Market News

Indian equities look attractive; valuations no longer a concern, says HSBC as it upgrades India to 'overweight'

4 min read | Updated on September 24, 2025, 13:24 IST

SUMMARY

Stock market news: A consumption boost by the government, first in the form of nil tax up to ₹12,00,000, and then the GST bonanza, coupled with rate cuts by the RBI, are seen as positive factors that are expected to boost equities.

The earnings growth recovery is likely to be gradual, says HSBC. | Image: Shutterstock

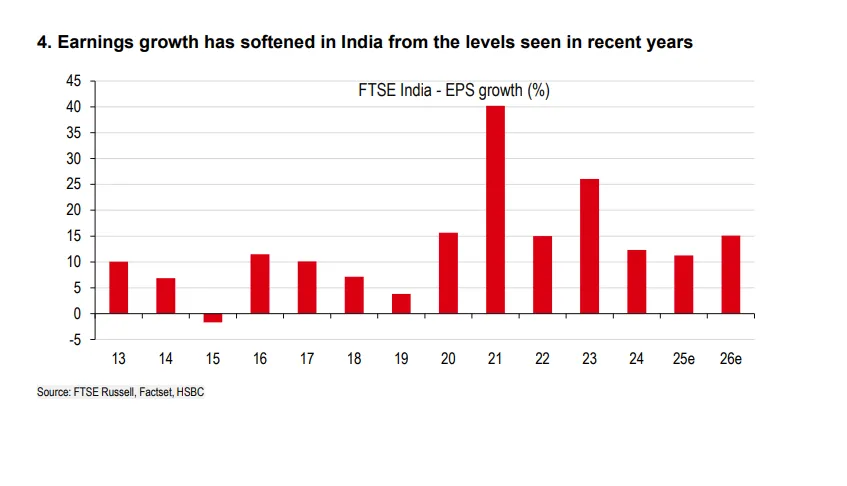

A turnaround in earnings growth still seems distant; however, analysts note that a gradual recovery is, indeed, on the cards that will aid the market.

A consumption boost by the government, first in the form of nil income tax up to ₹12,00,000, and then the GST bonanza, coupled with rate cuts by the RBI, are seen as positive factors that are expected to boost equities.

In its latest report, analysts at HSBC Research note that in stark contrast to the crowded trades in Korea and Taiwan, India is Asia’s quiet corner. Although foreign funds have withdrawn significant amounts from India in the last 12 months, a period in which the market has seriously underperformed, local investors have remained resilient.

FIIs have so far net sold equities worth ₹1,39,423 crore in 2025, NSDL data showed.

"While earnings growth expectations may still decline slightly, valuations are no longer a concern, government policy is turning supportive for equities, and most foreign funds remain lightly positioned," wrote Herald van der Linde, Head of Equity Strategy, Asia Pacific at HSBC, in a report co-authored with Prerna Garg, Adam Qi, and Varun Pai, Associates in Equity Strategy, dated September 24, 2025.

They added, "We think Indian equities now look attractive on a regional basis and upgrade the market to overweight (from neutral)."

A key reason, the report added, for the Indian market's underperformance is a slowdown in earnings while valuations remained elevated. Consumption and investment trends are weak, and in response, the administration is focused on boosting consumption, and the central bank is easing. Together with moderate inflation, this can support domestic demand and earnings.

Another issue that hangs over Indian earnings is the 50% US tariff on imports from India. Indeed, India faces some of the highest US tariff rates in the world. But most listed equities are domestic in nature, and less than 4% of sales for all BSE500 companies come via exports of goods to the US. When it comes to earnings growth, the direct impact from tariffs is muted, the report said.

The growth recovery is likely to be gradual, but we think the risks are reflected in valuations. 2025 consensus forecasts for earnings growth have come down – they are now at 12%, and we expect this to drop to 8-9%. 2026 estimates of 15% might appear high, and much will depend on how effective the policies will be in reviving growth, the report added.

Asian Markets

The research note said that foreign investors have been net sellers in Asia this year, which is normally bad news for regional stock markets. Yet the Asian market is up by an average of 20%, and for that "we can thank local retail investors, especially those in mainland China who are sitting on a mountain of cash."

Another feature of Asian markets is overcrowded trades, especially in companies related to AI in North Asia. The concern is that even a small deviation from sky-high investor expectations might lead to sharp corrections, the report added. However, they said that amid the chaos, India is a quiet corner.

Views on China

The research report said that after a strong run in Chinese equities, especially in Hong Kong, it is only natural to question whether this momentum will continue. Valuations are elevated but not excessive. "However, with retail investors sitting on $22 trillion in cash, some of which is gradually being reallocated to stocks, we expect Chinese equities to grind slowly higher," HSBC said.

"After the rally in H-shares – mainland Chinese investors have added a staggering $140 billion, more than double the annual average of $60 billion in the last three years – to their portfolio of stocks listed in Hong Kong this year, we think it’s time to build exposure to A-shares alongside H-shares," the analysts added.

Related News

About The Author

Next Story