Market News

Stock Market Weekly Recap: SENSEX, NIFTY rise up to 1% despite high volatility

.png)

5 min read | Updated on November 30, 2024, 09:52 IST

SUMMARY

SENSEX and NIFTY advanced nearly 1% this week amid high volatility and unusual FII activity. After a see-saw trade, NIFTY ended higher by 223 points and SENSEX by 685 points, marking their second straight week of gains.

- NIFTY, SENSEX marked the second straight week of gains.

- PSU bank shares rallied up to 8% this week.

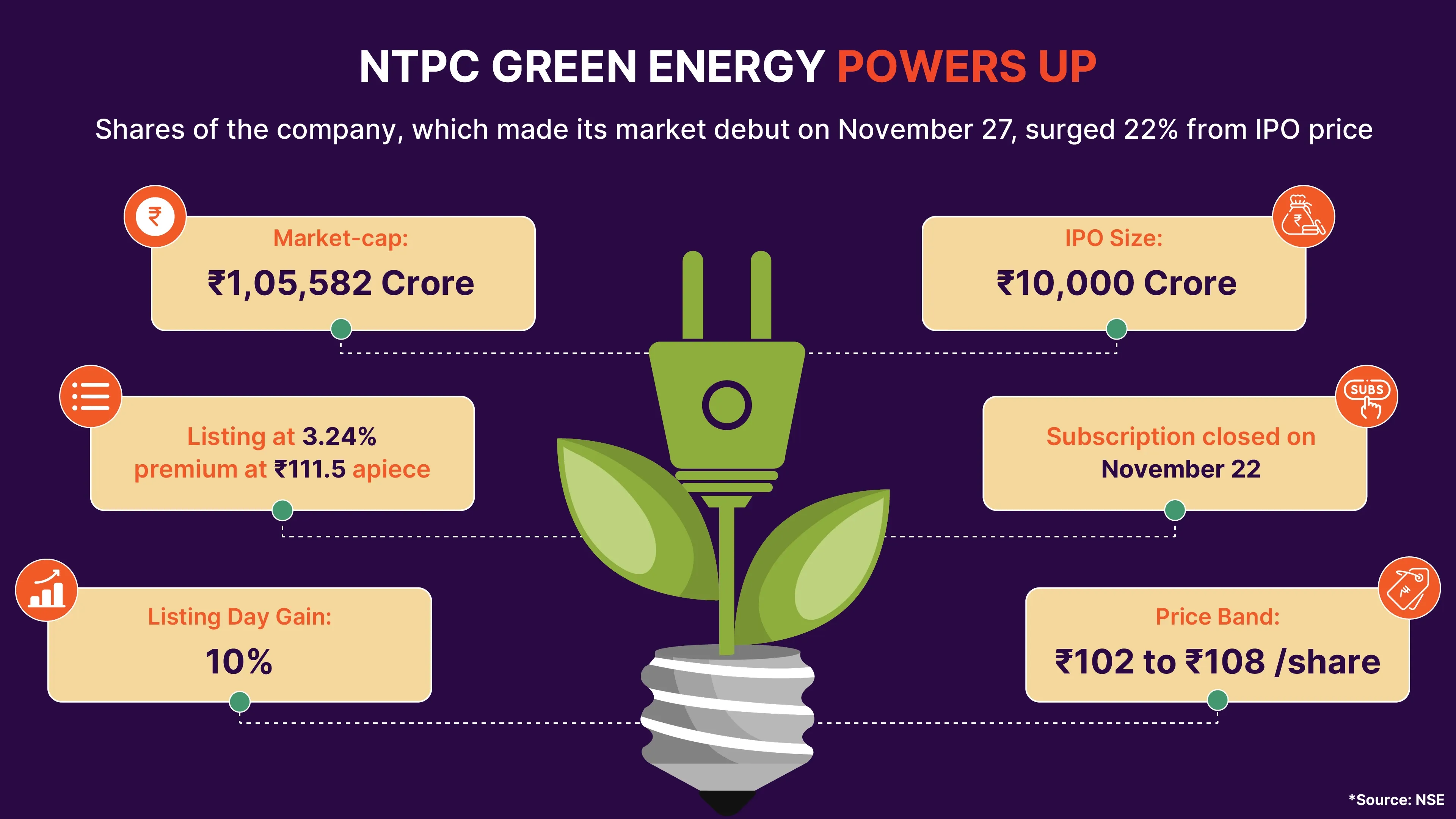

- Newly listed NTPC Green breaches ₹1 lakh crore market cap in debut week; shares rise 22% from IPO price.

