Market News

Trade setup for 10 June: NIFTY50 closes at record high, 23,000 immediate support

.png)

4 min read | Updated on June 10, 2024, 08:19 IST

SUMMARY

The NIFTY50 capped off a phenomenal week by closing at a record high level. After rebounding a staggering over 9% from the previous week's low, the index displayed strong bullish momentum. Experts remain optimistic about the broader trend, but caution that profit-taking at these elevated levels.

The NIFTY50 extended gains for the third day in a row, recouping all of its losses from the day of the election results

Asian markets update 7 am

The GIFT NIFTY is trading lower (-0.1%), indicating a flat to negative start for Indian equities today. Meanwhile, apart from Japan's Nikkei 225 (+0.5%), all the other Asian markets such as Hong Kong, China and Australia are closed for the holiday.

U.S. market update

- Dow Jones: 38,799 (▼0.2%)

- S&P 500: 5,346 (▼0.1%)

- Nasdaq Composite: 17,133 (▼0.2%)

U.S. stocks ended Friday's session flat to negative despite a stronger than expected May jobs report. Norfarm payrolls for May rose to 2,72,000 against an estimate of 1,90,000. This comes ahead of the release of U.S. inflation data and the Federal Reserve meeting in the week ahead.

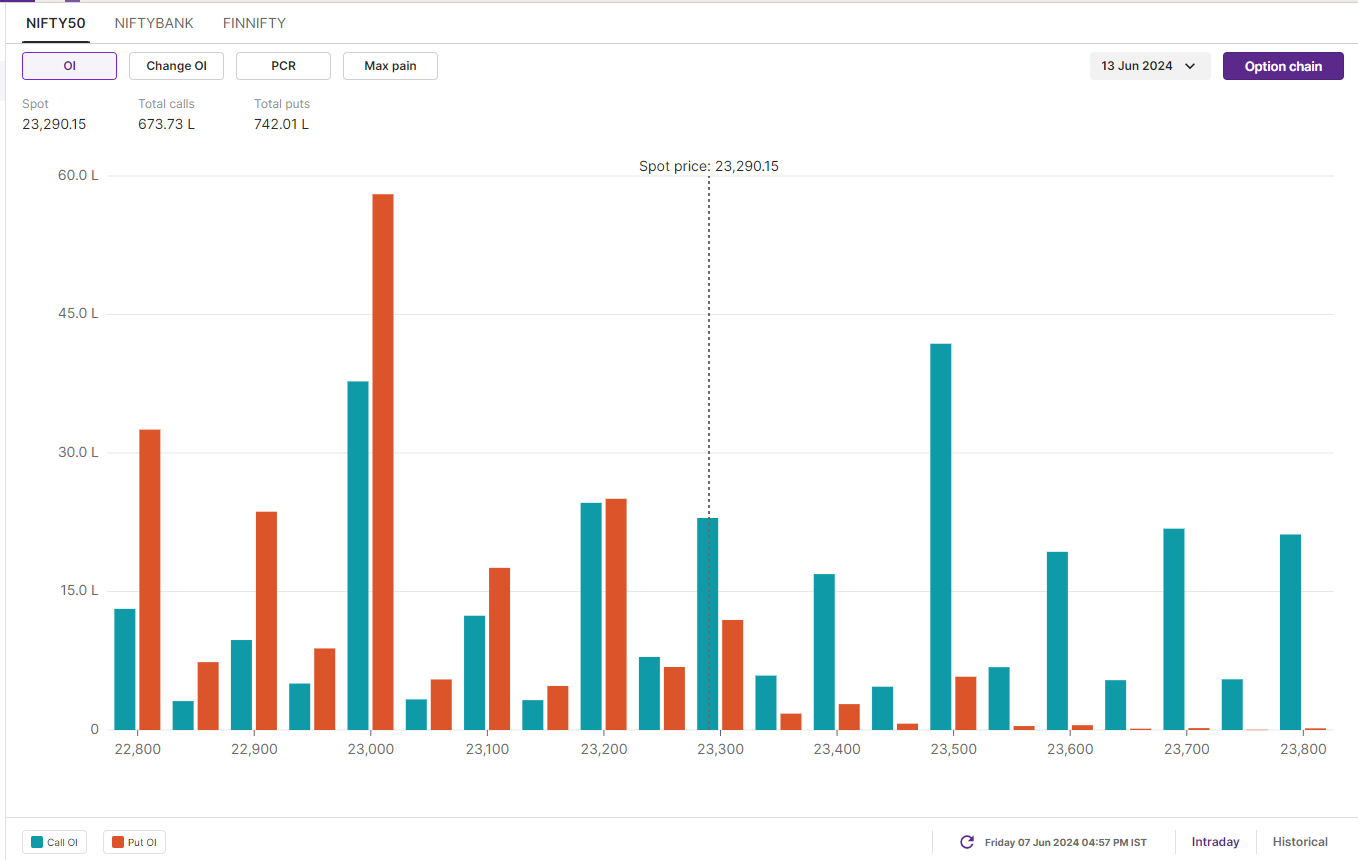

NIFTY50

- June Futures: 23,325 (▲1.9%)

- Open Interest: 5,24,513 (▼2.5%)

The NIFTY50 extended gains for the third day in a row, recouping all of its losses from the day of the election results, led by buying across all sectors. The index closed above the previous day's high and ended the day at record high levels.

