Market News

Stock Market Weekly Recap: SENSEX, NIFTY tumble 5% to log biggest weekly fall in 2 years

.png)

4 min read | Updated on December 20, 2024, 21:18 IST

SUMMARY

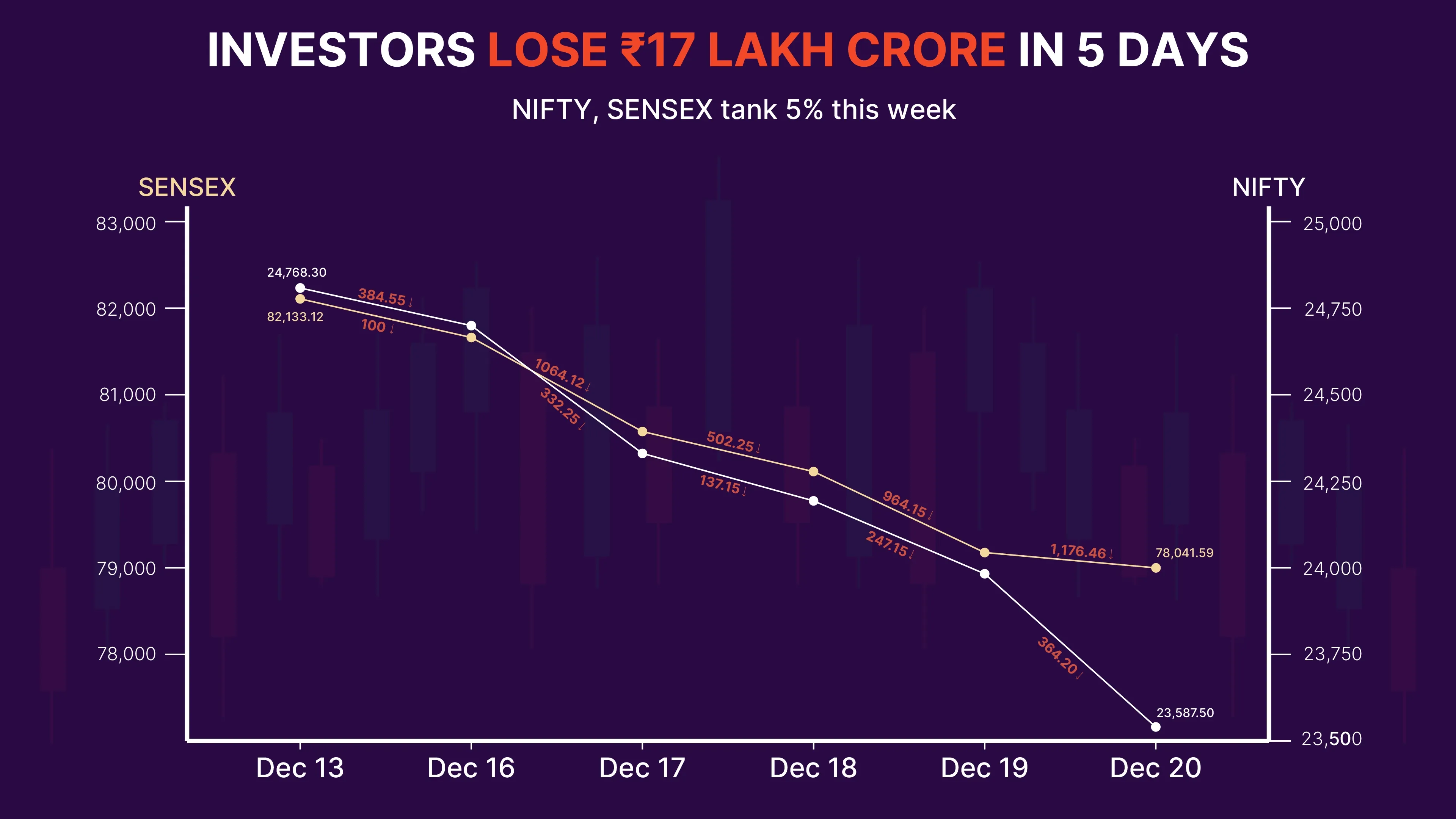

The SENSEX declined 4,091 points, or 4.98%, to 78,041.59 during the week ending December 20. Meanwhile, the NIFTY50 index was down 4.8%, or 1,181 points, to trade at 23,587.5 during the same period.

Stock list

- The NIFTY IT index, which touched a lifetime high last week, declined 4.8% in five sessions.

- The BSE-listed companies lost nearly ₹17 lakh crore in market cap this week.

- NIFTY Pharma index jumped 1.6% this week.

We are back with another quick recap of the markets this week, marked by a bloodbath on Dalal Street.

After witnessing four consecutive weeks of rallies, the equity markets got a rude shock this week. Five straight sessions of losses from December 16 to December 20 wiped out nearly ₹17 lakh crore of investors’ money this week.

Looking at the weekly charts felt like looking at the SENSEX and NIFTY tumbling down the hill. The benchmark indices dropped day after day, sliding 5% to log the biggest weekly decline in two years.

The SENSEX declined 4,091 points, or 4.98%, to 78,041.59 during the week ending December 20. Meanwhile, the NIFTY 50 index was down 4.8%, or 1,181 points, to trade at 23,587.5 during the same period.

The correction in the first half of the week can be attributed to cautious trading by jittery investors as they stayed on the edge ahead of the US Federal Reserve’s decision on policy rates. While the market had factored in a 25-basis-point cut from the US Fed, the fears of hawkish signals made the investors cautious.

And that is exactly what happened on Wednesday when the Federal Reserve lowered the rates on expected lines, but indicated that there might be just two more rate cuts in 2025 and not four as was expected earlier.

This triggered a fresh round of selloff that saw equities across the world taking a hit. The SENSEX and the NIFTY got caught in the whirlwind and fell 2.7% and 2.5%, respectively, in the following two sessions after the Fed policy outcome.

The Bank of Japan and People’s Bank of China, too, left benchmark lending rates unchanged as expected, offering no positive surprises.

IT stocks

Information technology (IT) stocks became the biggest victim of this week’s correction. The NIFTY IT index, which was in the news last week for hitting its lifetime high, declined in four of the five sessions and was down 4.8% cumulatively during this period.

Surprisingly, IT stocks declined even as the Indian rupee hit its lifetime low of 85.07 per US dollar, which is a big positive for tech companies that earn in the US currency.

Experts believed that investors in tech stocks were pessimistic about the prospects of higher-than-expected interest rates in the US next year. This could slow economic growth and curb discretionary IT spending by US businesses.

Pharma stocks

Amid the market mayhem, the pharma sector withstood the negative momentum this week. The NIFTY Pharma index jumped 1.6% this week as a weakening rupee was good news for Indian drug makers that sell their products in the US market.

MobiKwik shares doubled within three days of listing

What lies ahead?

Though further correction cannot be ruled out, analysts say that there are expectations of a pull-back rally in the markets next week as equities look oversold. This might result in a “Santa rally” that investors await every year during the holiday season.

About The Author

Next Story