Market News

Stock Market Weekly Recap: SENSEX, NIFTY rise for second week; FIIs return amid dovish Fed, weak dollar

.png)

5 min read | Updated on March 22, 2025, 12:48 IST

SUMMARY

FII activity will be a key market-moving factor next week amid anticipated reduced risk-free rates. FIIs turned net buyers on the last two sessions this week helping indices scale month-high levels.

A weak US dollar coupled with an anticipated reduction in risk-free rates helped FIIs return to Indian markets. | Image: PTI

- NIFTY, SENSEX surged over 4% this week.

- On a weekly basis, broader indices jumped up to 8%.

- Raymond Ltd emerged as the top gainer among NIFTY Realty constituents, with a rally of 21%.

Hey there! We are back with another quick recap of the markets this week, marked by a strong rebound after a volatile phase.

Benchmark indices SENSEX and NIFTY surged more than 4% in the five-day rally this week. SENSEX jumped 3,076 points and NIFTY rallied 953 points to settle at more than a month’s high as foreign institutional investors (FIIs) returned to Indian markets. While trade tensions and the reciprocal tariffs deadline of April 2 kept investors edgy, a dovish US Fed lifted the market sentiment. FIIs also increased their long positions in the Indian futures market giving much-needed relief to retail investors, who turned to broader markets.

A weak US dollar coupled with an anticipated reduction in risk-free rates helped FIIs return to Indian markets. Also, domestic consumption theme-based shares, insulated from the reciprocal tariffs, were major market drivers. All the key sectoral indices closed in the green. Capital Market and Defence indices gained the most, spurting by 14% and over 10%, respectively, after the government approved key purchase orders.

At the outset of this week, stock markets cut short their losses with benchmark SENSEX and NIFTY advancing over half a per cent. SENSEX cut short its five-day losing streak and gained 341 points to close above 74,000.

Key indices continued their momentum on Tuesday, gaining over 1.5%. SENSEX rallied 1,131 points to regain 75,000 while NIFTY spurted 325 points to close above 22,800. Buoyant global equities and gains in blue-chips boosted the confidence of local investors.

SENSEX and NIFTY added another 0.3% on Wednesday following value-buying by investors. Consumer durables, capital goods and realty shares led gains.

The key indices surged on Thursday by over a percent after US Fed signalled two rate cuts in 2025. FII turned net buyers for the second time, which boosted market sentiment.

The Indian benchmarks closed the week on a high with SENSEX gaining 557.45 points or 0.73% to close a more than a month’s high of 76,905.51. NIFTY rose by 159.75 points or 0.69% to close at 23,350.40. FIIs were major movers with anticipated reductions in risk-free rates and a correction in the US dollar index.

Broader markets were also on a high as midcap and smallcap indices rallied up to 2% at the market close. On a weekly basis, broader indices jumped up to 8%.