In our previous blog we highlighted the formation of the inside candle on the 5 June and the directional movement based on the break of the high or low. A close above the high has taken the index back above the 23,000 level. Furthermore, the index has also filled the gap on the daily chart that was formed on the 4 June.

For this week, the structure of the index remains positive, with immediate support at the 20-day moving average (around 22,600). On the other hand, resistance is at 23,500, the strike with the significant call open interest for the 13 June expiry.

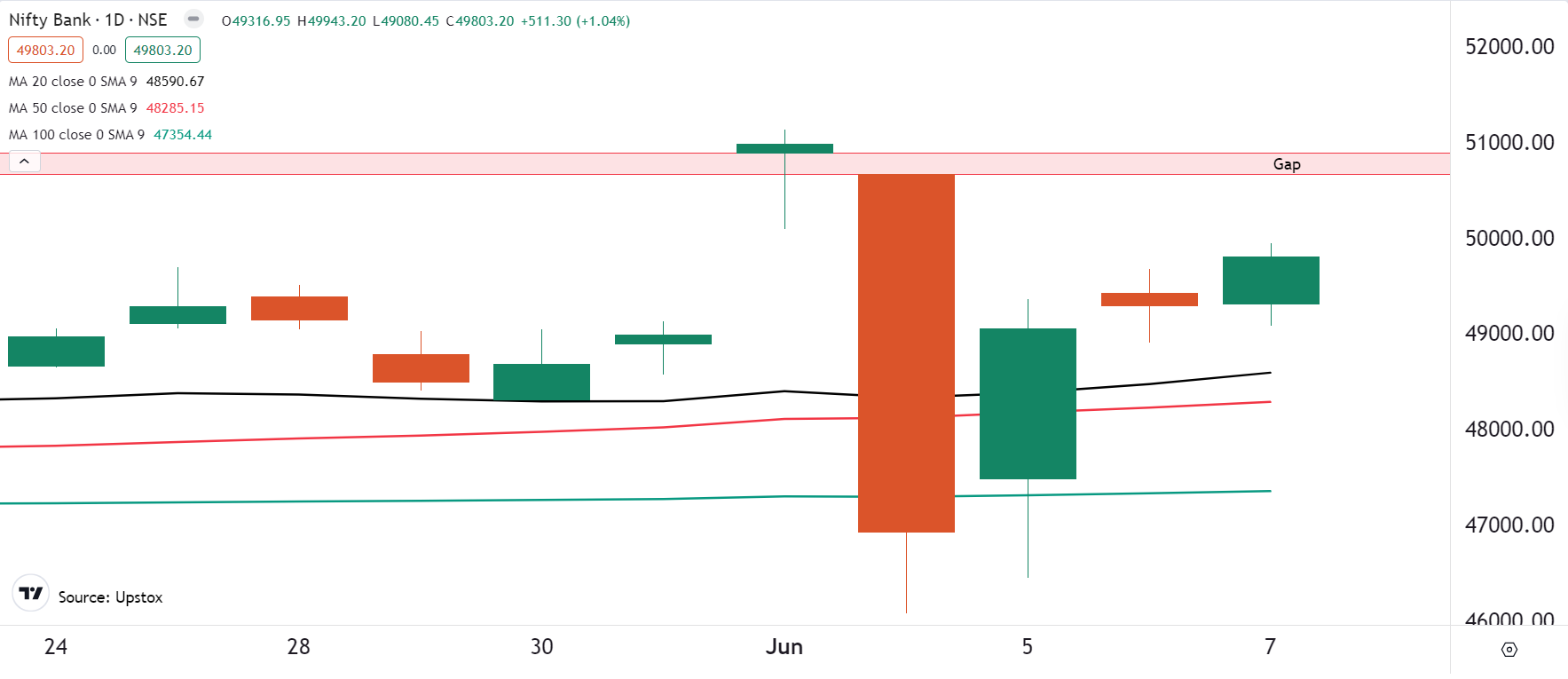

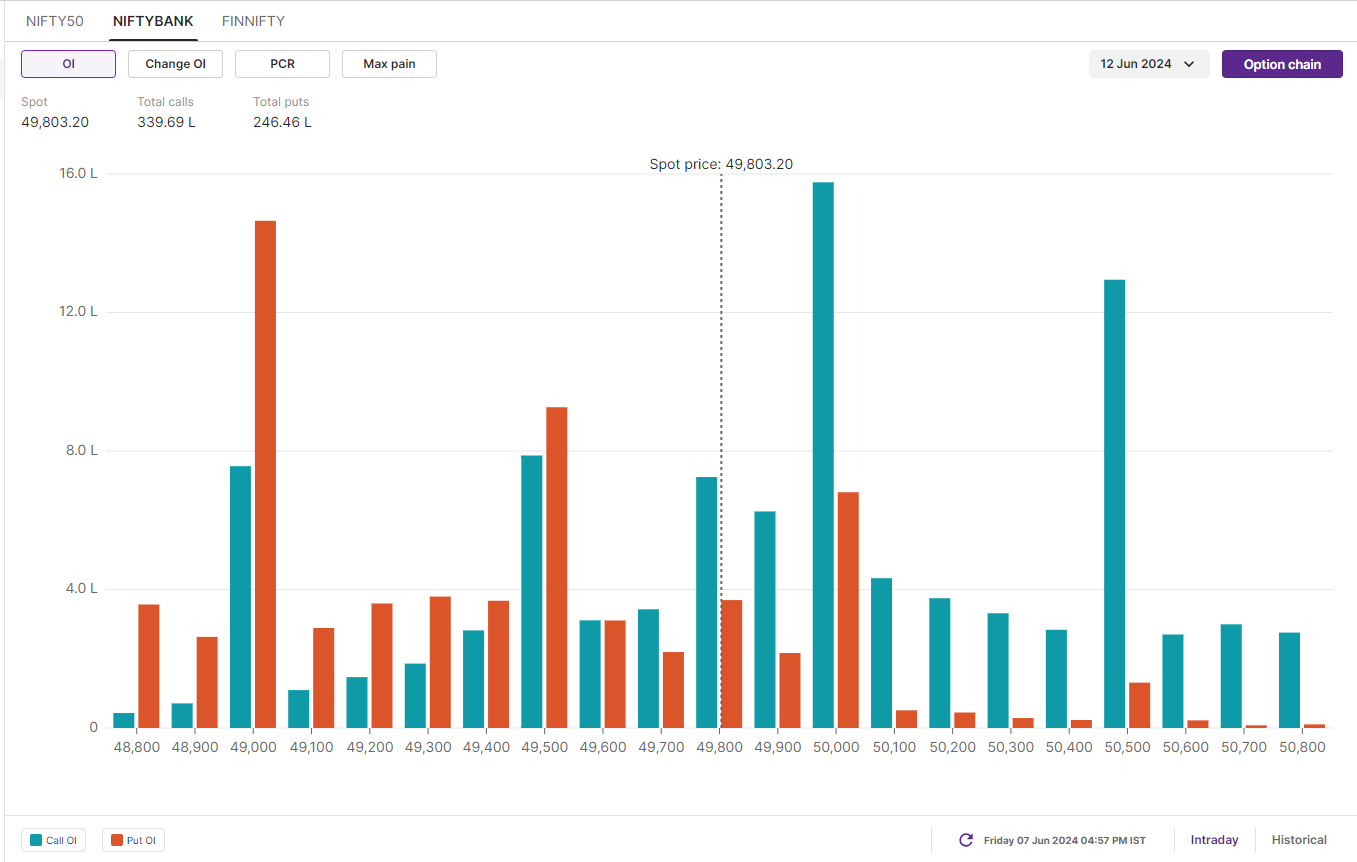

BANK NIFTY

- June Futures: 49,908 (▲1.0%)

- Open Interest: 1,76,726 (▲0.3%)

After a flat start, the BANK NIFTY index moved higher and consolidated its gains on Friday, led by gains in overall banking pack. The index closed above the high of the previous day’s candle, which was a neutral candlestick pattern.

Similar to the NIFTY50, the banking index also formed a inside candle on the daily chart on 5 June and after a day’s pause the index has closed above the inside candle, indicating strength in the index. For the coming week, the index has immediate support at its 20-DMA (around 48,500) and the resistance is around the 51,000-mark.

The open interest (OI) data for the 12 June expiry has maximum call open interest at 50,000 and 51,000 strikes. This indicates some resistance for the index around these levels. On the other hand, the significant put OI was seen at 49,000 and 48,000 strikes, suggesting supporting around these levels.

FII-DII activity

Stock scanner

Long build-up: Vodafone-Idea, Ramco Cements, L&T Finance, Steel Authority of India and Balrampur Chini.

Short build-up: Metropolis

Under F&O ban: Zee-Entertainment, Steel Authority of India and Balrampur Chini

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story