Market News

RBI MPC meeting, US-India trade talks, Pharma tariffs, What will move markets next week? Check details

.png)

6 min read | Updated on September 28, 2025, 14:01 IST

SUMMARY

The key triggers for the Indian stock market in the coming week will be the RBI Monetary Policy Committee meeting, developments in the India–U.S. trade deal, continued selling by FIIs and the movement of the Indian rupee. These factors are expected to influence market sentiment and direction during the holiday-shortened week.

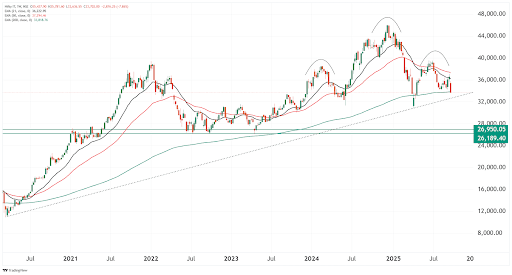

In the last six trading session, the SENSEX has dropped as much as 2.78% and NIFTY50 index has plunged 2.75%. | Image: Shutterstock

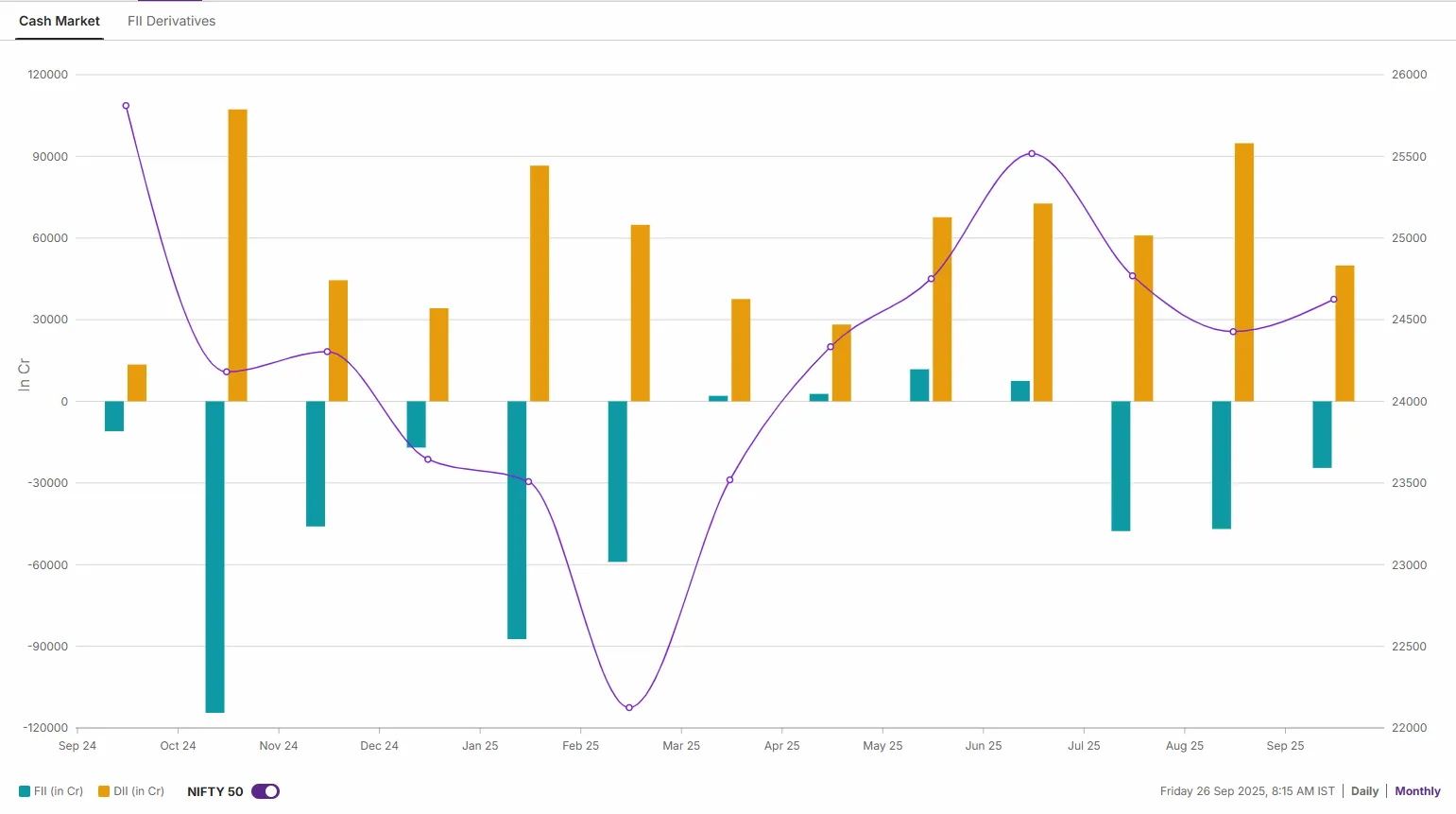

Indian markets experienced a sharp reversal last week, breaking a three-week winning streak. The NIFTY50 index posted the largest weekly decline seen in nearly six months. The decline was driven by ongoing selling by Foreign Institutional Investors (FIIs), new U.S. tariffs on pharmaceuticals, higher visa fees, a falling rupee and a rebound in dollar.