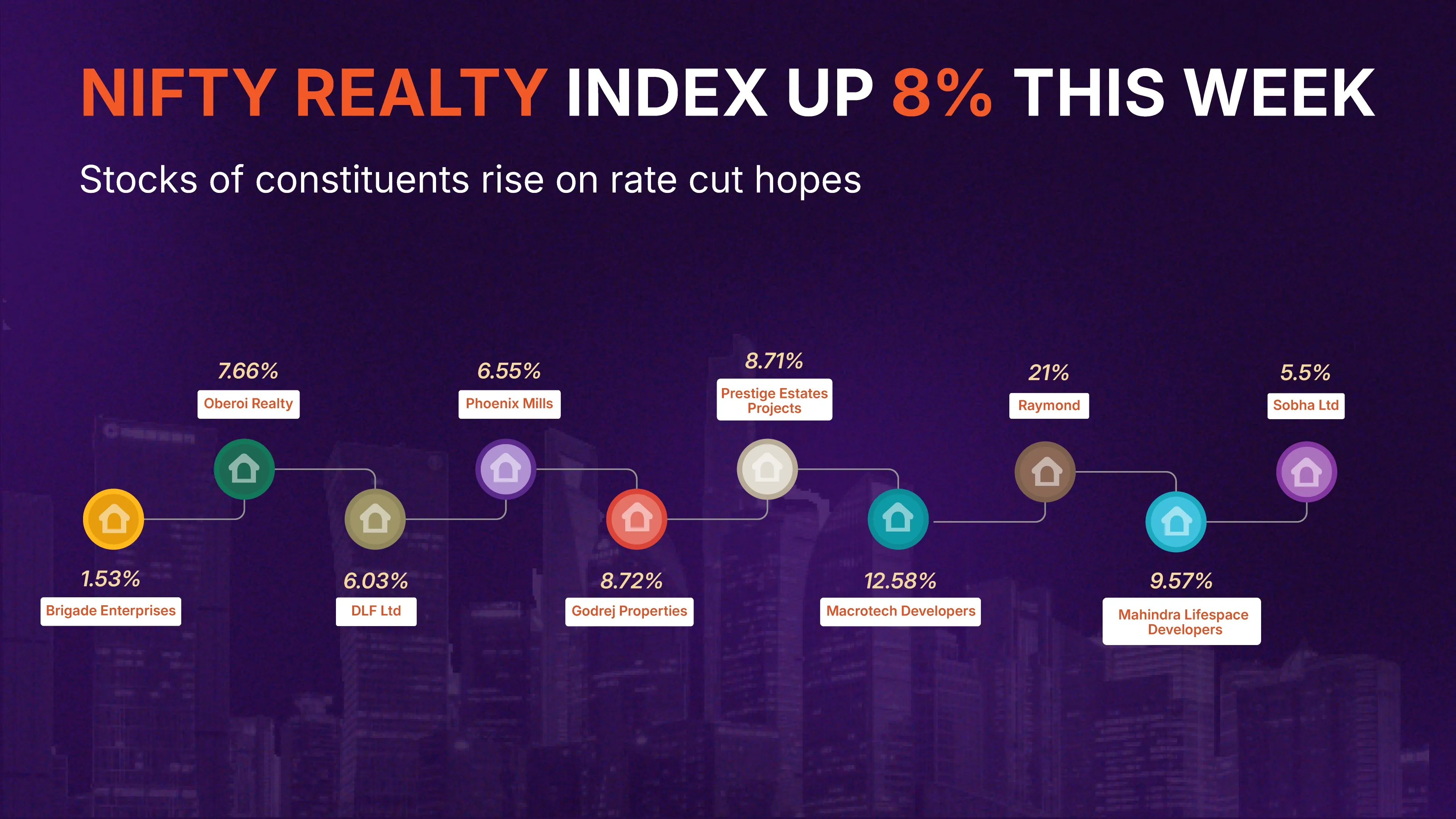

NIFTY Realty lead sectoral gainer on rate cut hopes

Value buying and rate cut hopes helped realty shares post gains. All the NIFTY Realty constituents ended in the green this week, while Raymond Ltd emerged as the top gainer with a rally of 21%. NIFTY Realty rose by 8%.

Other major gainers were DLF Ltd (6.03%), Godrej Properties (8.72%), Macrotech Developers (12.58%), Mahindra Lifespace Developers (9.57%) and Prestige Estates Projects (8.71%).

| Gainers | Losers |

|---|---|

| SBI Life (11%) | Tech Mahindra (-2%) |

| Shriram Finance (9%) | ITC (-1.6%) |

| HDFC Life (9%) | - |

Top sectoral gainers & losers

| Gainers | Losers |

|---|---|

| NIFTY Realty (8%) | - |

| NIFTY Media (8%) | - |

| NIFTY Auto (6%) | - |

US markets

| Index | % Change |

|---|---|

| S&P 500 | +2.49% |

| Dow Jones | +2.81% |

| Nasdaq Composite | +2.78% |

Commodities (MCX)

| Commodities (MCX) | Price | Change (%) |

|---|---|---|

| Gold | ₹87,490/10g | +0.31% |

| Silver | ₹97,693/kg | -2.86% |

Currency gainers/losers (USD, GBP)

| Currency/Index | Change |

|---|---|

| US Dollar Index | 0.24% |

| GBP | 0.18% |

Ajanta Pharma shares gain 10%, scale 6-week high

Railtel shares jump 9% this week; bags ₹16 cr order from Defence Ministry

Poonawalla Fincorp shares rise 15% as NBFC forays into CV loan biz

Poonawalla Fincorp shares rallied more than 15% this week after the NBFC announced a foray into the commercial loan business segment. The new service aims at strengthening the logistics and supply chain industries by improving transportation capabilities for CV operators, an exchange filing stated. The stock advanced on four of five sessions this week to end at ₹334.8 apiece on the NSE, up by over 15% from last week.

What lies ahead?

FII activity will be a key market-moving factor next week amid anticipated reduced risk-free rates. FIIs turned net buyers on the last two sessions this week helping indices scale month-high levels. Investors will also focus on key US data as US services and manufacturing PMIs, initial jobless claims and Consumer and core inflation data are scheduled to be released next week.

About The Author

Next Story