Market News

Stock Market Weekly Recap: NIFTY, SENSEX end in the red; IT stocks worst hit amid global turmoil

.png)

6 min read | Updated on March 15, 2025, 00:04 IST

SUMMARY

Stock markets are expected to remain volatile next week amid ongoing trade policy uncertainty. The US Federal Reserve will announce its policy review, which would dictate market trends globally. US data on retail, industrial production and jobs will be watched for further cues.

Stock list

FIIs remained net sellers in Indian equities as they offloaded shares worth over ₹4,900 crore on a net basis this week. | Image: PTI

- On a weekly basis, NIFTY declined by 155 points, or 0.69%, while SENSEX fell 503 points or 0.68%.

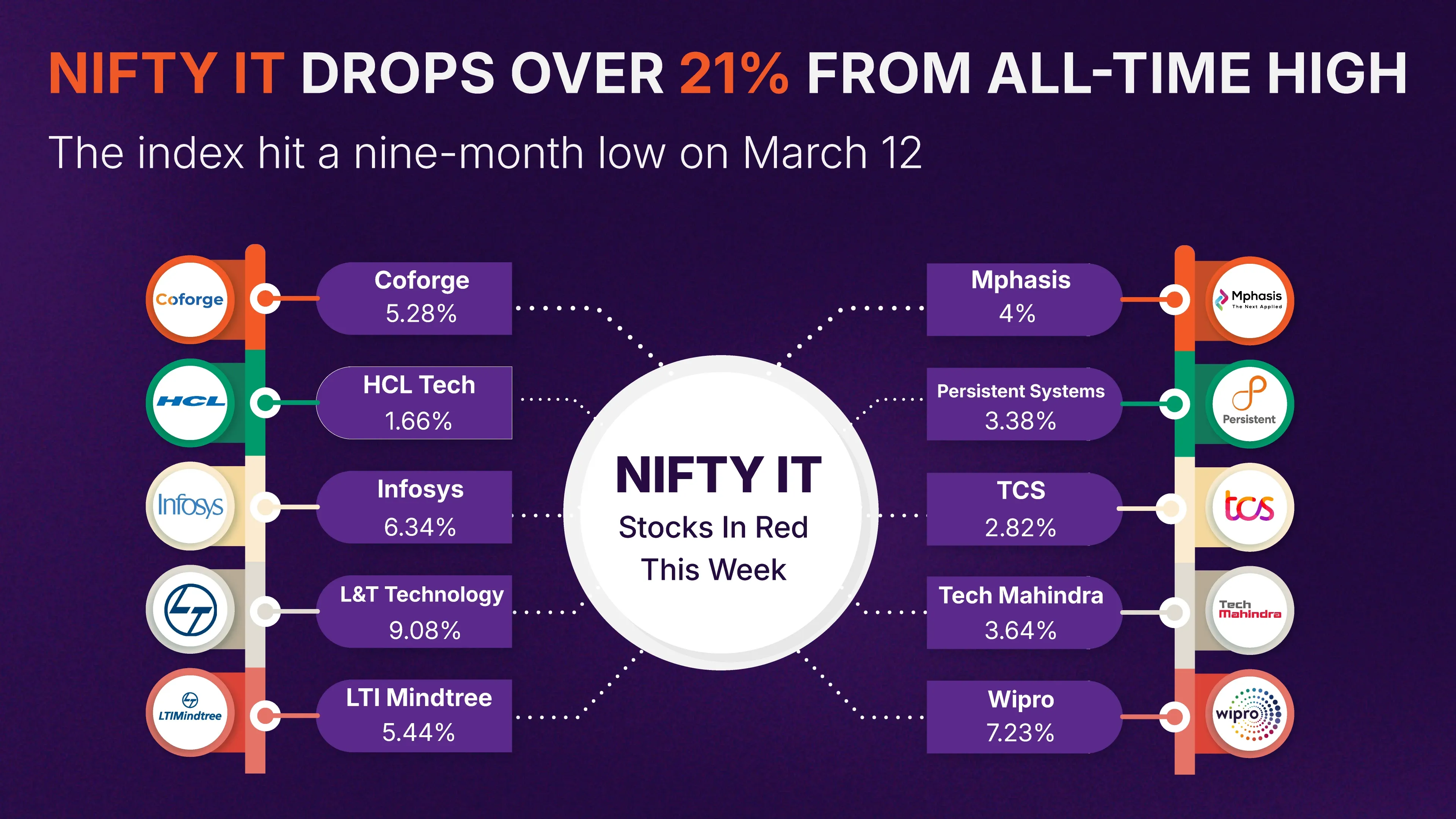

- NIFTY IT dropped over 21% from the all-time high hit in December 2024.

- IndusInd Bank shares slumped 28% on irregularities in derivatives portfolio.

It’s that time of the week again! We are back with a quick recap of all the major events in the stock markets. The D-Street missed the festive cheer ahead of the Holi festival amid volatility.

