Market News

Stock Market Weekly Recap: NIFTY, SENSEX witness longest losing run in 2 years

.png)

5 min read | Updated on February 15, 2025, 10:05 IST

SUMMARY

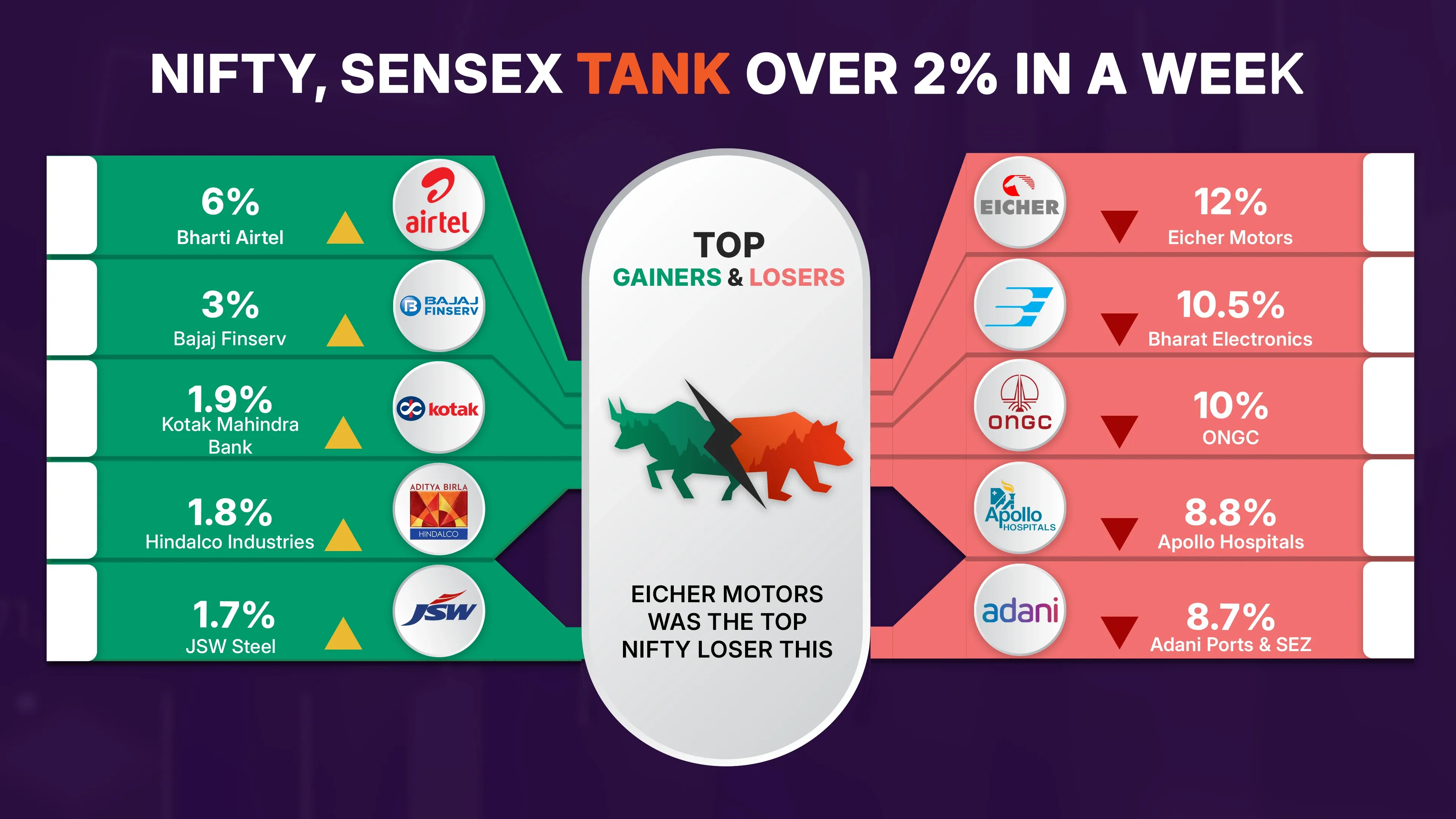

Benchmark stock indices SENSEX and NIFTY declined more than 2% this week, dragged by tariff war concerns and weak quarterly results. Persistent selling by FIIs continued to weigh on investor sentiment as stock markets fell for eight days on the trot, wiping out more than ₹25 lakh crore of investor wealth.

Stock list

On a weekly basis, the BSE SENSEX plunged 2.46%, or 1,920.98 points, while the broader NIFTY tanked 2.67%, or 630.7 points, to slip below 23,000. | Image: PTI

- Investors lose ₹25 lakh crore amid market crash.

- Eicher Motors is the top NIFTY loser, while Bharti Airtel emerges lead gainer this week.

- Natco Pharma shares tanked 31% this week after a 28% slide in just two days post weak Q3 earnings.

