Market News

Trade setup for 7 June: NIFTY50 continues relief rally, weekly chart shows mixed signals

.png)

4 min read | Updated on June 07, 2024, 08:14 IST

SUMMARY

With markets overcoming the volatility surrounding the election result, the participants will now shift their focus to the Reserve Bank of India's (RBI) monetary policy decision due today. Experts believe the central bank will maintain the status quo and keep interest rates unchanged for the eighth consecutive meeting.

Initial open interest data for the June 12 expiry is scattered, with the highest call OI at the 50,000 and 51,000 strikes.

Asian markets update 7 am

The GIFT NIFTY is flat, signaling a subdued start for Indian equities on Friday. Asian markets are mixed: Japan's Nikkei is down 0.2%, while Hong Kong's Hang Seng Index is up 0.1%.

U.S. market update

- Dow Jones: 38,886 (▲0.2%)

- S&P 500: 5,352 (▼0.0%)

- Nasdaq Composite: 17,173 (▼0.0%)

U.S. stocks ended Thursday's session on a subdued note ahead of the release of May's employment data. Experts believe that the U.S. added 1,80,000 jobs while the unemployment rate remained unchanged. Friday's report remains crucial for the market's direction amid concerns over inflation and economic growth.

NIFTY50

- June Futures: 22,899 (▲1.2%)

- Open Interest: 5,37,950 (▲4.0%)

The NIFTY50 extended Wednesday's gains, with broad-based buying across sectors for the second day in a row. The index reclaimed the key 22,800 level by closing above Wednesday's high.

In yesterday's analysis, we highlighted the formation of an inside candle on the daily chart and advised our readers to look for a close above or below this candle for further directional clues. In yesterday's session, the index closed above the high of the inside candle and maintained its gains throughout the session.

Going forward, the low of the inside candlestick becomes a critical level to watch. A close below this low would signal bearishness, while immediate resistance for the NIFTY50 is around the 23,000 level.

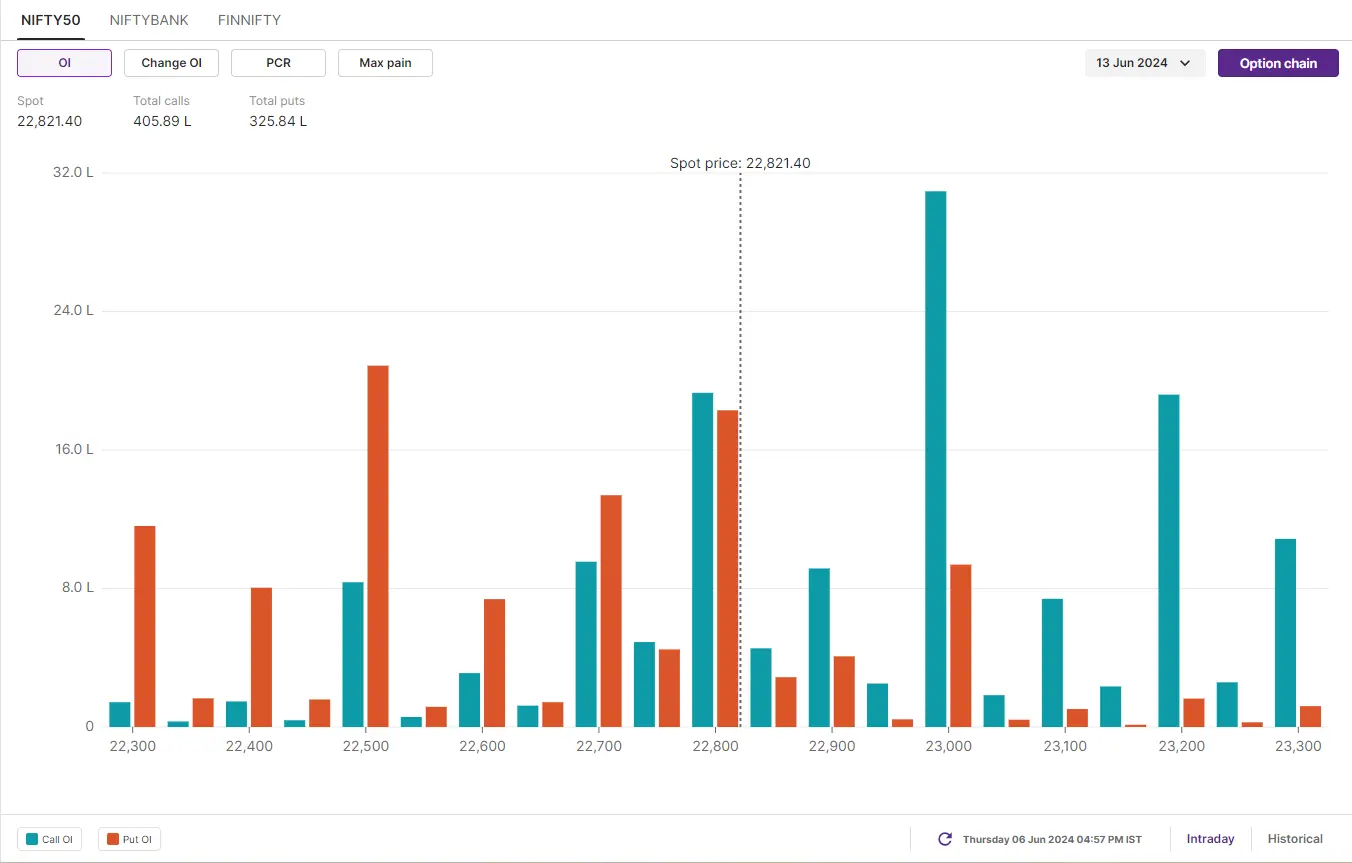

Initial open interest (OI) for the June 13 expiry is dispersed, with significant call OI concentrated at the 23,500 and 23,000 strikes. Conversely, put OI is mainly concentrated around the 22,000 and 22,500 strikes. Traders are advised to monitor the OI positioning and paying close attention to any changes in OI as the week draws to a close.

