Market News

NIFTY50 signals potential pause ahead of expiry

.png)

4 min read | Updated on February 22, 2024, 07:40 IST

SUMMARY

Experts believe that with profit-booking and the bearish candlestick pattern on the daily chart, the NIFTY50 has slipped back into the consolidation zone of the previous all-time high and the 21,100 levels. However, the index has strong support between 21,600 and 21,800 which coincides with its 20 and 50 day moving averages (DMAs).

US stocks erased all of their intraday losses in the final hour of trading to close mixed.

Asian markets update 7 am

The GIFT NIFTY is trading higher (+0.3%), indicating a gap-up start for the Indian equities today. Asian markets are also trading in the green. Japan's Nikkei 225 is up 1.3% and Hong Kong's Hang Seng Index advanced 0.2%.

US markets update

US stocks erased all of their intraday losses in the final hour of trading to close mixed. Shares of Nvidia jumped in the after hours of trading after the company's results beat expectations. The Dow Jones was up 0.1% at 38,612, while the S&P 500 gained 0.1% at 4,981. The tech-heavy Nasdaq Composite recovered from the day's low to close 0.3% lower at 15,580.

NIFTY50

February Futures: 22,070 (▼0.8%) Open Interest: 2,24,049 (▼1.4%)

After a gap-up start, the NIFTY50 index saw profit-booking around the day's high and closed the volatile session lower. On the daily chart, the NIFTY50 formed a bearish engulfing candle and failed to break above Wednesday's open price, suggesting a potential pause in the rally.

Experts believe that with profit-booking and the bearish candlestick pattern on the daily chart, the NIFTY50 has slipped back into the consolidation zone of the previous all-time high and the 21,100 levels. However, the index has strong support between 21,600 and 21,800 which coincides with its 20 and 50 day moving averages (DMAs). Now, Wednesday's high, 22,249 will act as immediate resistance in the short-term.

Open interest data for the today’s expiry of the NIFTY50 shows a significant call base at the 22,200 and 22,500 strikes. Conversely, the maximum put base is at the 21,500 and 22,000 strikes. This suggests that market participants expect the NIFTY50 to trade in a range of 21,600-22,400.

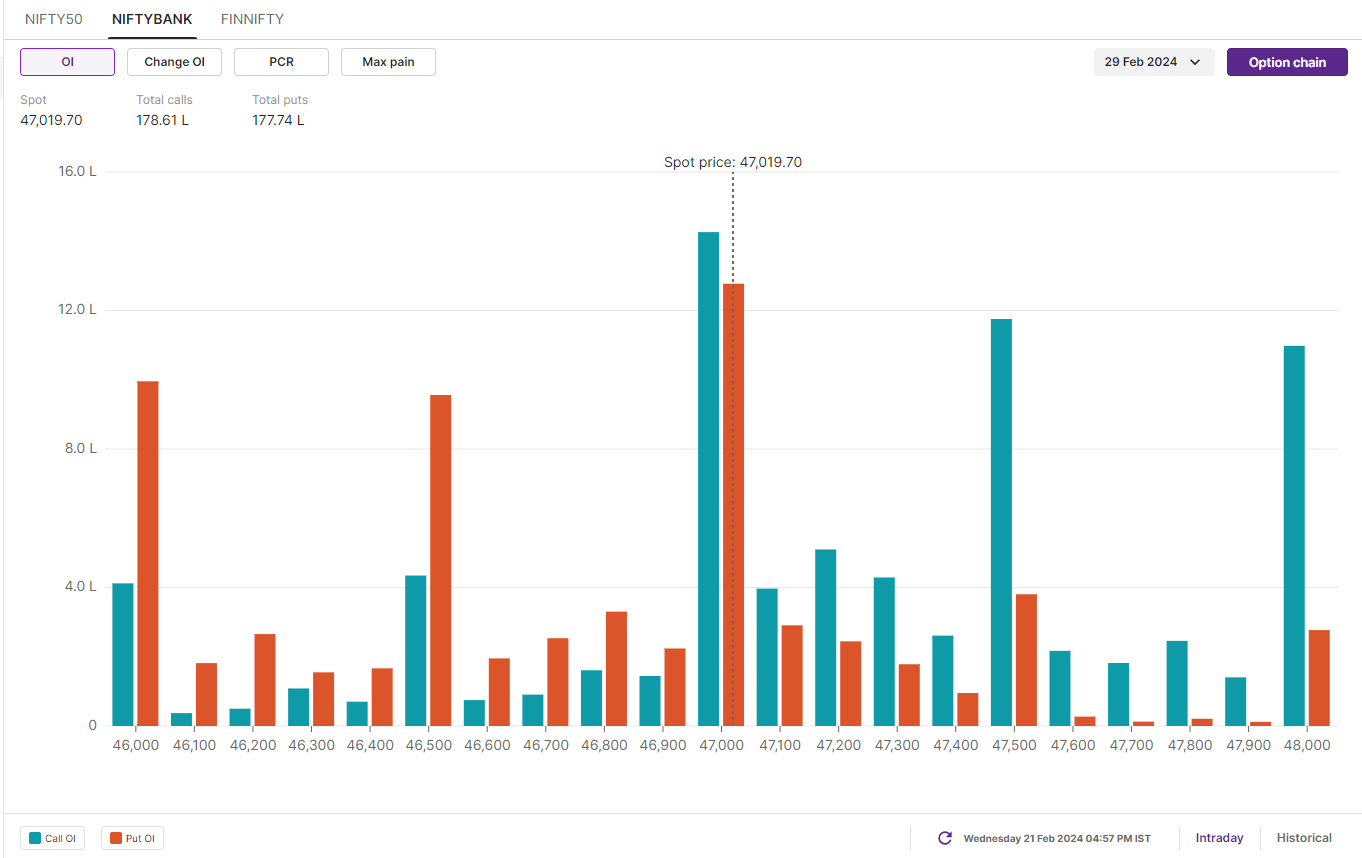

BANK NIFTY

February Futures: 47,024 (▼0.5%) Open Interest: 1,78,971 (▼0.4%)

Despite the strong start, the BANK NIFTY was unable to hold on to its gains and ended the volatile session of weekly expiry lower. The index made several attempts to rally but failed to breach Wednesday's opening level. It did, however, protect the 47,000 level on a closing basis.

As highlighted in our Wednesday’s morning trade setup blog, the BANK NIFTY has extended the trading range between 46,500 and the all-time high of 48,636. Within this trading range the immediate support for the index is at its 50-DMA, which is around 46,800 mark.

The initial OI build-up of the options chain shows a significant call base at the 47,000 and 47,500 strikes. Conversely, the put base is established at 45,000 and 47,000 strikes. As per the the options data, BANK NIFTY is expected to trade between 45,600 and 48,500 .

FII-DII activity

Stock scanner

Long build-up: ABB India and Piramal Enterprises.

Short build-up: Aditya Birla Fashion Retail, Power Grid and Aarti Industries.

Catch up on yesterday's NIFTY 200 insights! Don't miss our market recap blog, offering valuable insights in a concise format. Click here to read and stay informed.

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story