Hey there! We are back with a quick recap of the markets in the last week of November marked by high volatility.

SENSEX and NIFTY advanced nearly 1% this week amid high volatility and unusual FII activity. After a see-saw trade, NIFTY ended higher by 223 points and SENSEX by 685 points, marking their second straight week of gains.

Stock markets turned volatile this week due to Assembly poll results, unprecedented FII activity and the monthly expiry of derivatives contracts. After high trading activity on Monday, FIIs sold shares worth ₹11,756 crore on a net basis on Thursday after three days of inflows.

Stock markets started the week on a strong note, with benchmark indices gaining more than 1% following the BJP-led alliance’s convincing win in the Maharashtra Assembly polls. After the state elections, investors expected higher government spending, which could drive up corporate results in H2 of FY25. SENSEX jumped 992.74 points, or 1.25%, to regain the 80,000 level, while NIFTY surged 314.65 points, or 1.32%, to close above 24,200.

A sell-off in Adani shares following downgrades by rating agencies and weak global trends due to US President-elect Donald Trump's tariff threats against Mexico, Canada, and China dragged down the markets on Tuesday. NIFTY settled lower than 24,200. FIIs, however, turned net buyers in Indian equities after a long streak of selling, with MSCI rebalancing.

SENSEX and NIFTY retreated more than 1% on Thursday following the monthly expiry of derivative contracts and FII selling.

Huge outflows by FIIs, which sold shares worth ₹11,756.25 crore on a net basis, dragged the Indian equities down. RIL, HDFC Bank, Infosys, Tech Mahindra, Adani Ports & SEZ were lead losers. Investors lost nearly ₹1.5 lakh crore in a single day.

Stock markets staged a comeback on Friday, with SENSEX and NIFTY closing at nearly 1%. The recovery was led by buying in bluechips like Reliance Industries, Bharti Airtel, ICICI Bank and L&T.

Newly listed NTPC Green breaches ₹1 lakh crore marketcap

NTPC Green breached the ₹1 lakh crore market valuation mark in the first week of trade. NTPC Green shares made a muted market debut with over 3% gain on November 27, but ended the listing day with over 10% rally. Shares advanced around 5% on the second day after hitting all-time high of ₹132.3 on NSE. The stock has gained 22% from the IPO price despite some profit-taking.

PSU banks rally after Maharashtra poll results

PSU bank shares rallied up to 8% this week after the Maharashtra election results. FIIs’ buying also aided the rally. The Central Bank of India surged 10% on Monday after it received approval for an insurance venture. Indian Bank spurted around 8%, Bank of India and Bank of Maharashtra by around 7%, and PSB, UCO Bank, and Punjab National Bank by up to 6% this week. NIFTY PSU Bank was the lead gainer, rising by 5%.

FIIs turn net buyers after a long selling spell

FIIs turned net buyers this week after a long selling spree. On Monday, November 25, FIIs purchased shares worth ₹85,251.94 crore and sold shares worth ₹75,304.39 crore in the cash segment, resulting in a net inflow of over ₹9,900 crore. FIIs were net buyers of Indian equities in the next two days. However, they exited shares worth ₹11,756 crore on a net basis on Thursday.

Adani stocks in roller coaster ride amid bribery charges

Adani Group shares made a spirited recovery from Tuesday’s losses after the group clarified that its chairman Gautam Adani has not been charged with any violation of the Foreign Corrupt Practices Act (FCPA). Adani stocks were instrumental in the market fall on November 27. Recovering the losses, key Adani stocks hit the upper circuit, jumping 10-20% on Wednesday. Also, Adani Green Energy jumped 21.72% and Adani Energy Solutions by up to 15% on Friday following their inclusion in the F&O segment.

Swiggy's shares rise 12% ahead of Q2 results

New entrants in F&O segment as Sebi tweaks norms

As many as 45 stocks, including Adani Energy Solutions, Adani Green Energy, Jio Financial, Paytm, Adani Total and Zomato, entered the F&O segment this week. The NSE implemented the inclusion on November 29, following market regulator Sebi tweaking the criteria for entry and exit of shares in the derivatives segment.

What lies ahead?

Stock markets next week are expected to react to weaker-than-expected GDP data released on Friday. Investors will be focused on the upcoming RBI monetary policy despite hopes of a status quo on the rate front. Macro data like service and manufacturing PMI data, auto sales and US job data will also be on the radar of the investors before their next move in the stock markets.

About The Author

Next Story