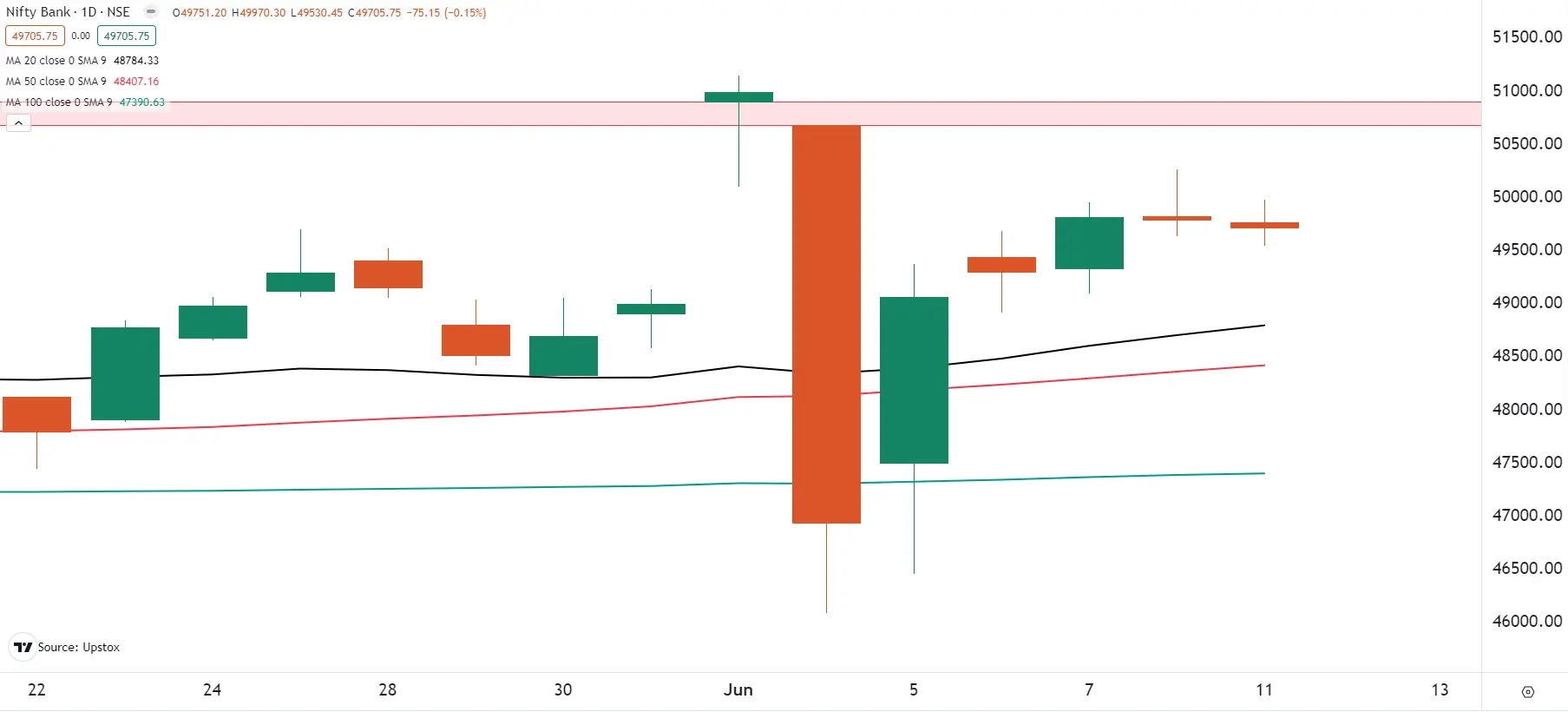

The BANK NIFTY also traded in a narrow range and closed the Tuesday’s session flat . Since Monday, the index has been consolidating in a range of nearly 700 points and protecting its gains at higher levels.

On the daily chart, the index closed below the doji candle formed on 10 June, indicating selling pressure at higher levels. However, it is important to note that BANK NIFTY is also trading above all its key daily moving averages and has crucial support around the 48,000 mark.

For today's expiry, the chart on the 15 minute timeframe shows range trading with a slight negative bias. As you can see in the chart below, the index has found support around the 49,500 zone on 3 occasions. A close below this zone could see the index fall towards 49,000. On the other hand, a break of 50,000 on the upside could take the index to immediate resistance of 50,250.

