Market News

Week ahead: Q1 earnings, India-U.S trade deal stalemate, MAG 7 results and FIIs flows to drive markets

.png)

6 min read | Updated on July 20, 2025, 10:08 IST

SUMMARY

In the coming week, markets will react to first quarter earnings from Reliance Industries, HDFC Bank and ICICI Bank. Additionally, the ongoing stalemate in India and U.S. trade negotiations may add to uncertainty. The technical outlook for the index remains indecisive within the range of 25,350 and 24,700. A decisive move beyond this range will set the next clear direction for the market.

NIFTY50 closed in red for third consecutive week.

Indian markets saw a third consecutive week of weakness as the key NIFTY50 and SENSEX indices ended with losses amid persistent selling pressure. The NIFTY50 index closed just below the critical level of 25,000 at around 24,968, shedding approximately 0.5%, while the SENSEX slipped towards 81,757, down 0.6%.

Although the headline indices came under pressure, the broader markets showed resilience, ending the week in positive territory. The NIFTY Midcap 100 rose 1%, while the Smallcap 250 jumped 1.5%, revealing the underlying strength beyond the benchmark indices.

Sectoral performance was mixed, with Real-Estate (+3.8%) and PSU Banks (+1.9%) standing out as notable gainers. Conversely, the Defence (-4.1%), IT (-1.4%) and Private Banks (-1.9%) indices dragged the headline indices lower. Muted guidance from IT bellwethers and weak results from Axis Bank, dented the investor sentiment.

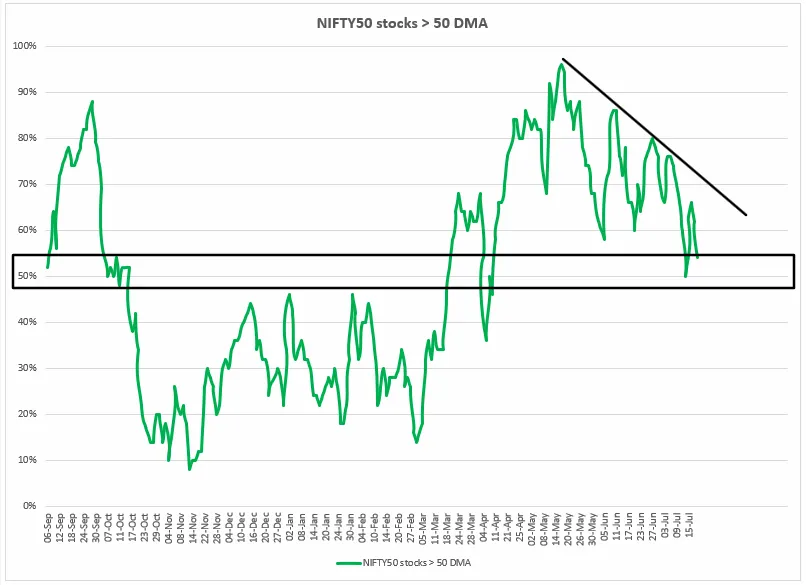

Index breadth

The NIFTY50 index remained under pressure throughout the week, with nearly half of its constituents trading below their respective 50-day moving averages (DMAs), indicating weakness. As shown in the graph below, the index experienced selling pressure with every rebound and has now fallen towards the important level of 50%.

This implies that nearly 50% of NIFTY50 stocks are currently trading below their 50-DMA. The breadth indicator suggests that as long as this reading holds above 50%, the index may sustain its gains. However, if it falls and sustains below the 50% level, the trend could turn bearish, reflecting a weakening market and a potential shift in investor sentiment.

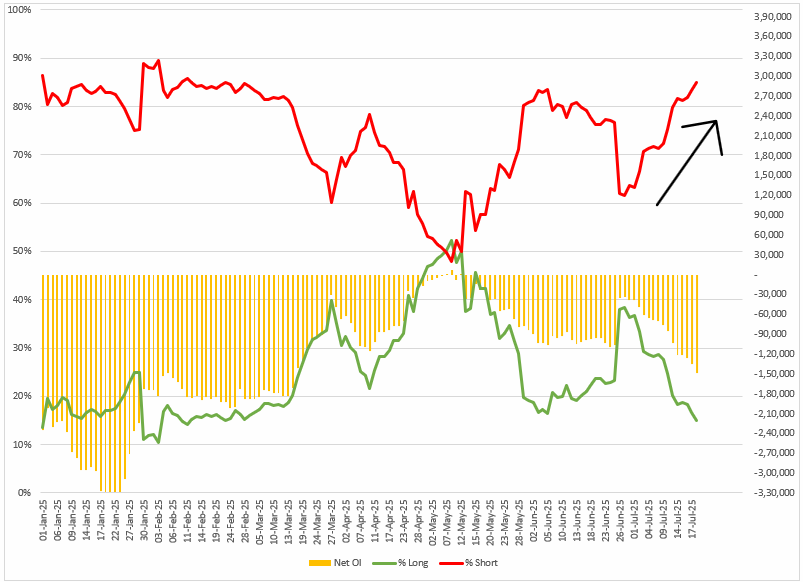

FIIs positioning in the index

Foreign Institutional Investors (FIIs) increased their bearish bets on index futures further, raising the long-to-short ratio to 15:85. They began the July series with a long-to-short ratio of 38:62, and have steadily increased their bearish bets each week, reflecting their pessimistic outlook. Additionally, FIIs' net open interest in index futures is now -1.48 lakh contracts, up 43% from last week.