Hey there! We are back with another quick recap of the markets this week, marked by a bloodbath on Dalal Street.

Benchmark stock indices SENSEX and NIFTY declined more than 2% this week, dragged by tariff war concerns and weak quarterly results. Persistent selling by FIIs continued to weigh on investor sentiment as stock markets fell for eight days on the trot, wiping out more than ₹25 lakh crore of investor wealth.

Stock markets reacted sharply to US President Donald Trump’s hard stance on tariffs. His decision to impose flat 25% duties on steel and aluminium and threat to impose reciprocal duties in response to action by other countries rattled investors this week.

An uptick in US inflation and firm jobs data also dented expectations of rate cuts by the US Fed. Though inflation numbers on the home front were a comfort, weak industrial production growth raised concerns over economic health.

Weak quarterly results and commentary also continued to disappoint investors.

On a weekly basis, the BSE SENSEX plunged 2.46%, or 1,920.98 points, while the broader NIFTY tanked 2.67%, or 630.7 points, to slip below 23,000.

Stock markets started the week on a feeble note, with benchmark indices dropping by nearly 1% due to US tariff worries and mixed earnings reports. Falling for the fourth consecutive day, the SENSEX lost 548 points. The NIFTY shed 178 points to close at 23,381.6. Realty, metal, and energy led the decline as the US announced 25% tariffs on all steel and aluminium imports. Broader indices tumbled over 2%.

With the US president signing the new tariffs, markets tumbled around 1.5% on Tuesday as well. SENSEX fell 1,018 points to a two-week low, while NIFTY crashed 309 points to close below 23,100. All sectoral indices closed in the red, led by realty, auto, consumer durables, and media shares.

SENSEX and NIFTY remained volatile on Wednesday and closed lower amid mixed cues. The indices started on a weak note, tanking more than 1% in early trade. However, gains in financial, metal and banking shares helped pare losses as the day progressed. NIFTY closed at 23,045.25.

The indices made a futile attempt to recover losses on Thursday but selling in financial and IT dragged them lower at close. Retail inflation falling to a five-month low in January was a respite but gains in Chinese stocks triggered FPI outflows.

Stocks declined on Friday as well in their eighth straight day of losses even as the US and India tried to resolve trade-related issues. SENSEX settled lower by 200 points at 75,939.21 while NIFTY shed 102.15 points to end at 22,929.25.

Broader markets took a bigger hit as NIFTY midcap indices tanked 7% while smallcap indices plunged by 10%.

Top NIFTY gainers & losers

| Gainers | Losers |

|---|---|

| Airtel (6%) | Eicher Motors (-12%) |

| Bajaj Finserv (3%) | BEL (-10.5%) |

| Kotak Bank (1%) | ONGC (-10%) |

Top sectoral gainers & losers

All the NIFTY sectoral indices closed in the red this week.

| Gainers | Losers |

|---|---|

| - | NIFTY Realty (-9%) |

| - | Media (-8%) |

| - | Auto & Pharma (-6%) |

US markets

| Index | Change (%) |

|---|---|

| S&P 500 | 1.47% |

| Dow Jones | 0.56% |

| Nasdaq Composite | 2.57% |

Commodities (MCX)

| Commodity | Price | Change (%) |

|---|---|---|

| Gold | ₹85,933/10g | +1.21% |

| Silver | ₹97,949/kg | +2.72% |

Currency gainers/losers (USD, GBP)

| Currency | Change (%) |

|---|---|

| US Dollar Index | -1.21% |

| GBP | +1.75% |

Eicher Motors' top NIFTY loser, Bharti Airtel emerges as lead gainer

Eicher Motors shares plunged over 12% to emerge as the biggest NIFTY50 loser this week. The Royal Enfield maker posted a 17.5% jump in Q3 profit which was below street estimates. Bharat Electronics dropped around 10% to emerge as the second-biggest loser. ONGC, Apollo Hospitals, and Adani Ports and SEZ were among top five NIFTY losers.

Bharti Airtel advanced 6% this week to emerge the lead NIFTY gainer. Bajaj Finserv (3%), Kotak Mahindra Bank (1.9%), Hindalco Industries and JSW Steel were among top five gainers.

Natco Pharma shares bleed 31% after Q3 earnings

Natco Pharma shares tanked 31% this week after a 28% slide in just two days to Friday following disappointing Q3 earnings. The stock plunged by 20% on Thursday and another 10% on Friday. The pharma company posted a 38% decline in Q3 profit while profit margins fell by 600 basis points.

Godfrey Phillips India shares rally 20% to hit upper circuit after Q3 results

What lies ahead?

Uncertainty over US President Donald Trump's trade policies and high valuations are likely to roil stock markets next week. FIIs would remain in focus as overseas investors have been net sellers of ₹24,888.74 crores, to date this month. Investors will also keep watch on minutes of Fed's January FOMC meeting and US jobless claims data.

Related News

About The Author

Next Story