Meanwhile, the broader market also witnessed significant selling pressure, with the small- and mid-cap indices seeing sharp losses. The NIFTY Midcap 150 index fell by 4.2% over the course of the week, while the Smallcap 250 dropped by 4.7%. This reflects a clear shift towards risk aversion and profit-booking amid heightened volatility.

On the sectoral front, IT (-7.8%) and Pharmaceuticals (-5.2%) led the slide, weighed down by U.S. President Trump’s announcement of 100% tariffs on branded drugs and a significant increase in H-1B visa fees, which has damaged sector sentiment. Defensive sectors such as FMCG (-2.5%) also corrected, mirroring broader risk-off moves. Meanwhile, relative outperformance was seen only in Metals (-1.0%).

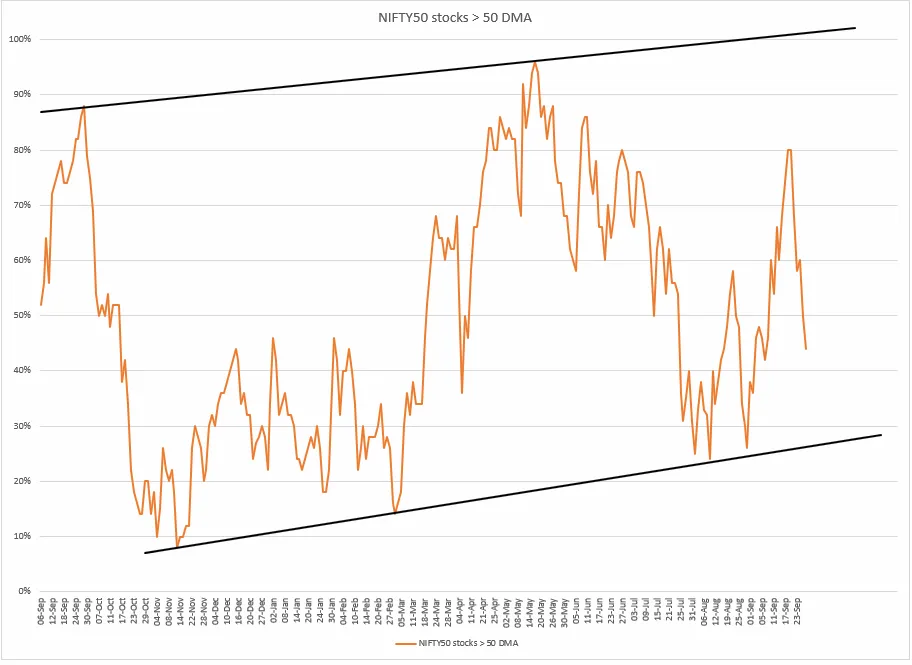

Market breadth

The breadth of the NIFTY50 index saw a sharp reversal, with the percentage of index stocks trading above their 50-day moving average dropping swiftly below the 50% threshold. The retracement follows last week's elevated readings, indicating a substantial decline.