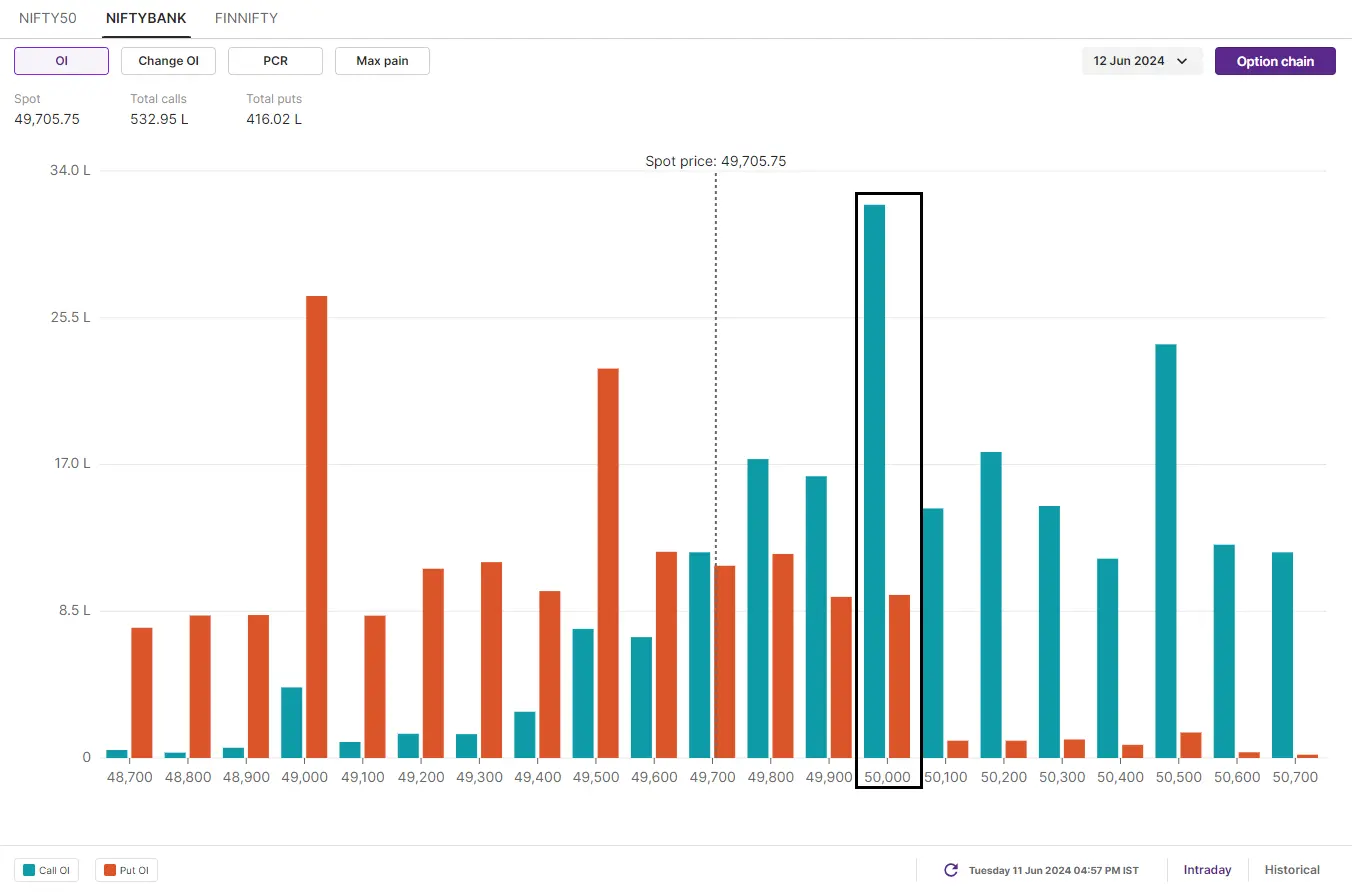

The open-interest data of today’s expiry has a significant call base at 50,000 and 50,500 strikes. The put OI was accumulated at 49,000 and 49,500 strikes. This broadly indicates rangebound positioning.

FII-DII activity

Stock scanner

Long build-up: GMR Airports Infrastructure, Indian Energy Exchange, ONGC, Petronet LNG and Sun Tv

Short build-up: Interglobe Aviation (Indigo) and Hindustan Copper

Under F&O ban: Balrampur Chini Mills, GMR Airports Infrastructure, Hindustan Copper, India Cements, Steel Authority of India and Zee Entertainment

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story