Market News

Trade Setup for Oct 1: BANK NIFTY confirms bearish engulfing pattern, all eyes on 20 DMA

.png)

4 min read | Updated on October 01, 2024, 09:29 IST

SUMMARY

As highlighted in our blog of 30 September, the BANK NIFTY index confirmed the bearish engulfing candlestick pattern and ended Monday's session below the low of the reversal pattern. This points to weakness and the index may extend the fall to its 20-day moving average, which is around 52,500.

NIFTY & SENSEX witness strong selling pressure by FII's on Monday

Asian markets update

The GIFT NIFTY is trading flat, indicating a subdued start for the Indian equities today. Meanwhile, the Asian markets are trading firmly in green. Japan’s Nikkei 225 is up nearly 2%, while the Hong Kong’s Hang Seng index is up over 2%.

U.S. market update

Dow Jones: 42,330 (▲0.0%) S&P 500: 5,762 (▲0.4%) Nasdaq Composite: 18,189 (▲0.3%)

U.S. stocks ended the Monday’s session on a positive note with Dow Jones and S&P 500 ending the day at record high closing. This comes after the U.S. Fed Chair Jerome Powell in his speech said that the central bank is not in a hurry to cut rates quickly. The Fed chair said that if the economy performs as expected, that would mean two more rate cuts this year, a total of 50 basis points.