The breadth of the index slipped to 44%, inching closer to the neutral zone, highlighting the shift to a more cautious approach. If the reading of the breadth indicator remains below the threshold of 50%, this would suggest a further deterioration in market sentiment.

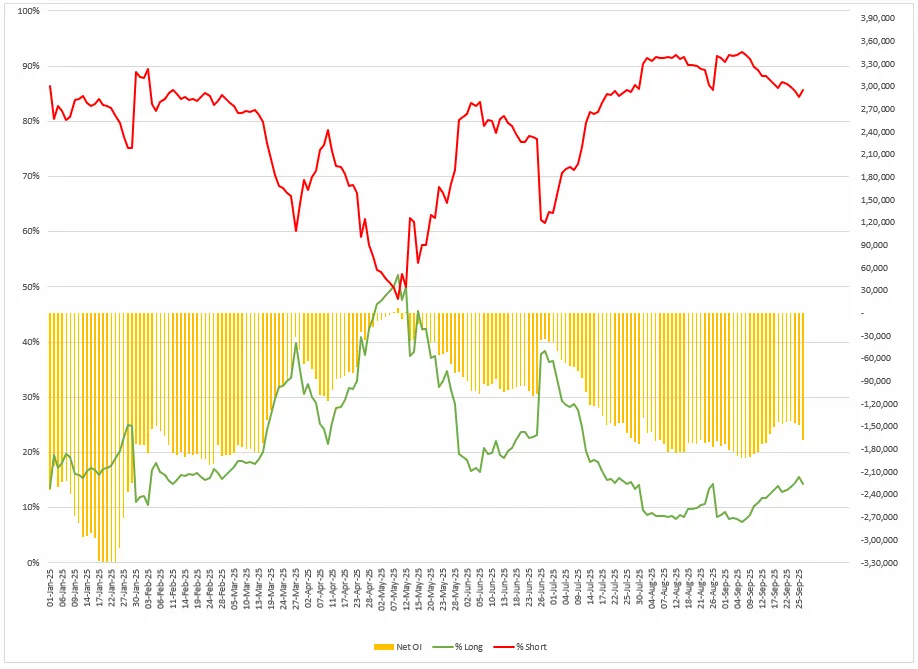

FIIs positioning in the index

Foreign Institutional Investors (FIIs) maintained their bearish stance in index futures, sustaining a long-to-short ratio close to 14:86. They increased their short positions, pushing the net short open interest by 14% to around negative 1,60,000 contracts. This escalation in short futures exposure further highlights FIIs' cautious outlook and reinforces their negative view of the market.

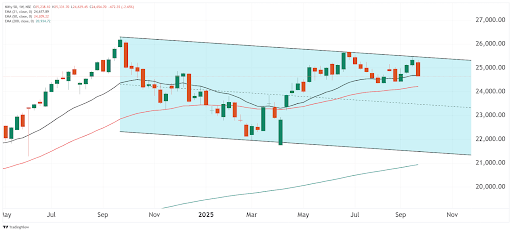

NIFTY 50 index

In India, the Reserve Bank of India is widely expected to keep the repo rate at 5.5% during its upcoming policy meeting on 1 October. Experts anticipate stable inflation and recent GST reforms as reasons for a pause. Although inflation has remained low and Q1 GDP was strong at 7.8%, the RBI is likely to adopt a cautious approach due to global uncertainties. Markets will be closely monitoring the statements of the RBI Governor on inflation outlook or growth projections.

Following this sharp decline, the NIFTY50 is now approaching a critical support zone near its 200-day EMA, which is currently at 24,389, just 1% below the close on 26 September. Price action around this level will be crucial in the coming sessions. A decisive close below the 200-day EMA could lead to further weakness.

On the other hand, unless it recovers immediate resistance of 25,100 on a closing basis, the index is likely to continue to show a sell-on-rise bias.

About The Author

Next Story