Market News

Stock market today: From global markets, crude oil price to FII data, RBI policy all you need to know before opening bell on Dec 4

3 min read | Updated on December 04, 2024, 08:34 IST

SUMMARY

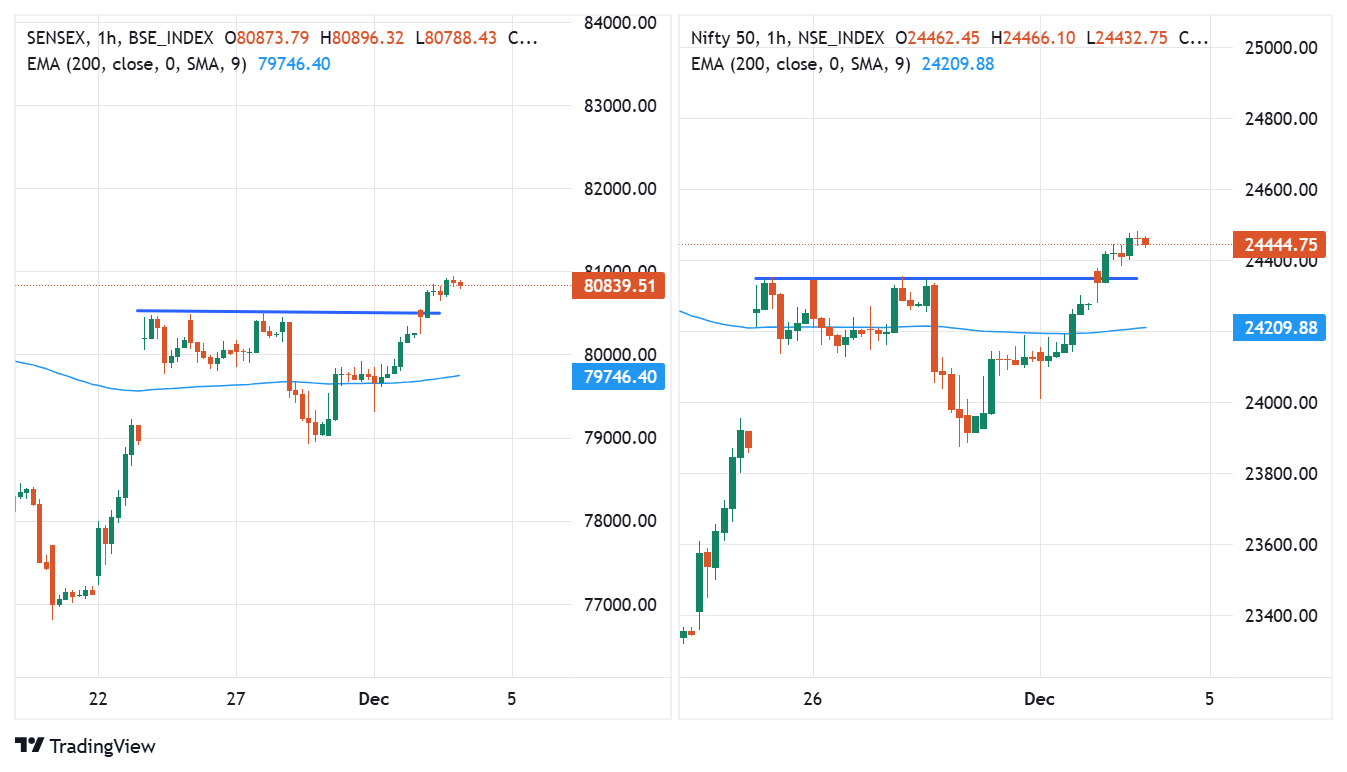

The NIFTY50 and SENSEX broke their key resistance levels of 24350 and 80500 to close 0.75% higher on Tuesday. The rally was fuelled by strong FII buying of ₹3,664 crores, while DIIs sold little to nearly ₹250 crores.

FIIs resume buying of Indian equities with strength as they buy Indian equities worth ₹3,664 crores on Tuesday.

Indian benchmark indices are expected to open higher amid renewed momentum in the Indian markets. The GIFT NIFTY trades 34 points higher on Wednesday morning after nearly a 1% rally on Tuesday. Global market cues remained mixed and muted as political turmoil in South Korea dampened investor sentiment in Southeast Asian markets.

Global markets

The US markets closed mixed on Wednesday, with little gain on key indices like the NASDAQ. Meanwhile, the S&P500 and Dow Jones closed in the red. Despite a volatile activity, NASDAQ continued to scale higher to new record levels with 0.4% gains on Wednesday. The US markets now look after the upcoming Federal Reserve policy meeting, for which markets now expect a 74% probability of a rate cut, up from 62% a week earlier.

Asian markets

Asian markets traded in the red on Wednesday morning amid political turmoil in South Korea. The South Korean president imposed martial law to counter anti-state forces. However, the decision was reversed within hours after facing backlash from the public. Following the development of South Korea’s benchmark index, Kospi jumped back from its previous losses. Meanwhile, Japanese and Chinese markets traded with marginal losses on Wednesday morning on their key benchmark indices.

Crude Oil prices

The crude oil prices staged a strong recovery on Tuesday after investors anticipated OPEC+ would delay the output restoration and new sanctions on Iranian crude oil. The WTI crude oil price trades at the $70 per barrel mark, holding overnight gains of 2.5%. Similarly, the Brent crude oil prices traded above $73 per barrel mark, holding steady after overnight gains of 2.4%.

FII DII data

Foreign institutional investors have started buying Indian equities after a sharp and relentless selling span over the previous two months. The FII’s bought Indian equities worth ₹3,664 crore on Tuesday. While DII’s sold equities worth ₹250 crore.

Domestic triggers

The Reserve Bank of India will start its bi-monthly monetory policy meeting today. The monetory policy commitiee will announce its decision on December 6. Amid a slowdown scenario in the economy, the policy stance is expected to remain status quo. However, some experts believe RBI may cut reserve requirements for banks through CRR cut. Majority of the experts believe, the first rate-cut is expected to be seen in the February 2025 policy meeting only.

Chart check

(Source: Tradingview,Upstox)

(Source: Tradingview,Upstox)The key benchmark indices of NIFTY50 and SENSEX have decisively broken their key resistance levels of 24,350 and 80,500 on Tuesday, indicating renewed momentum in the Indian markets. On a daily basis, the NIFTY50 and SENSEX move above 50DEMA mark indicating strength and momemtum to remain steady in the markets.

About The Author

Next Story