Market News

NIFTY50 ends May 2025 with 1.7% gains; what does June 2025 hold in store?

4 min read | Updated on May 30, 2025, 22:43 IST

SUMMARY

NIFTY50 historically has delivered positive returns 60% of the time in June, but largely witnessed an inverse relationship with May’s performance. With the historical trend and current consolidation at the crucial 25,000-25,200 resistance zone, NIFTY50's June 2025 fate hangs in the balance.

NIFTY50 gained 1.7% in May, whats in store for June? Image source: Shutterstock.

June 2025 is around the corner, and the stock market adage "June Swoon" must be on investors’ minds. The adage suggests that stock markets often underperform after a rally at the beginning of the year, potentially leading to a sell-off in May. However, the term "swoon" suggests a loss of interest among investors. Let's examine whether this holds true or false for the Indian stock markets.

To understand what June 2025 holds, let's go back to the historical data of the benchmark NIFTY50 index.

NIFTY50 performance from April to June (2010 - 2025)

| Year | May | June | May MoM (%) | June MoM (%) |

|---|---|---|---|---|

| 2010 | 5086 | 5313 | -3.6% | 4.5% |

| 2011 | 5560 | 5647 | -3.3% | 1.6% |

| 2012 | 4924 | 5279 | -6.2% | 7.2% |

| 2013 | 5986 | 5842 | 0.9% | -2.4% |

| 2014 | 7230 | 7611 | 8.0% | 5.3% |

| 2015 | 8434 | 8369 | 3.1% | -0.8% |

| 2016 | 8160 | 8288 | 3.9% | 1.6% |

| 2017 | 9621 | 9521 | 3.4% | -1.0% |

| 2018 | 10736 | 10714 | 0.0% | -0.2% |

| 2019 | 11923 | 11789 | 1.5% | -1.1% |

| 2020 | 9580 | 10302 | -2.8% | 7.5% |

| 2021 | 15583 | 15722 | 6.5% | 0.9% |

| 2022 | 16585 | 15780 | -3.0% | -4.9% |

| 2023 | 18534 | 19189 | 2.6% | 3.5% |

| 2024 | 22531 | 24011 | -0.3% | 6.6% |

| 2025 | 24751 | ? | 1.7% | ? |

Since 2010, the NIFTY50 has delivered positive returns in June in 9 out of 15 years. Further, in 6 of these years, it saw a significant upside.

Moreover, June witnessed a sharp bounce (5 out of 9 positive times) followed by weak May performances.

But wait, there is a catch. Whenever May has reported positive returns, June returns have been lower.

Thus, we see an inverse relation between May and June performances. Time will tell how June will treat the Indian stock markets… June Swoon or June Boom!

What’s the recent Nifty50 chart saying?

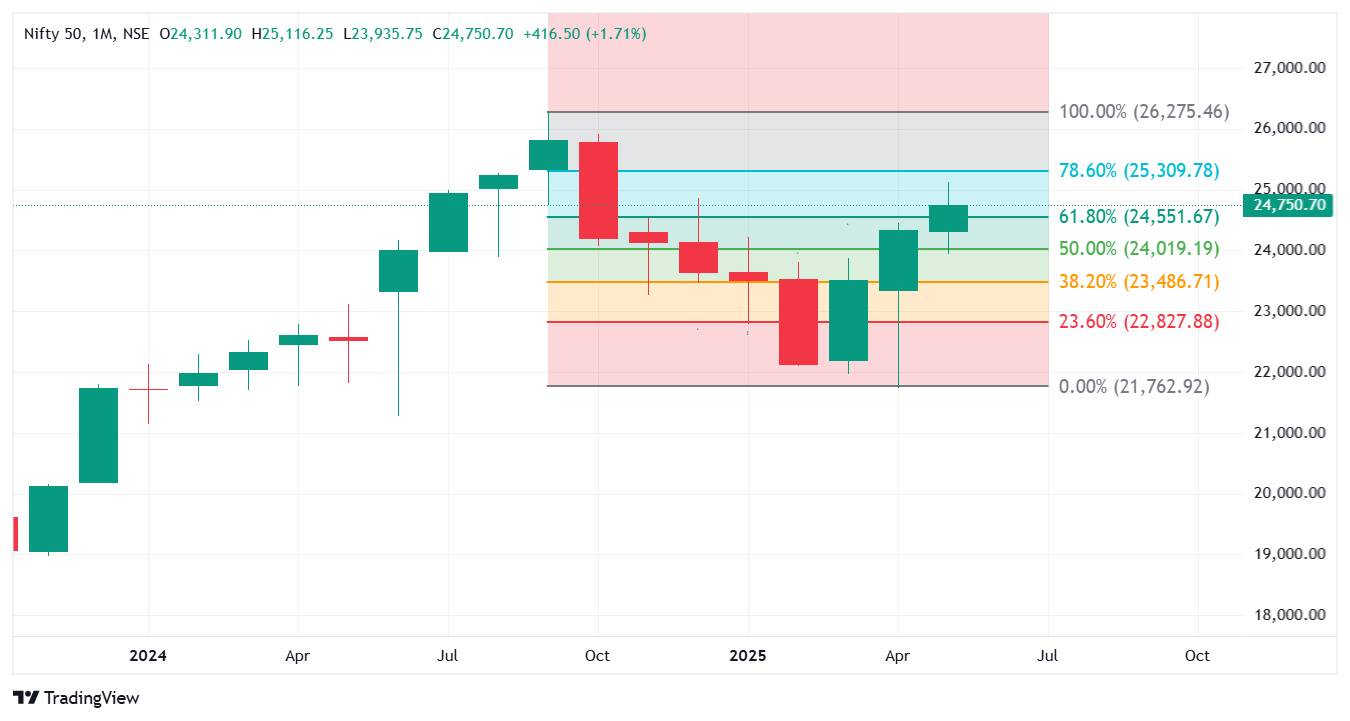

After a consistent rally from April 2025, NIFTY50 seems to have taken a breather at its major resistance zone of 25,000 (also a round number). Yet, on May 15, 2025, NIFTY50 managed to break out of the zone on a closing basis but couldn’t sustain the positive momentum till the end of the month.

Meanwhile, the index has also not shown any major downside. Instead, it has just halted with no trigger in any direction. Currently, the chart indicates near-term resistance around 25,000 and support at 24,450, which is its current swing low on the daily charts.

Considering the monthly time frame, the NIFTY50 has moved above 61.8% of the fall from the end of September 2024 to April 2025, indicating strength in the rally. If the rally sustains and if the market is able to break out of the current consolidation, it opens the door for NIFTY50 to retest its all-time high. Meanwhile, the RBI’s interest-rate decision in the first week of June holds the key to the market movement.

Economic Calender

| Date | Day | Event | Importance |

|---|---|---|---|

| June 2 | Monday | Manufacturing PMI for May | * |

| June 4 | Wednesday | Services PMI for May | * |

| June 6 | Friday | RBI’s interest-rate decision | *** |

| June 12 | Thursday | Inflation rate for May (YoY) | *** |

| June 16 | Monday | WPI inflation for May | ** |

| June 27 | Friday | Industrial production for May (YoY) | * |

About The Author

Next Story