Key stock indices tumbled up to 0.7% this week as recession fears in the US triggered selling in IT bluechips and auto shares. US President Donald Trump with his uncertain tariff actions continues to keep investors on the edge. Trump announced to impose an additional 25% tariff on Canada but stepped back when a Canadian province threatened to levy a 25% surcharge on the power supply.

US stock markets roiled due to fears of a slowdown following the Trump Administration’s flip-flops on tariffs, with benchmark indices tanking over 3% in the first two days of the week. Losses in the US markets triggered selling in global markets.

However, a recovery in US markets later and domestic tailwinds such as better-than-expected decline in retail inflation to 3.75% in February – below RBI’s inflation target of 4% – and industrial growth improving to an 8-month high of 5.01% in January cushioned the impact. Stock markets witnessed sharp swings during the day but recovered most of the losses at the close.

Lower inflation numbers also raised hopes of further cuts in policy rates. However, the likely imposition of tariffs on Indian goods by the Trump administration made investors nervous.

Benchmark indices, SENSEX and NIFTY started the week with losses closing lower by 217 points and 92 points, respectively, as major sectors came under selling pressure. Broader indices also fell up to 2.4% on Monday.

Stock markets remained volatile on Tuesday following deep losses in US markets but select buying helped indices end on a mixed note. SENSEX fell for the second day while NIFTY rose by 37 points to 22,497.90. IndusInd Bank shares tanked up to 27% due to accounting discrepancies.

IT pack tumbled on Wednesday following downgrades by experts and US growth concerns, dragging the indices down. NIFTY declined sharply in the first half, but recovered towards fag-end on buying in select heavyweights, closing down 27% at 22,470.50. SENSEX dropped 73 points.

SENSEX continued the falling trend for the fifth session on Thursday amid weekly expiry day. Almost all sectors declined, led by Auto, Realty, Metal and IT. NIFTY fell by 73 points to close at 22,397.2. SENSEX fell 200.85 points or 0.27% to settle at 73,828.91.

On a weekly basis, NIFTY declined by 155 points or 0.69%. SENSEX fell by 503 points or 0.68%.

NIFTY Midcap indices fell up to 2% while NIFTY Smallcap dropped up to 4%.

FIIs remained net sellers in Indian equities as they offloaded shares worth over ₹4,900 crore on a net basis this week. FIIs have pulled out more than ₹20,400 crore on net basis so far this month.

IT stocks retreat on US growth concerns, NIFTY IT enters ‘bear zone’

The NIFTY IT index plunged to its lowest levels since July 2024 this week, tanking by 15% after its components succumbed to selling.

The index fell into the ‘bear market territory’ on Wednesday as it declined more than 21% from the all-time high hit on December 13, 2024.

L&T Technology, Wipro, Infosys and LTI Mindtree were the biggest losers among NIFTY IT constituents this week. Recession fears following US President Donald Trump’s strong tariff rhetoric and experts having a pessimistic view over IT sector shares triggered the sharp sell-off in shares.

| Gainers | Losers |

|---|---|

| Sun Pharma (4.6%) | IndusInd Bank (-28%) |

| ICICI Bank (2.8%) | Wipro (-7%) |

| Kotak (2.58%) | Infosys (-6.2%) |

Top sectoral gainers & losers

| Gainers | Losers |

|---|---|

| NIFTY Financial Services (1%) | NIFTY IT (-4.49%) |

| NIFTY Pharma (0.04%) | NIFTY Media (-3.44%) |

| - | NIFTY Auto (-2.1%) |

US markets

| Index | % Change |

|---|---|

| S&P 500 | -2.69% |

| Dow Jones | -3.37% |

| Nasdaq Composite | -2.90% |

Commodities (MCX)

| Commodity | Price | Change |

|---|---|---|

| Gold | ₹87,963/10g | +2.50% |

| Silver | ₹10,7610/kg | +3.58% |

Currency gainers/losers (USD, GBP)

| Currency/Index | Change |

|---|---|

| US Dollar Index | 0.33% |

| GBP | 0.54% |

IndusInd Bank shares slump 28% on irregularities in derivatives portfolio

PB Fintech tanks 5% after investment proposals

Shares of PB Fintech, the parent of Policybazaar.com, tumbled 5% each on Wednesday and Thursday after it announced a ₹696 crore investment in subsidiary PB Healthcare Services. The company looks to expand the healthcare-related business, but investors were sceptical about the profitability. The stock ended the week lower by over 4% at ₹1,331.9 apiece on the NSE.

MTNL shares rally 12% on asset monetisation

What lies ahead?

Stock markets are expected to remain volatile amid ongoing trade policy uncertainty. Investors will keep a close watch on US President Donald Trump training his guns on India for alleged tariff abuses. The US Federal Reserve will announce its policy review next week, which would dictate market trends globally. US data on retail, industrial production and jobs will be watched for further cues.

Related News

About The Author

Next Story