Market News

Stock market weekly recap: NIFTY, SENSEX cut losses in holiday-shortened week amid caution

.png)

5 min read | Updated on December 28, 2024, 10:13 IST

SUMMARY

Stock markets are expected to see thin trading next week amid the ongoing holiday period in global markets. FII activity will remain in focus amid strengthening US dollar and bond yields which are triggering foreign fund outflows.

Stock list

- NIFTY and SENSEX, recovered up to 1% on a weekly basis to close in the green.

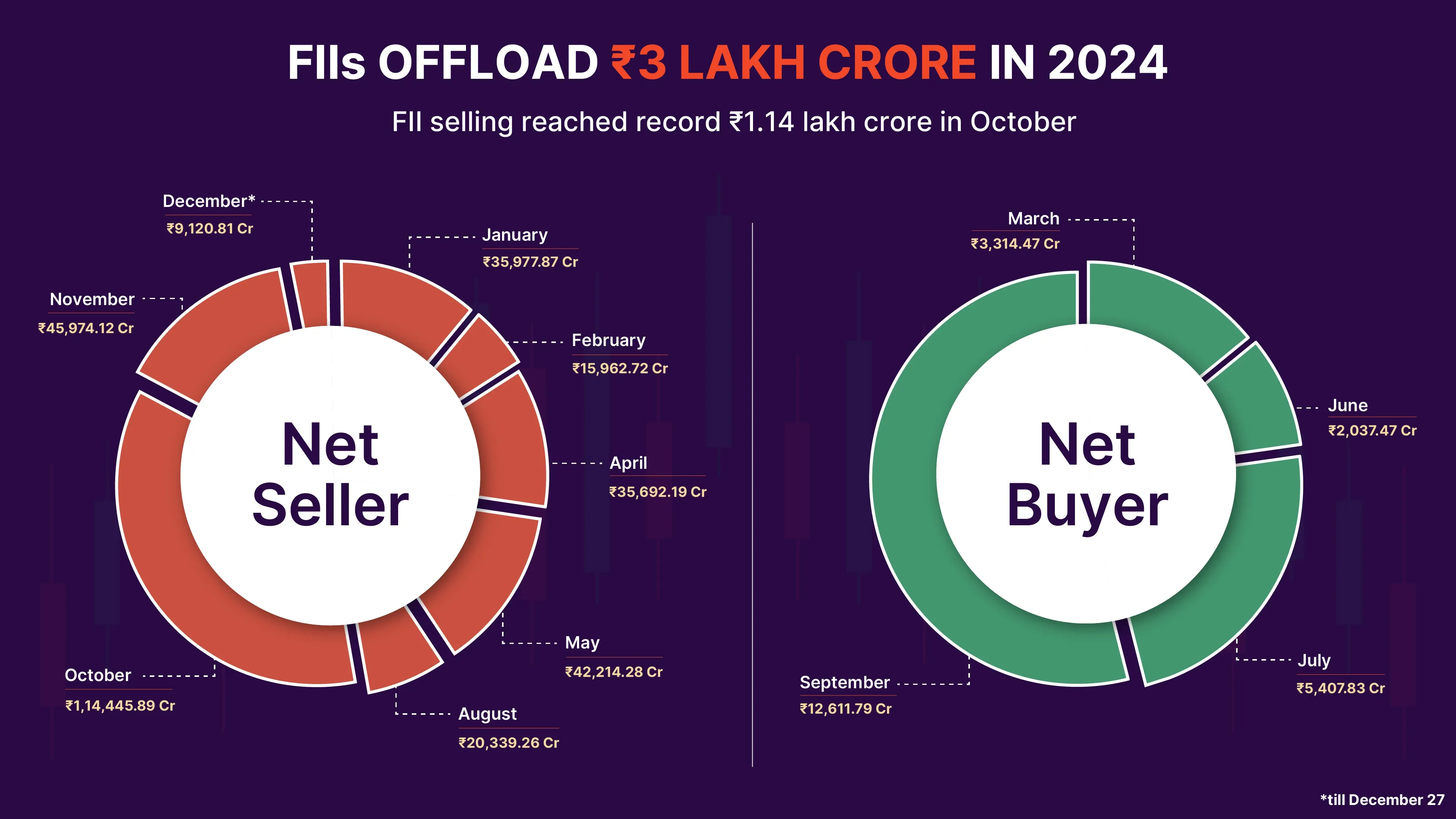

- The FII selling has surpassed ₹3 lakh crore so far this year.