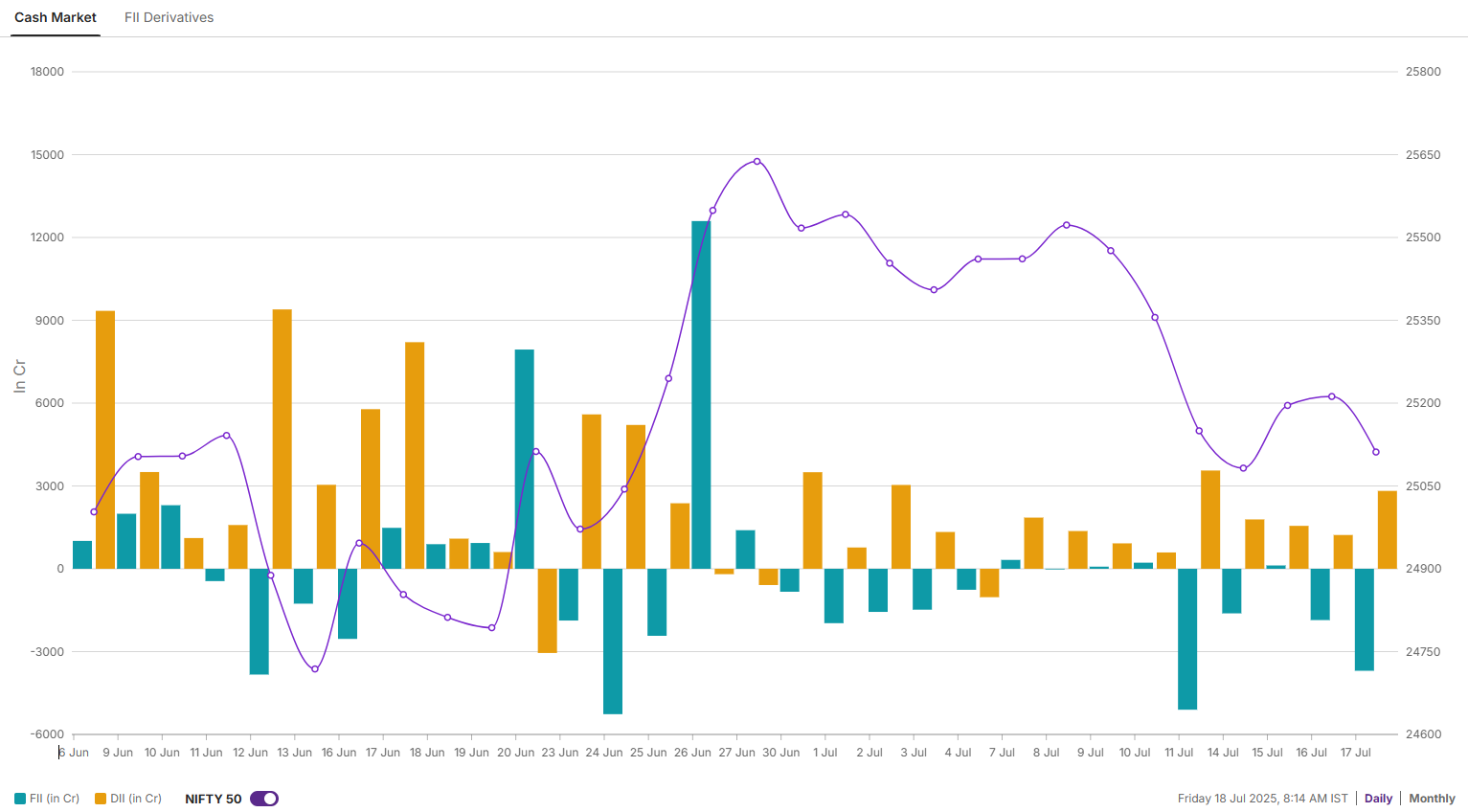

In the cash market, the FIIs remained net sellers in line with their bearish bets on index futures. They offloaded shares worth ₹6,671 crore. Meanwhile, the Domestic Institutional Investors remained net buyers and purchased shares worth ₹9,490 crore.

NIFTY50

The NIFTY50 index formed a bearish candle on the weekly chart and ended the week below previous week’s low, signalling weakness. Additionally, the index has also invalidated recent sharp breakout from last month and has slipped below the critical support level of the 25,000 mark.

For the upcoming sessions, the index has immediate resistance around the 25,350 zone, while the crucial support is around 24,800 zone. A break above or below these zones on a closing basis will provide further directional clues.

BANK NIFTY

BANK NIFTY index also extended the decline for the third consecutive week and ended the week below previous week’s low. Additionally, after a period of strong momentum, the curves of the 21-week and 50-week exponential moving averages (EMAs) are beginning to flatten. This indicates that the rate of price change is moderating and that the trend is losing intensity. In the upcoming sessions, traders can monitor the crucial support zone of 55,400. A break below this zone on a closing basis will signal further weakness, while bullish momentum will resume above 57,400.

HDFC Bank, on the other hand, reported a 12% year-on-year increase in standalone net profit to ₹18,155 crore, driven by robust growth in lending and deposits. However, its consolidated profit marginally declined due to higher provisions for potential bad loans and pressure on net interest margins, which fell to 3.35%. Additionally, the bank announced its first-ever 1:1 bonus issue and a special interim dividend.

About The Author

Next Story