BANK NIFTY

- June Futures: 49,435 (▲0.6%)

- Open Interest: 1,76,128 (▼7.5%)

After a gap-up start, the BANK NIFTY extended its gains for the second consecutive day led by strong performance of PSU banks. However, the index encountered resistance around the 49,500 level and traded in a narrow range throughout the day.

The BANK NIFTY also jumped above the high of the inside candle mentioned in yesterday's blog, but was unable to hold these gains. It failed to close above the high of the inside candle, indicating immediate resistance at higher levels. Conversely, a break below the 50-day moving average could signal increased volatility and potential weakness.

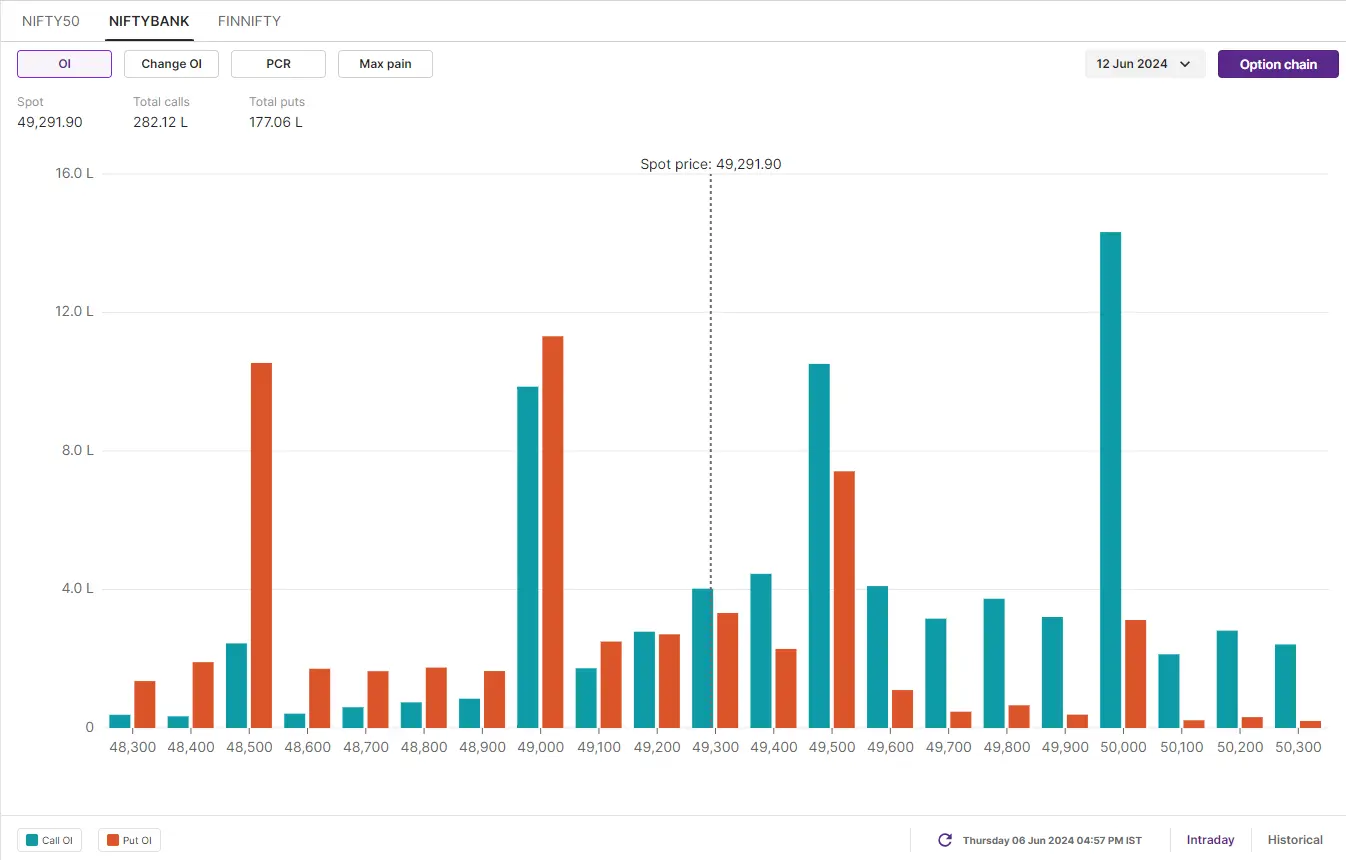

Initial open interest (OI) data for the June 12 expiry is scattered, with the highest call OI at the 50,000 and 51,000 strikes. Conversely, maximum put OI is concentrated at the 49,000 and 48,500 strikes. Traders should keep an eye on changes in OI to better understand market positioning as the index approaches the weekly close.

FII-DII activity

Stock scanner

Long build-up: Biocon, Exide Industries, Hindustan Aeronautics, Aditya Birla Fashion and Retail and Indian Energy Exchange.

Short build-up: IPCA Laboratories and Asian Paints

Under F&O ban: Zee-Entertainment

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story