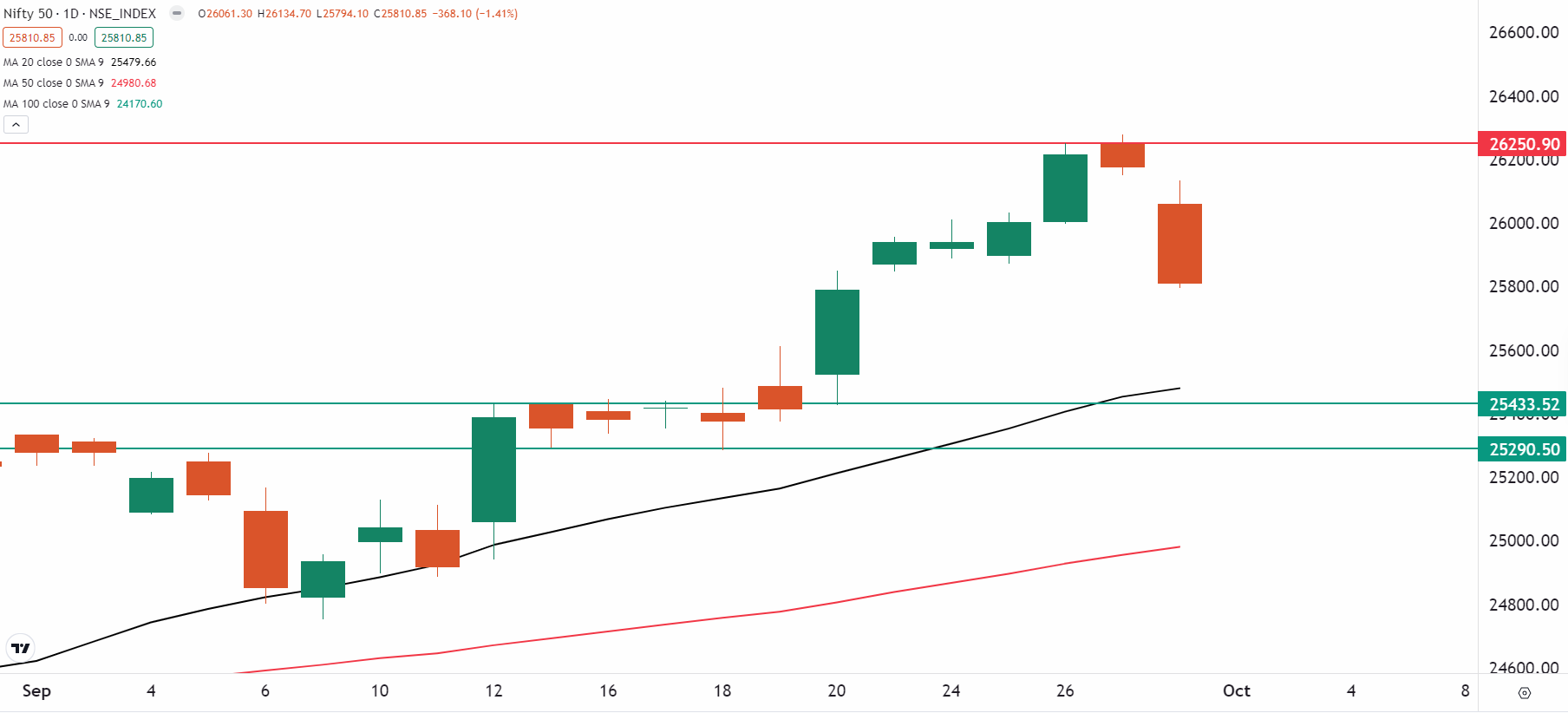

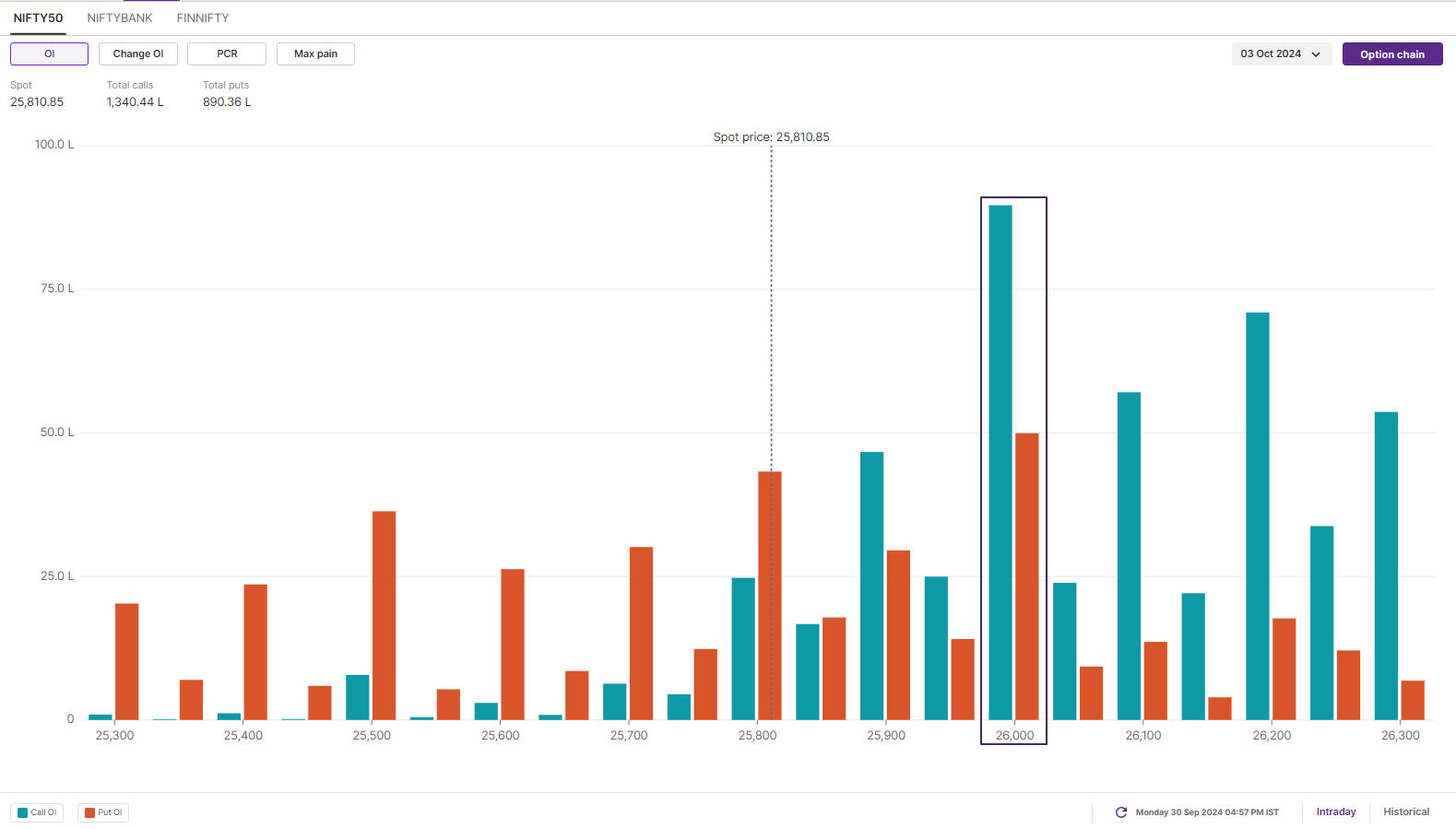

NIFTY50

October Futures: 25,990 (▼1.3%) Open Interest: 5,96,095 (▼8.4%)

The NIFTY50 index started Monday’s session on a negative note and fell over 350 points, forming a large bearish candle on the daily chart. The index slipped below the crucial support of 26,000, without meaningful intraday retractements and ended the session near the day’s low.