- NIFTY Auto, FMCG and Pharma indices were the lead sectoral gainers this week.

As 2024 draws to a close, the Indian stock markets have been on a roller-coaster ride. With only two trading days left in 2024, we are back with a quick recap of the holiday-truncated week marked by muted sentiment.

Benchmark indices recovered from last week’s sharp losses to settle marginally higher on a weekly basis amid trading holidays in global markets. While Indian markets lacked major triggers in the holiday-shortened week, firming US bond yields fuelled selling in Indian equities by foreign portfolio investors. The investors also remained cautious ahead of the swearing-in of the Republican Party government in the United States.

The key indices, NIFTY and SENSEX, recovered up to 1% on a weekly basis to close in the green despite a cautious investor sentiment.

Starting the week on a high note, stock markets snapped a five-day losing streak on Monday and advanced more than half a percent. SENSEX and NIFTY had tanked around 5% in the previous week hit by FII selling and firm US bond yields.

On Monday, SENSEX rose by nearly 499 points while NIFTY advanced nearly 166 points to settle above 23,750 level. FIIs remained net sellers while domestic investors remained net buyers.

The rebound, however, was short-lived as key stock indices closed lower on Tuesday in a range bound trade ahead of trading holidays in global markets. Select heavyweights across sectors saw profit taking.

SENSEX and NIFTY closed on a mixed note on Thursday as markets resumed trading after the Christmas holiday. Indices opened higher but failed to hold onto gains due to selling pressure on the monthly expiry day. SENSEX closed flat with a negative bias but NIFTY advanced 22 points.

However, the beginning of new series cheered stock markets on Friday and key stock indices gained marginally at close. SENSEX advanced 226.59 points, or 0.29%, to settle at 78,699.07, while the 50-share NIFTY closed at 23,813.4, up 63.2 points, or 0.27%.

In the broader market, midcap and smallcap indices closed flat this week. However, for 2024, the broader indices beat the benchmark NIFTY in terms of returns. While benchmark index advanced around 10% in this year so far, midcap and smallcap indices have gained 25-28% in this year so far.

NIFTY Auto, FMCG & Pharma lead sectoral gainers, Media falls 2%

NIFTY Auto, FMCG and Pharma indices were the lead sectoral gainers this week. NIFTY Media was the biggest loser dropping by 2%.

NIFTY Auto rallied the most by 3%, followed by FMCG and Pharma by 2% each. Banks, Oil & Gas, Realty Consumer Durables advanced 1% each. IT and Metal indices closed flat.

In 2024, Realty index gained the most by 39%, followed by Pharma (38%) and Consumer Durables (34%). NIFTY Auto jumped 27% and IT by 22% while Media dropped 22% in 2024 so far.

FIIs remain net seller this week, pull out record ₹3.19 lakh cr in 2024

The Foreign institutional investors (FIIs) turned net sellers this week as they pulled out more than ₹5,000 crore from Indian equities in the cash segment. Foreign investors withdrew around ₹9,120 crore from Indian equities in December so far.

With only two trading days remaining in 2024, the FII selling has surpassed ₹3 lakh crore so far this year. The FIIs turned net sellers in the cash segment in 8 of 12 months. The foreign investors sold equities worth ₹1.14 lakh crore on net basis in October alone.

Sagility India shares extend winning run to 9th day, rally nearly 75% since listing

One Mobikwik Systems rise over 28%

What lies ahead?

Stock markets are expected to see thin trading next week amid the ongoing holiday period in global markets. FII activity will remain in focus amid strengthening US dollar and bond yields which are triggering foreign fund outflows.

Investors have turned cautious ahead of the upcoming Q3 results, which will play a crucial role in shaping the market trajectory. PMI data for India, the US, and China, as well as US jobless claims would also be watched closely by market participants.

About The Author

Next Story