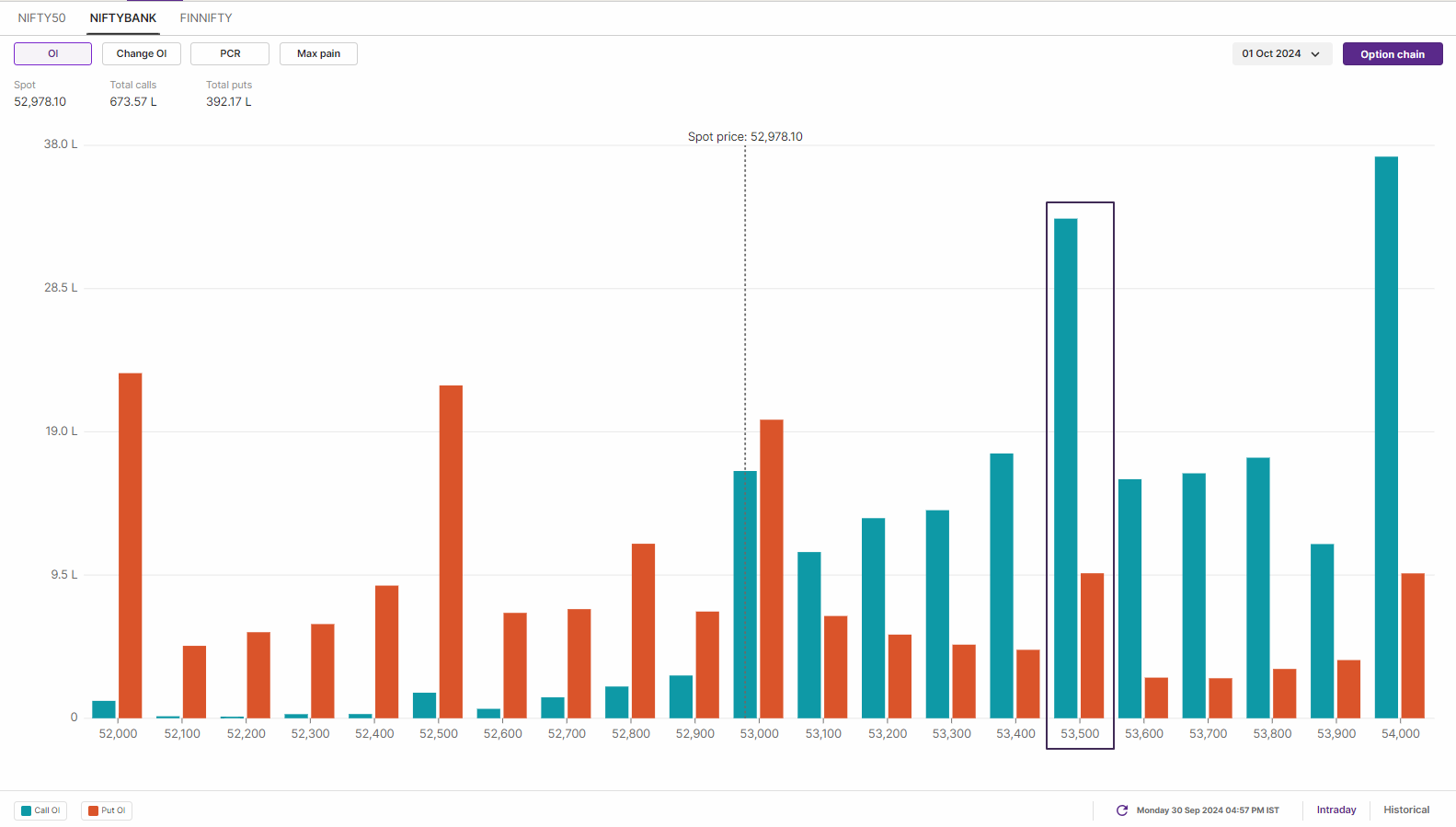

BANK NIFTY

October Futures:53,435 (▼1.4%) Open Interest: 1,19,186 (▼2.3%)

The BANK NIFTY index fell over 1.5% on Monday and witnessed the selling pressure for the second day in a row, confirming the bearish engulfing pattern formed on 27 September. It is a two-candle formation where a smaller bullish candle is followed by a larger bearish candle, completely erasing the previous day's gains, indicating weakness.

In our yesterday’s blog, we highlighted to our readers about the formation of the bearish engulfing pattern on BANK NIFTY, pending confirmation. The index confirmed the bearish pattern and ended the Monday’s session below the low of the reversal pattern, indicating weakness.

FII-DII activity

Stock scanner

Long build-up: Nil

Short build-up: Reliance Industries, Indian Hotels, Hero Motocorp, TVS Motor and Trent

Under F&O ban: Balrampur Chini Mills, Bandhan Bank, Hindustan Copper and RBL Bank

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story